Introducing

Float Business Accounts

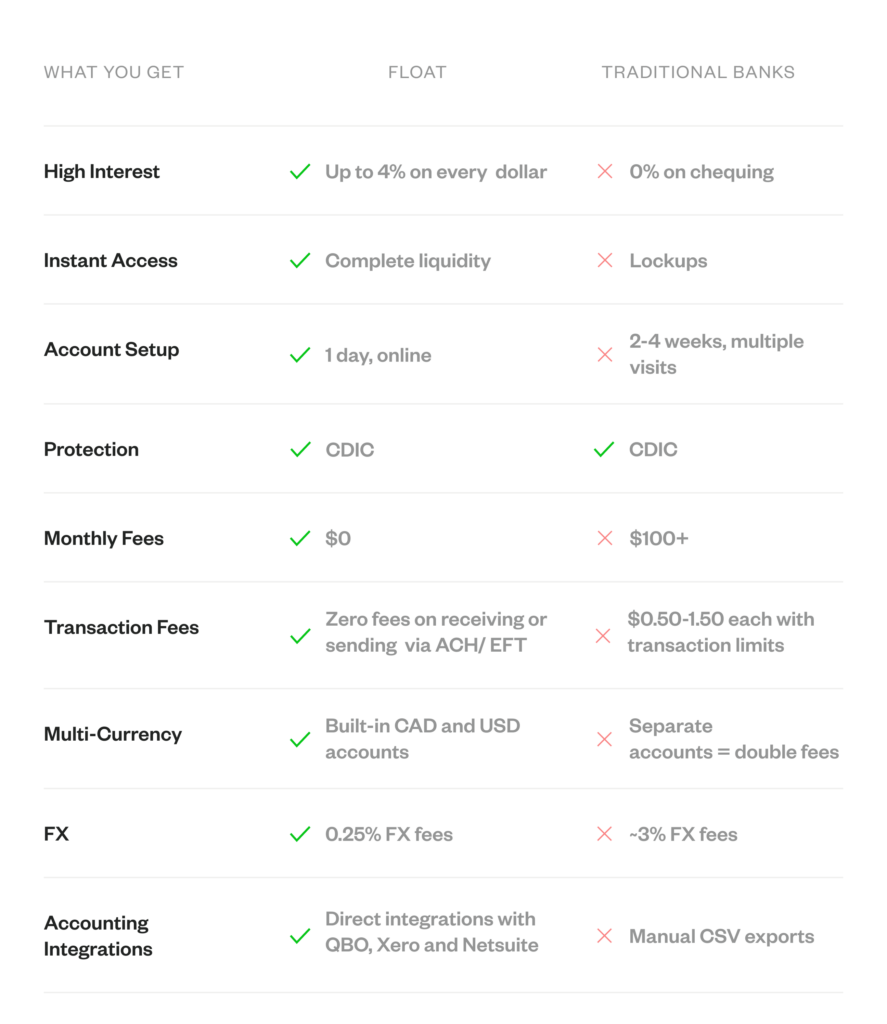

Zero fees, up to 4% interest and CDIC insured. The high-yield business account built for Canadian companies.

Interest is earned on cash balances. Balances with <$50K earn 2% interest, Balances ≥ $50K earn 4%. Float is definitely not a bank. Learn more.

Trusted by thousands of leading Canadian companies.†

Features

Finally, a business account

that works as hard as you do.

Banks say choose. We say no compromise.

Zero wait, zero fees

Open your account in minutes, not weeks. Move money instantly via ACH/ EFT or wires, with zero transaction fees on sending or receiving funds via ACH/ EFT.

The best interest rate in Canadian business finance

Every dollar in your Float balance earns up to 4% interest with rates up to 2.8X the Canadian banks. No minimums. No lockups and 100% liquidity.

CDIC insured

Operate your business with confidence, knowing your funds are CDIC-insured AND held in trust.

Borderless banking

Receive USD payments, hold USD funds and convert USD↔CAD at market-leading rates and manage both balances with ease from a single platform.

Interest is earned on cash balances. Balances with <$50K earn 2% interest, Balances ≥ $50K earn 4%. Float is definitely not a bank. Learn more.

The problem

Business banking in Canada

doesn’t make sense

Four questions you can finally stop asking.

From WTF? with traditional banking to Why There’s Float!

Traditional banks slow you down. Float moves you forward.

Float Earnings Calculator

Plug in your details to discover how much more you could earn and save by switching to Float.

2.25% under 50K, 4% above 50K

2% Cashback (min $25k/mo)

2.25% under 50K, 4% above 50K

2% Cashback (min $25k/mo)

FloatFX at 0.25% vs 3% at banks

Annual Savings and Earnings

That’s

$17,540

you’d save and earn by switching to Float from a bank.

