SURVEY

The State of SMB Finance in Canada: Navigating Challenges, Unlocking Potential

In October 2024, Float conducted a study of nearly 700 SMBs. Here are the findings.

Canadian SMBs are forging ahead with confidence, but beneath the surface, you’re facing financial obstacles that threaten to hold you back. What’s fueling this optimism despite the challenges? And how are traditional banks missing the mark when it comes to supporting your growth?

Dive into the results from our latest study that sheds new light on the complexities of financial management for SMBs and what’s causing the issues.

SMBs are confident amid challenges.

Canadian small and medium-sized businesses (SMBs) are showcasing extraordinary confidence and resilience in the face of significant financial challenges.

SMBs are bullish on performance, and optimistic about growth

Overwhelming

confidence

87%

feel confident about the current performance of their business.

Increasing

optimism

6 out of 10

feel more optimistic than a year ago.

Growth on

the horizon

1 in 2

anticipate year-over-year profit growth.

Financial Challenges

Despite their optimism, SMBs face a range of financial hurdles, with high operating costs and high interest rates or fees on financial products topping the list.

Bridging the gap between ambition and reality with purpose-built solutions could unleash a wave of SMB-driven economic growth.

Want to read more about how Float is tackling these challenges head-on?

Top 5 financial challenges faced by SMBs

High operating costs

High interest rates or fees on financial products

Inconsistent or unpredictable revenue

Insufficient cash flow

Difficulty accessing capital or credit and Inefficient financial processes or systems

Want to read more about how Float is tackling these challenges head-on?

Traditional banking is missing the mark; SMBs need custom solutions.

Canadian SMBs are frustrated with traditional banks, citing a widespread failure to meet their unique needs. This dissatisfaction is inadequate product offerings, operational processes, and overall value proposition.

