MONEY MOVEMENT

Fund your expenses at the speed of Float

Stop depending on banks to keep your money moving. Transfer cash to Float instantly and make payments up to 3x faster.

Trusted by thousands of leading Canadian companies.†

Finance without the frustration

Our approach helps you avoid lengthy bank delays so you can

pay quicker and sleep better

Instantly*

Fund your Float balance

3x

Faster to settle invoices

Zero

Worries about transfer times

*Funds will appear in your Float balance as soon as they’re received—usually almost instantly. Banks sometimes take up to an hour to release transfers.

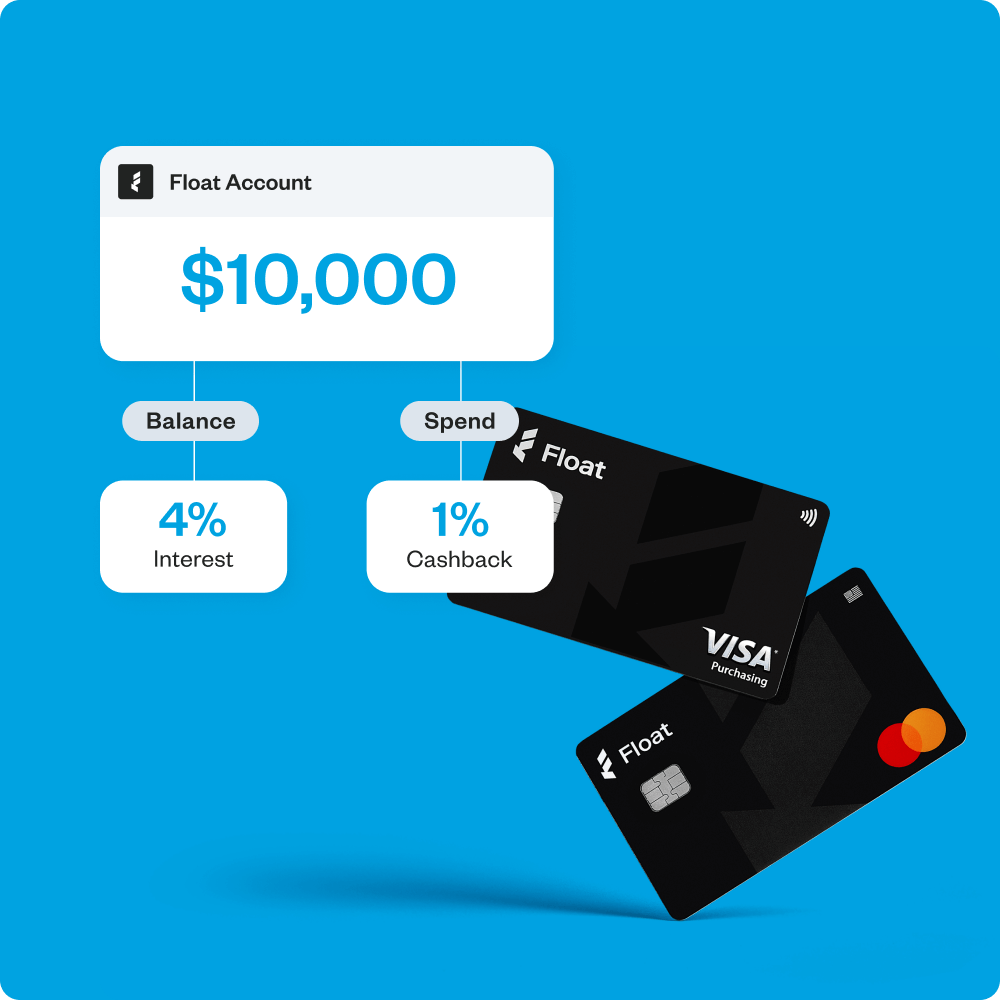

Speed up your cash flow and earn more, faster

Easily create pre-funded virtual cards that allow you to spend smarter and maximize liquidity, with limits as big as your bank balance

Give your cards more spending power faster with Interac e-Transfer® & Float’s Fast Funding

Stop worrying about low credit limits

Start earning faster —get up to 4% interest on the idle balance you keep in Float

Top-up instantly, anytime

Use Interac e-Transfer® to add up to $25,000 to your account with the click of a button

Fund your balance anytime, even on weekends and holidays

Be prepared to act on large, one-off expenses as they come up

Apply for Fast Funding for 1-day turnaround on transfers above $25K

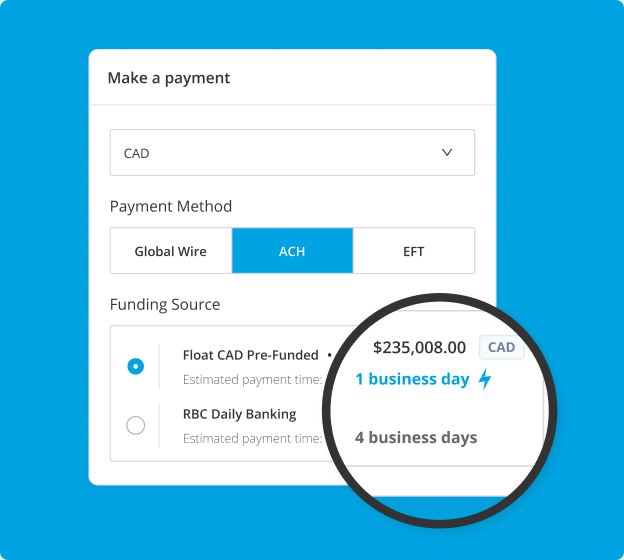

Settle up just as quickly

Cover recurring expenses with Float’s smart cards, or take advantage of other ways to pay — with none of the expected delays

Use your pre-funded balance to manage accounts payable and reimbursements

Settle invoices up 3x faster than traditional banking methods

Reimburse employees’ CAD bank accounts as quick as the next day

*Conditions apply. Book a demo to learn more.

