Cash Flow Optimization

How to Pay Invoices from the Philippines: A Step-by-Step Guide

Learn how to pay Invoices from Philippines as a Canadian Business and innovative solutions, like Float, that you can use for free to send Global Wires.

September 21, 2024

Paying invoices from the Philippines is a common task for many businesses and individuals. Whether you’re a freelancer working with clients in the Philippines or a company outsourcing services, it’s crucial to understand the various payment methods available and how to use them effectively.

In this comprehensive guide, we’ll walk you through the step-by-step process of paying invoices from the Philippines, ensuring that your transactions are secure, efficient, and hassle-free.

By the end of this article, you’ll have a clear understanding of the best practices for paying invoices from the Philippines, allowing you to maintain strong business relationships and avoid any payment-related issues.

Want to learn more about the accounts payable process more generally? Check out our AP Guide here.

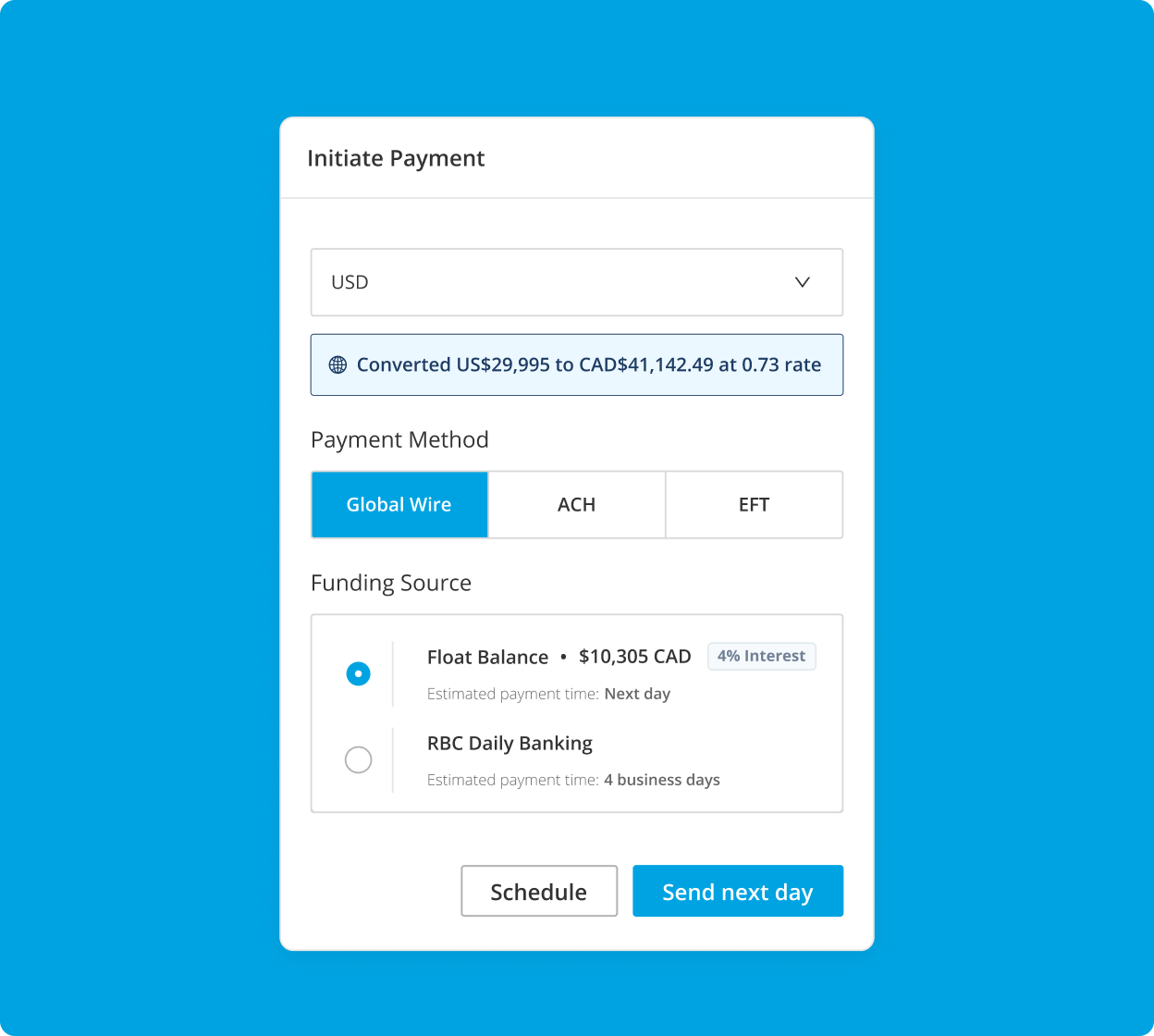

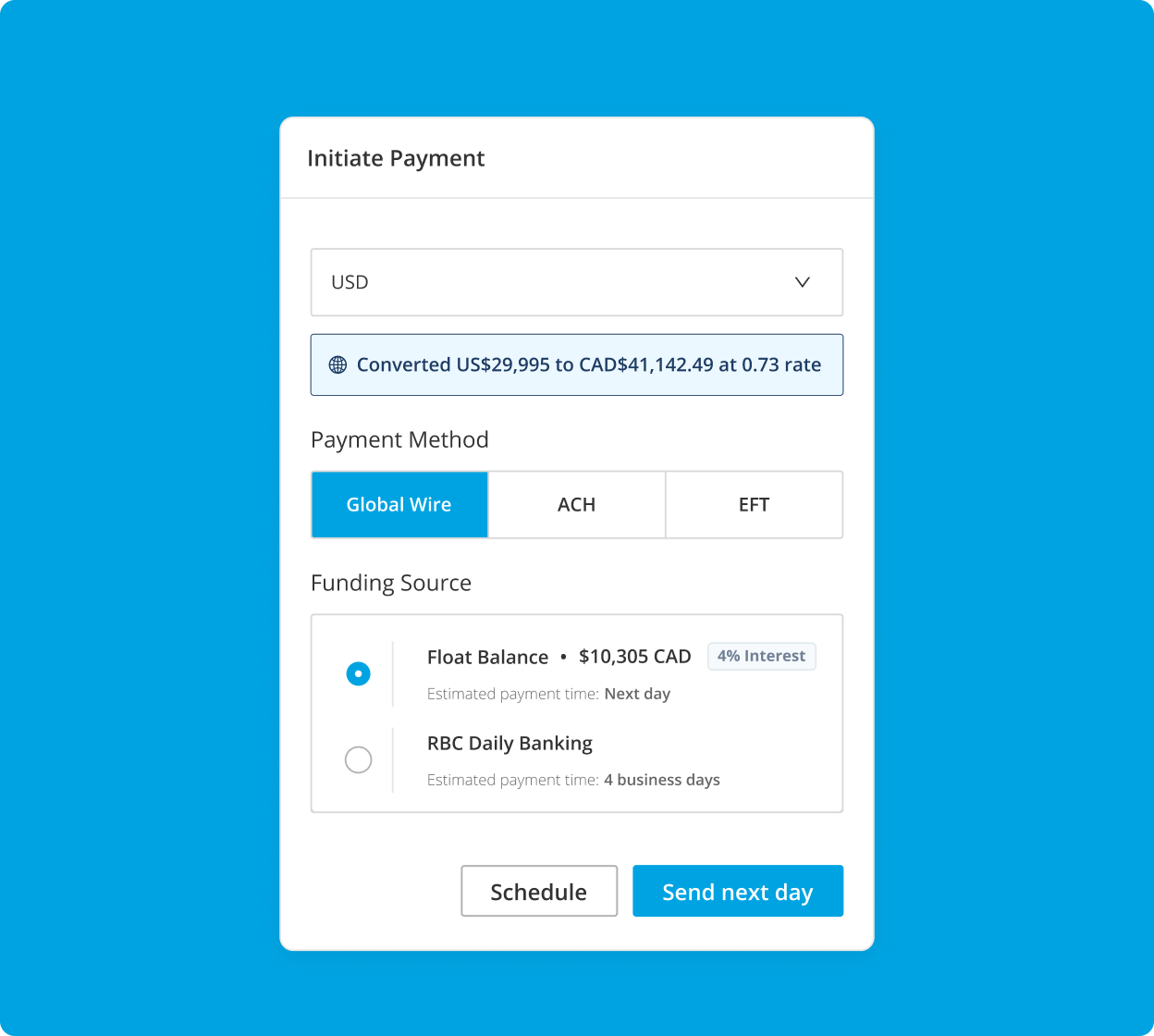

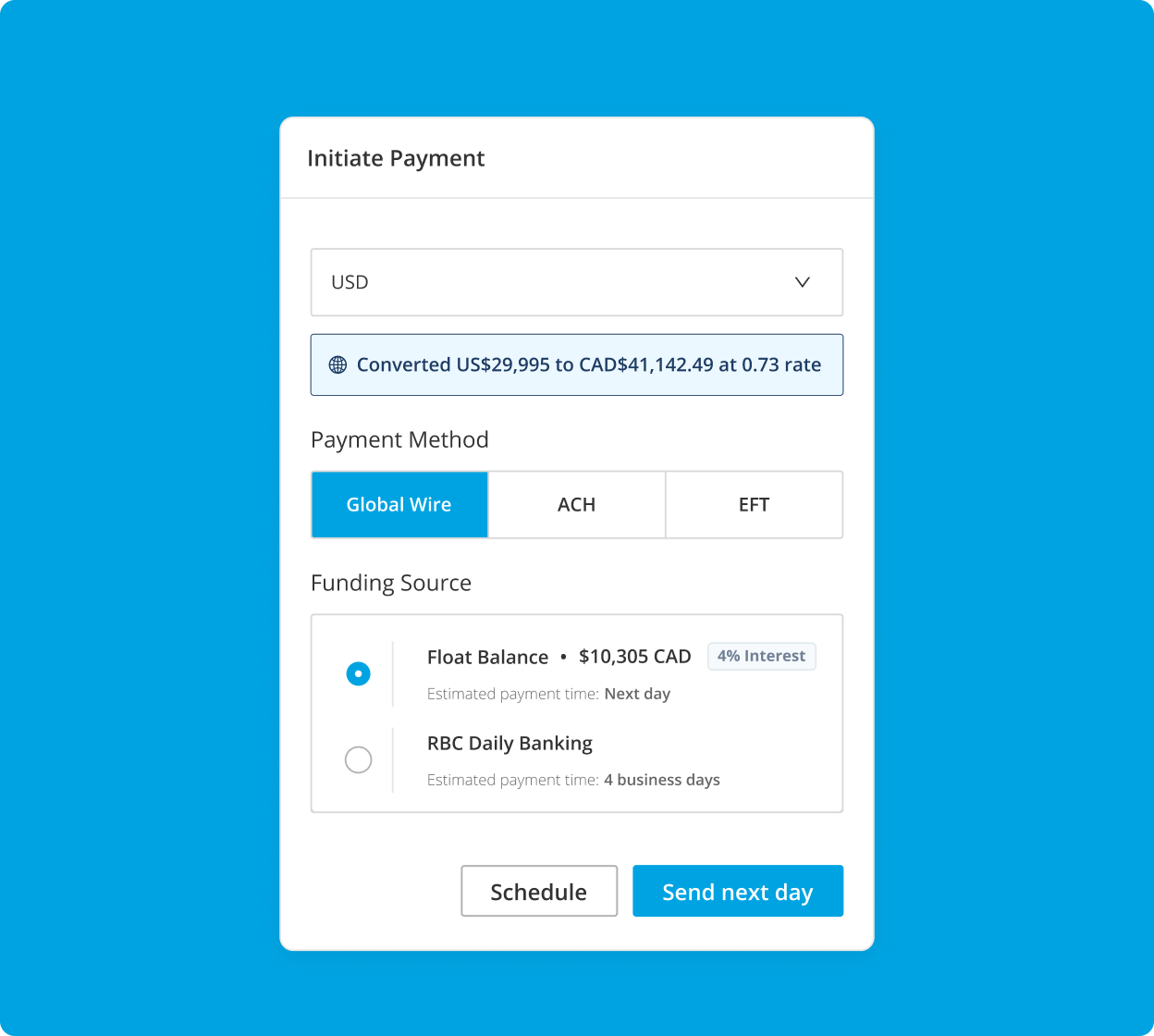

Make Global Wire Payments with Float

Canada’s best-in-class EFT, ACH, and Global Wires payments platform — plus average savings of 7%.

