Spend management for Canadian restaurants and hospitality

Keep service flowing and margins strong with a corporate card solution that gives you full visibility and control.

Trusted by thousands of leading Canadian companies.†

“No matter how large we scale, Float will remain an evergreen solution for us.”

Katherine Lei, Director of Finance

See how leading restaurants like Impact Kitchen use Float to save 100+ hours per year on reconciliation and admin.

Keep operations smooth and margins healthy

Get real-time visibility, automated controls and stress-free expense management. The result? Accurate books, empowered staff and stronger margins.

Maintain liquidity through every season

From holiday rushes to slower months, cash flow in hospitality is constantly shifting.

Float helps you stay ready with Business Accounts that earn up to 4% interest and Float Charge for quick access to credit during peak demand.

Same day and next-day transfers keep cash within easy reach.

Close the books in days, not weeks

Month-end doesn’t need to drag on.

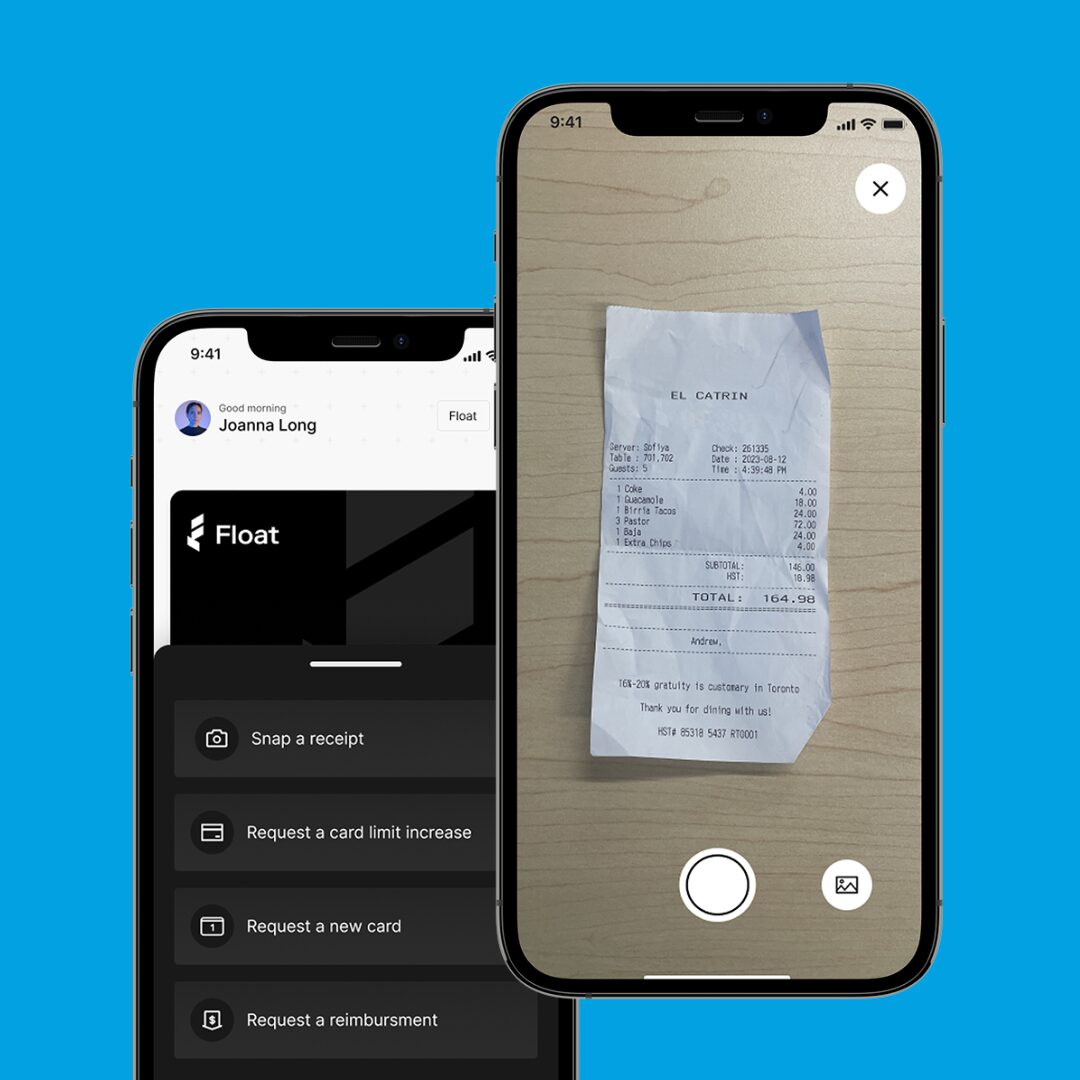

Float captures every purchase instantly with mobile receipt upload and automated coding.

Direct integrations with QuickBooks, Xero and NetSuite, as well as a custom API, help finance teams close the books in days, saving more than 100 hours a year.

