Cash Flow Optimization

Best Business Account Alternatives to Traditional Banking

Compare traditional banking head-to-head with Float and see why many Canadian companies are moving away from banks and toward modern digital business banking alternatives.

September 18, 2025

Canadian businesses are no strangers to the friction that comes with traditional banking. As a result, more founders are actively exploring business account alternatives that can actually keep pace with them.

What’s driving the shift? Long wait times, endless paperwork, hidden fees and outdated systems can leave business owners wondering why banking has to feel like such a bottleneck. For growing companies, these barriers aren’t just annoying. In reality, they slow down decisions, tie up cash and create blind spots that can hurt growth.

Outdated systems are compounding financial concerns for many Canadian SMBs, with over 40% struggling with inefficient reporting processes and nearly a third concerned about cash flow visibility. This lack of clarity can drive increased spending, which only makes cash issues more worrisome.

It’s no wonder entrepreneurs are searching for a business account alternative in Canada that they can rely on. The Big 5 may have been the default for decades, but the way Canadian companies operate has changed. They need flexibility, visibility and modern tools to manage money across currencies and platforms, without sacrificing security.

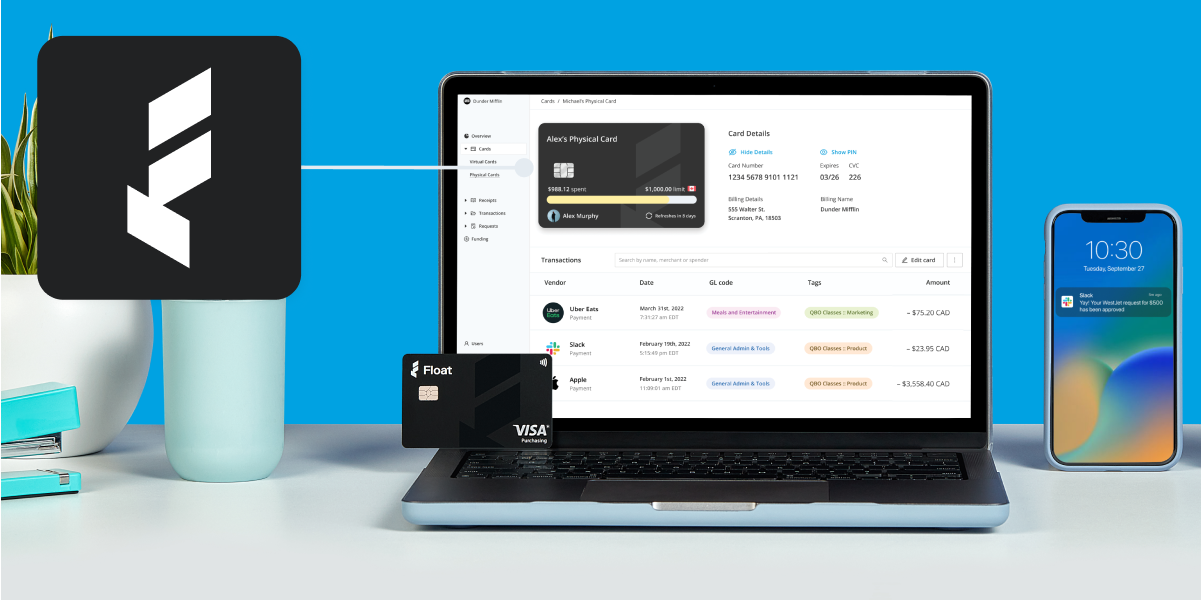

That’s where digital solutions like Float step in. As a Canadian-founded platform, Float was built to deliver everything companies wish their banks could do: instant account setup, market-leading yields, zero fees, better cross-border tools and built-in expense management software.

This article compares traditional banking head-to-head with Float across the features that matter most. By the end, you’ll see why many Canadian companies are moving away from banks and toward modern digital business banking alternatives.

Traditional banking vs. modern business account alternatives

Banks like to tell businesses they’re “trusted partners.” But if that’s true, why does it feel like pulling teeth every time you need to open an account, transfer funds or figure out where your money actually is? We’re digging in to show feature by feature how Float stacks up against traditional banks.

