Expense management for Canadian e-comm and retail

Tight margins need tighter controls. Float gives you real-time visibility and automated expense management so you can scale without the financial chaos.

Trusted by thousands of leading Canadian companies.†

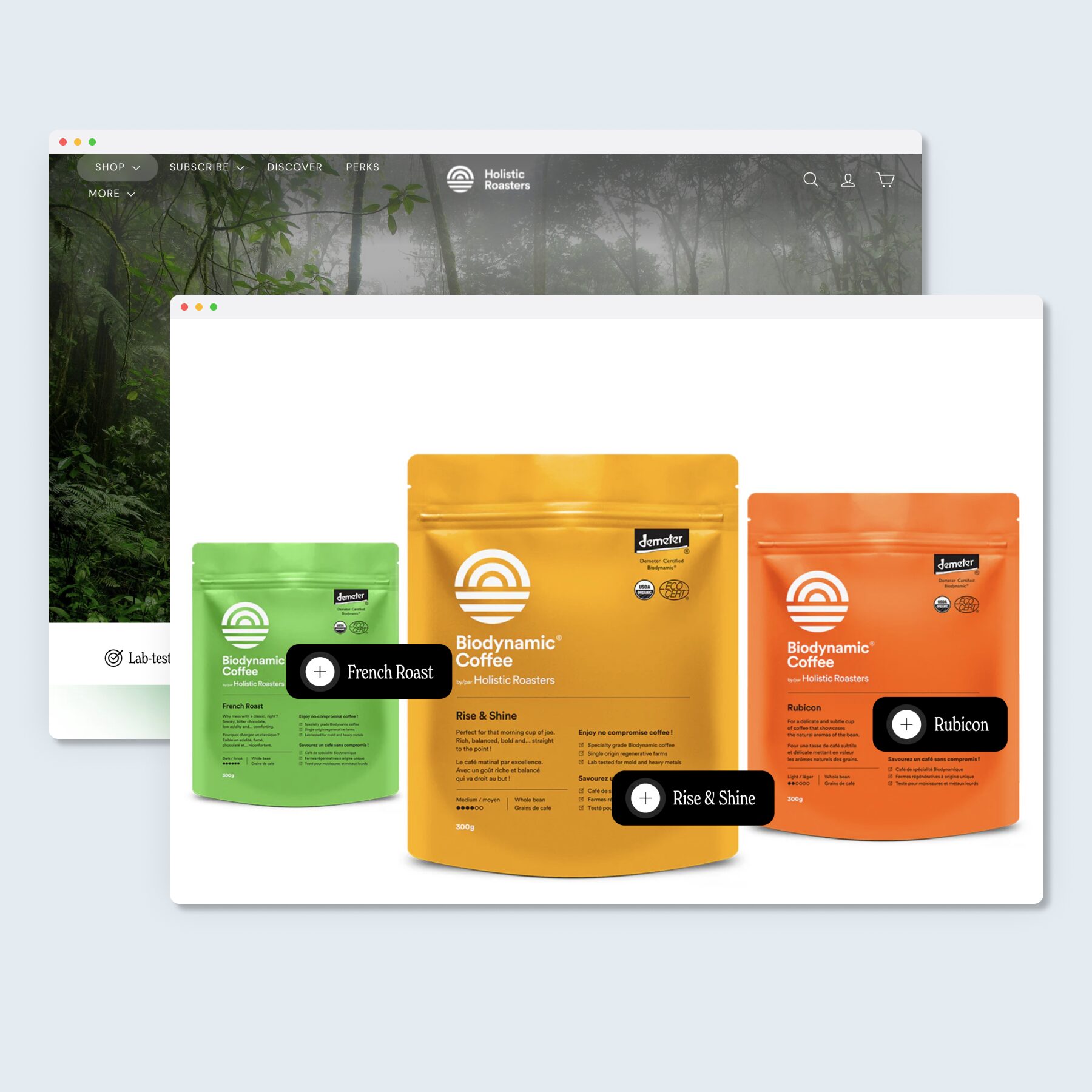

“From a fintech perspective, Float is nailing it. I’m so happy they’re doing this because banks are kind of a pain to work with, and Float is just the opposite.”

Greg Kalinin, Co-Founder of Holistic Roasters

See how this coffee roasting e-comm business streamlined expense tracking by replacing fragmented systems and personal card use with Float.

