PERSONAL REIMBURSEMENT SOFTWARE

Reimburse your

teams with ease

Introducing a simple way to collect and pay back out-of-pocket employee expenses — the expense report your team will actually love.

Trusted by thousands of leading Canadian companies.†

Benefits

The smartest expense report ever

Say goodbye to spreadsheet tracking, email chains, and complicated software. With Float, pay back your employees the easy way.

The expense reports your team will love

Float’s simple and AI-enabled workflow eliminates the frustration of manual entry for employees to submit out-of-pocket expenses — it’s like magic!

Speed up approvals and payouts

Process multiple expenses in a single request (including mileage!) and pay back employees directly from Float in as little as one business day.

Keep all employee spending in one platform

With Float Cards and Reimbursements, finance teams get full visibility into employee spending in one place.

How it Works

With a click of a button, you can start collecting your team’s out-of-pocket expenses the easy way. Use Float’s HRIS integration to start adding employees and manage all your team spend in one platform.

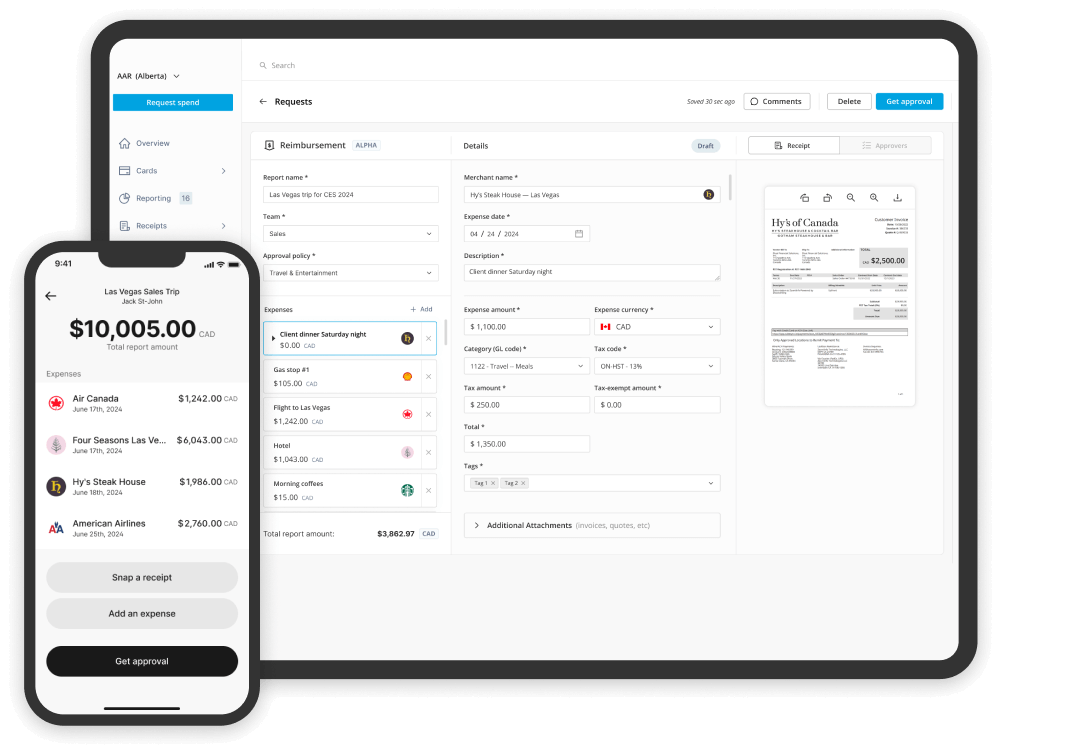

Seamless Requests

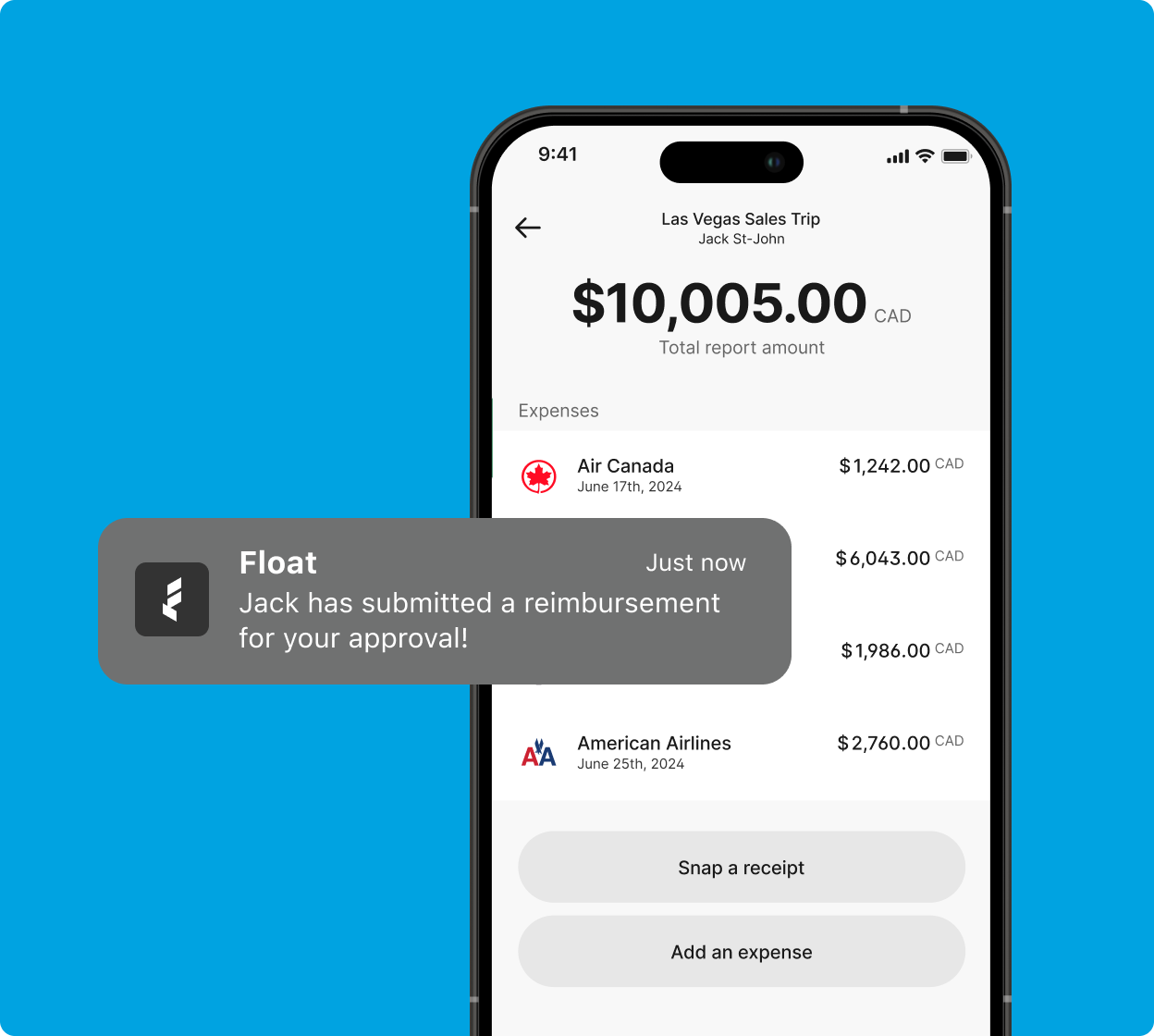

Employees request a reimbursement with the click of a button. Float’s AI-powered OCR automatically captures receipt details – no data entry required.

Make submission a breeze with AI-powered OCR that extracts all receipt information including currencies, line items and taxes