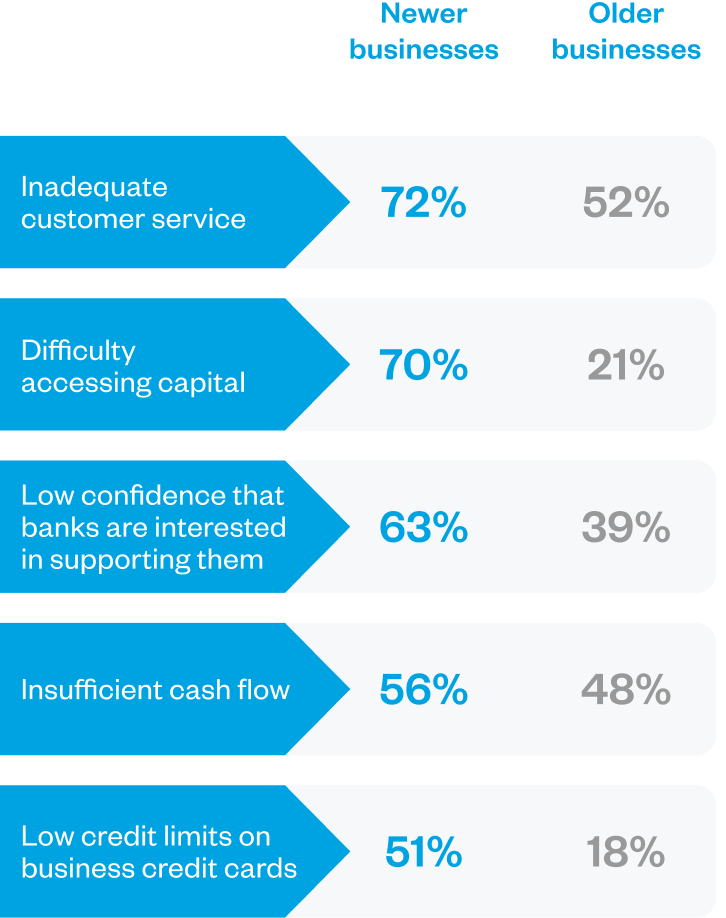

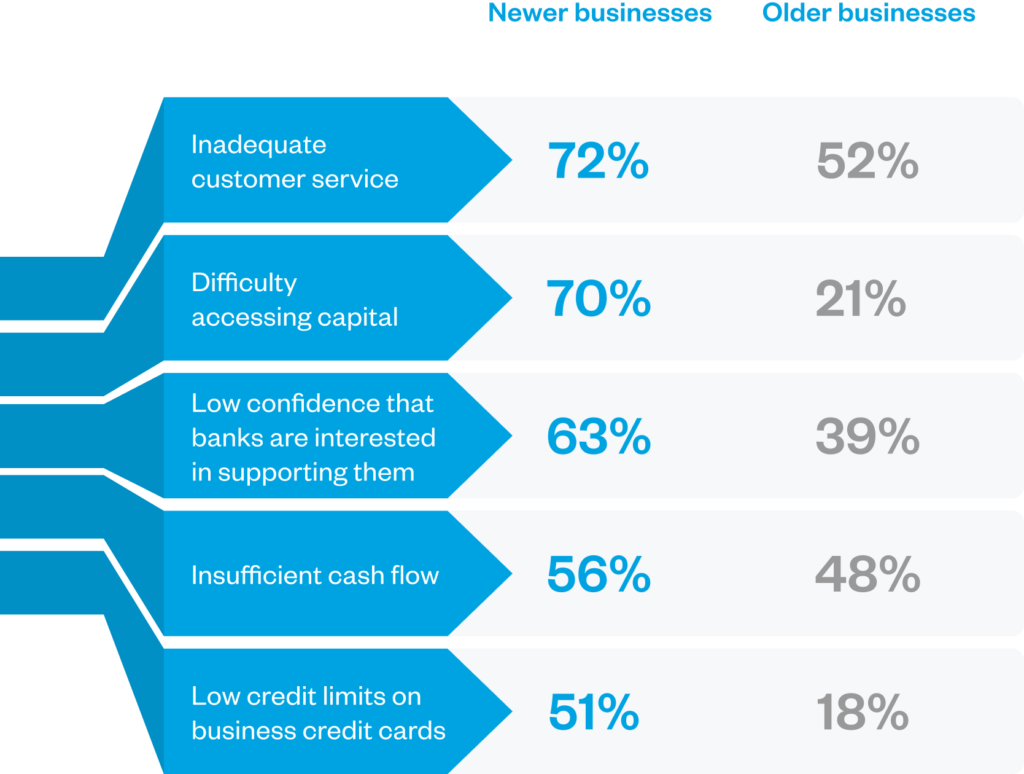

While all businesses are frustrated with current offerings from banks, newer businesses feel it more.

Newer businesses face

heightened financial challenges

and dissatisfaction with banking

SMBs are dealing with limited access to capital, poor customer service, and scant support from traditional financial providers. Nearly six out of 10 SMBs are unhappy with options for savings accounts, interest rates, and rewards programs.

More than half of SMBs feel traditional banks:

don’t understand their business or its unique needs

aren’t interested in supporting small business owners

don’t provide adequate levels of customer service

don’t offer competitive yield on cash balances

don’t offer satisfactory interest rates on business savings accounts

don’t provide attractive cashback or rewards programs

Insufficient cash flow is a major concern for SMBs:

65%

are dealing with long processing times for financial transactions

59%

are experiencing lengthy loan approval processes

Accessing financial services has become more challenging:

50%

of SMBs are dealing with low credit limits on business credit cards

41%

are struggling with high interest rates or fees on financial products

If you and your business are struggling with challenges like the ones outlined above, you’re not alone.

Float’s primary mission is to break down these barriers and tailor financial services for SMBs.

That’s why we penned the SMB Manifesto.

Want to read more about how Float is tackling these challenges head-on?

