FLOAT USECASES

Streamline Company Expenses with Float’s Intelligent Vendor Payment Automation

Float is a modern all-in-one finance platform that centralizes all vendor payments and approvals in a single place — plus average savings of 7%.

Manage your entire finance workflow from intake-to-pay on Float.

Create unlimited virtual cards and earn 1% cashback on vendor payments.

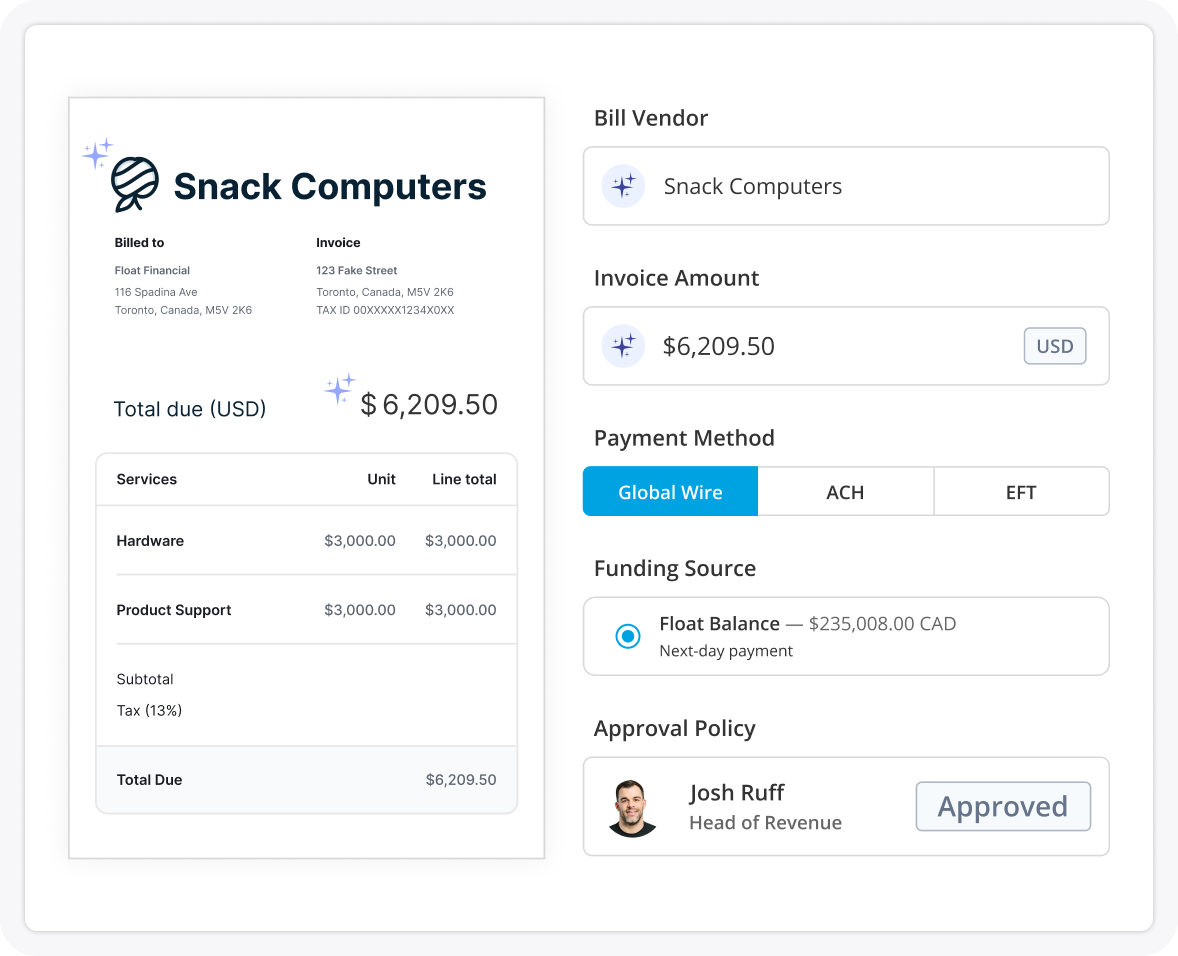

Pay via ACH, EFT, or Global Wires directly from Float.

