Corporate Cards

Best Credit Card for Startup Businesses in Canada

Discover the best credit card for startup businesses in Canada, with top picks, perks, and tips to manage spend and support your growth.

April 6, 2025

Starting a business sounds thrilling until it’s time to manage the finances. From unpredictable cash flow to early-stage scaling, startup founders are juggling a lot. Finding the best credit card for startup businesses can make a surprisingly big impact.

Financial matters are rarely far away from a founder’s mind. Funding is the most pressing challenge in Canada, worrying 66.8% of startup owners. Another 40% worry about cash flow, 34% worry about accessing bank loans and 14% are concerned with debt repayment. This isn’t exactly the path to getting any beauty sleep.

In this guide, we’ll explain why startups have unique financial needs, what to look for in a business credit card and how to choose the right option for your early-stage company.

Why startup businesses have unique financial needs

Startups operate in a pressure cooker of growth and uncertainty, and we don’t mean the kind that turns out a quick and delicious pulled pork. These entrepreneurs are balancing tight budgets, early traction and aggressive goals, all while trying to build systems that won’t collapse under future growth.

That means every financial tool needs to work overtime. Founders need flexibility to cover expenses, visibility to track spend and the ability to scale without constantly reinventing the wheel.

What is a business credit card?

A business credit card is designed specifically for business spending on expenses like travel, subscriptions, equipment and marketing. Unlike personal cards, business credit cards often come with higher limits, built-in expense tracking and the option to issue cards to employees with custom spending rules.

Figuring out how to get a business credit card for your startup will also help keep business and personal finances separate, which makes tax season a lot less stressful. (You’re welcome, accountants).

Try Float for free

Business finance tools and software made

by Canadians, for Canadian Businesses.

Why is a business credit card important for startups?

Startups typically start scrappy, sometimes using personal credit cards to cover initial costs. But as spend ramps up and the team grows, the downsides become clear fast. Reimbursements create more admin, and those personal credit limits? Not built for scaling.

A business credit card gives your startup a dedicated line of credit and clearer financial control. It also helps you:

- Smooth out cash flow

- Build your business credit history

- Reduce fraud risk with virtual cards and spending limits

- Earn cashback or rewards for business purchases

- Streamline how your team spends (and how you track it)

Common financial challenges for startups

Founders wear a lot of hats, including those of CEO, CFO and sometimes IT support. Managing the complexity of startup financials can quickly feel like a full-time job.

Here are a few challenges Canadian startup owners face:

- Cash flow gaps

Startups don’t always get paid on time (or at all), so being able to delay payments by a billing cycle gives some breathing room.

- Scaling costs

Hiring, marketing and software costs can spike without warning. A credit card offers flexibility to cover expenses during high-growth moments.

- Disorganized spending

Without proper systems, it’s easy to lose track of who spent what and why. A business card with smart controls and real-time tracking can fix that.

- Limited access to capital

Early-stage businesses may not qualify for loans, so a credit card with no personal guarantee (like Float’s charge card) can offer vital access to funds without tying it to the founder’s personal credit.

Key considerations for startups

Once you figure out how to get a business credit card for a startup, it’s time to consider which card is right for you. Look for cards that offer real value in building a robust credit card program, not flashy perks you won’t use.

When choosing a business credit card for startups, here’s what to look for.

No personal guarantee

Ideally, the card won’t be tied to your personal credit, so your risk is limited if the business hits a rough patch.

Flexible underwriting

Look for cards that assess your business based on cash flow or funding, not just time in business or credit score.

Virtual cards and controls

The ability to issue employee cards, set spending limits and restrict certain types of purchases is key to keeping spend in check.

Real-time tracking and software integrations

This is a key factor. Your card should help you close the books faster, not slow you down with manual work.

Cashback or rewards

Choose a card that gives something back for the way your startup actually spends, whether that’s SaaS, ads or travel.

Best business credit cards

Compare top options, fees and benefits for

Canadian companies.