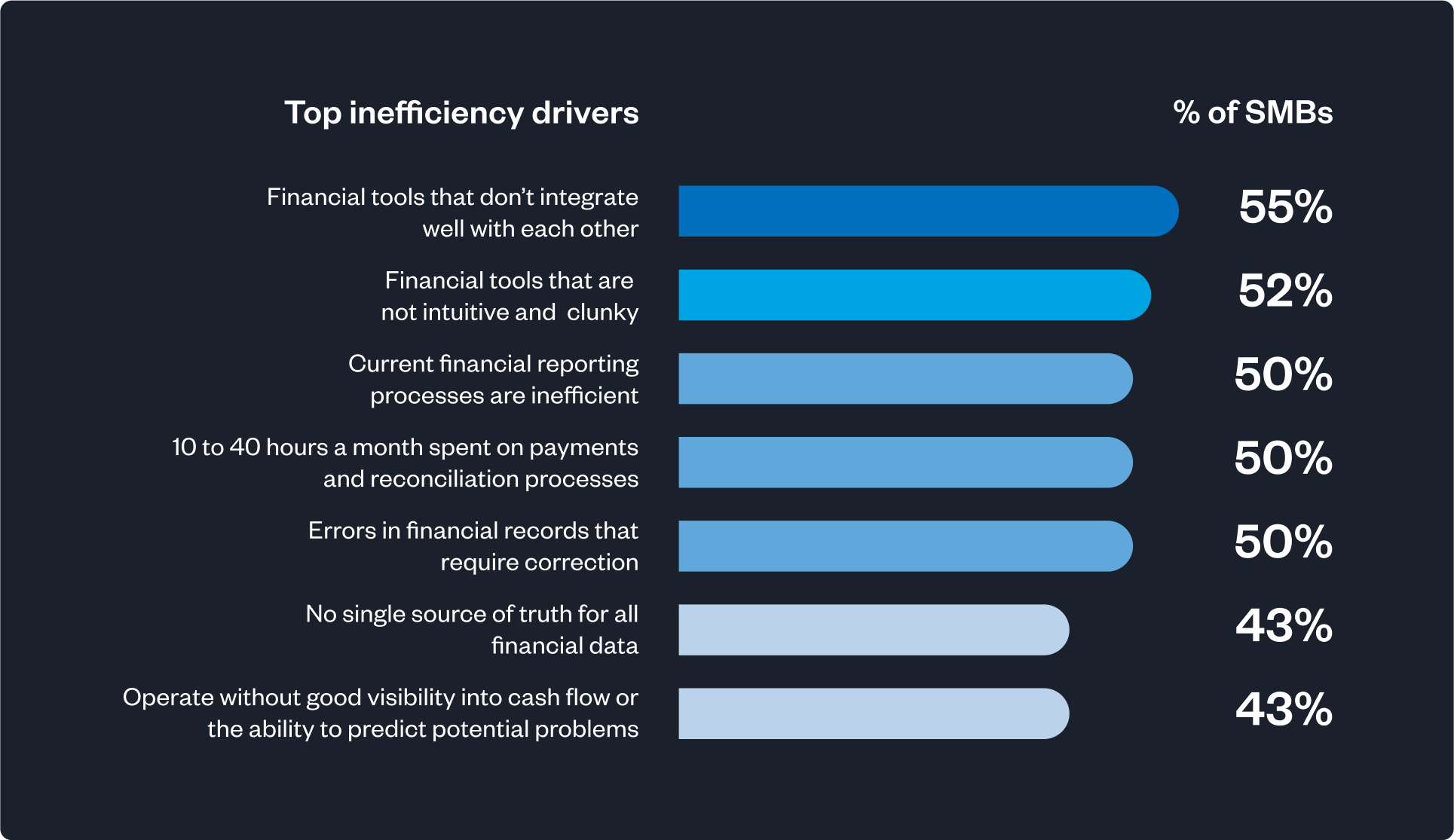

Current financial processes and tools add complexity, not efficiency.

Inefficient and manual financial processes and tools hinder the ability of SMBs to make informed decisions and predict potential issues.

SMBs with ineffective financial tools and processes were found to face a greater likelihood of severe financial challenges. This highlights the crucial role of streamlined, integrated financial management systems in maintaining business financial health and visibility.

There is a critical need for more efficient, integrated, and user-friendly financial management tools and processes for SMBs.

The current landscape of disconnected, clunky tools and inefficient processes is leading to significant time waste, data inaccuracies, and poor visibility into crucial financial metrics like cash flow.

These issues are not merely operational inconveniences but are directly impacting SMBs’ ability to manage their finances effectively, access capital, and make informed business decisions.

SMBs using poorly integrated tools are two times more likely to report poor visibility into their cash flow

SMBs who use financial systems that are clunky and unintuitive are twice as likely to report poor cash flow visibility

Operational teams are more attuned to challenges

Our research highlights a perception gap between business leaders and their teams, who report more concern about inefficiencies.

This suggests that executives may be overlooking or minimizing issues that contribute to their overall business health.

Elevate the way you manage your business. Demand more, accept nothing less.

At Float, we’re not waiting around for banks to catch up or for policy changes to make life easier for SMBs. We’re delivering real solutions right now—higher returns on your cash, interest-free funding, faster bill payments, and more game-changing features before year-end.

It’s time to stop settling. Demand financial tools that work for you. You deserve better.

*Trademark of Visa International Service Association and used under licence by Peoples Trust Company.