Float vs. AMEX:

A Better Alternative for Canadian Businesses

Ditch the high fees and limited acceptance. Get CAD and USD corporate cards with built-in expense management

Up to 1% cashback plus up to 4% interest on cash balances

CAD and USD cards with universal Visa and Mastercard acceptance

Real-time spend visibility with automated receipt matching

Trusted by thousands of leading Canadian companies.†

Compare Float vs AMEX

| Annual card fees | Up to $799/year | |

| Rewards model | Up to 1% cashback* | Points system |

| Travel insurance | Car rental insurance (Jan 1, 2026) | Comprehensive travel package |

| Universal card acceptance (Visa/Mastercard) | ||

| Native CAD and USD cards | ||

| Unlimited virtual and physical cards** | ||

| Granular spend controls | ||

| Up to 4% interest on cash balances | ||

| Built-in expense management | ||

| Accounts payable | ||

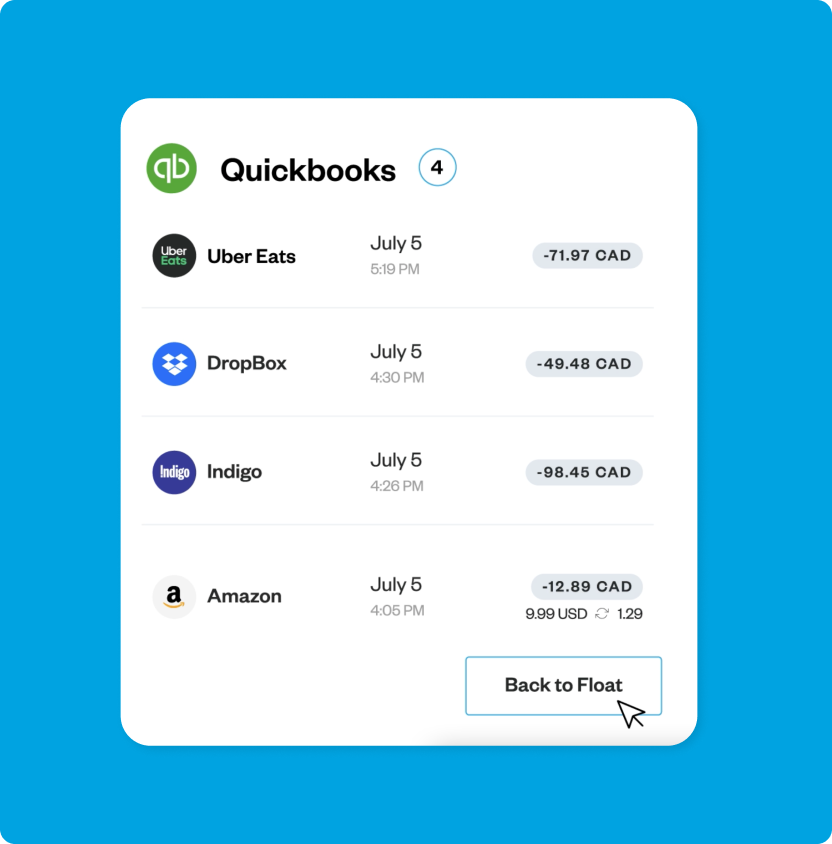

| Accounting integrations (QBO, Xero, NetSuite) |

*On monthly spend over $25,000, **For Professional plan members. Essential members get unlimited virtual cards and 20 physical cards.

Why choose Float over AMEX?

Competitive rewards with up to 4% interest

How does 4% interest on your cash balance sound? Get this alongside cashback and competitive FX fees with Float.

Close your books up to 8x faster

Eliminate expense reports with our automatic receipt collection and matching software. 1-click export to your accounting platform makes for a speedy month-end.

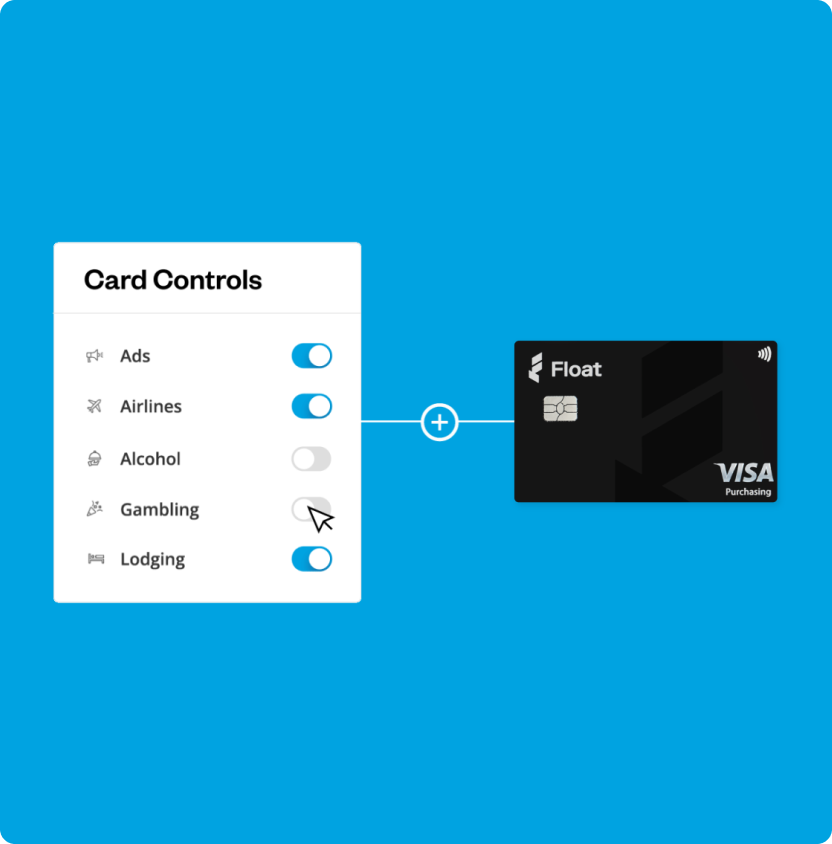

Unlimited corporate cards

Issue unlimited corporate cards in Canada and US. On a per-card basis, attach custom spending limits and card controls to enforce company expense policies.

Save 7% of your total spend

Float is the only platform that helps companies save 7% of their total spend from time savings at month-end to productivity gains across the company and earnings that are anything but a bank.

Enjoy 1% cashback on card spend, up to 4% interest on cash balances, and lower FX fees.

High Charge Card Limits Without the Frustration

Our smart corporate cards provide more flexibility for your employees with increased visibility for your finance team.

Get Charge Card limits of up to $3 million in 3-5 days with Float. Repay the balance automatically next day with automatic top-ups.

Save on FX fees with CAD and USD Cards

Float offers cards in both CAD and USD currencies helping businesses avoid FX fees when spending cross-border.

Why Coinberry switched to Float.

“When we were using AMEX, it was incredibly time-consuming to fund our cards. It often put our ad campaigns on pause & we’d lose users every day.”

Jerry Lin

VP Finance

*Trademark of Visa International Service Association and used under licence by Peoples Trust Company.