Cash Flow Optimization

Cash Flow Management for Canadian Businesses: 2026 Strategic Guide

Unlock business growth with our ultimate guide to understanding and improving cash flow in your business. Learn key strategies and tools to optimize today.

November 18, 2025

Imagine your business is booming. Demand is high and revenue looks great on paper. But when it comes time to pay vendors, cover payroll or invest in growth, you’re scrambling to find the cash. Sound familiar? Welcome to the world of cash flow.

Cash flow isn’t just about how much money your business makes. Timing is critical, too. You’ve got to know when the money is due to arrive and whether it’ll be there when you need it. A profitable business can still find itself in financial trouble if cash flow isn’t properly managed.

So, what is cash flow in a business? In this 2026 guide, we’ll break down why business cash flow matters, common pitfalls that trip companies up and actionable strategies to keep your finances in the green. Whether you’re an entrepreneur looking to scale or a seasoned business owner fine-tuning your financial strategy, this is your go-to guide for discovering it all.

What is cash flow in a business?

Simply put, cash flow is the money flowing in from customers, sales or funding, and the money flowing out to pay employees, cover expenses and invest in growth. We know from recent spend trend data that highly profitable companies dedicate a large portion of their spending to growth measures like digital marketing, so keeping an eye on your cash flow is key to sustainable growth.

Well-managed cash flow ensures that your business has the liquidity to meet financial obligations, capitalize on new opportunities and maintain stability—even in times of uncertainty. Understanding and optimizing cash flow is essential for long-term success. Even profitable businesses can struggle if they don’t have cash available when they need it.

Managing cash flow also means keeping a close eye on your working capital, which is the balance between your short-term assets and liabilities. This is what gives your business flexibility to operate, pay suppliers on time and take advantage of new opportunities.

Incoming vs. outgoing cash flow

Business cash flow can be broken down into incoming cash flow (money flowing into the business) and outgoing cash flow (money leaving the business).

Incoming cash flow includes things like customer payments, loan proceeds, investor funding and revenue from selling assets.

Outgoing cash flow covers rent, payroll, supplier payments, taxes, debt repayments, operational costs and other expenses.

Positive vs. negative cash flow

Positive cash flow means more money is coming in than going out. This allows for reinvestment into your business, savings and financial flexibility.

Negative cash flow happens when expenses exceed income, leaving a business struggling to meet obligations. While occasional negative cash flow may not be a red flag, consistent shortfalls signal potential trouble. Think of it like a leaky bucket: sooner or later, you’ll run dry unless you patch the problem.

Types of cash flow

Cash flow breaks down into three main categories:

- Operating cash flow: This is your day-to-day cash movement. It includes revenue from sales, payments from customers and expenses like payroll, rent and utilities.

- Investing cash flow: Money going in and out related to investments. This could be purchasing equipment, acquiring another business or selling assets.

- Financing cash flow: Funds moving between your business and investors or lenders, such as business loans, issuing shares, or paying dividends.

Understanding these cash flow types and categories can help you spot potential financial trouble before it happens.

Now that we’ve covered the basics, it’s time to understand why strong cash flow management matters for every business.

Float helps you better manage your business spend

See how with your personalized

demo from a Float expert.

Why is cash flow important?

Steady, positive cash flow gives you the ability to cover expenses, invest in new opportunities and weather unexpected financial storms.

Here’s why visibility into cash flow should be a top priority for every business owner:

1. It keeps operations running smoothly

If you don’t have enough cash on hand, even a minor delay in customer payments can lead to missed payroll, unpaid suppliers or service disruptions.

2. It prevents reliance on expensive debt

When cash is tight, businesses often turn to high-interest credit lines or loans to cover expenses. Avoiding unnecessary debt keeps your business financially healthy.

3. It fuels business growth

Whether you want to expand into new markets, hire additional staff or upgrade equipment, having available cash allows you to jump on opportunities without hesitation.

4. It builds financial resilience

Unexpected costs, like equipment breakdowns or economic downturns, can cripple a business that isn’t financially prepared. Well-managed cash flow acts as a safety net.

“There’s a timing aspect to cash flow,” Jennifer McNamee, CPA and Senior Finance and Account Manager at Float, explains. “If you have a mismatch on the inflows and outflows, you could run out of cash. Then you have to tap into emergency solutions like debt or a line of credit, which are costly ways to finance your business.”

With better visibility and automation, you can manage timing mismatches and make proactive financial decisions.

Common challenges in managing cash flow

Even businesses with strong revenue can run into cash flow problems. According to a Float study, 65% of SMBs are dealing with long processing times for financial transactions, and 59% are experiencing lengthy loan approval processes—both issues that can lead to significant cash flow issues.