“Float Business Accounts combine the best features of a fintech bank, expense management platform and treasury account while giving us up to 4% yield and free EFT/ACH transfers. This is what modern banking should look like.”

Gregory Kalinin

Co-Founder, Holistic Roasters Inc.

Your questions,

answered

Float is a business finance platform here to help save your company time and money. Float is not a bank—we’re a FINTRAC-registered Canadian Money Services Business that counts 5000+ Canadian companies as loyal customers.

Opening an account takes about 15 minutes online. No branch visits, minimal paperwork and you can start earning interest as soon as your account is approved and funded.

Float Business Accounts let you receive and store business funds with account routing details for EFT, ACH and wire transfers. Your accounts earn up to 4% interest with no minimum balance requirements or lockups. Funds are CDIC insured up to $100,000 and held in trust.

You can hold both CAD and USD, with no transaction fees on incoming payments. Business Accounts work alongside your Float Cards and spend management features in a single platform.

Float’s interest is an annualized rate, calculated daily based on your Float balance (in both CAD or USD) and paid monthly. Any balance in Float will start earning interest from the first dollar.

When your balance is equal to or exceeds $50,000 (in CAD or USD), you’ll earn 4% annualized interest on your entire balance up to $1M.

When your balance is under $50,000 (CAD or USD), you’ll earn interest at an annualized rate of 2% on every dollar, adjusting in tandem with the Bank of Canada’s overnight interest rate.

For example: if your balance in CAD is $60,000 and your USD balance is $5,000 on a given day, you’d earn 4% on your CAD balance and 2% on USD on that day.

Interest payments occur on the first day of every month.

Both CAD and USD funds are held in trust under your business’s name within dedicated trust accounts at Scotiabank.

This means that funds are legally separated from Float’s own assets, and in the extremely unlikely event that Float Financial were to go out of business, your funds would remain safe.

In addition, we’ve partnered with Scotiabank to offer our customers CDIC insurance of up to $100,000 CAD (combined across both CAD and USD cash accounts).

Please note: Float is not a bank or CDIC member institution. Float is a registered MSB (Money Services Business) in Canada. We are also SOC2, Type 2-certified, ensuring adherence to robust security protocols as verified by independent audits.

No lockups, and this isn’t a GIC. Customers can easily withdraw funds by contacting our Support team, which is available 7 days per week.

Yes, really. We believe in transparent, simple pricing that helps your business grow. That means no monthly account fees, no transaction fees on receiving funds via ACH/EFT or wires, and no fees on sending funds via ACH or EFT.

Float and our partner bank do not charge any fees for receiving funds through SWIFT. However, SWIFT transfers may pass through intermediary banks that can deduct fees before the funds reach your account. The amount you receive can depend on how the sender’s bank instructed the payment (e.g., SHA vs. OUR) and which intermediaries processed the transfer. These fees are outside of Float’s control.

You can receive funds in Float via bank transfer, EFT (CAD), ACH (USD) or wire transfer. Simply share your Float account details with payees or transfer from your existing accounts.

You can then use your Float balance to issue physical and virtual corporate cards in both CAD and USD, or use our bill pay and reimbursement features to transfer money.

You can easily withdraw funds by contacting our support team, which is available 7 days per week. Funds will take 2-5 business days to arrive back in your connected bank account.

To qualify for the $500 Account Opening Bonus, you must be a new Float customer and sign up between September 9 and September 30, 2025 using the referral code BUSINESSACCOUNTS. You’ll need to load and maintain a $10,000 CAD balance in your Float account and complete at least one transaction before October 31, 2025. The offer is limited to the first 150 eligible customers.

Your savings and earnings are calculated as follows:

– Interest: When your balance is equal to or exceeds $50,000 (in CAD or USD), you’ll earn 4% annualized interest on your entire balance up to $1M.

When your balance is under $50,000 (CAD or USD), you’ll earn interest at an annualized rate of 2% on every dollar, adjusting in tandem with the Bank of Canada’s overnight interest rate.

– Cashback: 1% on every dollar over $25k in monthly spending

– FX savings: We compare Float’s FX fee (0.25%) vs the average FX fee charged by traditional banks (3%)

– Savings from bank fees: We took the monthly fees of commonly available unlimited business banking products from each of the 5 big banks on September 5, 2025 and averaged them.

Float is not a bank or CDIC member institution. Float is a registered MSB (Money Services Business) in Canada. However, we’ve partnered with Scotiabank to offer our customers CDIC insurance of up to $100,000 CAD (combined across both CAD and USD cash accounts).