Automate your expense management

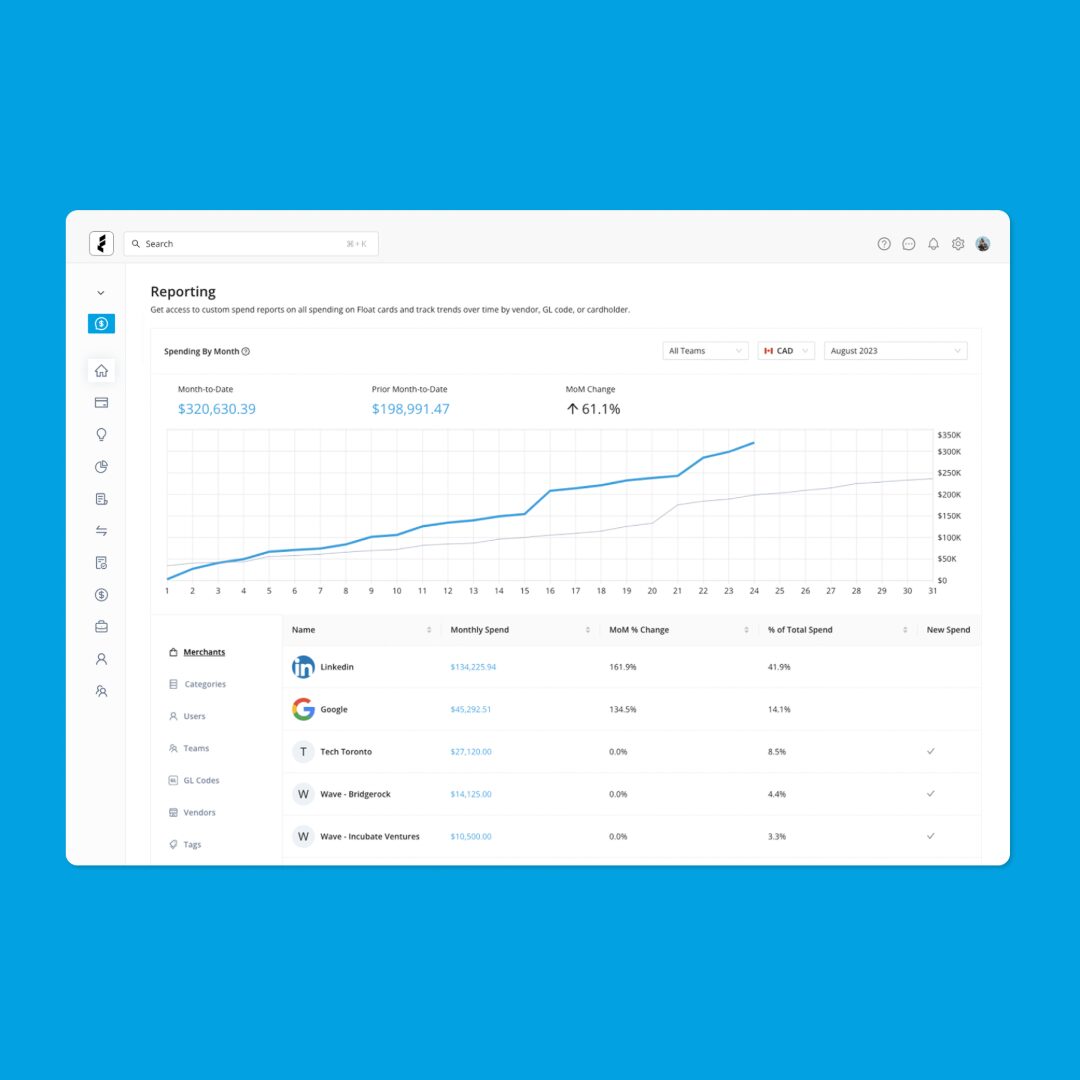

Track expenses, manage vendor spend and close books 8x faster with Float’s e-commerce corporate cards and real-time dashboards.

