Not imported. Not localized.

Business finance built for Canada. Period.

From the ground up, every feature of Float’s complete finance platform is designed to address the unique realities of running a business in Canada. Taxes, currencies, regulations—all the ways you actually operate.

Trusted by thousands of leading Canadian companies.†

The True Grit of Canadian Business

They said impossible. I built it anyway.We asked Canadian entrepreneurs: What was the worst advice you got?

Stop bending international platforms to fit your Canadian business.

From high-yield interest on your CAD to fast bill payments that optimize your cross-border spend, Float is ready to work the way you do.

Benefits

Finance automation for Canadian businesses.

Yes, including Quebec.

Float provides the homegrown expense management tools that US-based platforms can’t.

Business Cards for your Canadian HQ

Instantly issue both CAD and USD cards to team members based at any entity.

Canadian Compliance Expertise

Float helps your business stay CRA-ready and is fully compliant as a FINTRAC-registered Canadian Money Services Business (MSB).

Local Knowledge,

Local Support

We’re Bill 96-compliant, offering both our platform and our coast-to-coast support in English and French.

More flexible ways to fund and pay

From our flexible funding options to in-app FX, Float’s finance tools are tailored to how Canadian operators run their business.

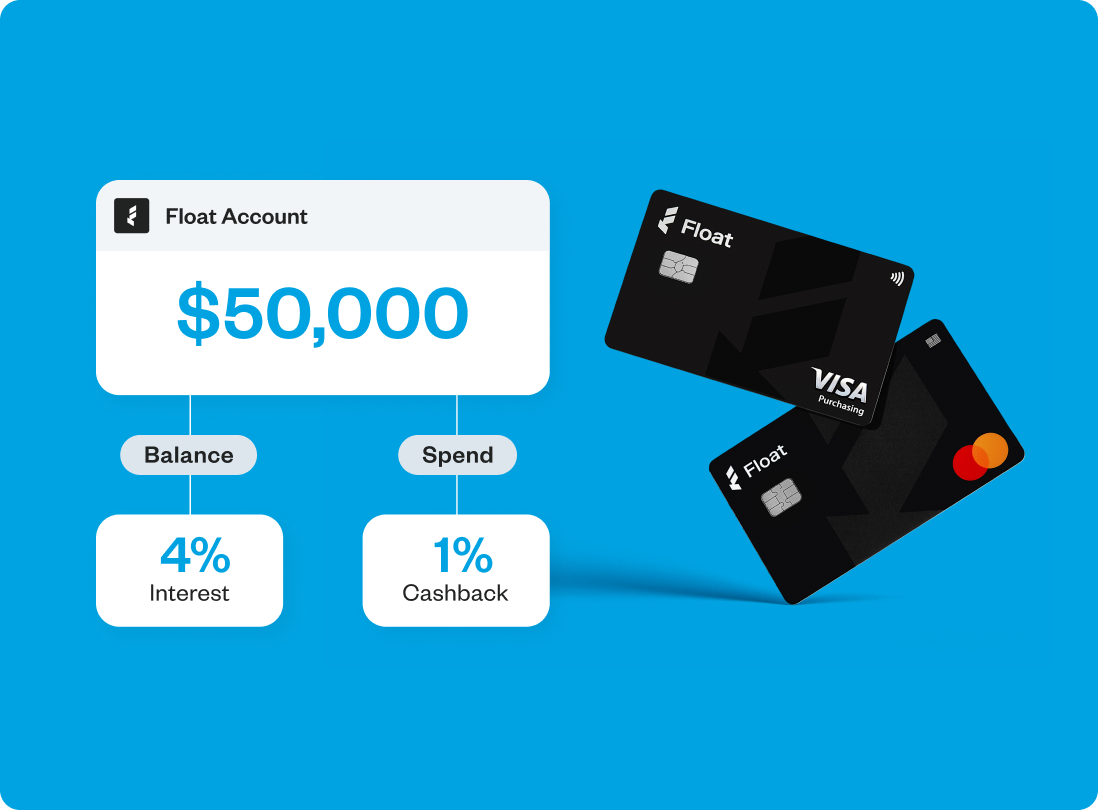

Fund corporate cards from cash-on-hand or apply for Charge—whatever fits your business best

