Expense Management

What is Mileage Reimbursement? A Quick Overview

Discover what mileage reimbursement is and how it can benefit you. Get insights on rates, policies, and tips for maximizing your reimbursements today!

October 10, 2025

If you use a personal vehicle for work, you may be wondering how mileage reimbursement works and what it covers. (After all, those kilometres don’t pay for themselves!) Whether you’re a business owner or an employee, understanding your company’s mileage reimbursement policy and broader employee expense policy is key to ensuring fair compensation for the costs associated with using a personal vehicle for business.

This article will provide a quick overview of mileage reimbursement in Canada—what it is, how it works and what types of trips qualify for reimbursement. We’ll also cover the CRA’s standard mileage rate, recordkeeping requirements, setting up reimbursement policies in 2025 and alternatives to traditional mileage reimbursement programs.

What is mileage reimbursement?

Mileage reimbursement is the compensation that an employer pays employees for using their personal vehicle for business purposes. This covers costs like gas, maintenance, insurance and depreciation for the business use portion of the car ride.

Employers typically reimburse employees at a cents-per-kilometre rate, which can vary by company. Some use the CRA standard mileage rate, called the kilometric rate in Canada, while others set their own rate.

Here, we will refer to the rate as a mileage rate, as it’s the common term in Canada and the United States. However, the mileage rate actually refers to kilometres in Canada rather than miles.

How does mileage reimbursement work?

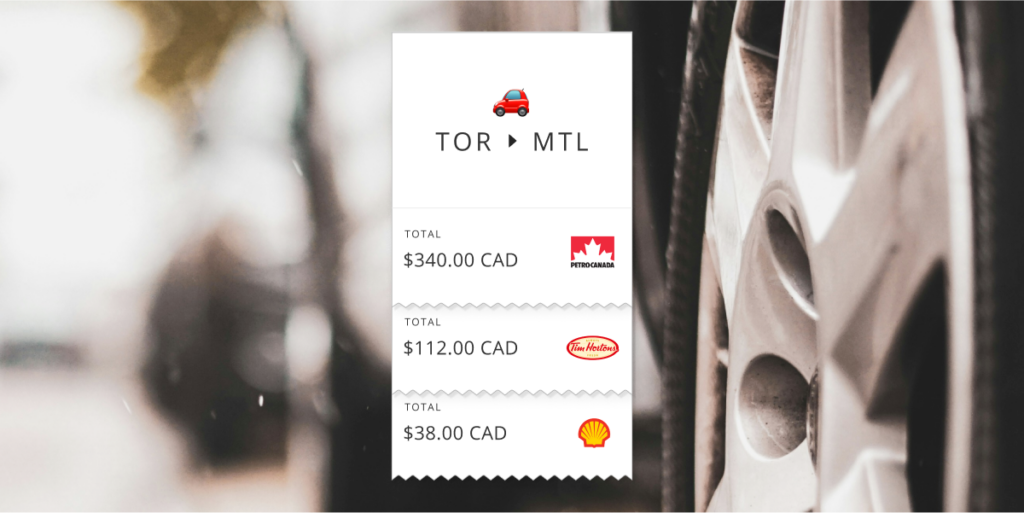

To claim mileage reimbursement, employees track their business mileage, often using an app or mileage log. They submit expense reports detailing the date, miles driven and purpose of each trip.

The employer then multiplies the total business miles by their designated cents-per-mile or cents-per-kilometre rate to calculate the reimbursement amount. Or, they can use a mileage calculator, like Float’s free mileage calculator specifically for Canada. Reimbursements are usually added to the employee’s next paycheque and are non-taxable up to the CRA standard mileage rate.

What mileage is eligible for reimbursement?

Mileage reimbursement generally covers business trips between offices or work sites during the workday, travel to meet clients or vendors, trips to run work-related errands and travel to the airport or train station for business purposes. Commuting between home and a temporary work location may also be eligible for reimbursement.

However, employees’ normal commute between home and their regular office is not reimbursable. (In other words, you can’t bill the company for the privilege of showing up.) Personal side trips or errands during the workday and travel from home to a second job are also ineligible for reimbursement.

2025 mileage reimbursement rates in Canada

The CRA sets an optional standard mileage rate annually for business travel, and these rates are reviewed quarterly. Employers can use this rate or set their own lower or higher rate.

Reimbursements at or below the CRA rate are generally non-taxable to the employee. However, amounts above the CRA rate are considered taxable income unless the excess is returned.