What is an Invoice?

An invoice is a document issued by a seller to a buyer that itemizes and records a transaction. Invoices are essential for businesses to request payment for products or services provided.

Why is it Important to Pay Invoices Promptly?

Paying invoices promptly helps maintain good relationships with suppliers, ensuring they continue to provide you with the goods and services your business needs. It also ensures smooth operations and cash flow management, as late payments can disrupt your supply chain and hinder your ability to meet customer demands. Moreover, timely invoice payments help you avoid late fees and penalties, which can add up quickly and eat into your profits.

How to Pay Invoices from the Philippines

When paying invoices from the Philippines, you have several methods to choose from, including bank transfers, online payment platforms, and digital wallets. Each method has its own advantages and considerations, such as transaction fees and processing times.

It’s essential to select the right payment method based on the specific requirements of your transaction, such as the amount being paid, the urgency of the payment, and the recipient’s preferences.

Step 1: Choose the Right Payment Method

- Bank transfers: This method involves transferring funds directly from your bank account to the recipient’s account. Bank transfers are secure and widely accepted but may have higher transaction fees and longer processing times compared to other methods.

- Online payment platforms: Platforms like PayPal and Stripe allow you to send payments electronically, often with lower fees and faster processing times than bank transfers. However, not all recipients may have accounts with these platforms.

- Digital wallets: Mobile payment apps like GCash and PayMaya offer a convenient way to send money using your smartphone. These methods are fast and often have lower fees, but both parties need to have an account with the same provider.

Step 2: Gather Necessary Information

Before initiating a payment, ensure that you have all the necessary information, including:

- Invoice number: This unique identifier helps track the payment and ensures it is applied to the correct invoice.

- Payment amount: Double-check the amount due on the invoice to avoid overpayment or underpayment.

- Recipient’s bank details: For bank transfers, you’ll need the recipient’s bank name, account number, and other relevant information, such as the SWIFT code for international transfers.

Providing accurate information is crucial to avoid payment delays or failed transactions.

Step 3: Initiating a Bank Transfer

To initiate a bank transfer for paying an invoice:

- Log in to your online banking account or visit your bank branch.

- Select the option to transfer funds and choose the account from which you want to send the money.

- Enter the recipient’s bank details, including their account number and SWIFT code (for international transfers).

- Input the payment amount and include the invoice number as a reference.

- Review the details and confirm the transaction.

Ensure that you have entered the correct bank details and reference numbers to avoid payment delays or failed transactions.

Step 4: Confirming the Payment

After completing the payment:

- Verify that the transaction has been successfully processed by checking your account statement or transaction history.

- Inform the recipient that you have made the payment, providing them with the transaction details, such as the amount paid, the invoice number, and the date of payment.

- Update your records to reflect the payment and keep a copy of the confirmation for future reference.

Confirming the payment with the recipient and updating your records helps maintain accurate financial records and prevents any misunderstandings.

Tips on Securing Your Payments

1. Double-check all details before confirming payment.

Before finalizing any payment, take a moment to review all the details, including the recipient’s information, payment amount, and invoice number. This simple step can help prevent costly errors and ensure that your payment reaches the intended recipient.

2. Use secure payment methods.

When paying invoices from the Philippines, opt for secure payment methods that offer encryption and protection against fraud. Trusted online payment platforms and digital wallets often provide additional security features, such as two-factor authentication and secure socket layer (SSL) encryption.

3. Global Wires in USD is the safest option

For large transactions or high-value invoices, consider using global SWIFT wires in USD. This method offers several advantages over other payment options:

- Enhanced security: SWIFT wires are processed through a secure global network of banks, reducing the risk of fraud or unauthorized transactions.

- Widespread acceptance: Most banks worldwide accept SWIFT wires, making it a reliable option for international payments.

- Traceable transactions: SWIFT wires provide a clear audit trail, allowing you to track the status of your payment and confirm receipt by the intended recipient.