“Float’s virtual cards continue to give our team the flexibility and autonomy they need and deserve.”

Andy O’Reilly

Senior Manager of Finance & Technology

Come for the speed,

stay for the software

Close Books up to 8x Faster

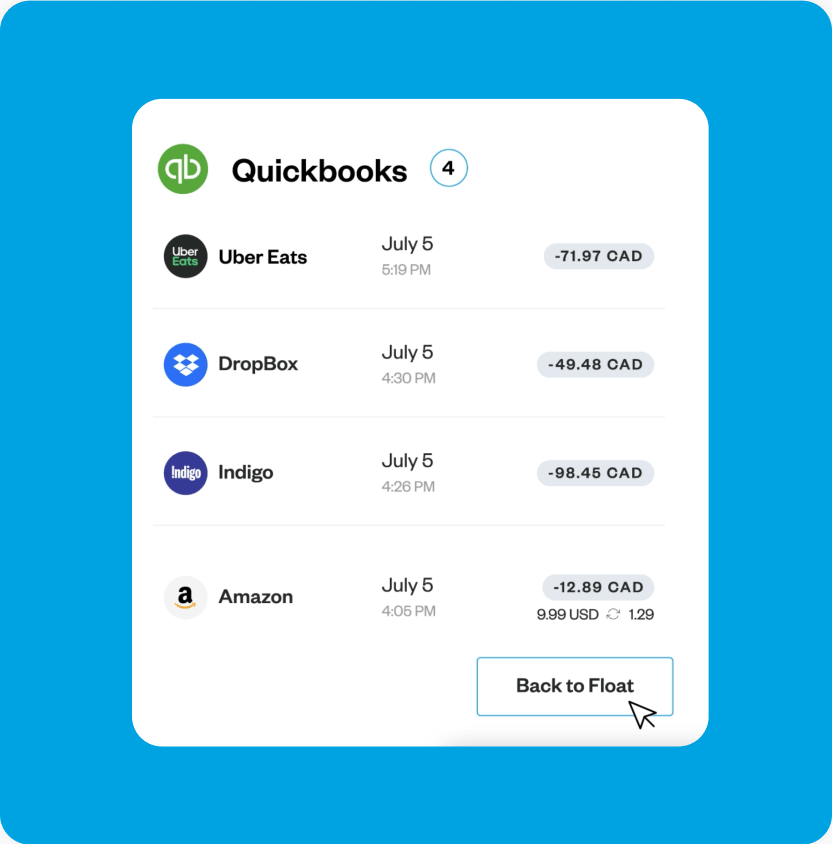

Direct integrations with QuickBooks, Xero, and NetSuite make month-end a breeze.

Pay your Bills

Capture, approve and pay bills via EFT, ACH or Wire. Automatic syncs directly to your accounting software.

Swipe and Forget

Upload receipts and track expenses on the go via text or the mobile app. Eliminate the need for expense reports.

Frequently Asked Questions

Customers can register their email address on the Float’s funding page to initiate Interac e-Transfers from their banking portal. Funds become visible and available instantly*.

Interac e-Transfer allows customers to transfer up to CAD 25,000 per transfer to your business’ Float balance. The customer’s bank may enforce other per-transfer, daily, weekly and/or monthly limits, which might be lower. Banks may choose to adjust this limit at their discretion. For transfers exceeding CAD 25,000 or for USD transfers, Float also offers Fast Funding for eligible customers.

With Interac e-Transfer for Float, funds will appear in your Float balance as soon as they’re received—usually almost instantly. Banks sometimes delay the first large transfer to a new email for approval, which can take up to an hour.

With Fast Funding, eligible Professional Plan customers can transfer money with a quick one-day turnaround.

This depends on the customer’s bank Interac e-Transfers fees. Float doesn’t charge any fee.

Fast Funding provides eligible customers quick one-day turnarounds when moving money to Float.

Float’s corporate cards are issued by Visa for CAD cards and Mastercard for USD spending. They offer direct 1% cashback on all categories after the first 25K of monthly spend. Float operates on a Charge Card or Prepaid funding model. Charge Card is different from Credit Card, as the balance has to be repaid fully at the end of the month, whereas a credit card charges an interest rate and allows you to carry over the balance into a future month. You can apply (*Conditions apply. Book a demo to learn more) for unsecured, 30-day credit terms with high limits up to $1M, no credit checks and personal guarantees. Prepaid model offers 4% interest on all deposits with no cash lockups with account opening in < 24 hours.

Float’s 4% interest is an annualized rate, calculated daily, and paid monthly on Float balances. Any balance in Float will start earning interest from the first dollar. Interest payments occur on the first day of every month, based on the preceding month’s average daily closing balances.

Float is Free to use on our Essentials plan, where you will be able to issue unlimited virtual CAD/USD cards, earn 4% interest on deposits, reimburse employees and pay vendor bills. If you need more sophisticated functionality, like over 20 physical cards, Netsuite integration, or an API solution, you will have to consider our paid Professional and Enterprise plans.

Float is based in Toronto, Canada and built for Canadian businesses, expertly handling complex provincial and territorial tax and accounting nuances.

*Trademark of Visa International Service Association and used under licence by Peoples Trust Company.