Issue both CAD and USD cards to cut foreign transaction fees & simplify cross-border spend

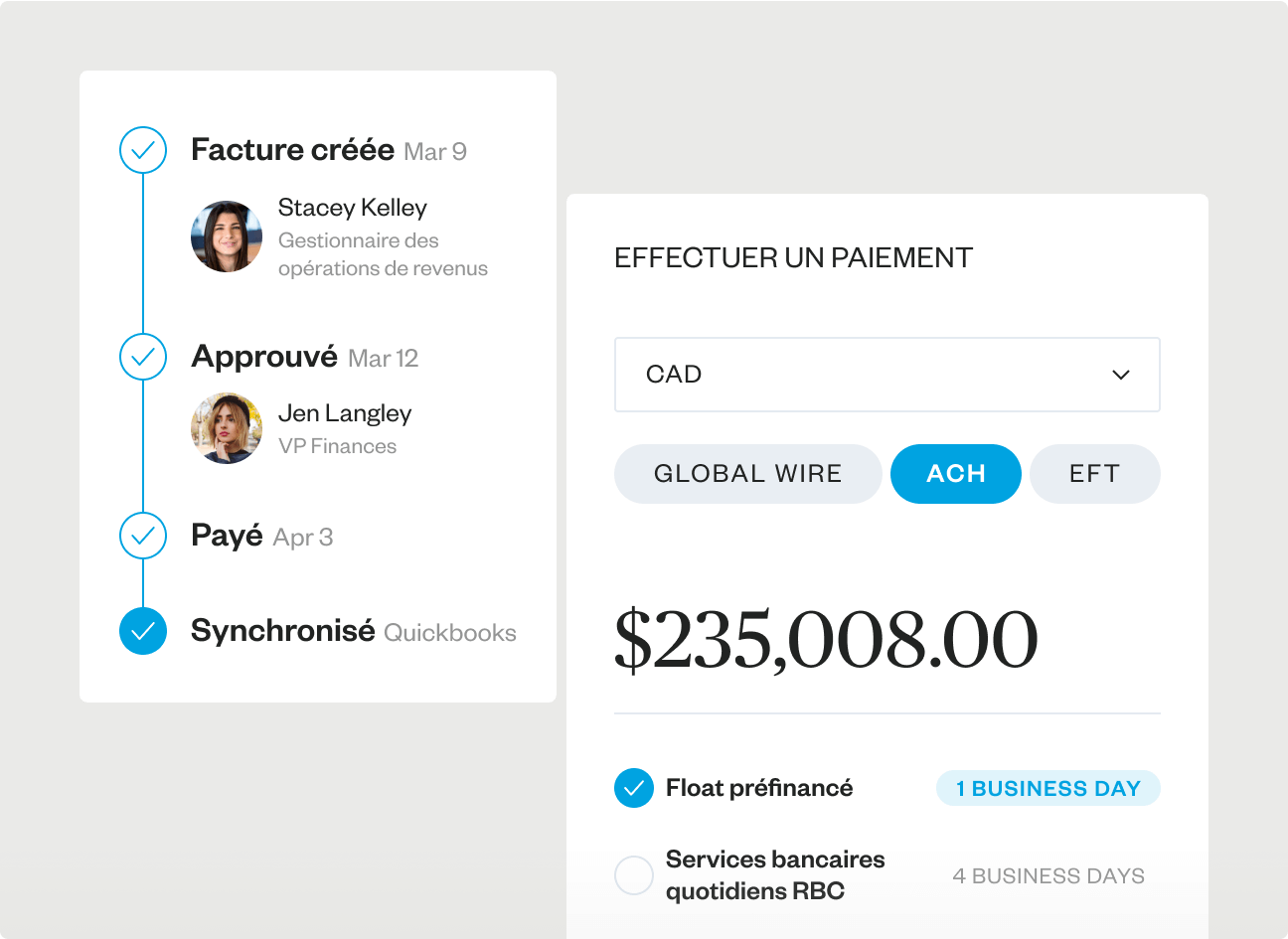

Convert cash in-app, hold balances in both currencies and pay via EFT or ACH for free

Earn up to 4% on both CAD and USD balances

With US expense solutions, you can’t pre-fund or yield interest on your CAD—causing you to leave money on the table.

