Smart Limit Charge Card + Spend Management Software

High-Limit Charge Card for Canadian Businesses

Apply for a high-limit Charge Card with Float in less than 5 minutes with limits available in USD and CAD.

Flexible capital with no interest

No personal guarantees or credit checks

Spending limits available in CAD and USD

Trusted by thousands of leading Canadian companies.†

High Charge Card Limits Without the Frustration

Our smart corporate cards provide more flexibility for your employees with increased visibility for your finance team.

$500k*

Card Limits

3-5 day*

Fast Approvals

10x

Higher Card Limits

Flexible capital,

no interest.

Available for both CAD and USD spend, Float’s Charge Card gives you flexible working capital that works for your business. All without requiring a personal guarantee or collateral.

Our minimum eligibility requirements:

Card spend of $10k+ per month

12+ months of operating funding in the bank or consistently profitable

$100K+ cash (or equivalents like GICs) on hand consistently

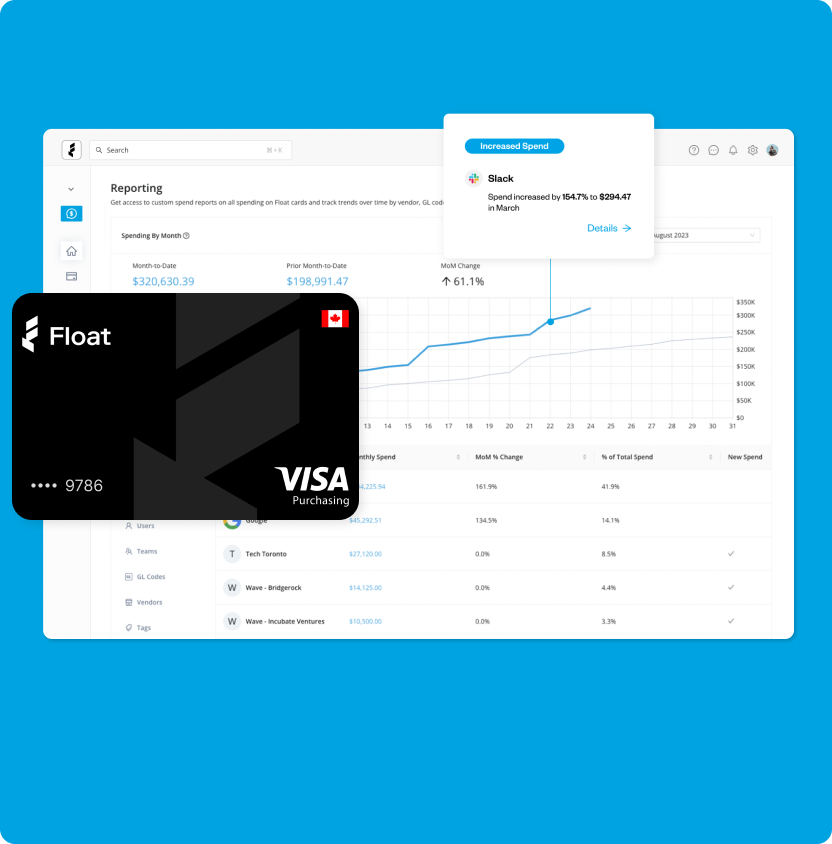

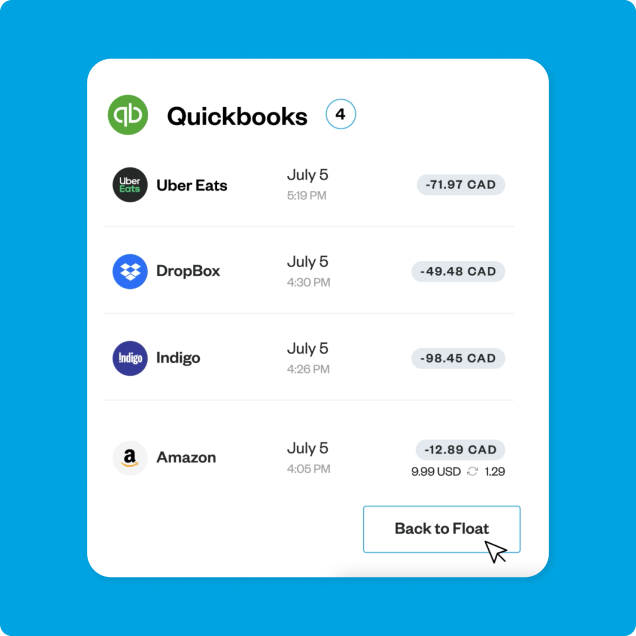

Powerful accounting integrations.

Float has deep integrations with QBO & Xero and supports custom exports into Netsuite & Sage. All transactions go through Float which captures receipts and taxes, automatically codes and categorizes, and exports them directly to your accounting platform’s General Ledger

Integrates with

As seen in

Why Coinberry switched from AMEX.

“When we were using AMEX, it was incredibly time-consuming to fund our cards. It often put our ad campaigns on pause & we’d lose users every day.”

Jerry Lin

VP Finance

Close the books 8x faster at month end.

Eliminate expense reports with powerful software that automatically collects and matches receipts.

Float captures transactions, automatically codes & categorizes & exports transactions directly into your accounting platform.