Here are some of the most common challenges that can impact financial stability:

Delayed customer payments

When businesses rely on invoices with long payment terms (e.g., net 30, net 60), it can create cash flow gaps. If customers take too long to pay, it affects the company’s ability to cover its own expenses.

Hefty upfront costs

Some businesses, especially those in retail or manufacturing, must pay for inventory, raw materials or equipment long before they generate revenue from sales.

Unexpected expenses

Emergencies happen. Whether it’s equipment repairs, tax obligations or market downturns, unexpected costs can drain cash reserves quickly.

Poor payment terms with vendors

If your vendors require quick payments while your customers take longer to pay, you may find yourself constantly short on cash.

Seasonality

Your business may have peaks and valleys in operations, much like an ice cream shop would during the winter. Accurately forecasting seasonal sales dips can help you prepare for the lull.

Lack of cash flow visibility

If a business doesn’t regularly monitor cash inflows and outflows, it can be blindsided by a sudden shortage. Understanding cash flow trends through regular reporting is key to avoiding financial surprises.

How to calculate cash flow

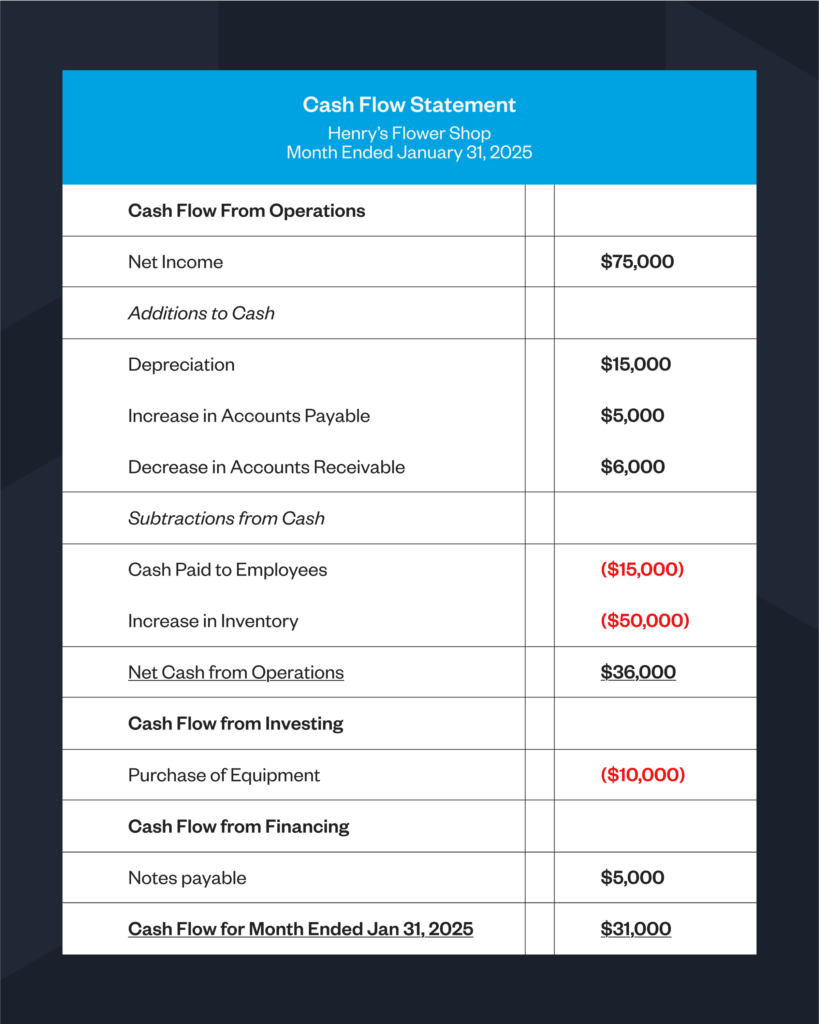

Calculating cash flow is essential for understanding your business’s financial health. Accurate visibility into cash flow requires diligent expense management, revenue tracking and proactive forecasting. The primary tool used to calculate it is the cash flow statement, which provides a snapshot of how cash moves in and out of your business over a specific period.

You don’t need to be a CPA to make sense of this (although a cup of strong coffee might help). To keep things simple, you can calculate cash flow with this basic formula:

Cash Flow = [ Cash Inflows – Cash Outflows ]

Reading your cash flow statement will be slightly more complex. Cash flow statements track the movement of money in and out of your business and are divided into three main sections, as shown in the example below.

Let’s break down the parts of this cash flow statement a little more.

