Cash Flow Optimization

How to Make EFT Payments in Canada: Complete 2025 Guide

Learn how to initiate EFT Payments as a Canadian Business and innovative solutions available on the market, like Float, that you can use for free.

November 19, 2025

As a business owner, you’re always looking for ways to streamline your financial operations and make payments more efficient. Electronic Funds Transfers (EFTs) have become an increasingly popular method for sending and receiving payments, thanks to their speed, security and convenience.

In this guide, we’ll walk you through the process of making an EFT payment, step by step. By the end, you’ll have a clear understanding of how to initiate and track EFT transactions, ensuring smooth and accurate payments every time.

Fast, simple, fee-free payments for your business

Free EFT/ACH, flat-fee international wires, and one place to manage it all.

What is an Electronic Funds Transfer (EFT)?

An Electronic Funds Transfer (EFT) is a digital transaction that moves money from one bank account to another without the need for physical paperwork. EFTs are commonly used for a variety of payment types, including payroll, vendor payments and personal transactions. They’re a key part of a modern accounts payable (AP) process.

In Canada, EFTs are managed under Payments Canada’s network rules, which set the standards for the secure movement of funds through banks. Financial institutions must also follow the Financial Transactions and Reports Analysis Centre of Canada’s (FINTRAC) anti-money laundering (AML) and Know Your Customer (KYC) requirements to verify recipients and report suspicious transactions. Together, these regulations keep EFTs secure, traceable and compliant within Canada’s financial system.

Why use EFT payments?

EFT payments offer significant benefits over traditional payment methods. They’re faster, more convenient and more cost-effective than cheques or cash. By eliminating the need for physical paperwork, EFTs reduce administrative work and enhance financial control.

For businesses, EFTs also improve accuracy and auditability. Every transaction leaves a digital record, making it easier to track spending, reconcile accounts and prevent duplicate payments. As more Canadian banks and accounting systems support direct EFT integrations, these payments have become the default for modern finance teams. Whether you’re paying contractors, reimbursing employees or settling invoices, EFTs keep payments organized, secure and compliant.

For how EFTs compare to other payment methods, see this article on ACHs vs. EFTs.

2025 EFT payment updates and changes

The Canadian payment landscape is evolving. New rules from Payments Canada and updated FINTRAC guidance are shaping how businesses send and report EFTs in 2025.

Here’s what’s new:

- Faster payments on the way: Payment Canada’s Real-Time Rail (RTR) continues testing this year, paving the way for faster, data-rich EFT payments once it launches.

- Simpler bill payment processes: Payment Canada’s updated Bill Payment Framework aims to reduce errors, improve reconciliation and make it easier for businesses to pay and receive invoices electronically.

- Stronger compliance expectations: FINTRAC’s 2025 reporting updates tighten requirements for verifying recipients and documenting EFTs. Businesses must maintain accurate records, monitor transactions and submit complete data on time.

For Canadian companies, this means EFTs are becoming faster, more transparent and more closely monitored. So make sure your finance team reviews its payment processes, stays compliant with FINTRAC’s AML rules and prepares for real-time settlement as Canada’s payment systems modernize.

This is also great for Canadian businesses looking for a more secure and compliant solution for their business financial needs. As a registered Payment Service Provider, recognized by the Bank of Canada, Float now meets Canada’s highest regulatory standards for operating within the payments ecosystem, reinforcing Float’s commitment to transparency, funds protection, and innovation.

How to make an EFT payment: A step-by-step guide

Initiating an EFT payment is a straightforward process that requires the correct information and authorization. By following these steps, you can ensure a smooth and secure transaction every time.

1. Gather necessary information

Before you can initiate an EFT payment, you’ll need to obtain the recipient’s bank account number and routing number. It’s crucial to verify that the recipient’s name matches the bank account details to avoid any errors or delays.

2. Choose your payment method

There are several ways to initiate an EFT payment, including online banking, mobile banking and an accounts payable platform. Each method may have slightly different steps, but they all generally require the same information.

3. Log in to your banking platform

To get started, log in to your online or mobile banking platform using your login credentials. Once you’re in, navigate to the payments or transfers section.

4. Enter payment details

Input the recipient’s bank account number and routing number, along with the payment amount and any relevant payment notes or references. Double-check all information for accuracy before proceeding.

5. Review and confirm the payment

Before finalizing the transaction, take a moment to review all entered information one last time. Once you’re confident everything is correct, confirm the payment and authorize the transaction. Some platforms may require two-factor authentication for added security.

6. Track the payment

After initiating the EFT payment, you can monitor its status through your banking platform. Most platforms provide real-time updates and notifications upon successful completion, giving you peace of mind that your payment has been processed.

Want to simplify this process? See how Float makes EFT payments seamless—take a 2-minute interactive product tour.

How much does an EFT payment cost?

EFT costs vary by financial institution: major banks charge $1.00-$1.50 per outgoing transaction, while incoming EFTs are often free. Credit unions and digital banks offer lower fees and modern, third-party providers like Float provide additional support for small businesses by offering no-fee EFTs.

