CASE STUDY

How Float Eliminated 96% of Coastal Reign’s Repetitive Bookkeeping Tasks

1 hour

reconciliation at month-end

Full visibility

with real-time insights

Xero integration

to close books faster

THE CHALLENGE

- Applying for traditional bank cards was time-consuming and tiresome, with employees needing to wait up to 3 weeks to receive the cards.

- Founders had limited visibility into which team member was responsible for various expenses.

- Employees struggled with submitting receipts and expenses on time, resulting in missing documentation and month-end backlogs.

THE SOLUTION

Coastal Reign provided Float cards to a quarter of their team, giving them immediate access to spend capital in order to do their jobs more efficiently. Designated cards by team member meant follow-up was more efficient, especially with Float’s instant reminders to Slack, text, or email receipts immediately following the transaction. This meant Finance wasn’t stuck in the dark and team members were less stressed at month-end.

THE RESULTS

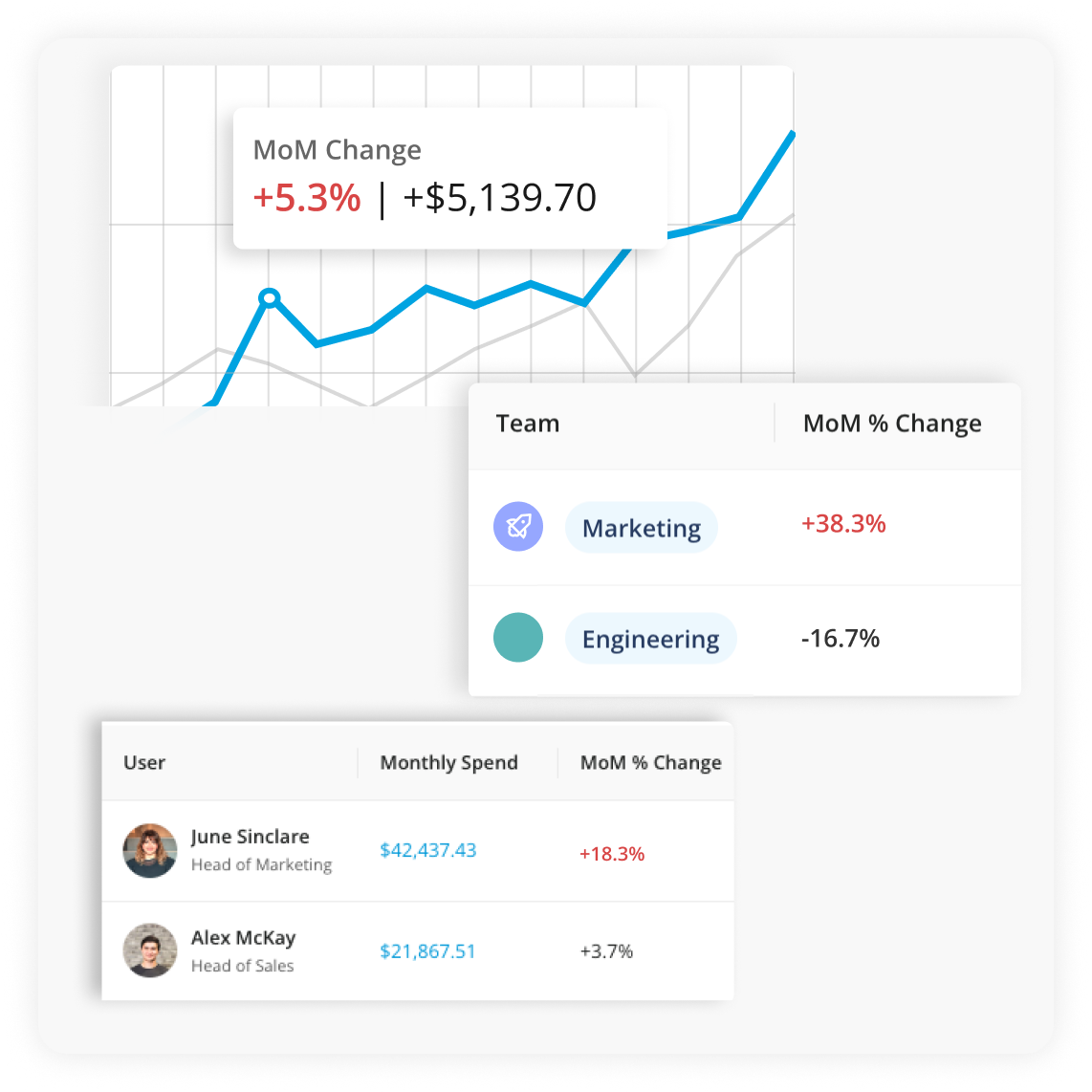

- Reconciliation at month-end went from 1 day to 1 hour, thanks to digital receipt submissions and automatic tagging of GL codes.