CRA kilometric rates for 2025

This table shows the CRA rates payable in cents per kilometre for the use of privately owned vehicles driven for business travel. If you’re driving your vehicle in more than one province or territory, or crossing the border into the United States, the rate payable is the rate applicable to the province or territory where the vehicle is registered.

| Province/Territory | Cents/km (taxes included) |

| Alberta | 57.5 |

| British Columbia | 60.0 |

| Manitoba | 56.0 |

| New Brunswick | 60.5 |

| Newfoundland and Labrador | 63.0 |

| Northwest Territories | 72.0 |

| Nova Scotia | 61.5 |

| Nunavut | 72.5 |

| Ontario | 63.0 |

| Prince Edward Island | 60.0 |

| Quebec | 60.5 |

| Saskatchewan | 56.5 |

| Yukon | 73.0 |

In the United States, the IRS has set the standard mileage rate as 70.0 cents per mile for self-employed people and businesses. Charities, medical organizations and the military have different mileage rates.

Mileage tracking requirements

To claim mileage reimbursement in both the United States and Canada, employees must keep accurate, up-to-date records of business mileage. This means recording your mileage right after each trip (instead of trying to remember where you drove three Tuesdays ago). A compliant log should include the date, destination, purpose and total miles.

Many companies simplify this by letting employees use apps that track trips via GPS, making it easier to submit accurate records while staying compliant with expense policies. Float lets employees submit mileage reimbursements directly through its platform—no clunky spreadsheets or standalone apps. All trips are logged, submitted, and approved in one place.

Maintaining accurate mileage logs is especially important for month-end close, as finance teams rely on these records to reconcile expenses, allocate costs correctly and ensure accurate reporting. Automating mileage tracking helps streamline this process, reducing errors and last-minute adjustments during financial close.

Try Float for free

Business finance tools and software made

by Canadians, for Canadian Businesses.

Mileage reimbursement vs. expense reimbursement: Key differences

If you’re a business owner with employees who travel often for work, you may find yourself getting confused between mileage reimbursement and expense reimbursement when you have to manage travel expenses. While these two concepts are related and similar, they’re not the same. Here’s what you need to know.

Mileage reimbursement

This is the payment an employer makes to their employee to cover the business use of their personal vehicle. The payment is calculated based on a standard per-mile (or per-kilometre in Canada) rate.

Employees must keep detailed mileage logs or records to calculate the number of miles travelled for business purposes. Float automates receipt and mileage log collection with real-time submission flows—ensuring month-end reporting is accurate and audit-ready.

If employees are reimbursed at or below the government-set standard rates, that money is non-taxable to the employee. However, if they are reimbursed above standard rates, the excess may be taxable.

Expense reimbursement

Expense reimbursement is a payment an employer makes to cover business costs an employee pays out of pocket while on the road, like tickets, supplies, meals, hotel or client entertainment.

Employees must provide their employers with receipts or invoices that show the costs incurred. All legitimate expenses are non-taxable, as long as they meet company policy and employees have the documentation to support up. If an employee receives extra compensation outside of the reimbursement, that may be treated as taxable income.

Essentially, mileage reimbursement is a type of expense reimbursement specifically for the business use of an employee’s personal vehicle. Expense reimbursement is a broader term that applies to a wide range of business expenses and travel expenses.

How to set up mileage reimbursement policies in 2025

If you’re considering establishing a mileage reimbursement policy for your business, remember that clarity is the most crucial aspect. Your mileage reimbursement policy needs to be written in plain language, offer examples and provide easy-to-understand rules. Here are a few best practices to help guide you.

1. Clearly define the policy and its purpose

Outline what the policy is for, such as for fairly reimbursing employees for using their personal vehicles for business in line with CRA guidelines.

2. Determine eligibility for reimbursement

Establish who is eligible for reimbursement of mileage by outlining specific roles within the company. Then, specify which tasks count as business travel using a personal vehicle. These may include:

- Travel to clients

- Travel to off-site meetings

- Travel between company locations

- Travel to conferences and continuing education seminars

With Float, admins can set clear reimbursement policies and attach documentation requirements—so every submission is CRA-compliant by default.

Be sure also to identify what isn’t eligible for mileage reimbursement, such as day-to-day travel from home to the company location.

3. Outline how reimbursement will be calculated

Will you use the CRA kilometric rate if you’re in Canada or the IRS mileage rate if you’re in the United States? Will you choose an entirely different rate for reimbursement? It’s up to you.

Keep in mind that if you select a rate that’s higher than the government-approved rate in either country, your employees will have to pay taxes on the excess income.

4. Specify what documentation you require

What kind of mileage log or receipts should employees keep to provide clear evidence of the mileage that needs to be reimbursed? Be sure to also state how often employees should provide this information for reimbursement. While recordkeeping isn’t a picnic, it’s a critical part of effective expense management.