Generally, costs depend on transaction volume, banking plans, processing speed and whether the transfer is domestic or cross-border. Compared to other methods, EFTs are typically cheaper than wire transfers ($15-$100) and business Interac e-Transfers ($1.50-$5.00), making them a preferred choice for businesses. With Float, EFT payments are free.

Use our free Bank Transfer Fee Estimator to estimate the cost of your bank transfer.

EFT payments vs. wire transfers: Cost and speed comparison

When deciding how to send business payments, cost and timing matter most. EFTs and wire transfers both move money electronically, but they differ in fees, processing speed and use cases. Here’s how they compare:

| Feature | EFT Payments | Wire Transfers |

| Cost | $0–$1.50 per transaction | $15–$100 per transaction |

| Speed | 1–2 business days (some same-day) | Same-day or next-day |

| Use case | Payroll, vendor payments, recurring transfers | High-value or international transfers |

| Tracking | Limited real-time visibility | Fully traceable (SWIFT network) |

For domestic business payments, EFTs often offer the right balance of cost, speed and convenience.

To learn how to streamline your full spend process, see expense management for Canadian businesses.

EFT payment security best practices for business

EFTs are very secure, but there are still gaps, especially with fraud and unauthorized transfers. These practices will strengthen not only your EFT security but also your overall financial security.

Here’s what to focus on:

- Use two-factor authentication for all online payments.

- Restrict EFT permissions to authorized finance team members only.

- Verify payee banking details directly with vendors before large transfers.

- Reconcile all EFT transactions regularly to detect errors or duplicates.

- Maintain audit logs for all payments to ensure traceability and compliance.

Centralized tools such as Float’s platform make it easier to manage EFTs, wires and reimbursements securely, all while staying audit-ready.

How to set up EFT payments for your business

Setting up EFT payments is easier than most business owners think. Once you’ve gathered the right account details and chosen a payment platform, you can start sending secure, traceable payments in just a few steps.

- Confirm eligibility: Check with your bank or payment provider whether your business account supports EFTs. Some banks will ask you to complete an EFT agreement or authorization form before enabling this feature for your business account.

- Collect payee information: Obtain the vendor’s bank name, account number, transit number and institution number.

- Create payment templates: Save recurring payees in your banking platform or expense management tool.

- Test with a small payment: Send a low-value transaction to confirm accuracy before scaling up.

- Automate recurring payments: Use trusted software to simplify approvals and scheduling.

Tip: If you’re already using a spend management tool, check whether it supports automated EFTs. For example, Float lets you upload invoices, extract payment details and schedule transfers directly without having to upload CSV files.

Common EFT payment issues and solutions

Even with the right setup, EFT payments don’t always go perfectly. Delays, mismatched details and duplicate transactions can still happen, especially when multiple vendors or accounts are involved.

Here are some common issues and how to fix them:

| Issue | Cause | Solution |

| Payment delayed | Bank cutoff time missed or processing backlog | Schedule before your bank’s daily cut-off time (usually between 5:00 p.m. and 8:00 p.m. local time) and allow up to two business days for completion. |

| Wrong account information | Typo in routing or account number | Always confirm vendor details before sending, ideally with a void cheque or direct deposit form. |

| Returned transfer | Account closed or information mismatch | Contact the vendor to confirm details, then reissue the payment. |

| Duplicate payment | Manual re-entry or duplicate file upload | Use automated reconciliation tools to flag duplicates before funds are sent. |

| Missing confirmation | The bank doesn’t issue transaction receipts | Use your payment platform’s confirmation letters or reports for recordkeeping. |

Most EFT hiccups stem from timing or data accuracy issues. Double-checking account information, setting clear approval workflows and using digital payment tools can prevent most errors before they start.

Tips on making EFT payments

Want to avoid those payment issues? Here’s what you need to be mindful of.

1. Ensure accurate information

To avoid errors and delays, always double-check the recipient’s bank details before initiating a transfer. Even a small mistake can cause significant headaches down the line.

2. Use secure networks

When conducting EFT transactions, it’s essential to use secure internet connections to protect your financial information. Avoid using public Wi-Fi for financial transactions, as these networks are more vulnerable to security breaches.

3. Monitor your transactions

Regularly check your bank statements and transaction history to ensure all EFT payments are accurate and authorized. If you notice any discrepancies, report them immediately to your financial institution to resolve the issue promptly.

Try Float for free

Business finance tools and software made

by Canadians, for Canadian Businesses.