Operating activities

These cover cash generated from day-to-day business operations, starting with net income and then adjusting for non-cash expenses, such as depreciation and amortization. Operating activities also account for changes in working capital, such as money tied up in accounts receivable, inventory and accounts payable. If your company sells products or services on credit, cash flow may be delayed, while paying suppliers later can temporarily improve cash flow.

Investing activities

These focus on buying and selling long-term assets. This includes capital expenditures (CapEx), like purchasing equipment or property, which reduces cash. On the other hand, selling assets or investments brings in cash. Investing activities also include buying or selling marketable securities or acquiring other businesses.

Financing activities

These track cash movements related to investors and lenders. Raising funds through loans or issuing stock brings in cash, while repaying debt, paying dividends, or buying back shares reduces it. Financing activities reflect how your company funds its operations beyond its core business activities.

At the bottom of the cash flow statement, all of these cash movements are added up to show the net increase or decrease in cash for the period. This is reconciled with the beginning cash balance, leading to the final ending cash balance, or the actual cash the business has on hand at the end of the reporting period.

Once you understand how cash moves through your business, the next step is predicting what’s coming next.

Cash flow forecasting management tools and techniques

Forecasting turns financial data into foresight. It allows you to anticipate shortfalls before they happen and plan your next move with confidence. But forecasting is only as good as the data feeding into it. Managing cash flow manually through spreadsheets or disconnected systems can leave blind spots that make planning harder than it needs to be.

Modern tools solve this by blending real-time visibility with automation. Today’s cash flow platforms integrate directly with your accounting and banking systems to give you a clear picture of company spend and Float account balancest and how that timing affects your working capital. They automate reconciliations, flag delayed or unusual transactions and reduce the manual work that slows teams down.

Once that foundation is set, you can build stronger forecasts. Here’s what to focus on:

- Create your cash flow statement: Use historical inflows and outflows as your base.

- Factor in seasonality and trends: Predict changes in demand, recurring payments and slow-paying clients as best you can.

- Run multiple scenarios: Create “best case,” “expected” and “worst case” models to stress-test your cash position.

- Automate and update often: Use digital tools, like Float or your ERP integration, to refresh forecasts weekly or monthly.

Platforms like Float’s expense management software provide the real-time spend visibility needed to inform stronger cash-flow forecasts.. Real-time visibility into cash positions can help optimize working capital as well as streamline approvals, and integrations with accounting tools, like NetSuite or QuickBooks make forecasts more accurate.

For a deeper dive, check out our cash flow forecasting guide.

Technology solutions for cash flow optimization

Technology is redefining how small businesses manage cash. The right system doesn’t just show you what’s happening—it helps you act on it.

Key solutions to consider:

- Automated expense management: Tools like Float’s platform give you transaction-level visibility, automate reimbursements and track spending across teams in real time.

- Bill pay solutions: Fast funding and next-day settlement for EFT and ACH payments ensure money moves when your business needs it, while global wires offer additional flexibility.: Predictive tools analyze spend patterns and help you plan for future liquidity needs.

- Smart corporate cards: Spend controls and category limits help you manage budgets automatically, preventing overspending.

- Integrated dashboards: Combine accounting, card spend and cash flow forecasts in one view to make faster decisions.

Together, these solutions optimize your cash flow and working capital, keeping your business agile.

Importance of company cash flow management and analysis

Analyzing cash flow will help you make smarter business decisions. Here’s how.

Identifying financial trends

By consistently analyzing cash flow, you can recognize patterns in revenue and expenses, such as seasonal dips, delayed customer payments or unexpected cash shortages. This allows your business to plan ahead, ensuring you have enough cash reserves during slow periods and optimizing spending during peak times.

Ensuring liquidity

Maintaining a steady balance between cash inflows and outflows allows your business to cover essential expenses like payroll, rent and supplier payments without disruption. A clear picture of your cash position helps prevent cash shortages that could jeopardize operations.

Avoiding unnecessary debt

Poor cash flow management often leads businesses to rely on short-term loans, high-interest credit lines or emergency funding to stay afloat. By proactively monitoring cash flow, you can better anticipate financial needs, reduce reliance on costly borrowing and allocate funds more efficiently to support sustainable growth.

But cash flow management isn’t all about saving for a rainy day. Once you’ve mastered it, you can use cash flow to help your business grow by reinvesting strategically. “Sometimes, businesses get too focused on cash preservation and miss out on opportunities for growth,” says Jennifer. “Finding the right balance between saving and strategic reinvestment is key.”

With a balanced approach, reinvestment can help you expand operations by opening new locations, hiring employees, or increasing production capacity. It can support technological upgrades, such as investing in tools or automation, that improve efficiency and productivity. Overall, sound cash flow management sets you up for sustainable success in your business.