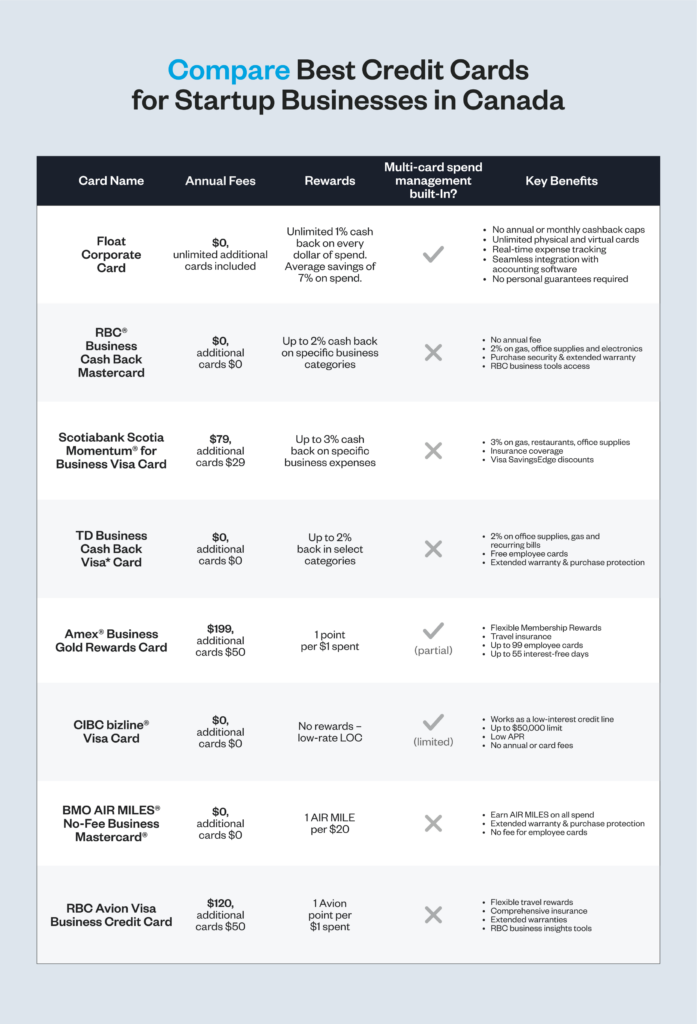

Best credit cards for startup businesses in Canada

Here’s a look at business credit cards that make sense for Canadian startups, whether you’re bootstrapping or scaling fast.

Float Corporate Card

With unlimited 1% cashback, no annual fees and no personal guarantees required, Float is purpose-built for startups that want to streamline finance ops for faster growth trajectories. Features like unlimited virtual cards, real-time expense tracking and seamless software integrations make this card a top choice for early-stage companies wanting financial systems to grow with them—especially when it comes to managing spend from multiple cards.

RBC® Business Cash Back Mastercard

This cash-back card from RBC rewards practical business spending, such as gas, electronics and office supplies, with 2% back on eligible categories. It’s a no-fee option that offers purchase protection and extended warranties, but the rewards program is less flexible than some competitors. Important to note that no spend management software is included. RBC’s online banking portal has limited features, so you’d have to integrate third-party tools like Expensify to get this functionality.

Scotiabank Scotia Momentum® for Business Visa Card

This Scotiabank card offers 3% cash back in a few key spending categories, which is a step up for businesses with predictable monthly costs. Restaurants, gas stations and office supply stores all earn higher rewards. It offers decent value for founders who don’t mind the $79 annual fee but may be overkill for early-stage startups with lighter spend. Again, no spend management software is included, which means you’ll be managing multiple cardholders and spend through basic banking portal tools and manual tracking or third-party apps.

TD Business Cash Back Visa Card

This is TD’s no-fee business credit card, and it’s designed to keep things straightforward. You’ll earn 2% cash back on office supplies, gas and recurring bills, with purchase protection and warranty extensions baked in. It fits early-stage businesses that want simple rewards and a reliable issuer, but the perks may not scale as well as other options on this list. No native spend management software or tools here either, so this is a good option for founders who want just the basics and plan to manually manage receipts and spending.