Spoiler alert: the future of business finance looks a lot less like a mahogany desk and a waiting line, and a lot more like a sleek dashboard you control from your laptop.

1. Account setup and requirements

Opening a business bank account in Canada usually feels like running a bureaucratic gauntlet. Expect multiple in-person branch visits, piles of paperwork, personal guarantees and credit checks. It can take weeks to get approved and even longer to start using your account.

Float flips that experience on its head. Account creation is digital, streamlined and typically approved within a single business day. For businesses that qualify, our Charge Card provides access to unsecured credit with no personal guarantees required. Alternatively, businesses can opt for our prefunded account, which doesn’t involve a credit approval process at all, nor a personal guarantee. Either way, approval is based on your business—not your personal credit history.

Winner: Modern alternatives. Float delivers speed and convenience via its online business banking solution and offers peace of mind by removing personal liability from the equation.

2. Interest and earnings

Canadian banks aren’t known for their generosity when it comes to business account interest. Most pay between 0% and 0.5%, and often only if you keep a high minimum balance. To earn anything meaningful, you’d typically need to tie up funds in long-term Guaranteed Investment Certificates (GICs), sacrificing liquidity in exchange for slightly better rates.

Float changes that. Every dollar in your CAD and USD balances earns a market-leading base rate of 3%, with the opportunity to earn up to 4% based on your Float Card spend. Funds are held in trust with our banking partners and eligible for CDIC insurance—so your money isn’t just earning, it’s protected.

That means businesses can keep cash liquid for payroll, bills or growth while still earning 2–3x the rate of most traditional business accounts in Canada.

Winner: Modern alternatives. Float lets businesses grow their balance instead of letting banks benefit from idle cash.

Make your money workas hard as you do

Introducing CDIC-insured Float Business Accounts, with zero fees, no minimums and earnings up to 4%.

3. Fees and costs

If you’ve ever felt like your bank was charging you for the privilege of storing your own money, you’re not wrong. Monthly maintenance fees, service fees, wire fees and even fees that sound made up (“statement handling,” anyone?) could show up on your bill. Add them up, and it’s clear who really profits from your business account.

Float takes a transparent approach. Its Essentials plan has no monthly fees, no minimums and no lockups. Businesses avoid fees on sending and receiving standard ACH and EFT transfers, while wires and currency conversions are priced clearly, without hidden markups. Premium tiers (starting at $100/month for a minimum of 10 users) are optional, offering added features but still priced clearly.

Winner: Modern alternatives. Float’s no-fee, transparent structure positions it as one of the most compelling choices for a business account, no fees required.

4. Multi-currency support

Canadian companies dealing in U.S. dollars know the drill: open separate accounts, shuffle money around and watch the bank skim a healthy cut—sometimes up to 3% fx rates, plus other hidden fees—on every conversion. It’s clunky, expensive and about as fun as filing your own taxes.

Float offers a single platform to manage both CAD and USD. Businesses can receive USD payments by wire or ACH with no fees, hold balances in both currencies, and convert funds at industry-leading rates of 0.25%, with no hidden fees. (Note: USD EFTs from Canadian banks are not currently supported and must be sent by wire.) Everything is integrated, eliminating the hassle of juggling multiple accounts or paying inflated spreads.

Winner: Modern alternatives. Float simplifies cross-border finance while keeping costs low.

5. Digital experience

Your business deserves more than a banking portal that looks like it was designed in 2004. Legacy systems and outdated apps aren’t just ugly; they’re slow, unreliable and often missing the features finance teams need most.

Float was designed as a modern, digital-first platform. The experience is mobile-friendly, intuitive and built for real-time financial management. You can issue corporate cards instantly, set spending rules and integrate directly with your accounting software. Month-end is faster, cleaner and less stressful.

Winner: Modern alternatives. Float’s online business banking experience empowers finance teams instead of slowing them down.

6. Expense management

Banks sell accounts. Float delivers a complete system. That’s the difference. If you’re relying on reimbursements, spreadsheets and generic credit cards, you’re already behind. Expense management should make tracking expenses easier, while also helping you control spending before it spirals out of control.

