Corporate Cards

Corporate Virtual Visa Card

Issue high-limit corporate Visa Virtual Card in both CAD and USD, perfectly paired with intelligent software that saves businesses 7% on their spend.

Trusted by thousands of leading Canadian companies.†

Benefits

More control, less unwanted spend

A virtual card that delivers both.

Issue unlimited Visa Virtual Card

Instantly issue unlimited Virtual Visa or Mastercard cards to anyone on your team in CAD or USD.

Free from expense reports

Automatically submit receipts via Float’s mobile app or text and eliminate the need for expense reports altogether.

Avoid unwanted charges

Use-it-then-lose-it with single-use virtual cards designed for one-off purchases.

What is a Float’s Visa Virtual Card?

The Float Financial virtual card is a powerful, digital Visa that lives on your phone or computer. With Float, you can instantly generate virtual cards, ready for immediate use. Each card is tied directly to your Float account and comes with its own unique details, allowing you to issue an unlimited number of cards for both employees and the company.

Benefits of Float’s Visa Virtual Card for Canadian Businesses

More control,

less concerns

Empower your team with virtual credit cards

Spend, track, approve, and reconcile all your CAD and USD expenses in one simple to use platform.

Issue a $0 balance card to any employee

Add funds only when you need to

Set recurring and temporary spend limits

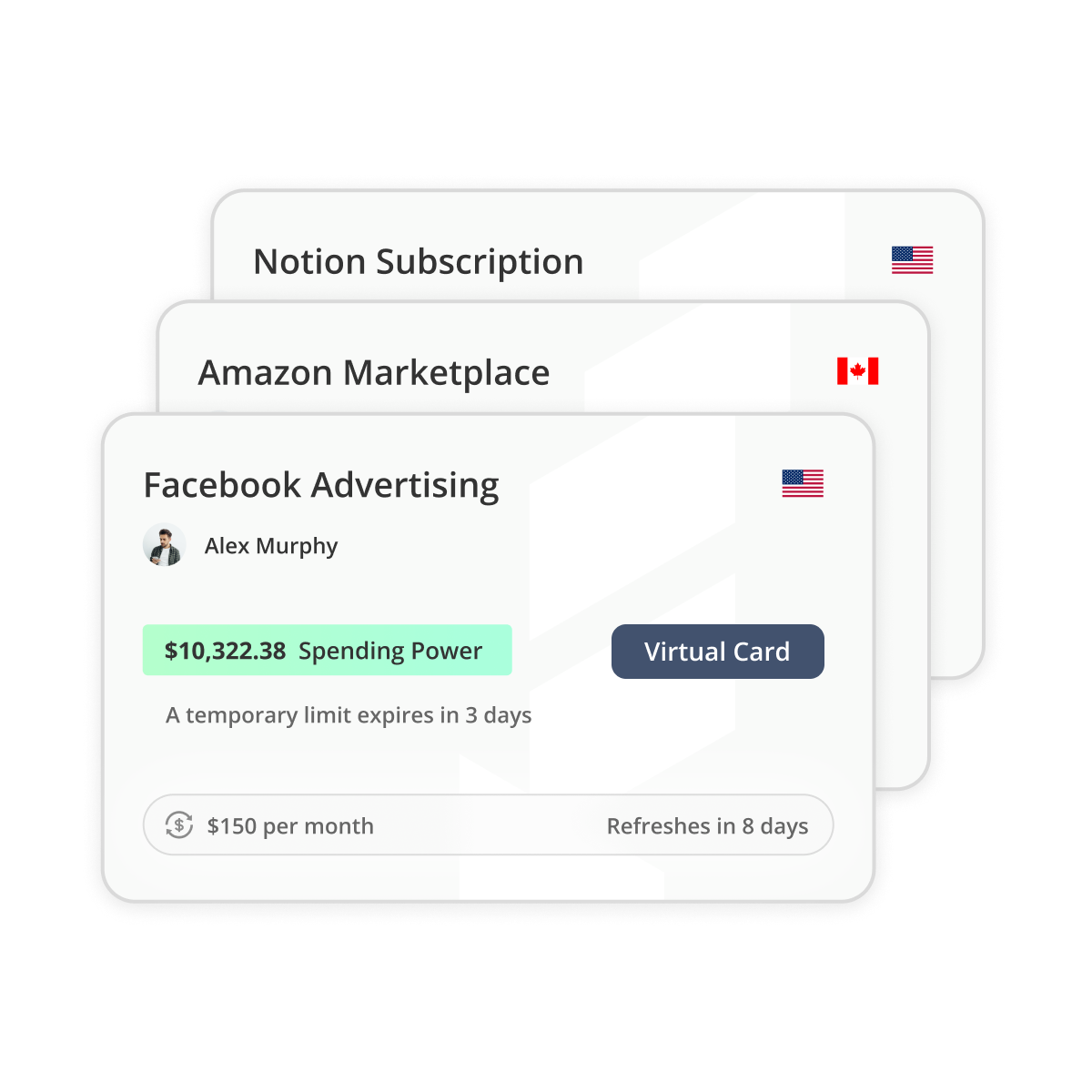

Control large vendor

spending

Ditch the catch-all card and create vendor-specific virtual cards for more control, especially with big recurring bills that require extra visibility.

Instantly issue virtual cards to use for software or advertising spend

Temporarily increase spend limits as needed by setting time limits

Dial limits back to $0 post-campaign or subscription terms

“Float’s virtual cards continue to give our team the flexibility and autonomy they need and deserve.”

