SURVEY

The Financial Outlook of Canadian SMBs in 2025: Resilience, Risk and the Road Ahead

Float surveyed more than 400 SMBs in February 2025 about their financial challenges and strategic responses to economic pressures.

Building on our State of SMB Finance in Canada report, this study examines how Canadian SMBs are navigating the triple threat of 2025: rising operational costs, demand uncertainty and inflation. Our research reveals three critical insights:

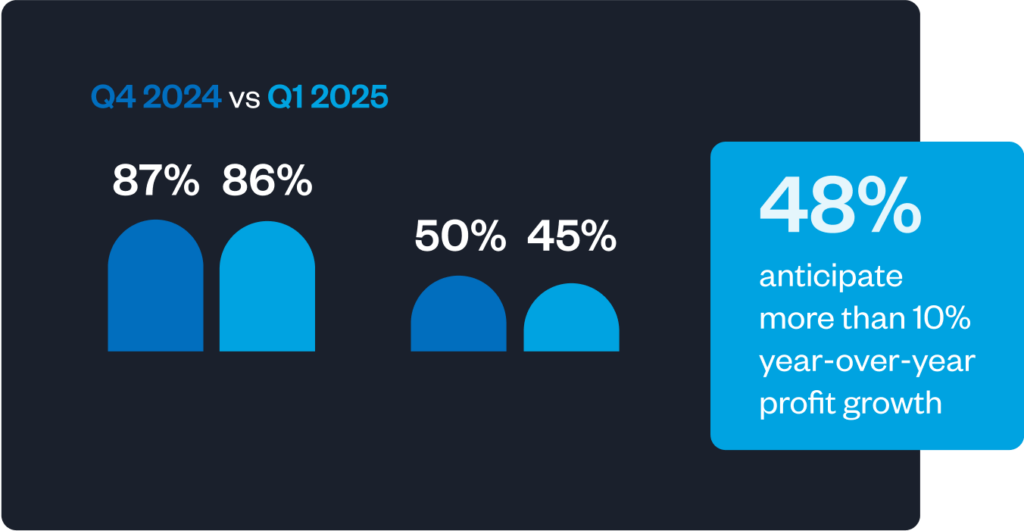

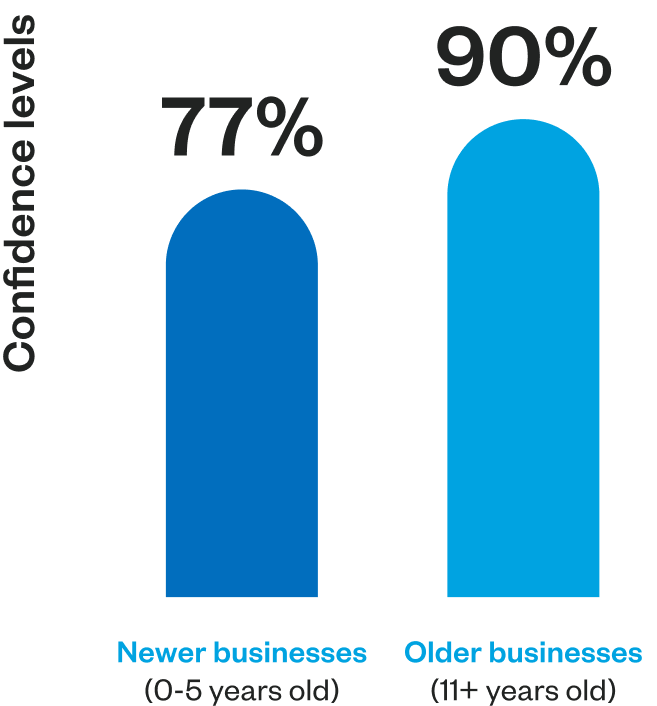

[1] The confidence gap: Established businesses are investing in growth while newer SMBs are struggling with financial roadblocks. This is creating a “two-speed” economy, where some businesses move ahead while others fall behind.

[2] The cautious approach to risk: Almost one in three SMBs are increasing growth investments. However, even businesses that depend heavily on US suppliers or customers haven’t adjusted their strategies to deal with new cross-border tariffs. The data suggests many SMBs may lack the right financial tools and visibility to make informed, strategic shifts.

[3] The infrastructure challenge: SMBs with outdated or inefficient financial systems and processes are more likely to increase spending without a clear picture of their finances. This lack of visibility can lead to costly decisions—especially as economic pressures grow.