Streamline your EFT payments with cutting-edge solutions

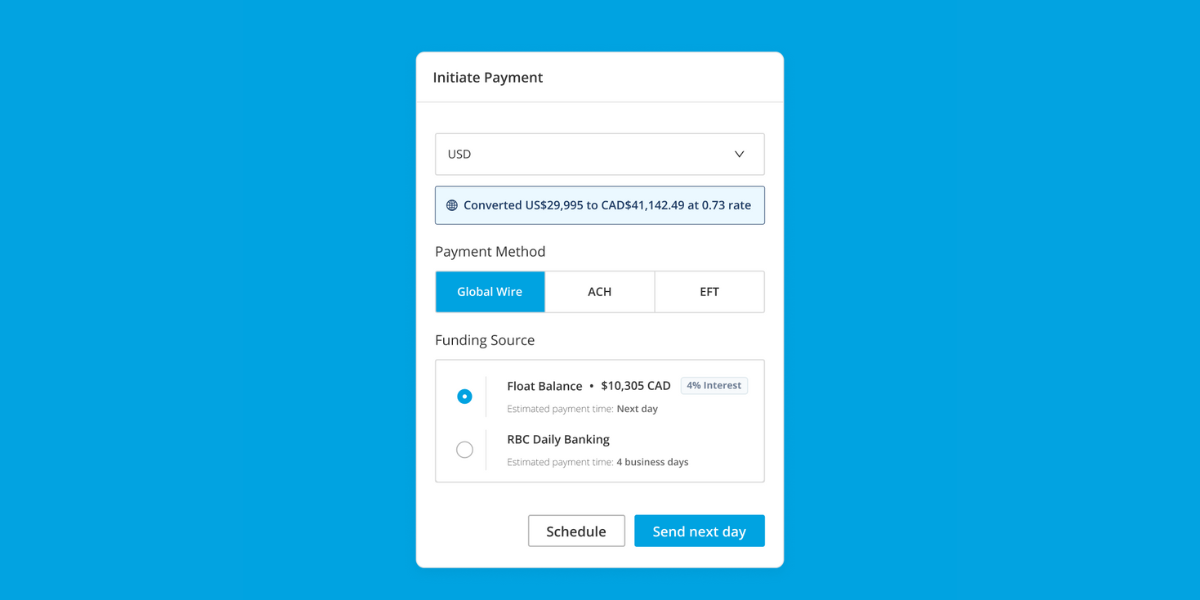

When making EFT payments, using a dedicated bill pay service can greatly simplify the process and offer additional benefits. A reliable bill pay solution should offer features like embedded EFT Payments, Automatically Generated Payment Confirmation Letter, ability to pay in USD and CAD and earn interest from funds in transit.

By using a comprehensive bill pay service, you can enjoy a centralized platform for managing all your invoice payments, regardless of the payment method or currency. This streamlined approach saves you time, reduces the risk of errors and provides greater visibility into your financial transactions.

If you’re looking for a comprehensive solution to streamline your EFT payment process, explore Float’s Bill Pay service. With features like AI-powered bill intake, embedded EFT/ACH ($0 fees), global wire and up to 4% interest on funds, Float’s platform is designed to simplify how you manage and make EFT payments in Canada.

Get started for free today and experience the benefits of a powerful, user-friendly bill pay solution that can help you save time, reduce errors and maintain better control over your financial transactions.

Frequently Asked Questions

EFT payments typically take 1-4 business days to process, depending on the receiving bank and the time of day the transaction is initiated. With Float’s Bill Pay solution, you can pay out directly from your Float balance, which means your money will arrive the next business day.

In most cases, EFT payments do not incur any fees from the sending or receiving bank. However, some banks may charge a small fee for outgoing transfers, so it’s best to check with your financial institution. Float offers low or no-fee EFT payments, depending on your plan.

Canceling an EFT payment after it has been initiated is not always possible. If the funds have already been released, you’ll need to contact the recipient directly to request a refund.

Most banks do not impose limits on the amount of money you can send via EFT. However, some banks may have daily or monthly transfer limits for security reasons. Check with your bank for specific limits.

Float is free to use on our Essentials plan, where you will be able to issue unlimited virtual CAD/USD cards, earn 4% interest on deposits, reimburse employees and pay vendor bills. If you need additional functionality, like over 20 physical cards, Netsuite integration and an API solution, consider our Professional and Enterprise plans.

Float offers Charge Card and Prepaid funding models. You can apply* for unsecured, up to 30-day charge card terms with high limits up to $3M—no personal guarantee required. Float assesses eligibility through a quick business credit review. Both funding models offer up to 4% interest on all deposits with no cash lockups with account opening in < 24 hours.

*Conditions apply. Book a demo to learn more.

Unlike traditional cards that get you to spend more, Float is the only corporate card in the world that helps businesses spend less. Float’s customers save an average of 7% on their spend thanks to financial rewards like 1% cashback, up to 4% interest on deposits, and no FX fees with our USD cards. They also save time—about two hours per employee on average—through streamlined processes and automation.

Written by

All the resources

Expense Management

How Do You Handle Employee Reimbursements Efficiently?

Learn how to simplify employee reimbursements with efficient, scalable strategies for small businesses and growing finance teams.

Read More

Corporate Cards

Amex Global Platinum Dollar Card Alternatives for Canadian Businesses in 2026

Canadian businesses are dealing with the discontinuation of the Amex Platinum Global Dollar Card and looking for a replacement card.

Read More

Expense Management

CDIC Insurance for Canadian Business Banking: Complete Protection Guide

Uncertainty about where your money sits—or whether it’s protected—is the last thing any business needs. That’s why understanding CDIC insurance

Read More