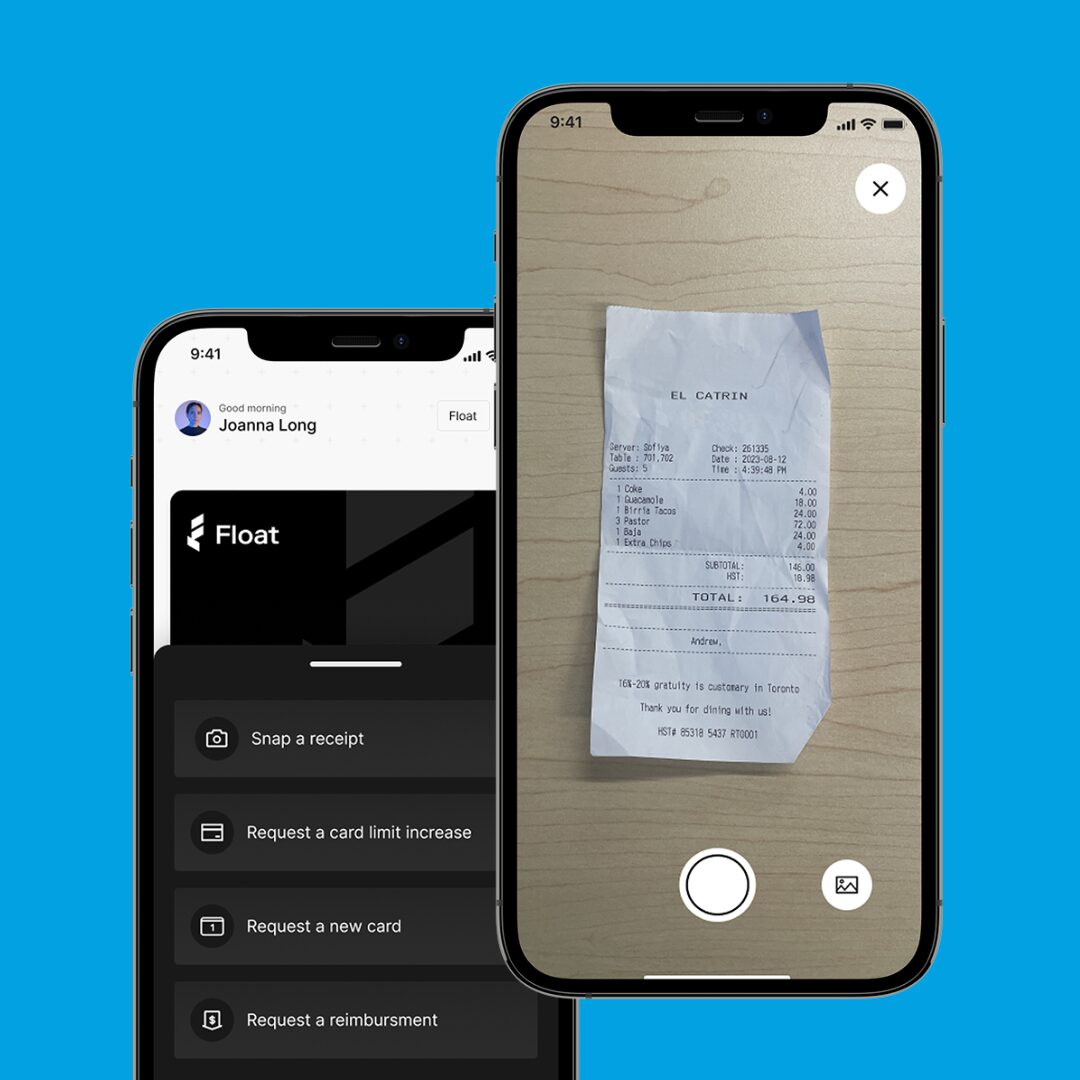

Reclaim 8+ hours per month on reconciliation

Ditch manual reconciliation and month-end chaos. Instead, automate receipt capture, GL coding and expense categorization, while integrating directly with your accounting software.

Cover seasonal spikes without draining reserves

Inventory and marketing spend surges during peak seasons. When revenue lags, get unsecured credit with interest-free, customizable payment terms designed to suit your business.

Maximize return on ad spend and ensure paid campaigns run without interruption

Delayed or declined payments on ad platforms can halt campaigns mid-flight. Instantly issue virtual cards for campaigns, merchants and vendors, simplifying reconciliation along the way.

