Expense Management

How Expense Management Can Transform Canadian Enterprises

Learn how expense management solutions can transform your business operations. Know what to look for when choosing the right solution for your business.

September 20, 2024

As a finance leader in a Canadian enterprise, you understand the critical role that effective expense management plays in driving business success. By streamlining processes, enhancing visibility, and enabling data-driven decision making, a robust expense management system can transform the way your organization operates.

In this article, we’ll explore the challenges of traditional expense management approaches and highlight how modern solutions are empowering Canadian businesses to optimize their financial operations. You’ll discover the key features to look for in an expense management platform and learn how these tools can help your enterprise achieve its goals.

Manage Spend with Float

Canada’s only finance & corporate cards Spend Management platform that helps businesses save 7% on their spend.

What is Expense Management?

Expense management is the process of tracking, controlling, and optimizing business spending. It involves recording expenses, enforcing spending policies, and analyzing financial data to identify opportunities for cost savings and process improvements. Modern expense management solutions streamline this process through automation and real-time visibility, enabling finance teams to focus on strategic initiatives rather than manual tasks.

The Challenges of Traditional Expense Management for Canadian Businesses

- Time-consuming manual processes: Manual expense tracking is error-prone and diverts valuable resources from more strategic activities.

- Lack of real-time visibility: Without instant access to spending data, finance teams struggle to make informed decisions and identify potential issues.

- Difficulty enforcing policies: Ensuring compliance with company spending policies is challenging when relying on manual processes and post-transaction audits.

- Tedious reconciliation: Reconciling expenses with accounting systems is a time-consuming month-end task that can delay financial reporting.

- Administrative burden: Managing paper receipts and expense reports creates unnecessary administrative work for employees and finance teams.

How Modern Expense Management Solutions Benefit Canadian Enterprises

- Automated expense tracking: Eliminate manual data entry and reduce errors by automatically capturing transaction data from corporate cards and receipts.

- Real-time visibility: Gain instant insights into company-wide spending patterns, enabling proactive decision making and budget management.

- Simplified policy enforcement: Customize spending controls and approval workflows to ensure compliance with company policies.

- Seamless accounting integration: Integrate directly with accounting software like QuickBooks and Xero for faster, more accurate reconciliation.

- Streamlined expense reporting: Digitize receipt capture and simplify expense report submission via web and mobile apps, reducing administrative burden.

- Data-driven insights: Leverage robust reporting and analytics to identify cost-saving opportunities and optimize spending.

Key Features to Look for in an Expense Management Platform

- Powerful corporate cards: Look for corporate card benefits like built-in spend controls, instant transaction data, and seamless integration with your expense management system.

- Mobile receipt capture: Enable employees to easily capture and submit receipts on-the-go using a mobile app.

- Customizable workflows: Ensure the platform allows you to tailor approval processes and spending policies to your organization’s unique needs.

- Accounting software integration: Prioritize solutions that offer direct integration with your existing accounting software to streamline reconciliation.

- Comprehensive reporting: Choose a platform with robust reporting and analytics capabilities to gain valuable insights into spending patterns and identify areas for optimization.

Choosing the Right Expense Management Solution for Your Canadian Business

When selecting an expense management platform, it’s essential to evaluate your organization’s specific needs and pain points. Consider the inefficiencies in your current processes and identify areas where automation and streamlining can have the greatest impact.

Look for a solution that is tailored to the unique requirements of Canadian businesses, such as multi-currency support and compliance with Canadian tax regulations. Ease of use should also be a top priority, as a user-friendly interface will encourage employee adoption and minimize training requirements.

Assess the platform’s integration capabilities with your existing accounting and finance tech stack. Seamless integration with tools like QuickBooks and Xero will ensure a smooth transition and minimize disruption to your workflows. Finally, prioritize data security and privacy, especially when dealing with sensitive financial information, to protect your business and maintain client trust.

Implementing an Expense Management System: Best Practices

- Define clear policies: Clearly communicate expense policies to all employees to ensure compliance and minimize confusion.

- Provide comprehensive training: Offer training and support during the rollout phase to help employees adapt to the new system.