Want to learn more about how tariffs will affect your industry and what can you do to stay ahead?

Business age divides fortunes as newest ventures face third economic blow

Most businesses remain positive about their performance, but there is a clear divide: established SMBs are positioned for growth opportunities while younger businesses are fighting for survival. This deep experience gap reveals how successive economic shocks—from COVID-19 pandemic lockdowns to sluggish economic recovery and now impending US tariffs—have disproportionately impacted new businesses.

Inexperience+uncertainty=compounding barriers for newer SMBs

Canadian businesses showcase their resilient DNA, maintaining remarkable confidence in the face of increasing economic pressures from rising costs, trade tensions and policy changes.

“Some good things can come out of these uncertain times—like becoming more self-sufficient and the growing ‘buy Canadian’ push—but in the short term, it’s more pain than anything.”

David Petrie

Vice President of Finance, Fittes

Confident businesses aren’t just optimistic—

they’re actually growing faster.

Confident SMBs are

2x as likely to expect >10%

profit growth this year

Experience offers established businesses some insulation from uncertainty, while younger ventures remain vulnerable.

Business confidence reinforces business growth.

Top 3 business challenges for confident SMBs

Customer acquisition

Managing growth and scaling operations

Hiring and retaining employees

Top 3 business challenges for less confident SMBs

Customer acquisition

Access to capital

Managing cash flow

Customer Story:

Professional Services

Brian Didsbury is part of the finance team at LiveCA, a proudly all-Canadian accounting firm serving SMBs since 2013. And while the company is looking for ways to navigate the impact of the new economic reality, he remains optimistic.

“We’re actively addressing client retention, recognizing that current churn is driven primarily by economic pressures forcing businesses to either significantly reduce spending or cease operations altogether, rather than dissatisfaction with our core services. While we remain committed to supporting clients through challenging times, preserving our ability to deliver a full back-office finance team at less than the price of a full-time hire is essential to our sustainable business model.”

Brian’s optimism stems from 4 areas:

- Strong pipeline of clients who value their services

- Commitment to providing an all Canadian team, which resonates with their target clientele

- Targeted operational efficiency through technology and automation (like Float), which frees up time and resources for growth without adding to headcount

- Talent density, which contributes to the firm’s ability to navigate challenges and deliver high-quality services

“I’m cautiously optimistic. There are a lot of great companies, a lot of great entrepreneurs that we need to support here in Canada. And we still have a good pipeline of clients that want to work with us. But we’ve had to reset expectations and revise down.”

Brian Didsbury

Senior Manager and Controller, LiveCA LLP

What’s a possible solution here?

Policy makers

Now is the moment for government and financial service providers to take action. Canada’s youngest and most vulnerable businesses are at a crossroads—without better access to capital and stronger cash flow support, many won’t make it through these economic headwinds. We need bold, targeted initiatives that don’t just acknowledge their struggles but actively fuel their survival and growth. This means tax incentives specifically designed to support new entrepreneurs, mandated requirements for banks to approve access to basic credit limits and accounts in a timely manner—eliminating the weeks-long delays that currently hinder businesses—and a federally enforced mandate ensuring affordable access to financial services.

Business owners

Improve cash flow by speeding up receivables, cutting unnecessary costs (e.g. consolidating software with all-in-one solutions) and securing flexible funding to overcome financial constraints. But being more efficient as a business means investing more efficiently as well. Take those cost savings and inject them into the areas of your business with the best chance to grow.

SMBs invest in growth while avoiding fundamental strategic changes

Canadian SMBs are facing a perfect storm of financial pressures in 2025. Rising costs, unpredictable demand and inflation make it challenging to simultaneously manage cash flow, grow the business and adapt to constantly changing trade and tariff policies.

Top 3 financial concerns in 2025

Rising operational costs

Demand uncertainty

Lingering inflation / interest rate concerns

So how are SMBs responding?

US tariffs pose a major challenge for Canadian SMBs, yet our data shows many—even those heavily reliant on US revenue—are unprepared.

Despite 65% of all SMBs expecting tariff impacts, 4 out of 10 remain in “wait-and-see” mode.

SMBs planning responses are using a variety of approaches.

Top 3

strategies:

Over the past six months, 30% of SMBs increased spending to fuel growth, while more than half (53%) maintained stable spending levels.

