Cash Flow Optimization

Step-by-Step Guide to ACH Payments for Canadian Companies

Discover our step-by-step guide to ACH payments for Canadian companies. Simplify your payment processes and improve cash flow with Float’s expert tips!

January 30, 2025

Are you looking to streamline your business’s payment processes and reduce transaction costs? ACH payments offer a secure, efficient, and cost-effective solution for Canadian businesses. In this step-by-step guide, we’ll walk you through the process of setting up and making ACH payments, helping you optimize your financial operations.

By understanding the benefits of ACH payments and following our detailed instructions, you can take advantage of this powerful payment method and improve your business’s financial efficiency. Let’s dive in and explore how ACH payments can transform the way you manage your transactions.

Try Float for free

Business finance tools and software made

by Canadians, for Canadian Businesses.

What is an ACH Payment in Canada?

ACH (Automated Clearing House) payment is an electronic funds transfer system that processes payments between banks. It is commonly used for direct deposits, bill payments, and other types of financial transactions. ACH payments are processed in batches and can be more cost-effective than wire transfers.

Why Use ACH Payments for Your Business?

ACH payments provide a secure, efficient, and cost-effective way for businesses to manage transactions. They offer lower processing fees compared to credit card payments and enable businesses to streamline their accounts payable processes. Additionally, ACH payments are ideal for recurring payments, reducing the need for manual intervention. But not every financial service provider offers ACH (learn more about ACH vs EFT in this article.)

How to Make an ACH Payment as a Canadian Business

Step 1: Set Up Your ACH Account

- Contact your bank to set up an ACH account, ensuring it supports ACH transfers.

- Provide necessary business documentation and verify your identity.

- Your bank will guide you through the setup process and provide the required forms.

Step 2: Gather Required Information

- Obtain the recipient’s banking details, including their bank account number and routing number.

- Ensure you have the recipient’s full name and address as it appears on their bank account.

- Collect any additional information required by your bank, such as the recipient’s SWIFT code for international transfers.

Step 3: Initiate the ACH Payment

- Log into your bank’s online portal or use their ACH payment service.

- Enter the recipient’s banking details, the payment amount, and the payment date.

- Review the information for accuracy and submit the payment request.

- Confirm the payment through your bank’s security verification process.

Step 4: Monitor the Payment Status

- Track the status of your ACH payment through your bank’s online portal.

- ACH payments typically take 1-3 business days to process, but this can vary based on your bank and the recipient’s bank.

- Ensure that the payment has been successfully completed and received by the recipient.

Step 5: Record the Transaction

- Keep a record of the ACH payment for your financial records.

- Update your accounting software or accounts payable platform with the transaction details.

- Monitor your bank statements to verify the payment has cleared.

Tips on Ensuring Successful ACH Payments

1. Verify Recipient Information

- Double-check recipient details: Carefully review all recipient information before initiating the ACH payment to avoid errors and delays in processing.

2. Schedule Payments in Advance

- Plan ahead: To ensure your ACH payments are processed on the desired date, schedule them in advance, taking into account the processing time required by your bank.

3. Use Secure Banking Platforms

- Prioritize security: Always use secure online banking platforms to protect your financial information and ensure the safety of your transactions.

Frequently Asked Questions

The steps include setting up an ACH account, gathering recipient information, initiating the payment, monitoring the payment status, and recording the transaction.

Yes, Canadian businesses must comply with regulations set by Payments Canada, including obtaining proper authorization from the recipient.

If you are looking for a modern solution for ACH payments in Canada, look no further than Float. Otherwise, many major banks in Canada offer ACH payment services, including RBC, TD, and Scotiabank, among others, however, additional fees may apply.

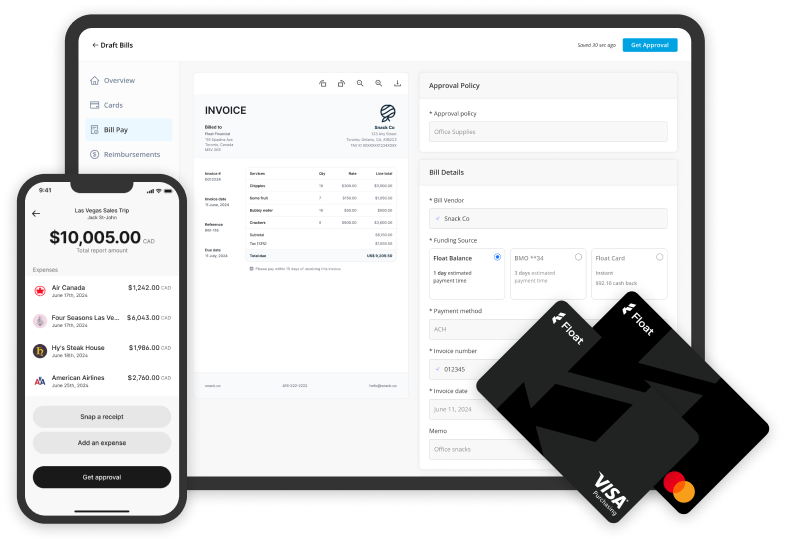

Float is Free to use on our Essentials plan, where you will be able to issue unlimited virtual CAD/USD cards, earn 4% interest on deposits, reimburse employees and pay vendor bills. If you need more sophisticated functionality, like over 20 physical cards, Netsuite integration, or an API solution, you will have to consider our paid Professional and Enterprise plans.