Trusted by thousands of leading Canadian companies.†

End-to-End Vendor Payment Software

Float is Canada’s only all-in-one vendor payment platform that handles everything from intake, approval, and enables payments via credit cards , ACH,, EFT, and Global Wires.

Centralized Payment Management

Track all of your invoices, contracts, and payments in a single system to maximize control and never miss a payment.

Pay in CAD or USD next day with Float.

Apply for a 10x higher card limit with Float’s Charge Card.

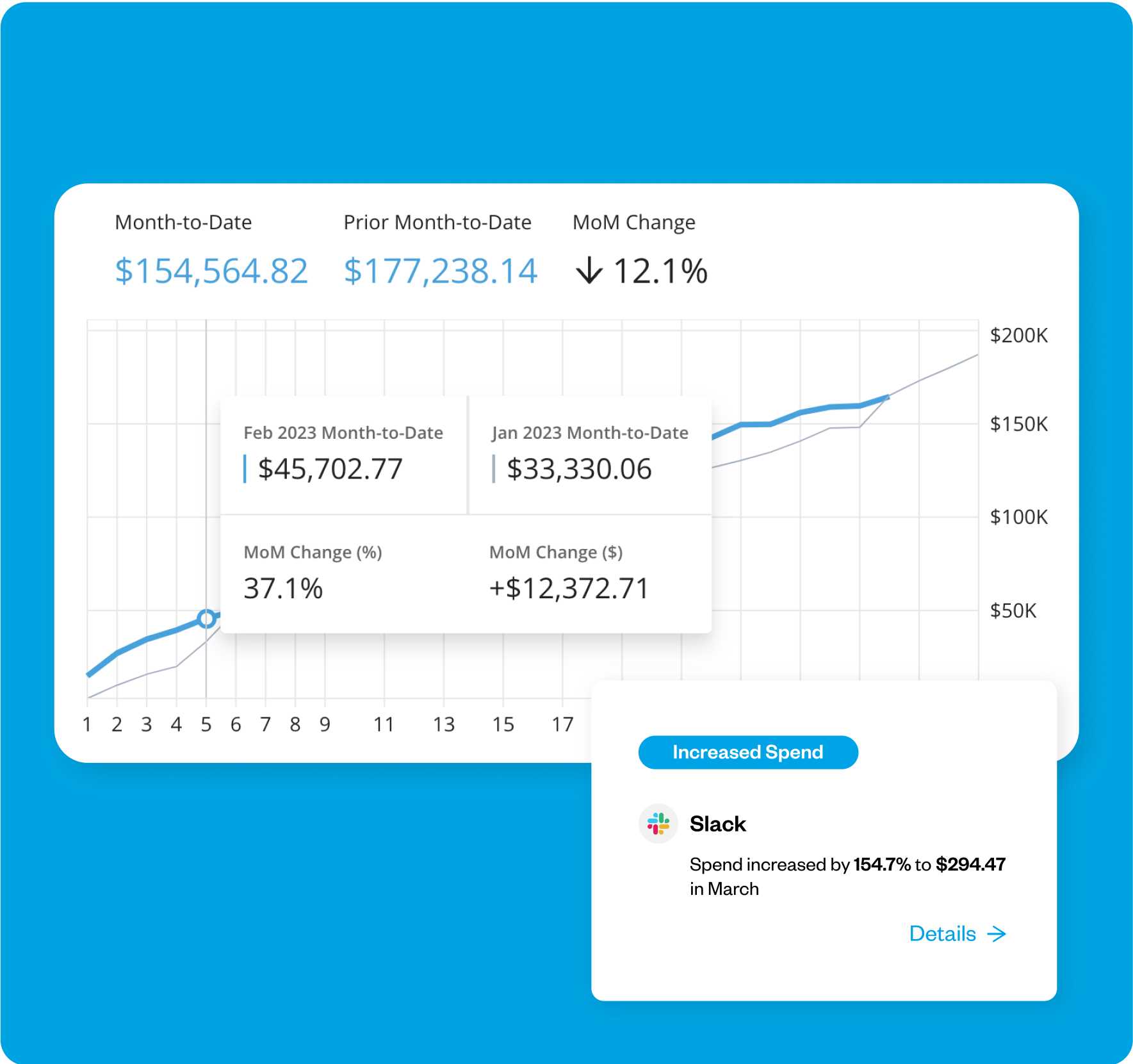

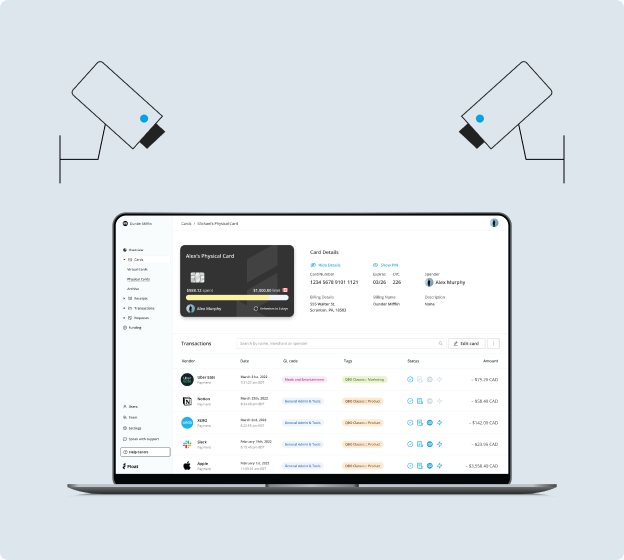

See transactions in real-time to track spend and spot spend anomalies.

Real-Time Tracking and Reconciliation

See spend immediately as it happens and sync all of your transactions into QBO, Xero or Netsuite automatically.

Real-time spend insights that help your business avoid unwanted charges or spikes in spending.

Know your SaaS usage and upcoming renewals or charges ahead of time.