Top areas of

increased spending*

36%

Digital advertising and marketing

34%

Hiring employees or contractors

Top areas of

reduced spending*

27%

Office space / operational costs

24%

Travel and events

*in the past 6 months

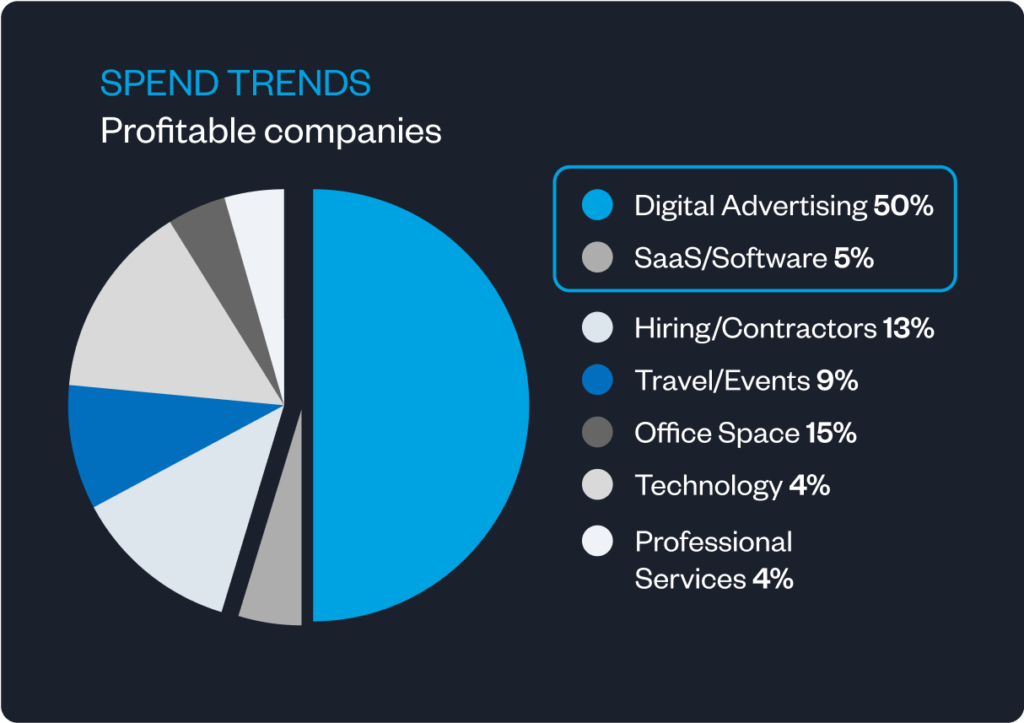

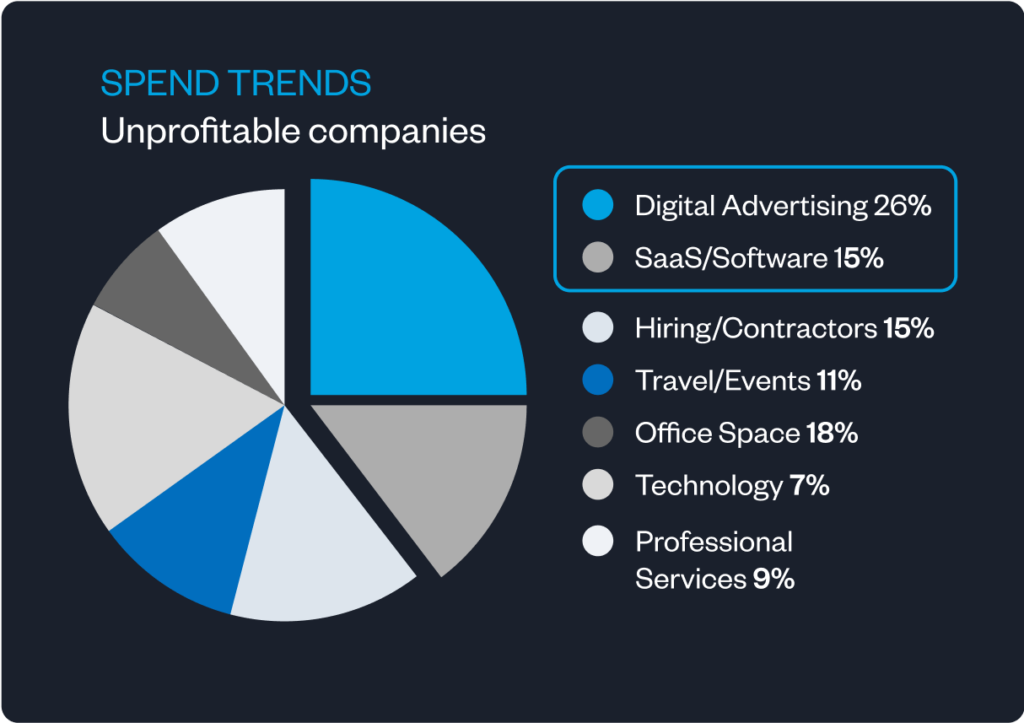

But where SMBs allocate their spending makes a significant difference.