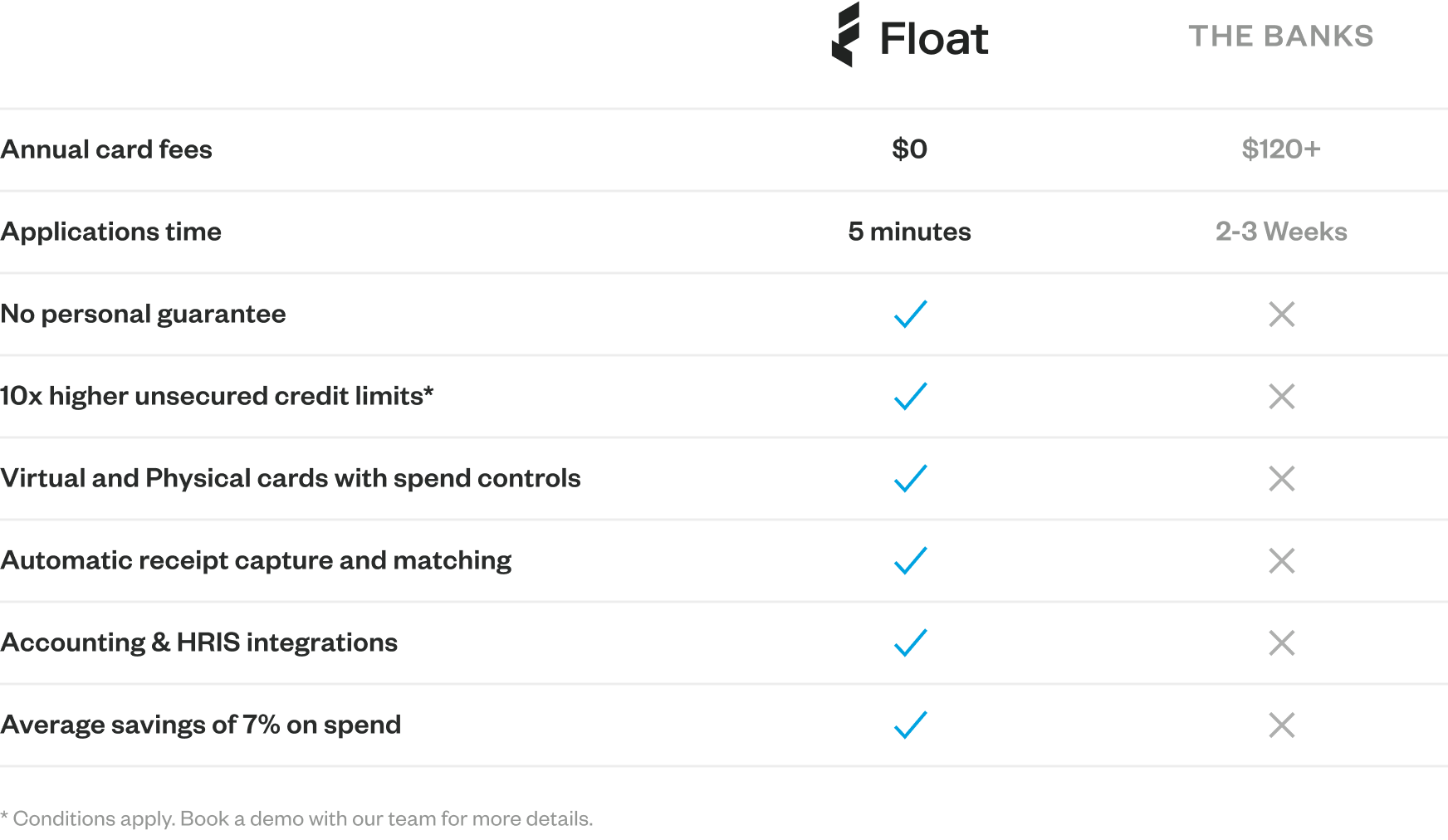

You’ve evolved, banks haven’t.

Get higher limits to unlock your business growth with Float’s Charge Card.

Frequently Asked Questions

A charge card requires full payment of the balance each month, with no interest charges but also no credit limit. A credit card allows you to carry a balance over time, accruing interest on unpaid amounts, and comes with a preset credit limit. Both offer rewards and purchase protection benefits.

Yes, charge cards in Canada often come with annual fees, which can vary based on the card type and benefits offered. However, charge cards typically don’t charge interest, as the balance is due in full monthly.

Unlike the traditional solutions, Float doesn’t charge high interest fees and doesn’t require high annual fees either.

Signing up for Float takes less than 10 minutes and can be done fully online. You can apply (*Conditions apply. Book a demo to learn more) for unsecured, 30-day credit terms with high limits up to $1M, no credit checks and personal guarantees.

Float is Free to use on our Essentials plan, where you will be able to issue unlimited virtual CAD/USD cards, earn 4% interest on deposits, reimburse employees and pay vendor bills. If you need more sophisticated functionality, like over 20 physical cards, Netsuite integration, or an API solution, you will have to consider our paid Professional and Enterprise plans.

Unlike traditional cards that get you to spend more, Float is the only corporate card in the world that helps businesses spend less. Through a combination of financial rewards like our 1% cashback, 4% interest on deposits, no FX fees with our USD cards and time savings of at least 8 hours per employee Float’s customers on average save 7% on their spend.