Make Global Wire Payments with Float

Canada’s best-in-class EFT, ACH, and Global Wires payments platform — plus average savings of 7%.

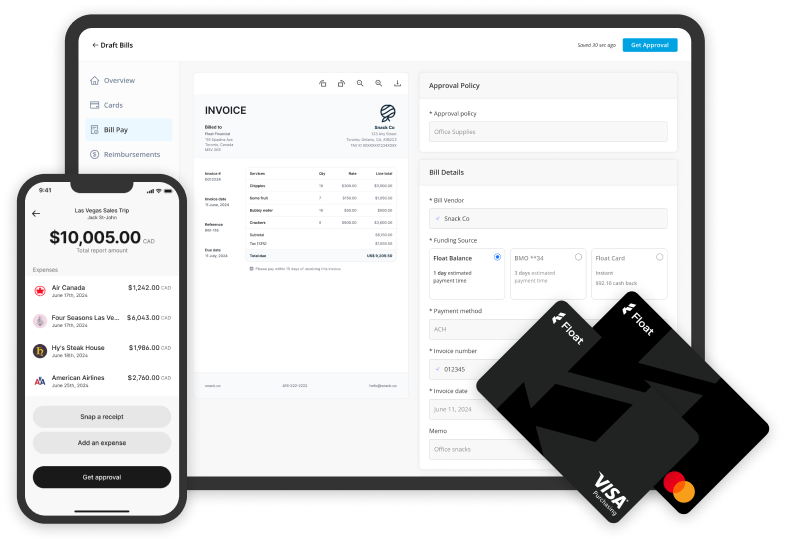

Streamline Your Global Wire Payments with Float

To simplify and optimize your invoice payment process, consider adopting a comprehensive payment solution that offers features tailored to your business needs. Look for a platform that provides:

- Global wire transfers in USD: Securely send international payments using the SWIFT network, ensuring fast and reliable transactions.

- AI-powered bill processing: Automate invoice data extraction and validation, reducing manual effort and minimizing errors.

- Integrated accounting workflows: Seamlessly sync your invoice payments with your accounting software, streamlining your financial management processes.

By leveraging a powerful payment solution, you can save time, reduce costs, and improve the overall efficiency of your invoice payment process, allowing you to focus on growing your business. Get started for free today and experience the benefits of seamless global payments, AI-powered bill processing, and integrated accounting workflows.

Frequently Asked Questions

The most common payment methods for invoices in the Philippines include bank transfers like Global Wires, online payment platforms like PayPal, and digital wallets such as GCash. Choose the method that best suits your needs.

Processing times vary depending on the payment method used. Bank transfers may take 1-3 business days, while online payment platforms and digital wallets often offer instant or same-day processing.

Yes, most payment methods involve fees, such as transaction fees or currency conversion charges. Compare the fees associated with each method to find the most cost-effective option for your business.

If you experience issues with your invoice payment, first contact the recipient to confirm they have not received the funds. Then, reach out to your payment provider’s customer support for assistance in resolving the issue.

Float is Free to use on our Essentials plan, where you will be able to issue unlimited virtual CAD/USD cards, earn 4% interest on deposits, reimburse employees and pay vendor bills. If you need more sophisticated functionality, like over 20 physical cards, Netsuite integration, or an API solution, you will have to consider our paid Professional and Enterprise plans.

Unlike traditional cards that get you to spend more, Float is the only corporate card in the world that helps businesses spend less. Through a combination of financial rewards like our 1% cashback, 4% interest on deposits, no FX fees with our USD cards and time savings of at least 8 hours per employee Float’s customers on average save 7% on their spend.

Written by

All the resources

Industry Insights

Canada’s Crossroads: Why Now is the Moment to Move from Defensive to Intentional Growth

Float's 2025 report on Canadian business shows modest growth, rising costs and shrinking reserves. Find out exactly what the data

Read More

Expense Management

Controller Month-End Close Automation: Streamline Financial Reporting

Controllers, this one's for you. Let's talk about how how automating month-end close helps you move faster without sacrificing accuracy.

Read More

Corporate Cards

Corporate Card Program Implementation: Complete Management Guide

Ready to implement a corporate card program? This is where to start.

Read More