Come for the card,

stay for the software

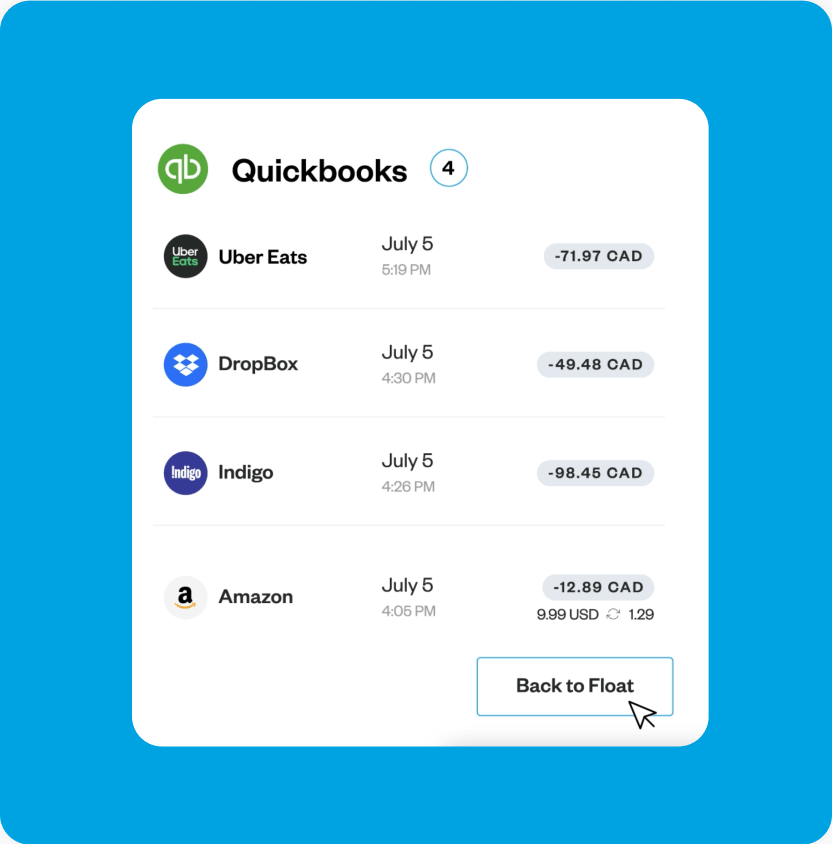

Close books up to 8x Faster

Direct integrations with QuickBooks, Xero, and NetSuite make month-end a breeze.

Pay your bills

Capture, approve and pay bills via EFT, ACH or Wire. Automatic syncs directly to your accounting software.

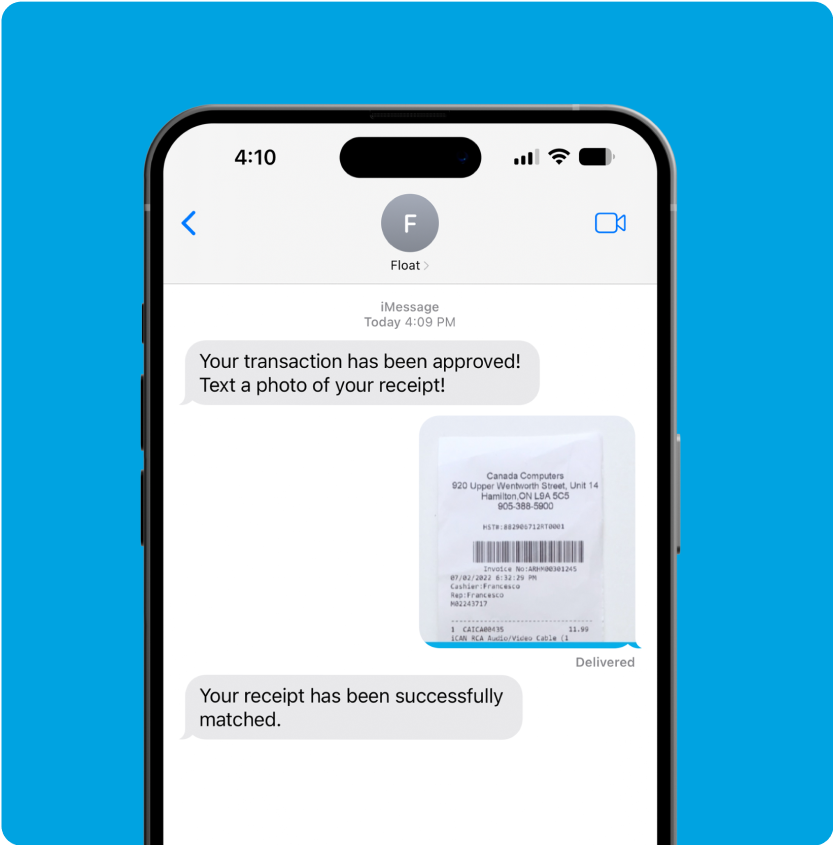

Swipe and forget

Upload receipts and track expenses on the go via text or the mobile app. Eliminate the need for expense reports.

*Trademark of Visa International Service Association and used under licence by Peoples Trust Company.