Actual spend data shows highly profitable companies invest more in digital marketing, likely mastering a growth playbook that outpaces competitors.

VS.

In contrast, unprofitable companies allocate more to software and professional services, tying up funds in non-growth activities.

Customer Story: Construction / Manufacturing

David Petrie, Vice President of Finance at Fittes, a Canadian design and building supplies company, faces significant challenges caused by the general US tariffs on Canadian goods as well as sweeping tariffs on all steel imports. With a lot of their products being made of steel, they face a double tariff impact that has forced more conservative planning.

How Fittes is mitigating tariff impacts:

- Supply chain optimization: Looking for opportunities to improve and optimize manufacturing processes, negotiating with current suppliers and improving shipping efficiency

- Price adjustments: Evaluating pricing strategies with the least potential impact on customer demand

- Scenario planning: Conducting detailed financial projections across multiple scenarios to navigate uncertainty

- Inventory management: Shipping maximum stock to the US before the tariffs took effect

“If you can’t pass the full 25% tariff to customers, you work smarter in other areas of the business—marketing, staff, rent, software. The cost of advertising also continues to rise in an ever competitive market, which adds even more pressure. Having said that, our core focus will always be the value we can add to our customers’ lives, and we won’t allow the quality of our product or service to suffer.”

David Petrie

Vice President of Finance, Fittes

Recommendation:

Develop a tariff plan by assessing how changes will impact your customers (and their customers, if relevant). Analyze the effects on suppliers, market positioning and overall business dynamics—some impacts may be unexpectedly beneficial, while others will pose challenges. Acknowledgment is the first step, followed by strategic planning to minimize risks and seize new opportunities.

Be strategic to managing cost impacts while using marketing to strengthen your position—your finance team can play a key role in this. Finance teams should be strategic growth drivers, not just cost-cutters. They can help allocate resources effectively and support long-term business success.

SMBs need efficient financial tools, not just economic relief

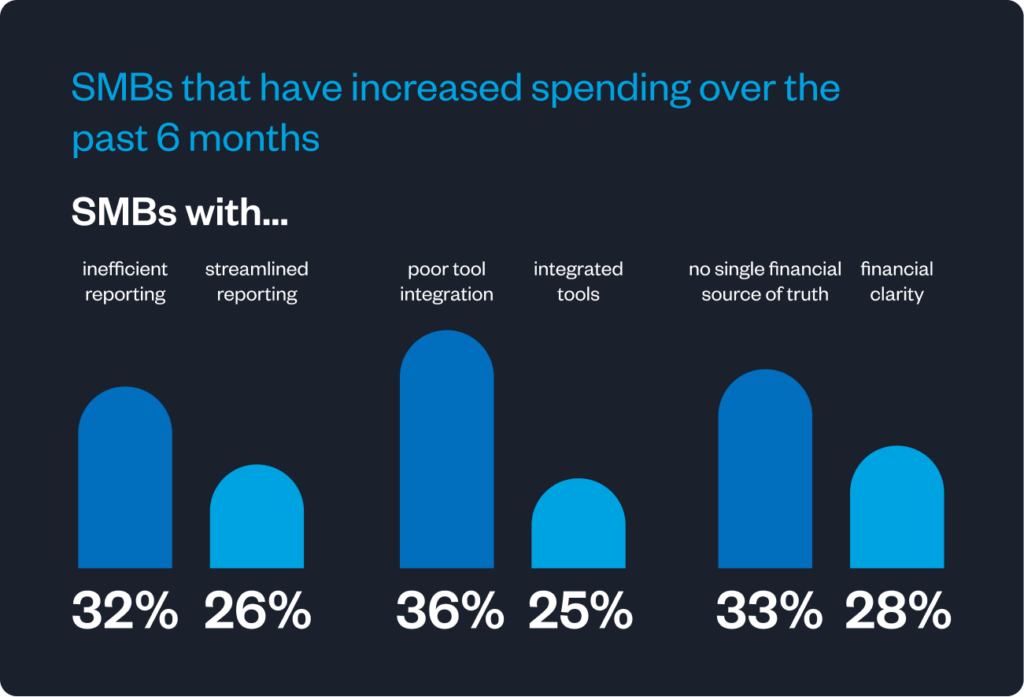

Businesses with poor financial systems tend to make more spending decisions despite lacking full visibility, turning operational inconvenience into strategic risk.