- Eliminated the need to hire another contractor for reconciliation.

- Full visibility into which team members are responsible for each purchase, with controls to cancel or reissue cards in seconds.

- Float’s integration with Xero makes bookkeeping a breeze.

About the Company

Meet Coastal Reign, a scrappy start-up founded in a living room transformed into a cross-Canada custom printing provider with a staff of 30+. Known for their dedication to exceptional quality and customer service, Coastal Reign caters to everything from schools and sports teams, to government agencies, to small- and medium-sized businesses, to huge companies like Microsoft, Netflix, and Walt Disney.

THE DETAILS

In just 10 years, Coastal Reign co-founders Eddison Ng and Boaz Chan scaled the company from a living room to a global enterprise with more than 30 employees. But despite the expansion, team members still shared one single traditional bank card for expenses, resulting in confusion, stress, and countless hours of follow-up when it came to closing the books at month-end.

“When we were all using the same card, there was no accountability whatsoever,” shares Eddison. “We were always chasing receipts – it’s important but the worst part of your day for anyone who had to do it. And we wondered if some charges were legitimate or fraudulent. We were losing sleep because of the uncertainty.”

The pair considered applying for additional credit cards to add more flexibility, but neither was interested in visiting a local branch in person, filling out endless forms, or waiting weeks on end for physical cards. And if an employee left, they had to go through the whole process over again since bank cards weren’t transferable. Plus, it still didn’t solve the problem of internal accountability and receipt-chasing.

“Because of Float, we’re all free to focus on data-driven, value-added work that grows our business and supports our customers.”

Eddison Ng, Co-Founder, Coastal Reign

That’s when the company’s bookkeeper shared a recommendation for Float’s card and spend management platform.

After a quick online application, the 8 employees who needed one had a virtual card in their name, with a physical card shipping just 24 hours later once requested. The cards were pre-funded with amounts set by the team, and auto-funded with top-ups once a minimum balance was hit.

“We maintain a healthy balance and enable auto-loading to ensure no delays,” shares Eddison. “It’s important that all our employees feel like we’re on the same team, and for us, that involves making sure they have the necessary funds to do their jobs without waiting on transfers.”

Even better, Eddison and Boaz are no longer concerned about knowing who spent what. Since there’s no extra charge for additional cards, every employee who needs one has a personal card. Cards can also be assigned by vendor or GL code to make identifying charges and repeat spends easy. And because Float sends an automatic email, text, or Slack message after every transaction, employees are able to quickly reply with a photo or attachment of their receipt, meaning month-end is spent reconciling the books, not chasing down month-old receipts.

“Float is incredibly intuitive to use and our team immediately appreciated the simplicity and ease-of-use.”

Eddison Ng, Co-Founder, Coastal Reign

“We have a rule in place. You have to upload your receipt immediately to Float, and once you do, your card is unlocked for you to spend again. Other spend management platforms didn’t let us put this extra control in place.”

For one-off expenses, like flights or conferences, the team can toggle the settings so funds expire after a certain date or can’t surpass a specified amount; helpful when loading cards with higher amounts or giving cards to more junior employees. For recurring expenses, like subscriptions or weekly team lunches, pre-funded amounts can stay low, but reset on a daily, weekly, monthly, or annual basis.

“Float is incredibly intuitive to use and our team immediately appreciated the simplicity and ease-of-use.”

Eddison Ng, Co-Founder, Coastal Reign

“Float is incredibly intuitive to use and our team immediately appreciated the simplicity and ease-of-use,” shares Eddison. “Plus, our bookkeeper loves the additional reporting and ability to spot red flags instantly.”

One such red flag popped up early on—a supplier accidentally shared confidential card details via email. With a traditional card, Coastal Reign would have spent frantic hours finding the right number to call, being put on hold, providing details, cancelling the card, and then waiting weeks for a replacement. Yet because they were with Float, everything was handled in minutes, with an immediate cancellation of the card and the creation of a new one.

“Because of Float, we’re all free to focus on data-driven, value-added work that grows our business and supports our customers,” says Eddison. “Float eliminates 99% of the repetitive bookkeeping tasks and manual labour with automation that ensures our data is always current and accurate—and that definitely helps us sleep at night.”

Explore more customer stories

Wahi

Wahi’s finance team spends up to 76% less time on receipt collection, reconciliation, and month-end close.

Makeship

Float provides seamless management in both CAD and USD currencies, while decreasing time spent on month-end by 60%.

Practice Better

“Where it took 12 days before, I can now close expenses in one or two days. It just reconciles so easily.”