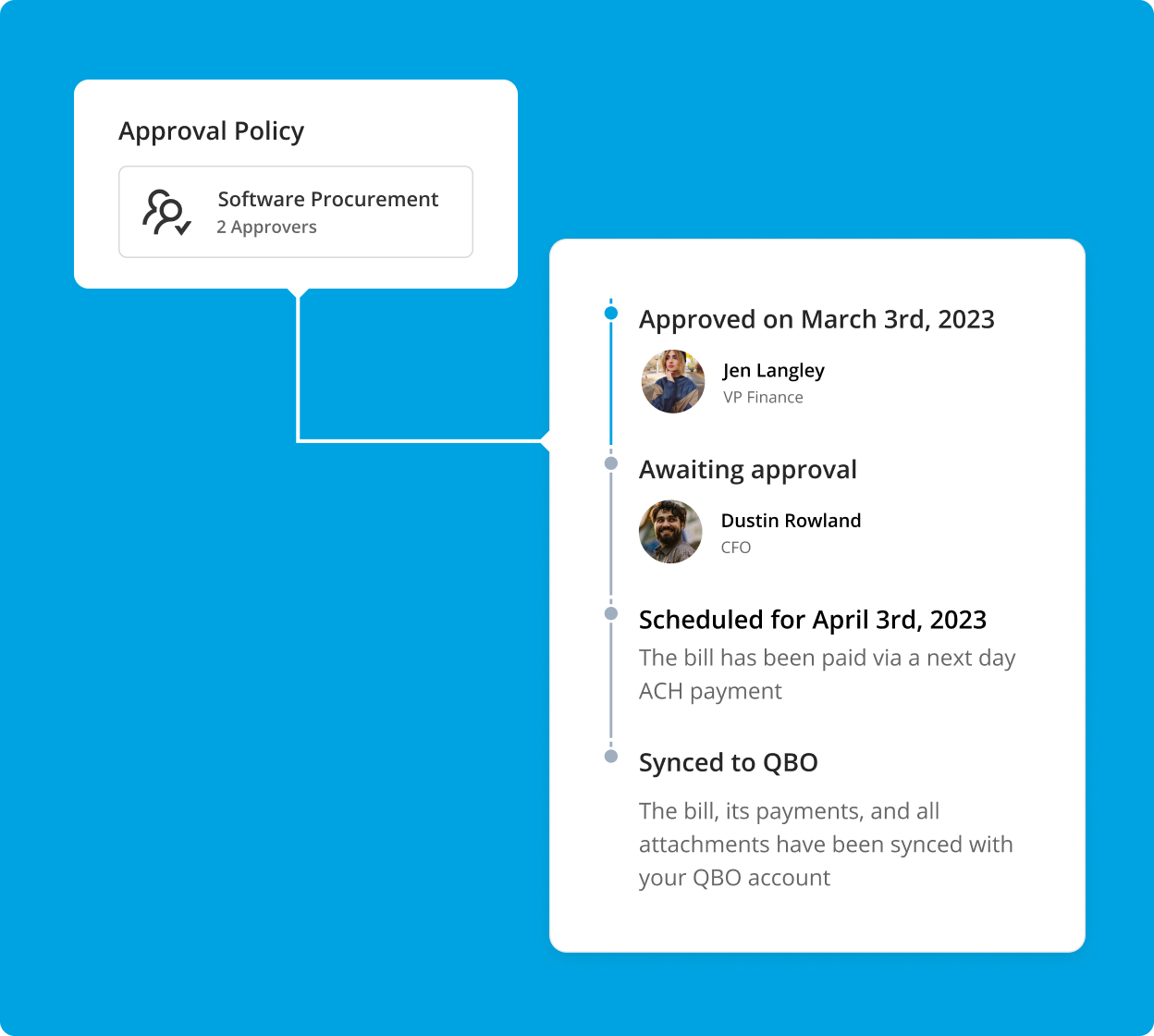

Customized Approval Workflows

Build custom approval policies to review expenses before or after they happen.

Create approval policies based on spend, department, or expense type.

Enable your team to seamlessly review spend via email or Slack.

Maintain a single audit trail of all approvals and transactions.