Unlike traditional cards that get you to spend more, Float is the only corporate card in the world that helps businesses spend less. Through a combination of financial rewards like our 1% cashback, 4% interest on deposits, no FX fees with our USD cards and time savings of at least 8 hours per employee Float’s customers on average save 7% on their spend.

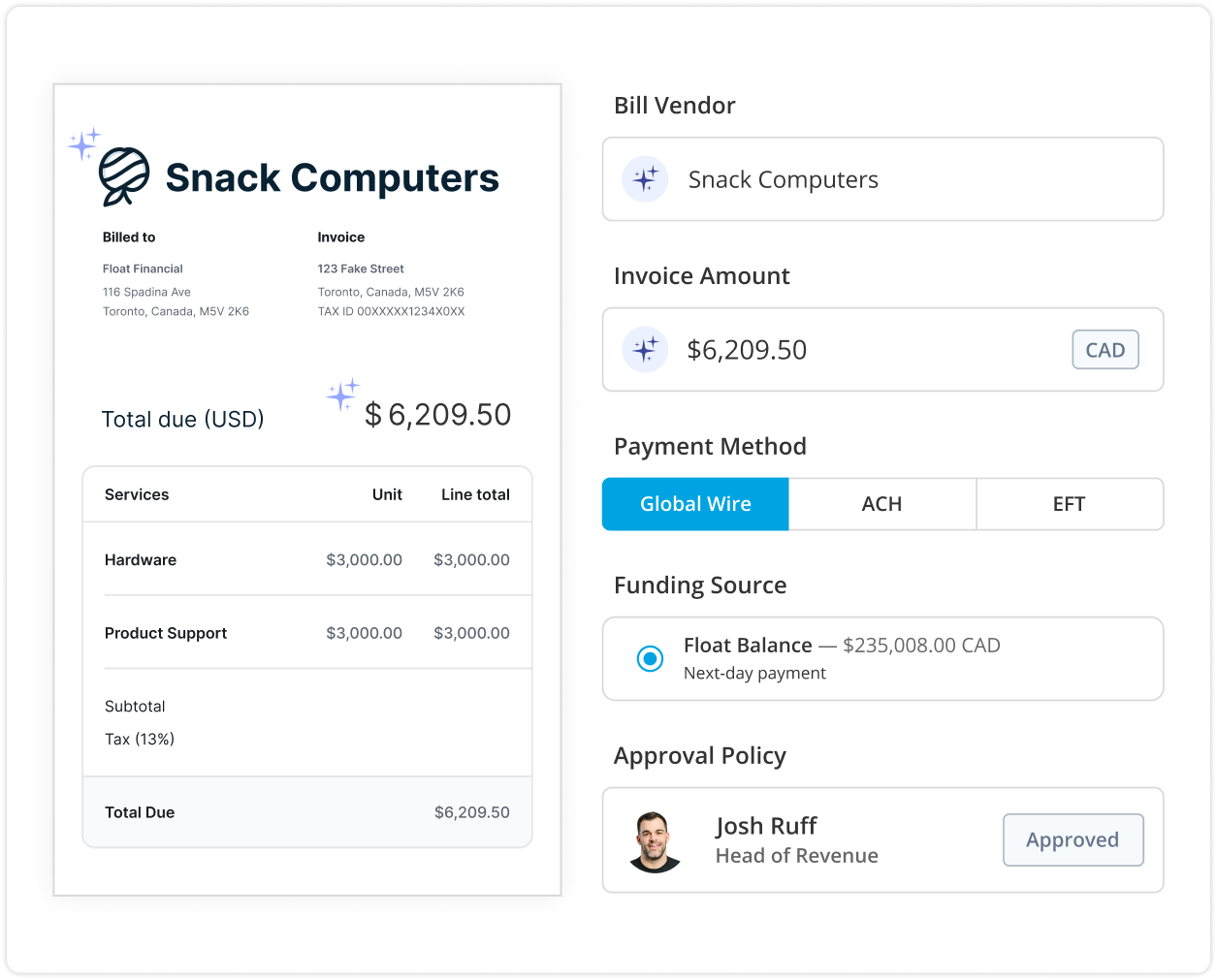

Best way to manage ACH payments is with Float

Using our bill pay solutions and accounts payable platform, Canadian businesses can streamline their ACH payment processes, reduce errors, and ensure timely payments. Our platform offers seamless integration with your existing financial systems, making it easier to manage accounts payable and stay on top of your business finances.

By following this step-by-step guide, you can confidently navigate the world of ACH payments and unlock the benefits they offer for your Canadian business. As you embark on this journey, remember that we’re here to support you every step of the way. Get started for free with our user-friendly platform and let us help you streamline your payment processes, saving you time and money.

Written by

All the resources

Corporate Cards

Discover: Virtual Credit Cards for Canadian Businesses

Explore the benefits of virtual credit cards with Float. Discover how this modern payment solution enhances security and simplifies your

Read More

Cash Flow Optimization

Working Capital Turnover: Measuring Efficiency

Ready to master your working capital turnover? Get expert tips from Float and Sendy Shorser.

Read More

Financial Controls & Compliance

4 Free Online Bookkeeping Courses for Canadian Businesses

Want to level up your bookkeeping? These courses might be the key. Read more to learn what you should be

Read More