Mileage reimbursement tax implications for Canadian businesses

For Canadian small business owners, mileage reimbursement is often a cost-effective way to compensate your employees for using their personal vehicles for business purposes. When it comes to tax considerations, here’s what you need to keep top of mind:

- Keep mileage reimbursements non-taxable: If you reimburse employees at or below the CRA’s per-kilometre rates, the reimbursement is non-taxable (and hassle-free!) for employees. You also don’t need to worry about extra CPP, EI or income tax withholdings on the reimbursement.

- Consider a tax deduction for your business: Mileage reimbursements that follow CRA guidelines may be deductible business expenses for your company.

- Don’t over-reimburse employees: You may think you’re being generous, but going above the CRA’s per-kilometre rate can be problematic for you and your employees. The excess is a taxable benefit for the employee, and you’ll need to report it on their T4 and be responsible for payroll remittances.

- Always ask for detailed documentation: The CRA requires detailed mileage logs that contain the date, destination, purpose and kilometres driven. If your employee can’t provide this information, the reimbursements could be classified as taxable income. Be sure to tell employees about the necessary documentation and consider asking them to use mileage-tracking apps for accurate results.

Mileage reimbursement, when done right, is a win-win for your business and your team. You get a deductible expense and your employees get non-taxable compensation.

Best practices for mileage tracking and documentation

Want to ensure you’re doing mileage reimbursement correctly in Canada? To avoid any issues with reimbursement or tax deductions, follow these expense policy best practices:

- Make the mileage log non-negotiable: The CRA, as well as the IRS, require detailed mileage records to prove that a personal vehicle was used for business purposes. To be eligible for reimbursement, ask employees to provide a detailed log including the date of the trip, the destination and starting point, the purpose of the trip and the distance driven. If your employees don’t provide this information, the reimbursement could be classified as taxable income.

- Encourage the use of tracking technology: It can be challenging to maintain accurate and timely manual logs. Consider asking employees to use technology like GPS-based apps that help them categorize business and personal trips. With Float, you don’t need separate GPS or mileage tracking software—employees can log, submit, and track reimbursements directly in the app.

- Establish a submission process: How often should employees submit their mileage logs? For many businesses, bi-weekly or monthly submissions work best. Streamlining the process for reviewing and approving mileage reimbursements will save you a lot of headaches.

- Have straightforward policies in place: Your mileage reimbursement policy should be easy to understand and accessible to employees. Outline the types of travel that are reimbursable and those that are not. Be available to answer any questions employees may have regarding the policy.

- Hold onto records: It’s best practice to hold onto mileage logs and digital records for at least six years, just in case your business is audited.

- Review CRA rates regularly: The CRA reviews kilometric rates quarterly. They often change from year to year, so it’s best to keep an eye on the rates to ensure your reimbursement policies are aligned with the CRA. Be sure to communicate any changes to your team.

Expense management as a whole, and mileage reimbursement in particular, may seem like a lot of red tape. However, following the CRA’s simple rules helps keep reimbursements tax free and protects your deductions, saving you time, money and stress.

Alternatives to mileage reimbursement

While mileage reimbursement is a common way for employers to compensate employees for business use of their personal vehicles, it’s not the only option. Some companies provide a flat monthly car allowance to cover estimated costs, while others use a fixed and variable rate (FAVR) reimbursement that combines a monthly allowance with a cents-per-mile rate.

For employees who frequently drive for work, a company-provided vehicle may be a more cost-effective solution than mileage reimbursement or a car allowance. Keep in mind that these options may have different tax implications compared to mileage reimbursement.

Feel confident about mileage reimbursement in Canada

Fuel costs, hybrid and remote work and tighter expense scrutiny make mileage policies more important than ever for Canadian small businesses. If you’re looking for a simpler way to manage mileage reimbursements and other business expenses, we can help!

Float helps Canadian businesses streamline mileage reimbursements—from trip logging to policy enforcement to CRA-compliant submissions. Try Float’s reimbursement module alongside corporate cards, bill pay and real-time expense tracking—all in one platform, built for Canadian teams.

Learn more about Float

Get a 10-minute guided tour through our platform.

Written by

All the resources

Industry Insights

Canada’s Crossroads: Why Now is the Moment to Move from Defensive to Intentional Growth

Float's 2025 report on Canadian business shows modest growth, rising costs and shrinking reserves. Find out exactly what the data

Read More

Expense Management

Controller Month-End Close Automation: Streamline Financial Reporting

Controllers, this one's for you. Let's talk about how how automating month-end close helps you move faster without sacrificing accuracy.

Read More

Corporate Cards

Corporate Card Program Implementation: Complete Management Guide

Ready to implement a corporate card program? This is where to start.

Read More