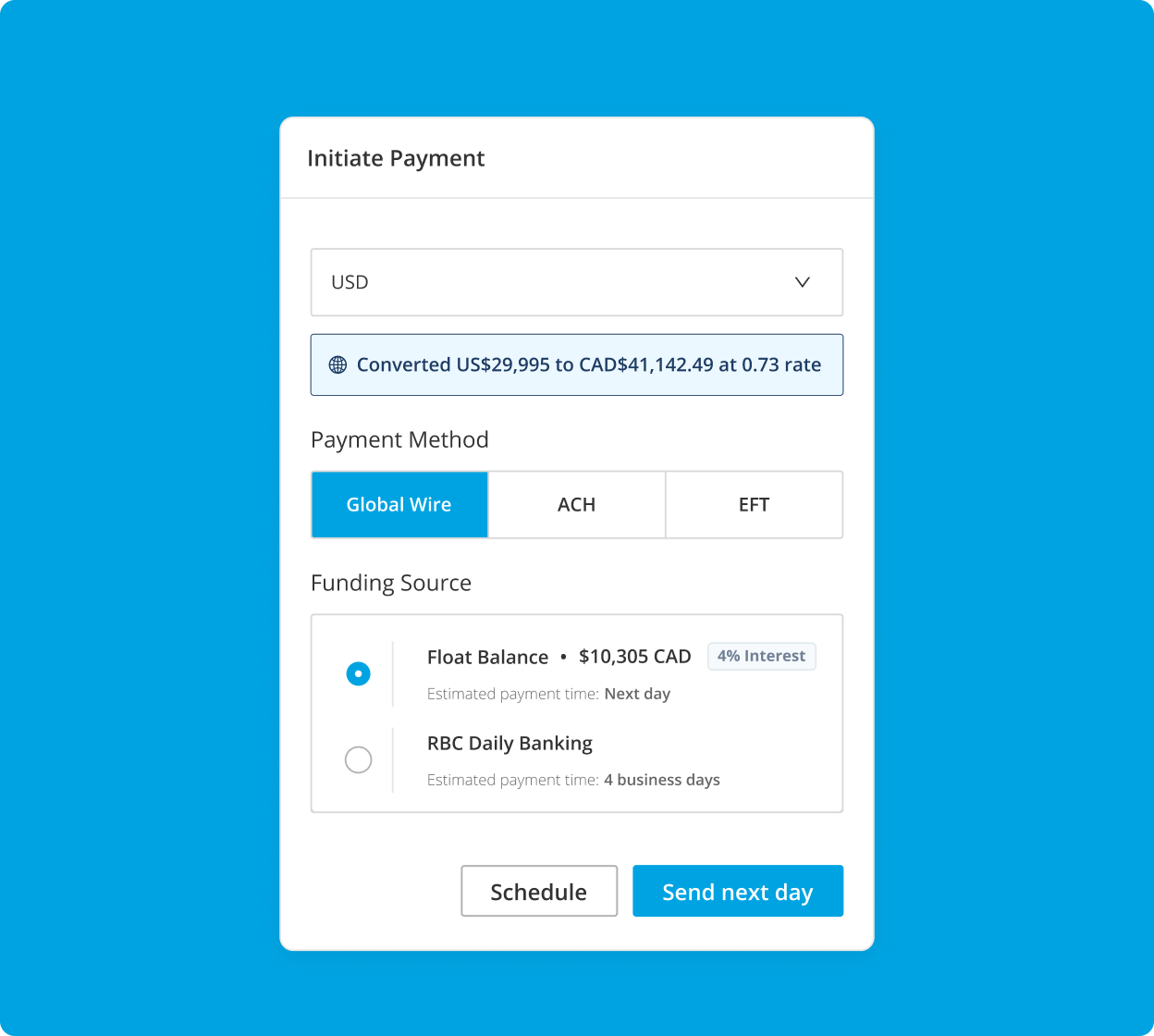

Flexible Payment Methods

Float offers multiple payment options like virtual cards, physical cards, Global Wires, ACH, or EFT.

Pay vendors that accept credit cards using Float’s USD and CAD corporate cards to maximize cashback.

Initiate Global Wires in USD or CAD to save on FX fees and pay out globally.

Leverage low-cost local rails like ACH and EFT to pay next day in Canada and the US.

Enterprise-Level Security

Float is built from the ground-up with financial control at the centre of everything we do. Read more about Float’s Security measures.

Float is PCI-DSS and SOC 2 Type 2 Certified.

Float offers advanced fraud detection and prevention protocols, 24/7 fraud monitoring, and 3D Secure.

Float keeps your accounts safe with multi-factor authentication and SAML single sign-on.

Benefits

Discover Benefits of Using Float

Learn how you can better manage vendor payments with Float’s flexible payment methods and software.

Improve Vendor Relationships

Pay vendors on time, track contracts, and streamline approvals with centralized solution for all payments.

Maximize Rewards and Save

Earn 1% cashback* and 4% interest on funds held with Float. Plus, save on FX fees when paying in US and Canada.

Save Time and Reduce Errors

Close your books 8x faster with Float’s accounting integrations and enable your team to focus on things that really matter.

*1% with over $25k in monthly spending. Charge Card has different rewards structure. Contact sales for more information.

Save 7% on your Spend with Float

With Float businesses can earn 1% cashback on card spend, up to 4% interest on funds held in Float, and close the books up to 8x faster.

Simplify the Vendor Payment Process for Your Business Today

All of your business payments in a single platform.

Automated Accounts Payable

Capture, approve and pay bills via EFT, ACH or Wire. Automatic syncs directly to your accounting software.

Virtual Cards