Float’s built-in expense management is a game-changer. Every physical or virtual card comes with custom limits, category restrictions and automated receipt capture. Transactions sync in real time with accounting tools, so finance teams move from chasing receipts to simply reviewing transactions at month-end. Reimbursements, bill payments and approvals all live in one platform.

Winner: Modern alternatives. With receipt capture and month-end automation, Float offers the kind of integrated solution that fintech business solutions are known for: convenient, automated and scalable.

7. Customer support

Bank customer service is legendary for all the wrong reasons. Waiting on hold, repeating your story three times or being bounced from one “specialist” to another doesn’t exactly scream support.

Float’s support is digital-first, fast and tailored to businesses. Dedicated teams respond quickly, understand Canadian finance needs and help you troubleshoot without forcing you through layers of bureaucracy. Support is available seven days a week, so you’re not left waiting when your business needs answers.

Winner: Modern alternatives. Float’s support prioritizes speed, expertise and accessibility.

8. Speed and flexibility

If banks were built for agility, you wouldn’t still be filling out paper forms to adjust a spending limit. Traditional institutions move at the pace of their policies, not the pace of your business.

Float is built for agility. Accounts open in minutes, cards can be issued instantly, and limits or categories can be changed with a few clicks. Finance leaders can adapt policies on the fly, keeping the business moving without red tape.

Winner: Modern alternatives. Float delivers the speed and flexibility modern businesses need in a business account alternative Canada has been waiting for.

Which solution is right for your business?

Comparisons are helpful, but let’s get practical. What does this look like in real life?

Let’s walk through three common business structures to show how the choice between Float and a bank actually plays out. We’ll look at a startup, a growing service firm and an established company to help you sort out your best option.

Think of it as a choose-your-own-adventure for your company’s finances.

Tech startup with USD revenue

Growing startups often rely on U.S. clients and investors. With a traditional bank, that means multiple accounts, complicated transfers and frustrating foreign exchange (FX) fees that chip away at margins.

Float simplifies cross-border finance. Startups can receive USD payments directly into their Float account, hold balances in both CAD and USD and convert funds at market-leading rates. No more paying inflated spreads or wasting time managing transfers.

Takeaway: Startups with U.S. revenue find Float’s digital business banking features to be a far more efficient and profitable choice.

Growing service business

Service companies face a different challenge: scaling expense management as teams expand. With banks, corporate cards are limited, reimbursements become messy, and third-party software adds costs and complexity.

Float removes those barriers. Every employee who needs to spend can be issued a physical or virtual card with strict controls. Transactions are tracked in real time, approvals flow automatically and integrations keep accounting clean. Instead of month-end chaos, finance leaders get visibility and control at every step.

Takeaway: Service businesses that value efficiency and oversight can scale seamlessly with Float, proving how fintech business solutions can simplify the way money moves.

Established business optimizing cash flow

Mature businesses may already have stable banking relationships, but are underwhelmed by returns on idle cash. At a traditional bank, balances often sit in accounts earning next to nothing or get tied up in illiquid GICs.

Float turns idle balances into earnings to improve your cash flow. Businesses earn up to 4% interest with no lockups, while maintaining full liquidity. That means they can optimize working capital, keeping funds available for payroll, expansion or emergencies without sacrificing yield.

Takeaway: Established businesses can use Float to maximize returns on cash while still benefiting from one of the best business bank accounts in Canada for daily operations.

Making the right choice for your business

By now, the pattern is obvious: Float wins on speed, earnings, cost and digital experience. But making the switch from a bank to a modern platform can still feel like a leap.

This section helps you cut through hesitation with a clear decision framework for when to choose Float, when to stick with a bank and how to transition without disrupting your operations.

Choose Float if:

- You want to earn meaningful interest on business cash

- Your business deals in both CAD and USD

- You need integrated expense management and corporate cards

- You value modern, digital-first financial tools

- You want to avoid personal guarantees and lengthy approvals

- Your company prioritizes speed, visibility and efficiency

The business account that makes sense, and money.