Smarter spend for every team

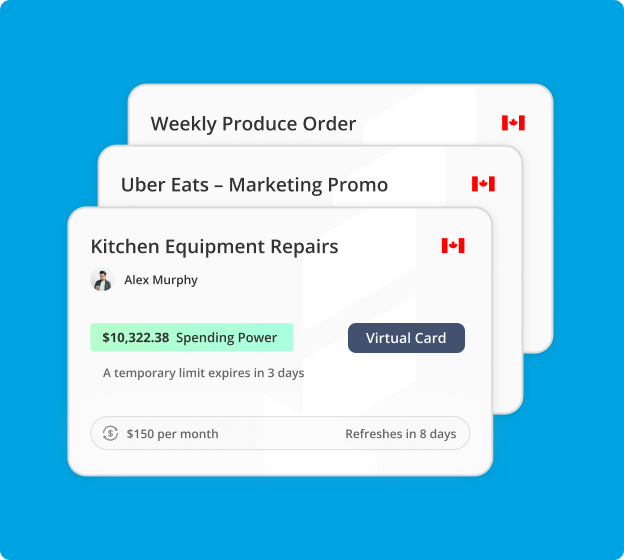

Dispersed teams and shared cards make it hard to track expenses.

With Float, every manager, location or vendor gets their own card with built-in controls.

Spend limits, merchant locks and approval policies keep teams on budget without slowing down service.

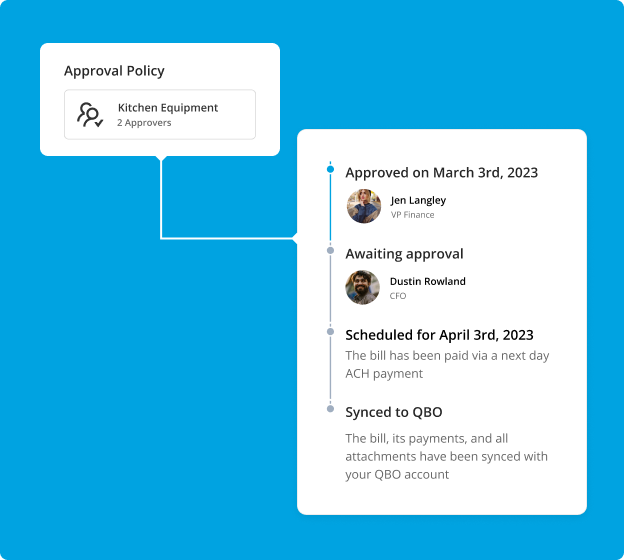

Keep vendors happy and supplies moving

Payment delays slow down operations and strain supplier relationships.

Float makes it easy with instant card issuance, real-time approvals and fast bill pay so vendors are paid on time and supplies keep flowing.

