Easy International Money Transfers for Canadian Businesses

Join 4,000+ Canadian businesses and finance professionals making international payments with Float.

Save on bank fees and skip the visit to the branch by paying with Float online.

Trusted by the most iconic Canadian businesses & fastest growing Finance teams

Online International Money Transfer for Businesses

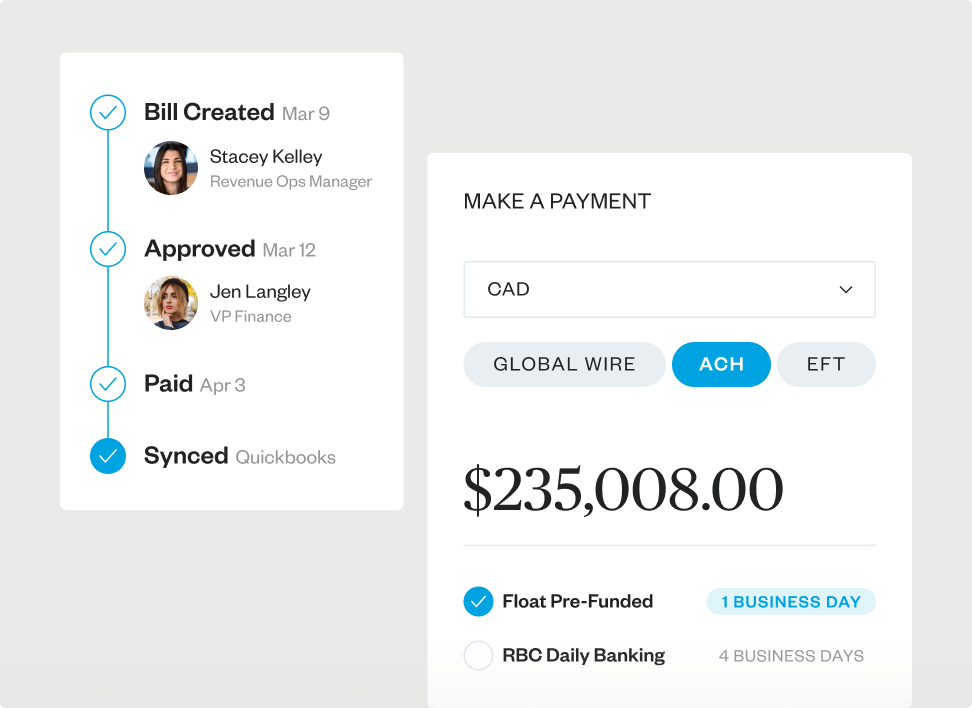

Faster payments

Banks usually take up to 5-7 business days to process a wire transfer and up to 3 business days to process an ACH or an EFT payment.

Experience next day payments with Float when paid from the Float balance to ensure that your money travels faster.

Make payments online

Banks require business owners to visit the branch just to initiate a Wire payment. Float will never do that.

Skip the branch visit and make payments anywhere in the world completely online using Float’s EFT, ACH and Global SWIFT Wire payments.

Save on bank fees

At Float, you pay a straightforward, flat fee—no hidden extras, ever. By contrast, banks typically tack on larger wire fees and pad their exchange rates, so you end up paying more than you realize. With Float, you see exactly what it costs to send money worldwide and keep more of your funds where they belong: in your pocket.

Banks on average charge $45 CAD per wire transfer. Float on the other hand offers much lower cost options to transfer funds.

Float’s wire transfers are up to 55% cheaper and ACH and EFT transfers are as low as $1 CAD.

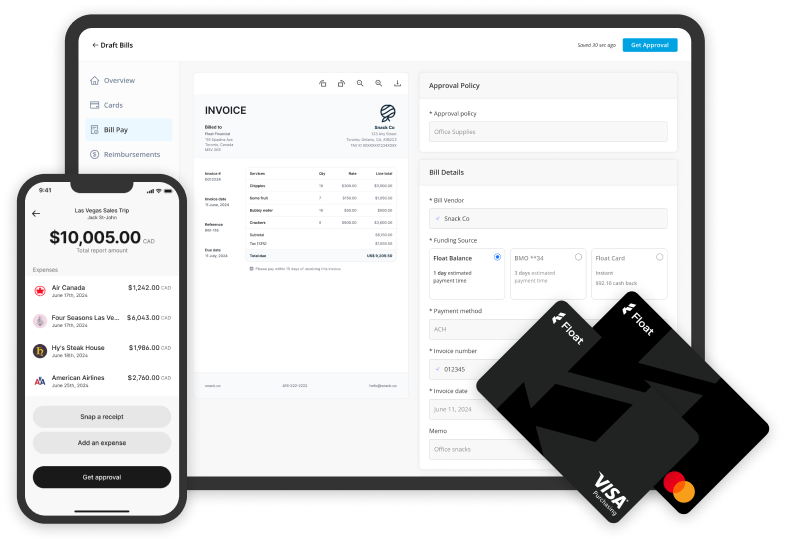

Make International Money Transfers in 3 Easy Steps

Use your Float business account to seamlessly send money in Canada, US and internationally.

Open a Float account

Create your Free account with Float, get approved in <24hrs and begin making payments.

Manage payees in Float

Create any number of payees in Float track their invoices and payments.

Send money in Canada, US or Internationally

Send money directly from your Float account in CAD or USD via EFT, wire, or ACH payments.

How to Send Money Internationally with Float?

When you need to send money internationally, it’s essential to understand the process to ensure a smooth and secure transaction. This step-by-step guide will walk you through the key aspects of making an international money transfer, helping you navigate the process with confidence.

What is an International Money Transfer?

An international money transfer is the process of sending money from one country to another, often through banks or online platforms. It involves currency conversion and can be used for personal or business purposes.

Why Use International Money Transfers?

International money transfers are essential for businesses and individuals who need to send money across borders efficiently. They offer a reliable way to support family abroad, pay for services or conduct global business transactions.

How Long Does an International Money Transfer Take?

Once initiated, an international money transfer typically takes 1 to 5 business days, depending on factors like the destination country, transfer method and banking networks involved. Transfers using digital platforms or fintech services like Float are often faster, sometimes processing within minutes or hours. Delays can occur due to currency conversion, regulatory checks, or time zone differences.

Payment Methods for Canadian Businesses

Global SWIFT Wire transfers

Float’s Global SWIFT transfers enable next-day international payments with reduced fees, providing faster, more affordable cross-border transactions than conventional bank wires. Use Float’s free transit, institution or routing number look-up tool.

EFT payments

Float’s EFT solution offers near-instant transfers with lower fees and real-time tracking—far outperforming the slow, costly processes of traditional banks. Follow our EFT payment guide to ensure seamless payments process.

ACH payments

Float’s ACH system cuts costs and speeds up recurring payments, delivering a user-friendly dashboard and efficiency that banks simply can’t match.