Zero-fees, up to 4% interest, and CDIC insured. The high-yield business account built for Canadian companies.

Choose traditional banking if:

- You need in-person branch services for complex transactions

- Your business operates with very traditional banking needs

- You’re not yet comfortable with newer financial technology platforms

- You require services beyond typical business account features

- You have unique compliance or regulatory requirements and banks are better suited to handle them

Migration path from traditional banks

Switching your company’s finances doesn’t have to feel like ripping off a bandage. Moving from a traditional bank to Float can be a smooth, low-stress transition—think of it like dating someone you like before jumping into marriage.

You don’t need to shut the doors on your bank account on day one. Instead, you can ease into a modern setup at a pace that feels right for your business.

Here’s a practical way to transition smoothly:

1. Open a Float account alongside your existing bank account

Approval typically takes one business day, so you can get started fast, no endless paperwork or in-branch visits required.

2. Transfer a portion of your balance to Float and test its features

Try issuing a few physical or virtual cards, setting smart spend limits, paying a couple of vendor bills and watching your balance earn daily interest. This “test drive” shows you how much faster and cleaner finance operations can be.

3. Gradually expand usage as you gain confidence

Move payroll funds, scale card programs to more employees or run month-end with Float’s accounting integrations. Each step reduces manual work and increases visibility.

4. Keep a bank account if needed

For branch-only services like certified cheques or unusual compliance requirements, your bank can still serve as a backup. But for day-to-day efficiency, such as payables, expense management and cash yield, Float becomes your financial home base.

This blended approach lets businesses modernize without risk. You get the best of both worlds: the comfort of a traditional account for the rare situations where you need it, and the speed, savings and control of Float for everything else.

Over time, most companies find the scales tipping in Float’s favour. Once you’ve experienced faster approvals, 4% yields and automated expense controls, going back to bank lineups and paperwork feels like dial-up internet.

Frequently asked questions

We get it. Changing the way you manage money is a big deal. This FAQ clears up some of the most common concerns, from security to earnings to whether Float can really replace your current business bank account. (Remember, whichever you choose, we always advise separating your business expenses from your personal expenses.)

Is Float as secure as a traditional bank?

Float is a FINTRAC-registered Money Services Business in Canada with Service Organization Control (SOC 2) Type 2 certification. Customer funds are held in trust at Tier 1 Canadian banks and protected by CDIC insurance up to $100,000 across both CAD and USD balances, giving businesses dual-layer protection and peace of mind.

How does Float make money if it pays high interest rates?

Float earns revenue through interchange fees on corporate card transactions, premium software features and efficient digital operations. By avoiding legacy costs such as branches and paper-heavy processes, Float passes more value back to customers.

Can I replace my traditional business bank account with Float?

Many Canadian companies use Float as their day-to-day financial hub for earning interest, managing expenses and moving money. That said, some businesses keep a traditional account for specific services like pre-authorized debits, payroll funding or cheques, which Float doesn’t support yet.

Try Float for free

Business finance tools and software made

by Canadians, for Canadian Businesses.

Where banks fall short (and Float steps up)

The verdict is simple: traditional banking may be familiar, but it’s rarely built for the realities of running a modern business. High fees, low returns and outdated processes leave companies looking for better business account alternatives in Canada.

Float offers that alternative. With faster onboarding, higher earnings, integrated expense management and smarter cross-border tools, it’s designed to help businesses save money, boost efficiency and stay competitive.

For companies tired of jumping through banking hoops, the choice is clear: it’s time to experience the simplicity of a Float business account, no fees, no fuss.

Written by

All the resources

Industry Insights

Canada’s Crossroads: Why Now is the Moment to Move from Defensive to Intentional Growth

Float's 2025 report on Canadian business shows modest growth, rising costs and shrinking reserves. Find out exactly what the data

Read More

Expense Management

Controller Month-End Close Automation: Streamline Financial Reporting

Controllers, this one's for you. Let's talk about how how automating month-end close helps you move faster without sacrificing accuracy.

Read More

Corporate Cards

Corporate Card Program Implementation: Complete Management Guide

Ready to implement a corporate card program? This is where to start.

Read More