Corporate Cards

Corporate Card Program Management Dashboard: Features & Benefits Guide

Explore modern card program management dashboards that streamline expense management for Canadian businesses.

August 18, 2025

Much like a pilot depends on a cockpit for visibility and control, your corporate card dashboard puts real-time insight into company spending at your fingertips, so you can steer your business forward with confidence.

Without this granular data in real time, the pilot could crash. Your business, too, can suffer without current, accurate information on company spend. Relying on manual reconciliations and retroactive expense reports can leave you in a fog, resulting in overspending and risky financial exposure. This is why a comprehensive card program management dashboard is essential. It can give you greater control over expenses and make financial operations as efficient as the airport’s priority boarding lane.

In this card program management guide, we look at how a modern card program management dashboard can streamline expense management for Canadian businesses through real-time visibility, smart controls and automation. Plus, we share the key benefits your company can get with the right card program management dashboard.

What is a card program management dashboard?

A card program management dashboard is a centralized platform for overseeing every aspect of your corporate credit card program.

It provides real-time insights into card activity for each cardholder, in addition to spending patterns, trends and anomalies. In a card program management dashboard, you have access to custom controls for each corporate card, spend approval workflows and internal card expense policies.

Month-end, often the bane of every accountant’s existence, is far simpler with a card program management dashboard. Your finance team can reconcile spend daily instead of waiting until the end of the month, as the dashboard seamlessly integrates with accounting tools like QuickBooks and Xero. This saves your team several hours every month while also making reconciliation more accurate.

Key features to look for in a corporate card program management dashboard

There are several corporate card management tools on the market, so how do you know which one is right for your business?

Here are the top five features we recommend you look for in a corporate card program management dashboard for the best control and visibility.

1. Real-time transaction monitoring

Opt for real-time transaction monitoring features that not only show you spending as it happens, but also provide alerts for unusual or out-of-policy transactions. Having the ability to detect fraud and misuse quickly enables your finance team to react quickly and rectify the situation before spending goes off the rails.

2. Customizable spend controls

Visibility into corporate card spending is table stakes. Having the ability to control that spending brings your business to another level. Look for card management tools that give you the ability to set spend limits by user, team or department, so you can have granular control based on your business needs.

You may also want the ability to restrict card usage by merchant category, such as advertising, alcohol and bars, apparel and more. This prevents spending approved funds on items that fall outside of business needs or require additional oversight.

Customizable spend controls give your finance team peace of mind since card users cannot overspend or spend beyond your company’s policy. If they go over card limits or use the card in a restricted area, the transaction is automatically declined. You can enforce your expense policy at the point of spend, instead of after the fact when it may be too late.