How payment timing affects cash flow

The key to healthy cash flow is watching when money flows through your business—not just how much. This helps you avoid the cash crunches that can occur if customer payments arrive late or supplier bills come due too soon. Aligning inflows and outflows also reduces your reliance on short-term credit.

- Collect receivables faster: Send invoices promptly, shorten payment terms and automate reminders to bring cash in sooner.

- Delay outflows strategically: Negotiate longer payment terms with suppliers or schedule large payments after key receivables clear.

- Match inflows to obligations: Align billing cycles with recurring costs like payroll or rent to minimize shortfalls.

These timing adjustments smooth out volatility and improve working capital. Float’s expense management platform automates payment tracking and visibility, helping you stay ahead of due dates and avoid overdrafts.

How to improve cash flow in a business

Here are 7 ways to take back control and improve your business’ cash flow.

1. Speed up receivables

One of the easiest ways to improve cash flow is to get paid faster. Send invoices as soon as work is completed and set clear payment terms. Consider offering early payment discounts to encourage quicker transactions, and automate reminders to follow up on outstanding invoices. The faster money comes in, the less likely you are to run into cash shortages.

2. Negotiate better payment terms

Negotiating extended payment deadlines with vendors gives your business more flexibility. If possible, arrange staggered or milestone-based payments for large projects to spread costs over time. Many vendors are open to flexible arrangements, especially if you maintain a strong relationship.

3. Cut unnecessary expenses

Conduct regular audits of your expenses to identify areas where you can cut back costs. Cancel unused subscriptions (hey, we’re all guilty of it!), renegotiate contracts and consider shifting to more cost-effective operational models. Even small savings can add up to significant cash flow improvements over time.

4. Maintain a cash reserve

Having a financial cushion is crucial for handling unexpected expenses. Set aside a portion of your profits into an emergency fund that can cover at least three to six months of operating costs. Consider placing these reserves in a high-yield business account to maximize returns on idle cash while keeping it accessible when needed. This ensures that you have funds available to navigate downturns without relying on expensive debt options.

5. Optimize inventory management

For product-based businesses, inventory can be a major cash drain. Avoid overstocking by closely monitoring sales trends and using just-in-time inventory systems to reduce holding costs. Clearing out slow-moving stock through discounts or promotions can also free up cash that’s otherwise tied up in unsold products.

6. Leverage cash flow management tools

Technology can help you track and improve business cash flow. Software like Float provides real-time insights into cash movements, helping you forecast potential shortfalls and make informed decisions. Automating financial tracking also reduces human error and ensures you always have a clear picture of your financial standing.

Float helps you better manage your business spend

See how with your personalized

demo from a Float expert.

7. Diversify revenue streams

Relying on a single income source can be a risky strategy. Consider expanding your offerings, entering new markets or adopting subscription-based models to create more predictable revenue. Upselling and cross-selling to existing customers can also improve business cash flow without increasing acquisition costs.

Cash flow management for seasonal businesses

If your business has busy and slow periods, cash flow planning is non-negotiable. Retailers, tourism operators and agriculture businesses all face seasonal swings that can make budgeting unpredictable. Strong forecasting and visibility help you prepare—not just react.

Here are a few ways to stay steady:

- Forecast for your slow season: Build cash reserves during peak periods to cover fixed costs during the slower periods.

- Use rolling forecasts: Update projections regularly to adapt to new data and seasonal shifts.

- Cut variable costs when demand dips: Reduce inventory or pause non-essential spending.

- Explore flexible funding: Use credit facilities or Float’s spend management tools to manage short-term gaps responsibly.

- Track spending in real time: Float’s dashboards show where money is going, helping you time expenses around revenue cycles.

For more on best practices, explore our article on working capital management.

Take control of your business cash flow

Cash flow management doesn’t have to be a guessing game. With Float, you gain real-time insights into your business’s financial health with a leading spending and expense management platform that helps you track outflow to make informed financial decisions.

In a year when every dollar counts, visibility and timing are everything. Book a demo today to see how Float can help you master your cash flow and strengthen your business finances.

Written by

All the resources

Corporate Cards

Corporate Card Security Best Practices for Canadian Businesses: 2026 Complete Guide

Corporate cards should streamline spending, not invite fraud. Seb Prost, CPA, shares how businesses can stay ahead with proactive security.

Read More

Corporate Cards

Discover: Virtual Credit Cards for Canadian Businesses

Explore the benefits of virtual credit cards with Float. Discover how this modern payment solution enhances security and simplifies your

Read More

Cash Flow Optimization

ACH vs EFT Payments: Key Differences for Canadian Companies

Learn the key differences between EFT and ACH payments, how they work, which options might be available to your business

Read More