Corporate Cards

Virtual Cards

powered by software

Prepaid virtual corporate cards in both CAD

and USD, perfectly paired with

intelligent software.

Trusted by thousands of leading Canadian companies.†

Hassle-free, high-limits

Get all the benefits of a bank without any of the headaches.

$1M

Card Limits

1 day

Approvals

Zero

Personal Guarantees

Conditions apply. Book a demo with our team for more details.

Benefits

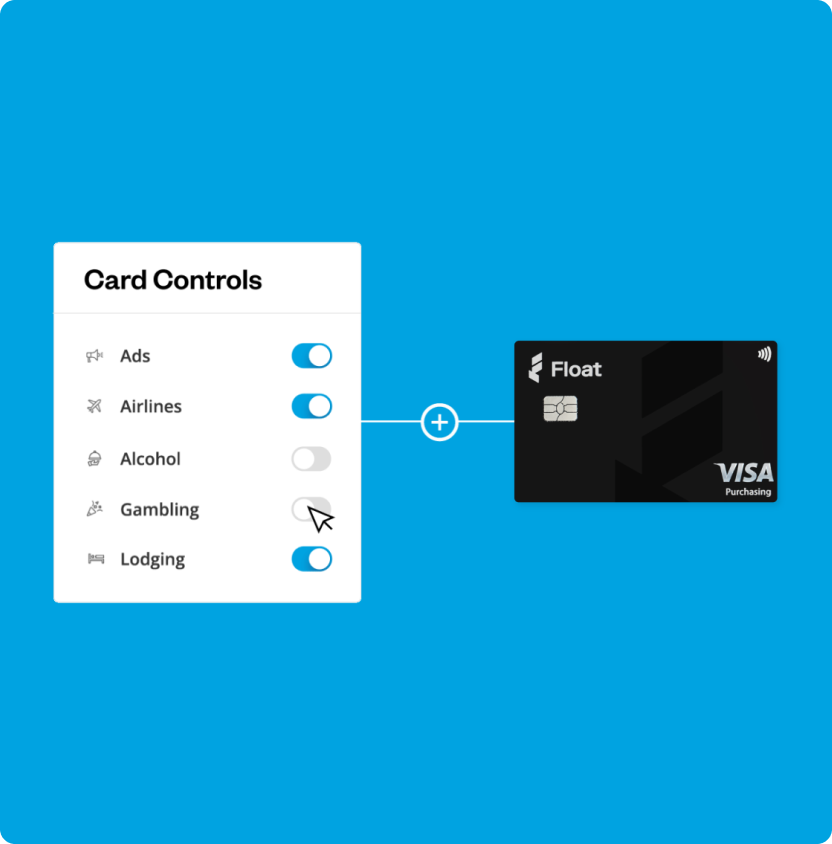

More control, less unwanted spend

A virtual corporate card that delivers both.

Issue employee cards worry-free

Instantly issue cards to every employee (really). Add funds only when you need to.‡

Control large

vendor spending

Ditch the catch-all card and create merchant-specific virtual cards to manage risk.

Avoid unwanted charges

Use-it-then-lose-it with single-use virtual cards designed for one-off purchases.

Features

Smart spending in multiple currencies

Get access to smart corporate cards in both CAD and USD, and spend no matter the currency.

Avoid foreign transaction fees on your USD spending.

Spend in the currency you get paid.

Save on conversion fees by connecting directly to your USD or CAD bank account.

Create new cards in just a few clicks

With unlimited* physical and virtual corporate cards, your spending limits can scale as your team grows.

Instantly add new users, set spend limits, and cancel cards.‡

Accepted everywhere other credit cards are.

No monthly card fees, and no limits on the number of users.

*Unlimited virtual cards. Unlimited physical cards are

available on Float’s Professional plan.

Payment terms for your stage of growth

Don’t let the limitations of big banks keep you from investing in growing your business.

Easily access pre-funded cards, where your limits = your bank balance.

Apply* for unsecured, 30-day credit terms with high limits (up to $1M).

No lengthy credit checks or personal guarantees.

*Conditions apply. Book a demo to learn more.

You’ve evolved, banks haven’t.

Don’t be fooled by flashy rewards. Spend less with Canada’s smartest corporate card program.

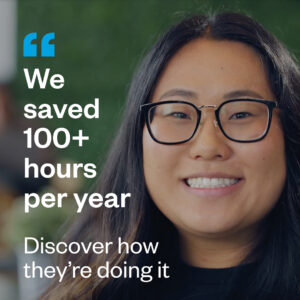

“Float’s virtual cards continue to give our team the flexibility and autonomy they need and deserve.”

Andy O’Reilly

Senior Manager of Finance & Technology

Come for the card,

stay for the software

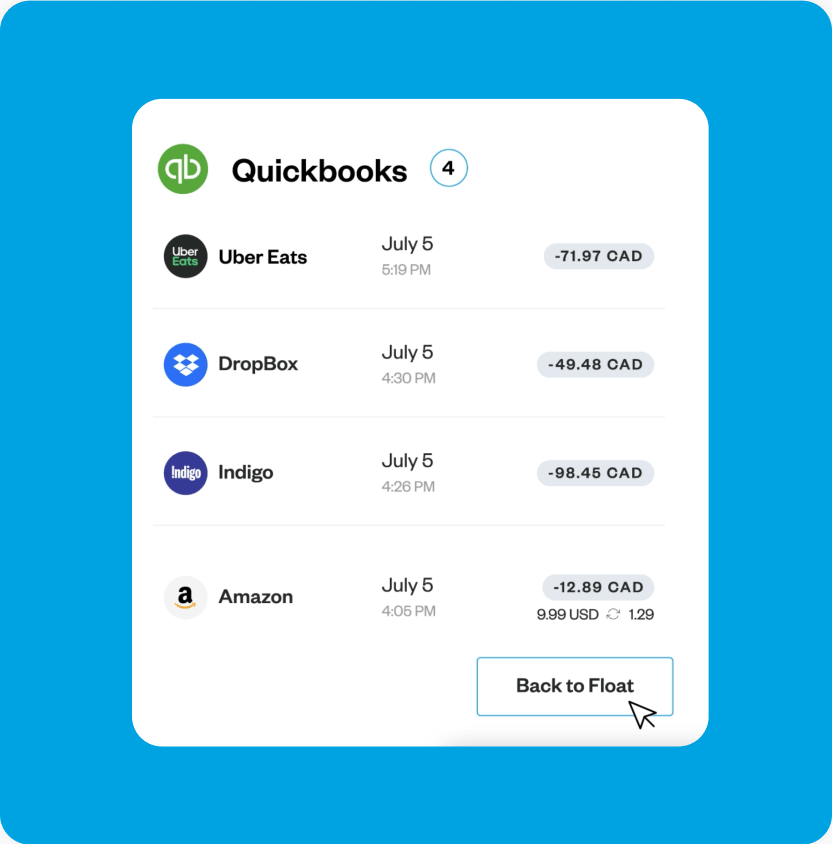

Automated Accounting

Direct integrations with QuickBooks, Xero, and NetSuite make month-end a breeze.

Expense Management

Get customized spend controls and approval policies to help you manage your company spend.

Reporting & Insights

React quickly to changes in spending patterns and market trends with real-time insights into your spend.