- Start with a pilot group: Begin with a small pilot group before deploying company-wide to identify and address any issues early on.

- Encourage adoption: Use incentives and gamification techniques to encourage employee adoption and maintain engagement.

- Continuously improve: Gather feedback from users and iterate on processes as needed to optimize performance and user satisfaction.

The Future of Expense Management for Canadian Enterprises

As technology continues to advance, expense management solutions will become even more sophisticated and powerful. AI-powered expense auditing and fraud detection will help businesses identify and prevent unauthorized spending, while predictive analytics will enable proactive budget management and forecasting.

Blockchain technology may also play a role in secure and transparent expense tracking, providing an immutable record of transactions and reducing the risk of fraud. Greater integration with corporate travel management systems will streamline the end-to-end travel and expense process, from booking to reimbursement.

Personalized spend insights and recommendations for employees will help them make more informed decisions about their business spending, while also identifying opportunities for cost savings at the individual level.

Manage Spend with Float

Canada’s only finance & corporate cards Spend Management platform that helps businesses save 7% on their spend.

How Float’s Spend Management is Transforming Canadian Businesses

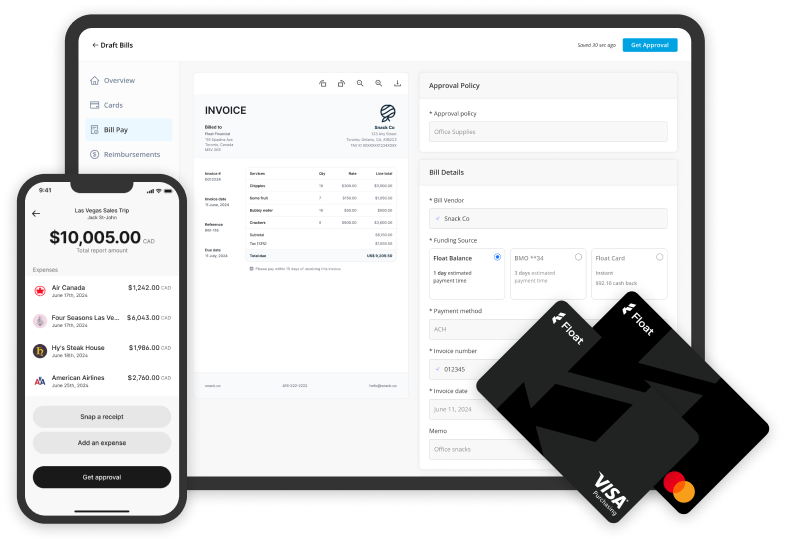

An all-in-one platform that combines corporate cards, expense management, and bill pay can revolutionize the way Canadian enterprises manage their finances. By offering 1% cashback on all spend and 4% interest on deposits, businesses can maximize their savings and improve their bottom line.

Automated receipt capture and one-click expense report submission streamline the expense reporting process, while seamless integration with popular accounting software ensures accurate and up-to-date financial data. Advanced spend controls and real-time transaction monitoring provide unparalleled visibility into company-wide spending, enabling finance teams to make informed decisions and identify potential issues before they escalate.

Float is the only Canadian Spend Management platform that helps businesses save on average 7% of their spend. Float offers powerful accounting automations, 4% interest on all funds held in Float and a Charge Card option. Float also features multitude of payment options with Corporate Cards, Bill Pay, and Reimbursements (including EFT payouts). Float is completely free to use on the Essentials plan, so why not just give it a try?

Written by

All the resources

Expense Management

How Do You Handle Employee Reimbursements Efficiently?

Learn how to simplify employee reimbursements with efficient, scalable strategies for small businesses and growing finance teams.

Read More

Corporate Cards

Amex Global Platinum Dollar Card Alternatives for Canadian Businesses in 2026

Canadian businesses are dealing with the discontinuation of the Amex Platinum Global Dollar Card and looking for a replacement card.

Read More

Expense Management

CDIC Insurance for Canadian Business Banking: Complete Protection Guide

Uncertainty about where your money sits—or whether it’s protected—is the last thing any business needs. That’s why understanding CDIC insurance

Read More