Expense Management

Why You Need a Better Way to Track Employee Receipts

Tracking receipts. It can feel like climbing Everest – unless you’re doing it the right way.

February 1, 2022

Keeping up with your corporate expenses can be a total nightmare but it doesn’t have to be. In fact, 15% of all Canadian SMEs have found tracking expenses and reconciling their books to be a major challenge. If your team is growing, there’s a good chance your expenses are too, which means getting a handle on your expense management is key. Finding a better way to track and manage corporate spending can save you thousands of dollars a year – and we’re here to let you in on the solution.

It pays to keep track.

Canada Revenue Agency requires Canadian businesses to keep records of all transactions to support their income and corporate expense claims. Companies can claim tax deductions on expenses, but only if they have a valid proof of purchase and can prove it was a business expense. How can they do this? 🤔 By providing a receipt. 🧾

If your corporate receipts aren’t organized or properly submitted, you won’t be able to use these expenses as a tax reduction, which means less money back in your pocket come tax season. That’s why companies need to invest in the proper tools to enable managers to easily collect and record receipts from employees all year round. This will help them easily track their expenses and have a better picture of where their money is going, who is spending it and why. When it comes time to file taxes, you’ll feel like a major weight is lifted off your shoulder!

Automate & Celebrate! 🤩

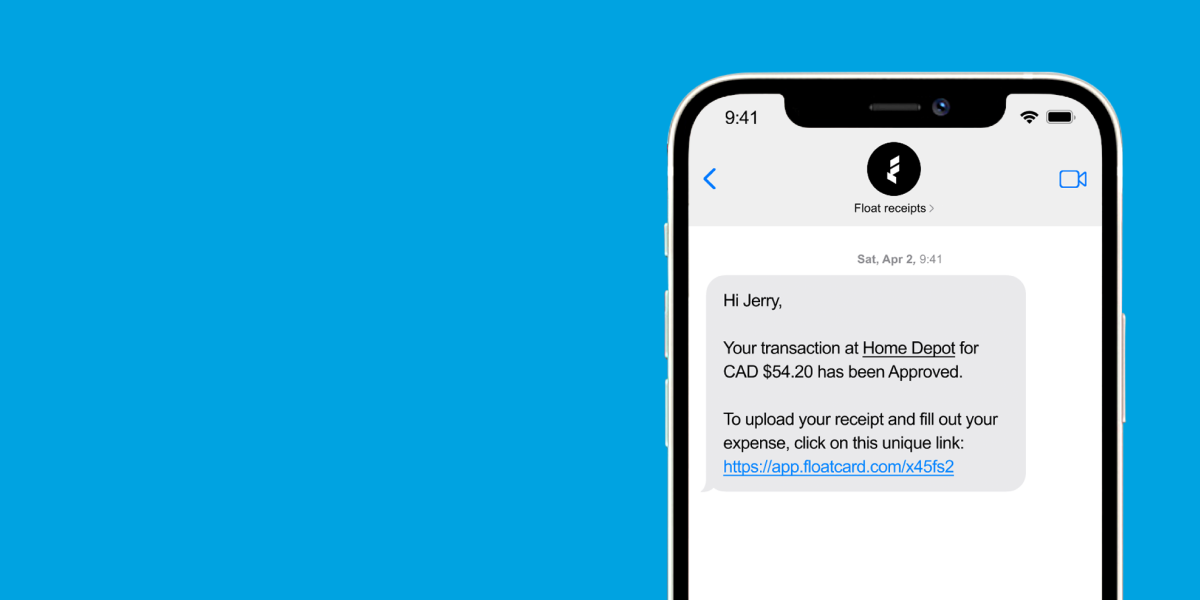

Let those piles of receipts and chasing employees down be a distant memory of the past. 👋🏽 Not only is it annoying and inefficient, but it just makes things more difficult than they need to be. We have a better way with Float. Our innovative expense software and corporate cards automate this entire process, helping companies easily track employee purchases in real time while eliminating all of the headaches and paperwork that come with it. When purchases are made using a Float card, employees are instantly notified to submit a digital receipt so that your finance team has everything they need to review expenses, manage budgets and easily claim tax deductions. Float not only helps teams save hours in expense management every month, but we also give you back control over corporate spending in your organization. Not to mention, keeping financial records in the cloud has proven to be safer and more secure – and good for our planet. 💚 If there is any damage such as a fire or flooding in the office, you can ensure that everything is protecting, floating in the cloud!

We’ve got you covered.

Our platform collects your receipts so that you don’t have to – leaving extra space in your filing cabinets and less stress on your mind. With Float, you can:

Get started fast with our simple set-up & onboarding 🚀

Quickly and easily reconcile your books ⚡️

Track business purchases in real time 💸

Create financial policies for all employees to follow 👍🏾

Instantly notify employees to submit receipts after a transaction 🧾

Set spending limits & approve spend requests in seconds ⏰

Collect and review key financial data all in one place ✅

Are you ready to introduce smarter, more efficient financial processes in your business? Book a demo with Float today!

Written by

All the resources

Corporate Cards

Amex Global Platinum Dollar Card Alternatives for Canadian Businesses in 2026

Canadian businesses are dealing with the discontinuation of the Amex Platinum Global Dollar Card and looking for a replacement card.

Read More

Expense Management

CDIC Insurance for Canadian Business Banking: Complete Protection Guide

Uncertainty about where your money sits—or whether it’s protected—is the last thing any business needs. That’s why understanding CDIC insurance

Read More

Expense Management

Working Capital Management Software Guide

There's a lot that goes into managing your working capital. But, like many things, the right software can help make

Read More