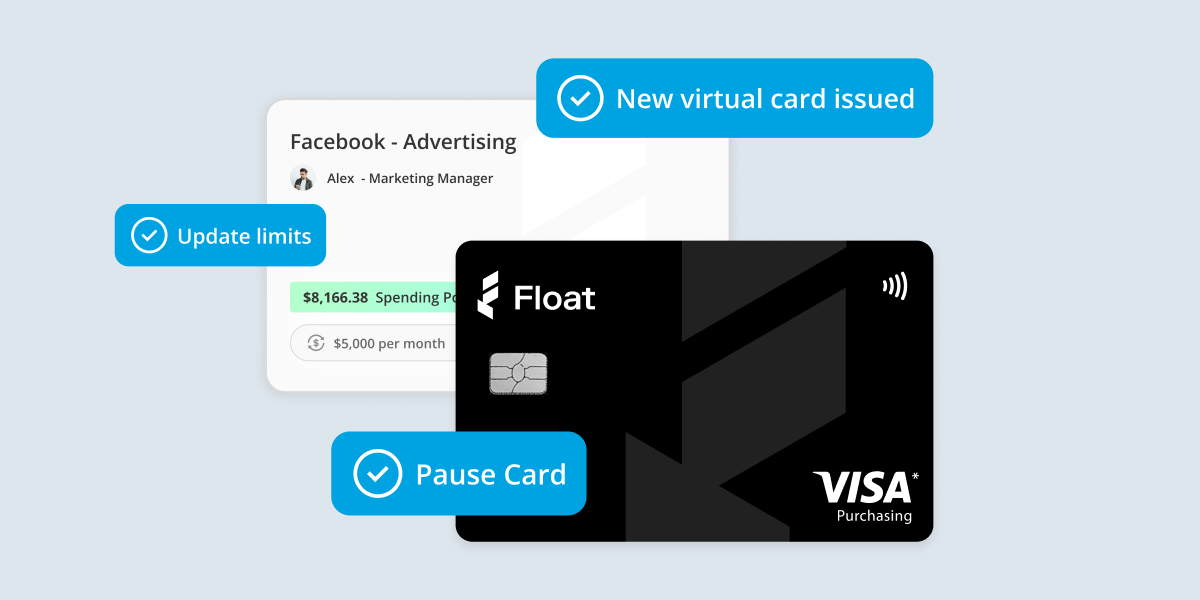

3. Easy card issuance and management

When you know who should get company cards, having the ability to easily issue them is key. Opt for features that enable you to instantly issue both virtual and physical cards to employees without going through a waiting period. Some banks take two to three weeks to issue corporate cards—who’s got time for that?

When you’re able to instantly allocate cards based on employee roles and needs, rather than card program restrictions, you can offer your team more flexibility and agility to get their jobs done well while still controlling employee spend.

Together with card issuance features, choose a card program management dashboard that enables you to manage card activation, suspension and cancellation without having to contact a help desk or wait on hold for hours.

Best business credit cards

Compare top options, fees and benefits for

Canadian companies.

4. Automated expense reporting

With a payment card program strategy in place, you’ll want to have access to automated expense reporting at the click of a button. Go for a card program management dashboard that auto-categorizes transactions for easy reconciliation. Think Uber rides automatically categorized as transportation and restaurants automatically categorized as meals.

To encourage card users to submit receipts, opt for instant digital receipt capture so employees can send in receipts right away from their phone. This allows for a streamlined month-end where your finance team doesn’t have to chase down receipts.

Built-in approval workflows are another great feature to have. The current pace of business doesn’t allow employees to wait days to get approval for an expenditure or spend amount (yawn!). If they have to compete at a fast pace, your team needs access to funds fast to stay ahead of competitors.

5. Robust reporting and analytics

In addition to automated expense reporting, growing Canadian businesses need access to comprehensive reporting and analytics features. Go for corporate card management tools that show you a breakdown of spend by individual, team, project or category in real time.

Opt for analytics that show you trends and anomalies so you can determine if something needs your attention and reduce unnecessary spend. You’ll also want the ability to flag issues early so your team can remain compliant with your spend policies.

Benefits of using a card program management dashboard

With the right card program management dashboard, your team can reconcile spend daily as it happens, saving hours each month. Other advantages include:

- Visibility and control: Get financial compliance enhancement with access to real-time spend monitoring. Prevent overspending and ensure policy guidelines are met with real-time insight.

- Operational efficiency: Eliminate manual expense monitoring and reconciliation processes, reduce approval delays and minimize human error. Finish month-end faster with synced accounting data and spend tracking optimization.

- Cost savings: With robust reporting and analytics, you can identify wasteful spending and vendor negotiation opportunities. Plus, you’ll be able to spot fraud and unauthorized spending before it’s too late to make changes.

- Enhanced employee experience: With an easy-to-use interface, fast reimbursement and flexible card options, you can provide employees with flexibility and control so they can excel in their work.

Float: A card program management dashboard designed for Canadian businesses

Looking to steer your business ahead of competitors?

Get the visibility and control you need with Float’s card program management dashboard. As your finance team grows, it’s critical to manage spend in real-time and reduce manual processes. With Float, you can track and manage spend as it happens, issue cards instantly, customize spending control and get access to robust reports.

Choosing the right corporate card program is a key business decision for both today and the future of your company. Discover how Float supports Canadian businesses with a comprehensive corporate card program.

Try Float for free

Business finance tools and software made

by Canadians, for Canadian Businesses.

Written by

All the resources

Corporate Cards

What is a Fleet Card? Complete Canadian Business Guide 2025

Explore the best fuel cards for small businesses in Canada. Learn about the benefits of using fleet cards to save

Read More

Financial Controls & Compliance

How to Find Your Business Incorporation Number: 2025 Guide

Learn how to find your business incorporation number in 2025. Discover why it’s important, where to look and what’s changed

Read More

Corporate Cards

QuickBooks Integration for Corporate Cards: Canadian Business Accounting Guide

Want a clear understanding of your expenses at all times without the hours spent chasing receipts? A QuickBooks integration might

Read More