Capture receipts on the go with Float’s iOS and Android Mobile App

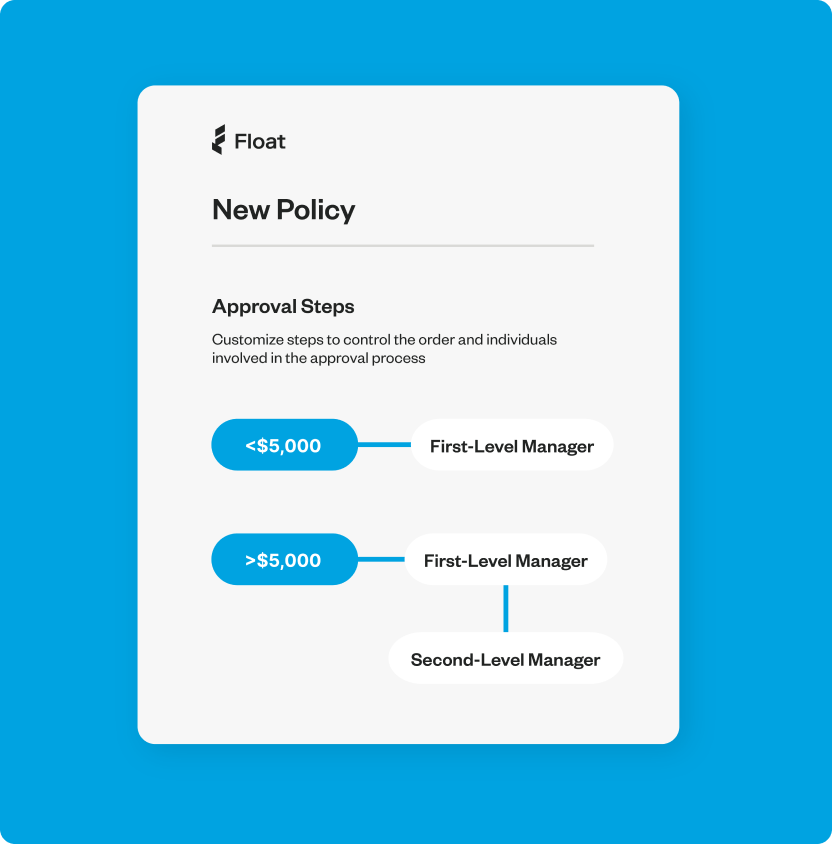

Flexible Approvals

Float directs requests to the right reviewer based on your company’s custom approval policies via mobile, email or Slack.

Create customizable multi-level approval workflows to always have the right sign-off before your team is paid back

Keep all your approval sequences up to date with 100+ HRIS integrations

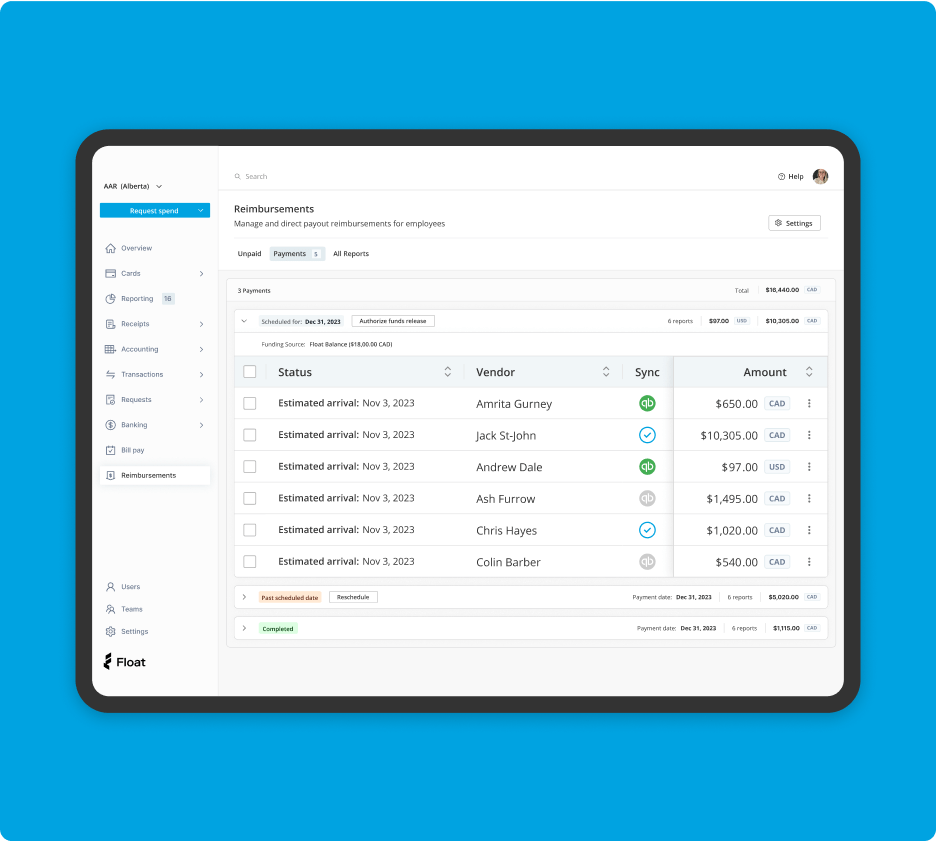

Direct Payouts

Once expenses are approved, your finance team can easily review who needs to be reimbursed and pay out directly via EFT.

Auto-batches payments for multiple reimbursements

Deliver seamless employee payouts via EFT

Pay from your Float balance, and earn industry-leading interest rates of up to 4% on your funds held in Float

Automated Month-end

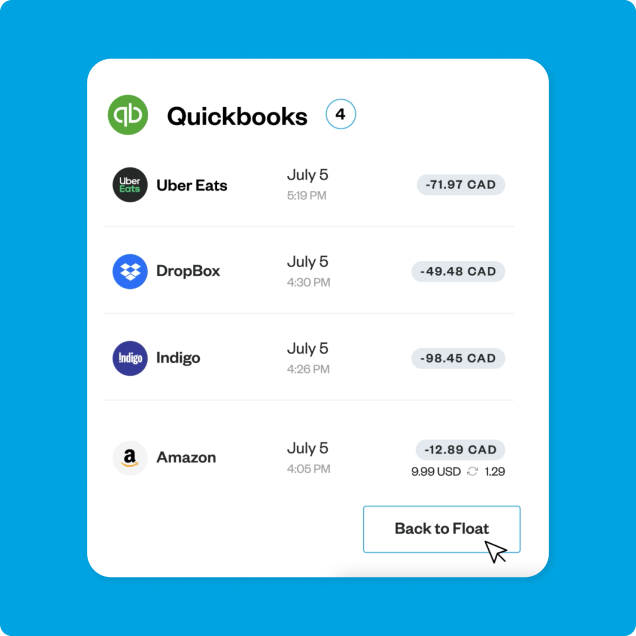

Reimbursements are exported directly to your accounting software with GL codes, tax codes and embedded receipts.