Float ensures the bulk of your operating cash is eligible to earn interest

No minimum eligibility or lockups required

Earn interest from the minute your funds land in Float to the moment they get spent

CRA-ready.

Not Retrofitted.

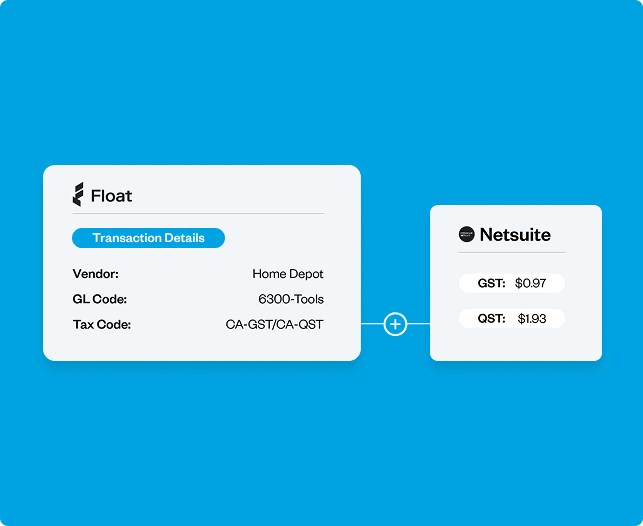

International expense solutions promise automated spend tracking, but don’t support Canadian tax structures—leaving you to fill in the gaps.

Float lets you track multiple tax components—GST, PST, QST or HST—on a single transaction

OCR technology reads your receipts and auto-splits taxes into multiple components reliably

Our support for Canadian tax structures speeds up reconciliation, reduces errors and maximizes your ITCs

Want to switch to French? Pas de problème.

Most international tools offer English-only platforms. Float lets you manage expenses your way, with support for both of Canada’s official languages.

Use the web app in French with full functionality for admins and finance teams

Submit expenses with the mobile French app for employees on the go

Have questions? Get help from our bilingual support team

“With hundreds of transactions per month, Float’s multi-part Canadian tax codes save significant time. It also improved accuracy since we no longer manually type in the tax-exempt amounts.

Aaron Corbin

Financial Controller

Come for the card,

stay for the software and savings

Corporate Cards

Use smart corporate cards that can save your business up to 7% on spend.