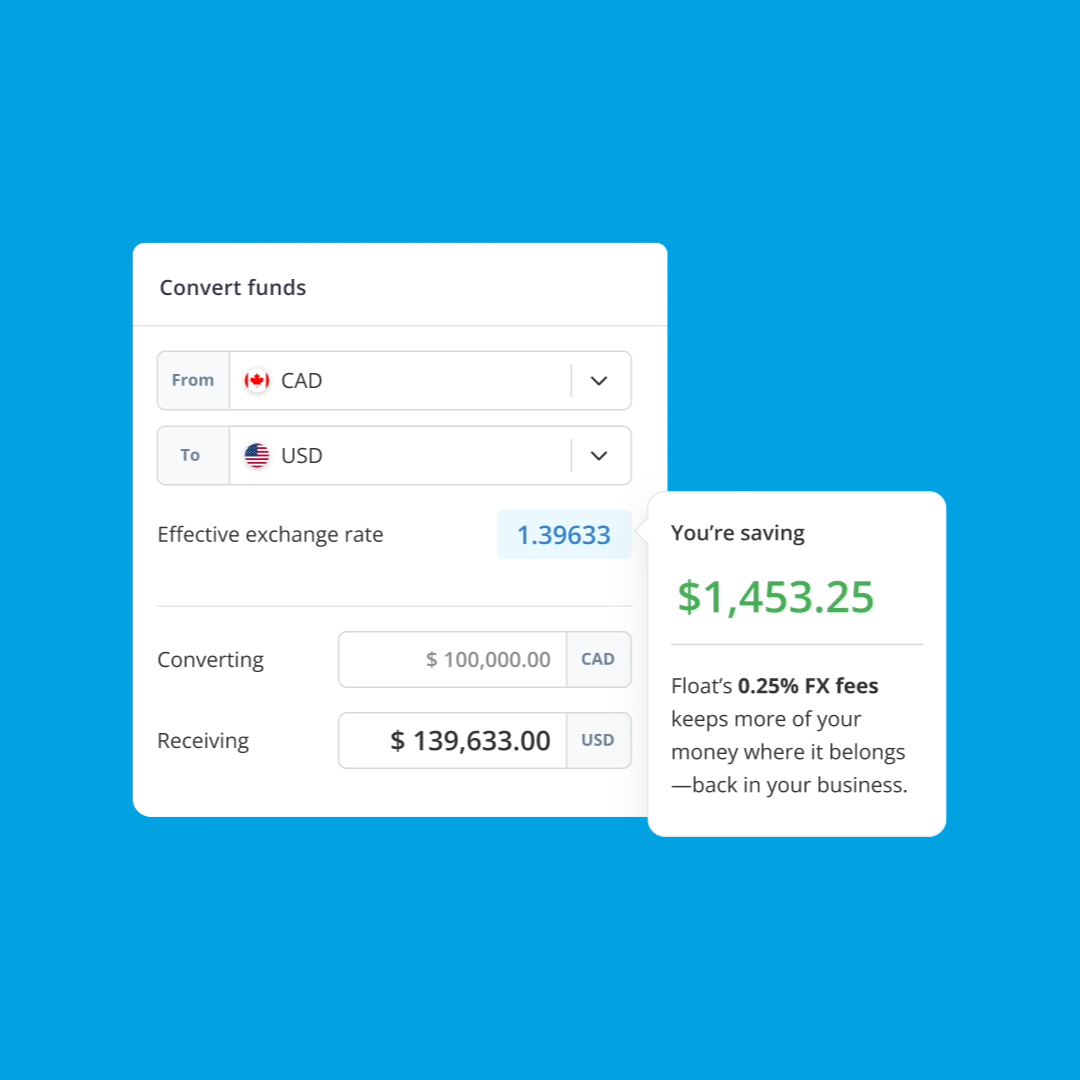

Save more on cross-border transactions

Foreign exchange markups eat into already thin margins.

With Float’s CAD and USD cards, market-leading FX rates and low-fee cross-border payments, you can simplify vendor payments and save up to 90% on FX fees compared to traditional banks.

Pricing for hospitality businesses

Choose between our Essential, Professional and Enterprise plans. Contact our support team to explore the best option for your team.

Essential

$0CADuser/mo1

The free solution for spend control & payments.

Free access to:

-

Up to 20 physical & unlimited virtual cards with custom limits and controls 3

-

Credit limits up to $3M

-

1% cashback on spend

-

Up to 4% interest on CAD and USD funds

-

0.25% FX Rates

-

Mobile app, automated receipt collection, and matching

-

Canadian tax tracking

-

Employee reimbursements with mileage and CAD direct payouts

-

Bill payments via Wire, and no-fee EFT & ACH

-

Interac e-Transfer and 1-business-day funding

-

Accounting sync with QBO, Xero or custom exports

-

Customer support in English and French

Professional

$10CADuser/mo2

Advanced controls & workflows for growing teams.

Everything in Essential, plus:

-

Unlimited physical and virtual cards with advanced controls

-

Team management with multi-level requests and approvals

-

Customizable submission and approval policies

-

International reports and USD direct payouts for employee reimbursements

-

Post-sale manager transaction reviews

-

Delegate access

-

Advanced accounting integration with NetSuite

Enterprise

Contact Us

Dedicated support and custom solutions at scale.

Everything in Professional, plus:

-

Custom implementation and data migration

-

Team training and advanced workshops

-

Premium support and access to new features

-

Dedicated Customer Success Manager

-

Custom Charge Credit terms with dedicated underwriting team

-

Custom pricing and rewards

Essential

Professional

Enterprise

Accounting integrations that keep you out of the weeds

Skip the month-end chaos and manual work. Connect Float to QuickBooks, Xero, NetSuite, or use custom exports tailored to restaurant and hospitality workflows.

“Float Business Accounts combine the best features of a fintech bank, expense management platform and treasury account while giving us up to 4% yield and free EFT/ACH transfers. This is what modern banking should look like.”

Gregory Kalinin

Co-Founder, Holistic Roasters Inc.

Restaurant & hospitality FAQs

Float is a business finance platform here to help save your company time and money. Float is not a bank—we’re a FINTRAC-registered Canadian Money Services Business that counts 6,000+ Canadian companies as loyal customers. Funds are CDIC insured up to $100,000 and held in trust.

Float’s Business Accounts let you earn up to 4% interest on reserves until you need them, while Float Charge gives you fast access to credit for peak seasons.

Yes. Float syncs with QuickBooks, Xero and NetSuite, and also offers custom exports for restaurant specific systems.

With Float’s mobile app, employees snap a photo at purchase. The receipt is auto matched to the transaction, keeping finance teams audit ready.

Yes. You can create unlimited virtual or physical cards with custom limits and merchant locks for each location, vendor or staff member.

Absolutely. Float cards can be used for everyday in-person transactions like food orders, supplies and deliveries, as well as online expenses such as software, marketing and reservations.