Andy O’Reilly

Senior Manager of Finance & Technology

Request, approve,

spend on Float’s Virtual Cards

Instantly create or approve temporary and recurring limits on Float’s Visa Virtual Cards to unlock spending power when needed. Apply automated controls to ensure spend happens within your expense guidelines.

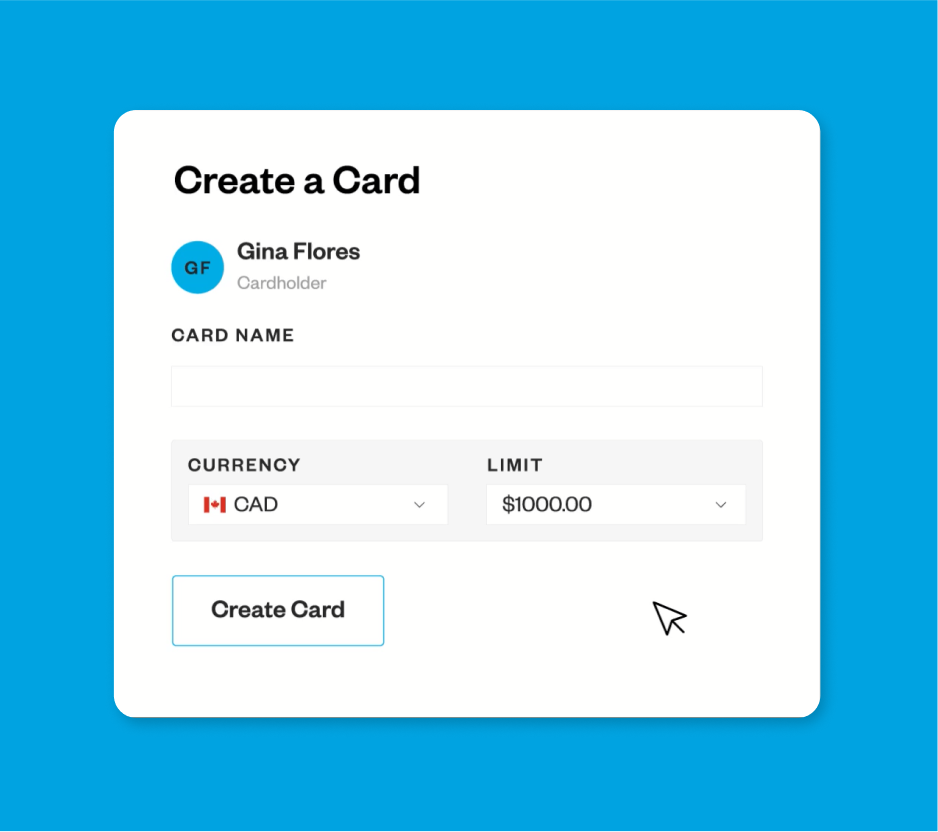

1

Create or Request New Cards

Admins can create cards and set spending limits for team members. Employees can also request cards directly from approved Managers with a click of a button.

2

Approve,

Edit, or Deny

Admins and Managers can approve, edit or deny spending requests in-app or via Slack. Best of all? Float keeps an audit trail of approvals for easy audits and controls.

3

Spend

and Close

Cardholders are automatically notified to submit receipts via Slack, SMS, or email as soon as a purchase is made and transactions are auto-coded immediately in Float.

Frequently Asked Questions

To get a business virtual credit card in Canada, research providers, understand eligibility requirements, prepare necessary documentation, submit your application, set up the card, integrate with business systems, and train employees on usage.

Float’s cards are issued by Visa and Mastercard and have the same acceptance rates and earn cashback just like a traditional Virtual Credit Card.

Fees can vary by provider, so it’s important to compare features and costs. Float is a completely free virtual card solution for Canadian businesses that you should consider.

Virtual cards are the same as a traditional physical card with the exception that the card number for these cards is presented digitally. You can create and cancel virtual cards for any purchase and set custom limits on a per-card level to avoid overcharges from the vendors. Float’s virtual cards are excellent for recurring subscription expenses, digital ads spend, and one-off small employee purchases as they can be added into Apple or Android Wallet and deleted once the purchase is complete. Float’s Essentials plan offers unlimited virtual cards and <10 minutes account application time.

Signing up for Float takes less than 10 minutes and can be done fully online. Float does not require any personal guarantees and does not perform credit checks to open your account. Ready to get started on our Free Essentials plan? Sing-up today.

Float is Free to use on our Essentials plan, where you will be able to issue unlimited virtual CAD/USD cards, earn 4% interest on deposits, reimburse employees and pay vendor bills. If you need more sophisticated functionality, like over 20 physical cards, Netsuite integration, or an API solution, you will have to consider our paid Professional and Enterprise plans.

Float offers Charge Card and Prepaid funding models. You can apply (*Conditions apply. Book a demo to learn more) for unsecured, 30-day credit terms with high limits up to $1M, no credit checks and personal guarantees. Prepaid model offers 4% interest on all deposits with no cash lockups with account opening in < 24 hours.

Unlike traditional cards that get you to spend more, Float is the only corporate card in the world that helps businesses spend less. Through a combination of financial rewards like our 1% cashback, 4% interest on deposits, no FX fees with our USD cards and time savings of at least 8 hours per employee Float’s customers on average save 7% on their spend.