Automatically sync all bills, payments, and attached files in real-time to your connected accounting system

Get real-time visibility into payment status to close the month with confidence

Collect and pay back employee expenses without all the hassle

Why Canadian Teams Love Float

No waiting

to get repaid

No risk

of personal card use

No time wasted

compiling expense reports

Before, we would be reviewing expense reports that were a month old. But with Float, we can see our expenses almost on a real-time basis.

Jane Jon

CFO

Previously at Ledn

Your questions,

answered

Float Reimbursements is the simplest way to collect and pay back employee out-of-pocket expenses. Reimbursements is part of Float’s business finance platform, a central place for you to earn rewards for your business while saving time automating and managing your company’s spending.

Float is definitely not a bank – we’re a FINTRAC-registered Canadian Money Services Business built to simplify spending for Canadian companies and teams.

When you sign up for Float, you’ll be able to access our core Cards, Reimbursements, and Bill Pay products for your company. Float offers plans ranging from Free to Custom, built to scale with your company’s spend management needs (check out our Pricing here).

Whichever plan you choose, you can eliminate tedious expense reporting (or expensive software) and save up to 7% on your total spend with Float’s smart approval workflows, real-time reporting, and accounting automations.

With Float’s Reimbursements you can schedule and send CAD payments via EFT directly to your employee’s bank accounts via your Float Balance. Even better? Float offers leading per-transaction rates for payments.

Float makes it easy for employees to submit and managers to approve requests directly from our web or mobile apps. Paired with Float’s intelligent approval workflows, OCR capabilities, and accounting automations, it cuts significant administrative time so your teams can focus on what matters.

For an even faster solution, Float’s all-in-one software also includes zero-balance Float Cards so you can see all your team spending in real-time (and one-platform). Plus you’ll receive cashback and interest on your CAD and USD card spend and cash balances.

Yes! With Float’s Reimbursements employees can submit multiple line item expenses in one report for easy submission and approval.

Currently Reimbursements supports one-way accounting sync of bills and payments with QBO, and also offers CSV exports for you to upload to your accounting system.

Unlike traditional cards that get you to spend more, Float is the only corporate card in the world that helps businesses spend less. Through a combination of financial rewards like our 1% cashback, up to 4% interest on deposits, no FX fees with our USD cards and time savings of at least 8 hours per employee Float’s customers on average save 7% on their spend.

Reimbursements includes the ability to set a mileage rate for both US and CAD and auto-calculates the amount owed based on the starting point and destination provided.

Come for the card,

stay for the software

Corporate Cards

Use smart corporate cards that can save your business up to 7% on business spend

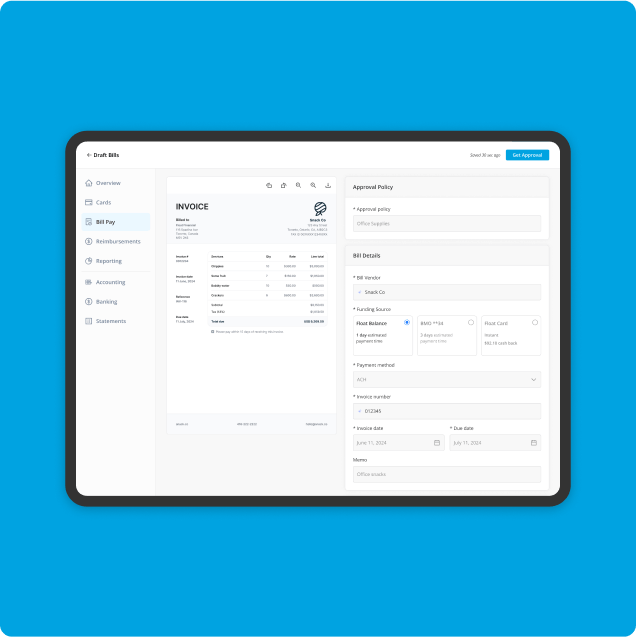

Bill Pay

Save time on invoice collection, payment and reconciliation

Accounting Automations

Automate accounting tasks and close books faster, without all the manual effort