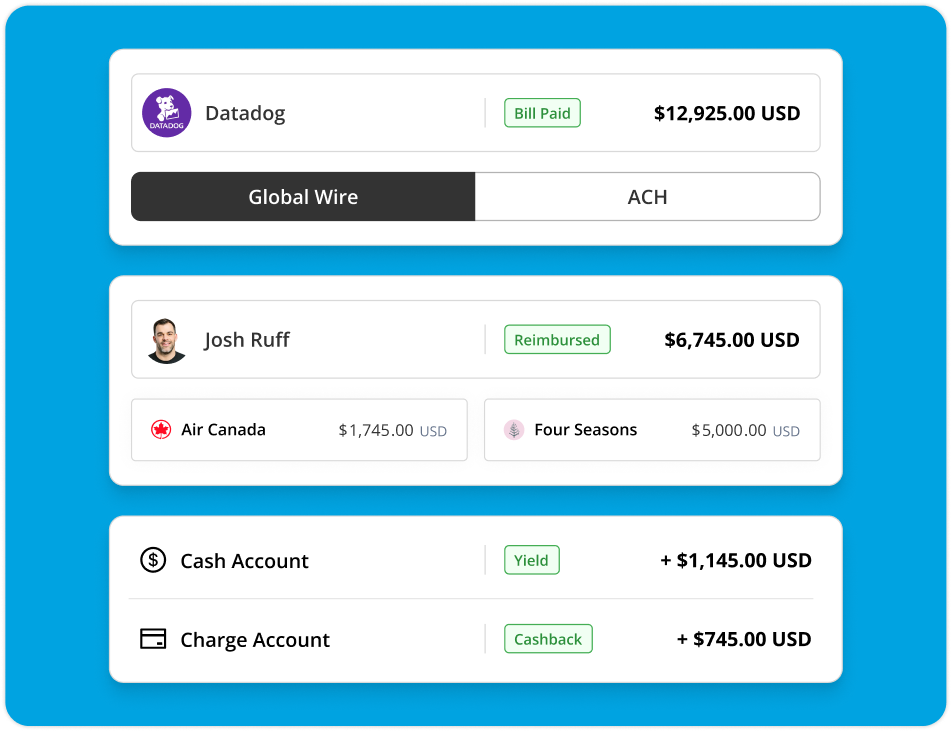

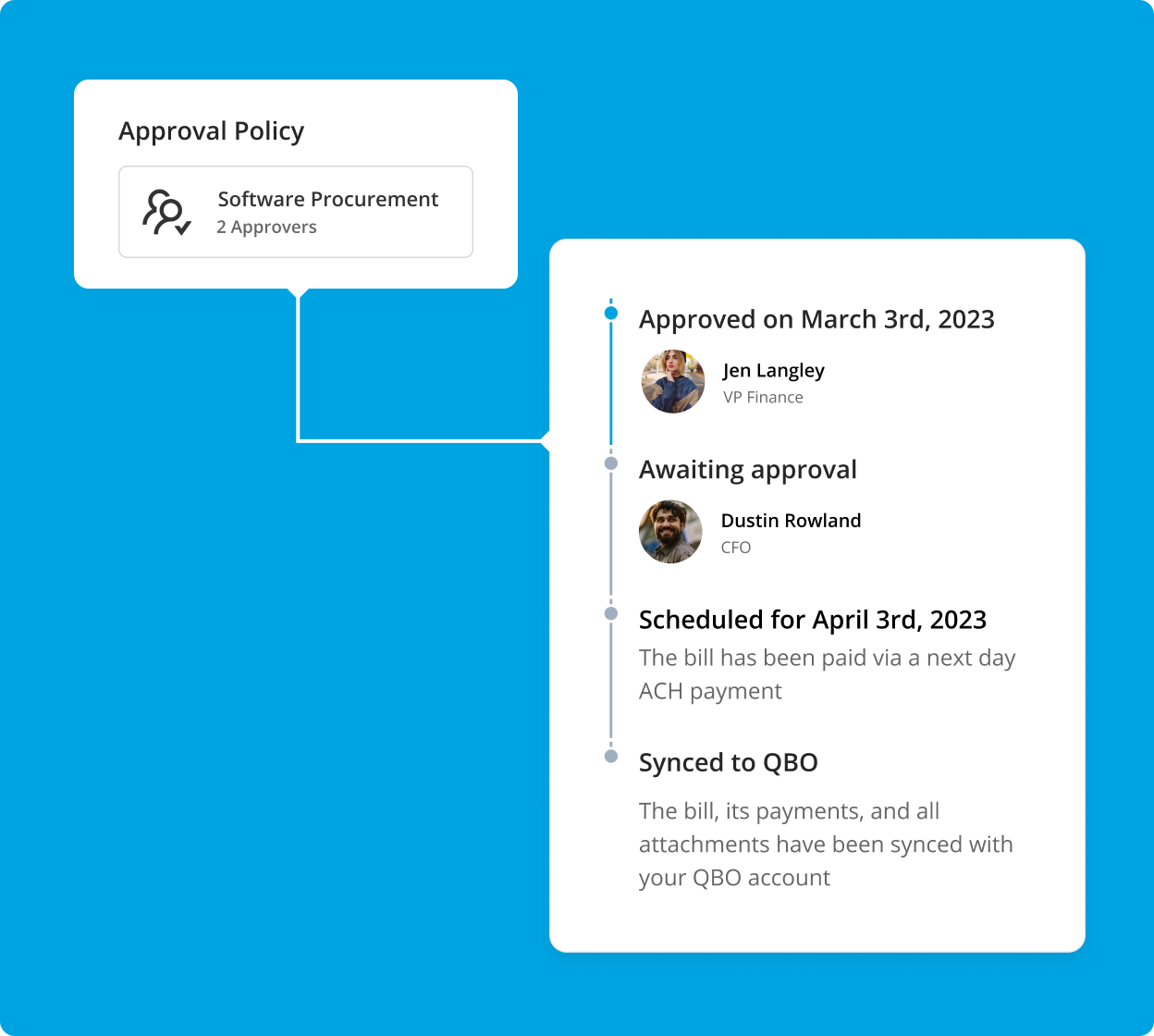

Accounts Payable

Automate approval and payment workflows and save on free EFT and ACH

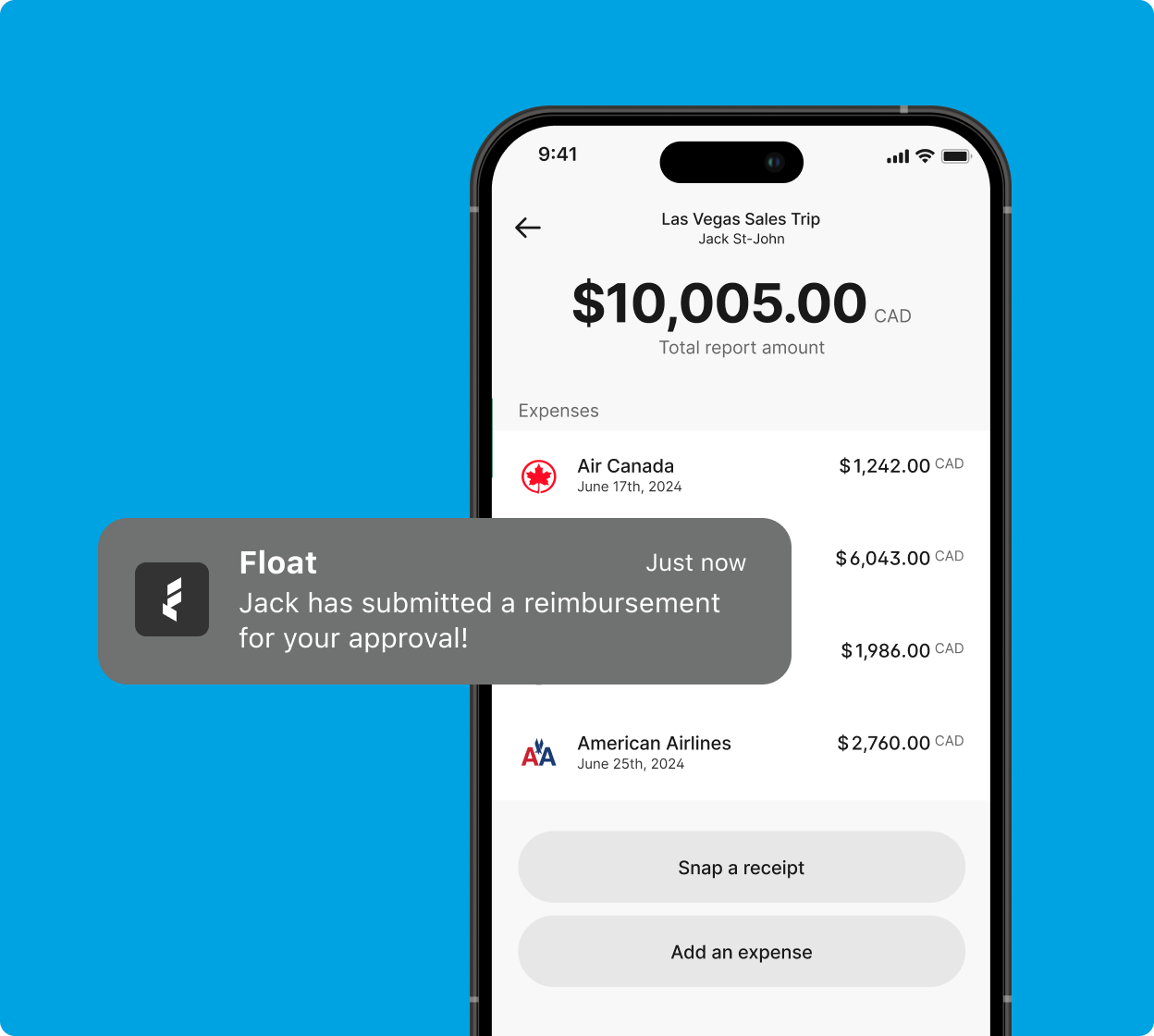

Expense Management

Eliminate the pain of expense reporting and pay out reimbursements in 1 business day

*Trademark of Visa International Service Association and used under licence by Peoples Trust Company.