American Express® Business Gold Rewards Card

If your startup spends big, especially on ads, software or travel, this premium card from Amex offers plenty of value. You’ll earn Membership Rewards points, benefit from expense tracking tools and get access to travel perks and insurance. The $199 annual fee is high, so it might only be worth it for founders who aren’t looking to cut costs or who know how to really get the most out of Amex points. Amex does have some built-in expense tracking that allows you to download statements, receipts and categorize spending, as well as run an employee card program. But there are no real-time spend alerts or approval workflows and no automated reconciliation of receipts (unless you integrate a third-party tool).

CIBC bizline® Visa Card

This is more like a credit line in card form. With low interest rates and no annual fee, the CIBC bizline is a strong pick for startups that want simple access to funds without racking up debt. It’s light on perks but heavy on utility. If you’re focused on stability and managing cash flow over chasing rewards, it’s worth a look. But, it won’t be a great option for scaling spend as the company grows, since it offers very limited tools, no real-time spend control, no employee card tools and no integrations.

BMO AIR MILES® No-Fee Business Mastercard®

For startups that already collect AIR MILES, this card helps you stack rewards on business spending without an annual fee. You’ll earn 1 mile for every $20 in purchases and get basic protections like extended warranties, but miles aren’t as flexible as cashback. No spend management software included. No need for multi-card oversight? This may be the option for you, since it does not support multiple cardholders, team-level controls or integrations for spend management software.

RBC Avion Visa Business Credit Card

This RBC card is built for businesses with travel in their plans. With Avion points earned on every purchase, it’s a good choice for companies that want flexibility and premium travel perks. The $120 fee gets you a rewards program and insurance coverage, but it may be better suited for more established scale-ups with frequent travel needs. One step up from the basic RBC business cashback, this card offers some spend management features like multiple cardholders with basic limits and reports, but you’ll need to integrate with a third-party tool for true spend control, approval workflows or receipt capture.

How to choose the best credit card for your startup business

Choosing a business credit card for a startup is much like choosing a co-founder. It needs to be a good fit for how you operate now and how you plan to grow. Before you apply, make sure you understand your current financial position.

Take Properly, a Canadian real estate company that turned to Float’s solution to create a solid framework for company spend and approvals.

“As a startup, our credit card limit was low and our spend policies were essentially non-existent. What we had wasn’t scalable and Float turned it all around,” says Rhianna, finance director at Properly.

Match the card to your spend categories, and choose rewards and features that deliver long-term value. If your biggest costs are software and ads, a travel-heavy rewards card probably isn’t the right call.

“Float gives us the flexibility to set up cards with different titles, controls and spending limits,” says Rhianna. “Float also gives our finance team the power to spot and audit expenses coming through in real time.”

Alternative funding options

A business credit card is just one piece of the puzzle. Many startups don’t yet have years of credit history or steady revenue, so traditional financing options may not be within reach. Some startup businesses can benefit from a layered funding approach that may include lines of credit, venture debt or grants and government funding.

With some creativity, you can combine funding to offer you flexible access or a bit more runway when needed. Pairing a smart credit card with other funding tools can give your business more resilience, growth potential and less stress.

Float: Business credit cards tailored for startups in Canada

Float offers a business credit card and spend management platform with solid benefits for Canadian startups, giving you the tools to make your money work harder.

With flexible approvals, real-time expense tracking and unlimited virtual cards, Float helps early-stage companies move faster, stay in control and build a foundation for future funding.

Written by

All the resources

Expense Management

Controller Month-End Close Automation: Streamline Financial Reporting

Controllers, this one's for you. Let's talk about how how automating month-end close helps you move faster without sacrificing accuracy.

Read More

Corporate Cards

Corporate Card Program Implementation: Complete Management Guide

Ready to implement a corporate card program? This is where to start.

Read More

Cash Flow Optimization

Working Capital Management for Controllers: Optimize Cash Flow with Corporate Cards

Let's explore how controllers can use corporate cards to strengthen cash flow, improve operational control and support smarter financial decision-making

Read More