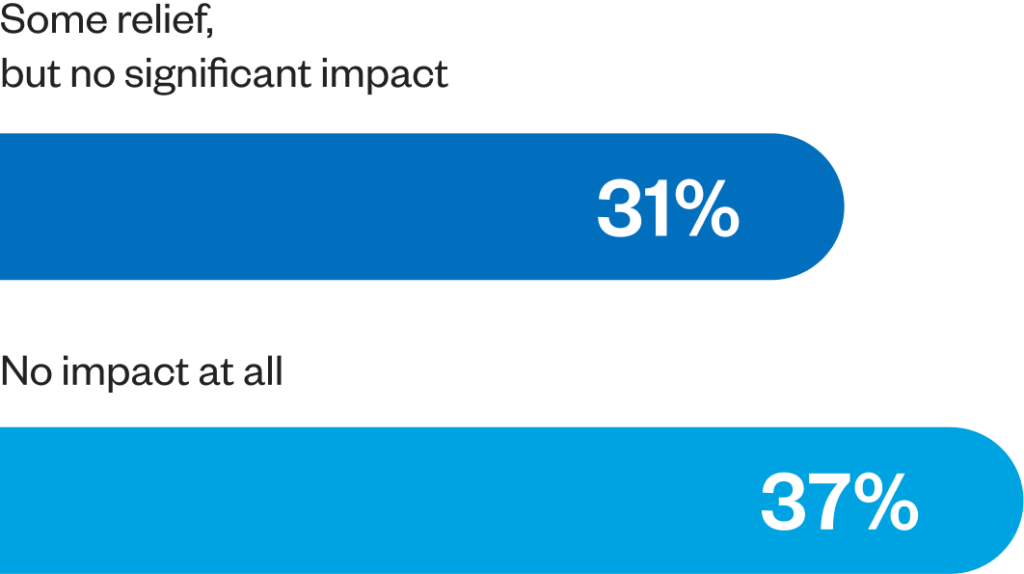

If the Bank of Canada cuts interest rates in March, almost 7 out of 10 (68%) SMBs believe it will have little to no impact on their business.

During times of economic uncertainty or financial challenges, businesses need a clear understanding of their financial situation the most. But outdated financial systems are making it harder to see and analyze this data effectively. For many SMBs, these tough economic times are being compounded by inefficient systems that quietly waste resources and make strategic decision-making that much harder.

44%

struggle with inefficient financial reporting processes

40%

lack a single source of financial truth

39%

use tools that don’t integrate effectively

30%

do not have good cash flow visibility and cannot predict potential issues

SMBs with poor financial visibility and clarity are more likely to increase spending, potentially making growth investments without fully understanding their financial position.

Currency exchange is an increasingly

high-cost challenge for Canadian SMBs.

39% of businesses exchange currency weekly or monthly

More than half struggle with high fees and poor exchange rates

41% say CAD-USD fluctuations are hard to manage

FX with outdated banking systems =

expensive, clunky and require a US bank account

Recommendation:

To gain competitive edge in 2025, finance teams should adopt modern financial tools that integrate with each other to save on manual work and provide real-time insights, so you can make confident decisions regardless of changing economic conditions.

The road ahead for Canadian SMBs

Canadian SMBs are resilient. There’s no question. But they now face critical challenges: a growing confidence gap, hesitation to adapt strategies and inefficient financial tools. To thrive in today’s uncertainty and position themselves for growth and opportunity, businesses need both clear financial visibility and ready access to capital.

At Float, we’re committed to equipping Canadian businesses with better ways to manage their financial operations. Float provides the only complete business finance solution that is localized for the needs of Canadian companies: corporate cards, bill payments, expense management and more.

Businesses and finance teams using Float…

- Close their books 8x faster each month

- Make payments up to 3X faster

- Earn 4% interest automatically

- Save an average of 7% of their total spend with Float

This report is based on a February 2025 survey of 402 Canadian SMB owners, operators and finance team leads. Respondents represent a diverse range of industries and business sizes, providing insights into the financial challenges, strategies, and outlook of SMBs across Canada. Spend trend data is based on transactions from companies with 25–75 employees with $2.5M–$7.5M annual revenue during FY2024.