Create virtual cards for each vendor to avoid overcharges and prevent fraud. Earn unlimited cashback on large credit card vendor bills.

Corporate Cards

Spend, track, approve, and reconcile all your CAD and USD expenses in one simple to use platform.

Your questions,

answered

To make an ACH payment to a vendor, you’ll need their bank account and routing numbers. Enter this information into your bank’s payment system or use software like Float, which automates ACH payments. Float’s solution streamlines vendor payments, saving time and reducing manual entry errors.

When replying to vendors requesting payment, confirm the amount due, payment method, and expected payment date. With Float’s bill pay solution, you can easily track invoices, automate payments, and send updates to vendors, ensuring timely communication and reducing manual follow-ups on outstanding payments.

To set up recurring vendor payments, collect the vendor’s payment details, then schedule automatic payments through your bank or accounting software. Float’s bill pay solution simplifies this by allowing you to set up recurring payments effortlessly, ensuring timely, automated transactions without the need for constant manual input.

To automate payments to a vendor, set up recurring payment schedules through your bank or accounting software, ensuring you have the correct vendor details. With Float’s bill pay solution, you can automate the entire process—from bill intake to approval and payment—streamlining workflows and reducing manual tasks.

Yes, there are free solutions to manage vendor payments, including Float’s Essentials Plan, which is forever free to use. It offers key features such as bill intake, automated approvals, and vendor payment tracking, making it an ideal choice for businesses looking to streamline their payment process without additional costs.

*Trademark of Visa International Service Association and used under licence by Peoples Trust Company.