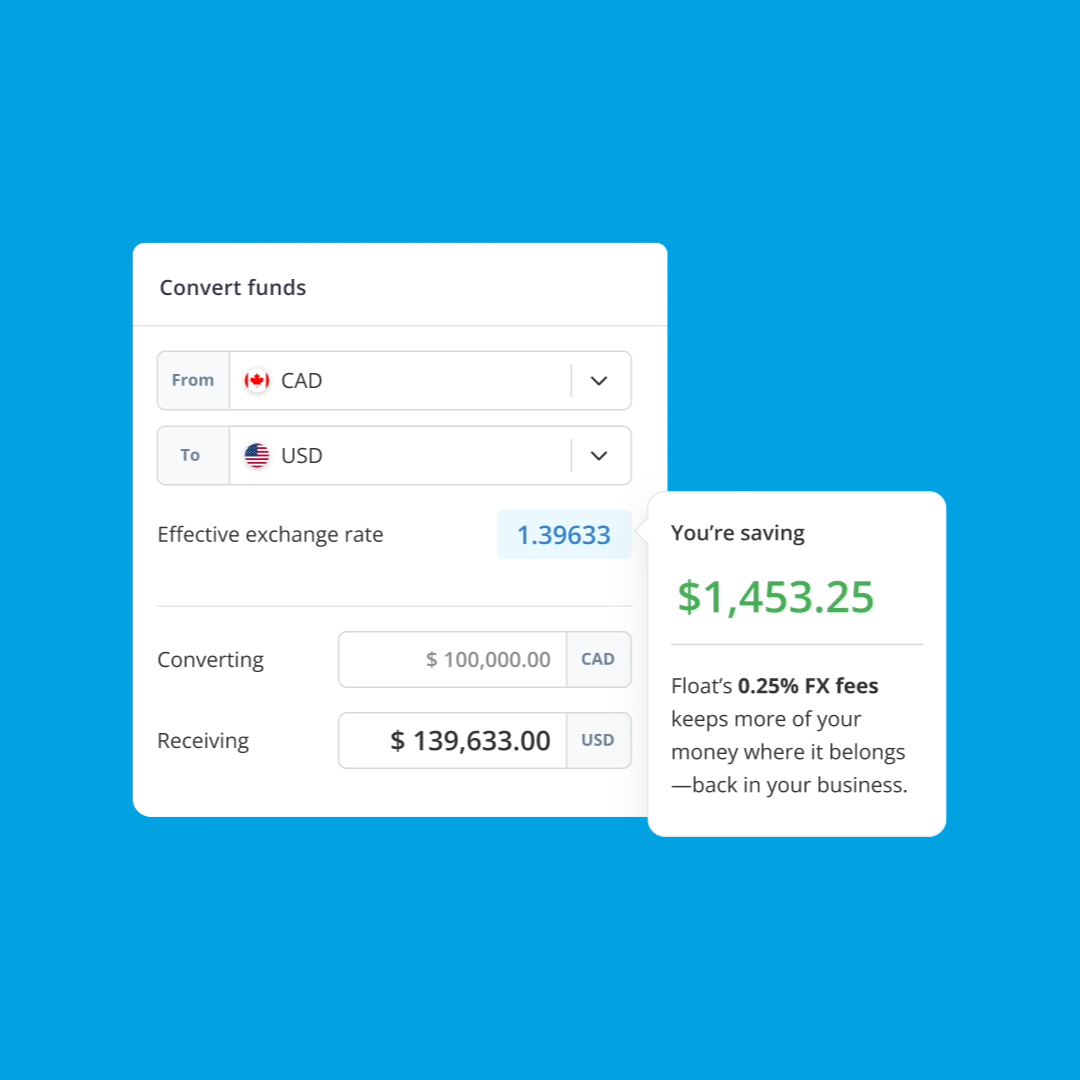

Save thousands on FX

Heavy USD spend leads to high FX fees. Float offers market-leading USD rates with transparent pricing, so you keep more of your revenue in your pocket.

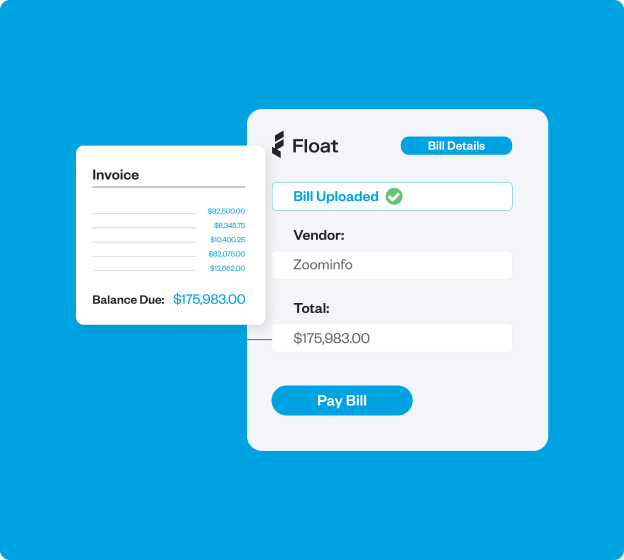

Build stronger vendor relationships with fewer payment disputes

Manual payment processes cause unnecessary delays. Automate paying North American suppliers and manufacturers with free EFT and ACH payments and global vendors via wire.

Get accurate forecasting and cleaner audits

Shared cards and a lack of granular controls make it difficult to track spend. With real‑time dashboards, get instant visibility by campaign or team so you know exactly where your money is going.

E-comm and retail pricing

Choose between our Essential, Professional and Enterprise plans. Contact our support team to explore the best option for your team.

Essential

$0CADuser/mo1

The free solution for spend control & payments.

Free access to:

-

Up to 20 physical & unlimited virtual cards with custom limits and controls 3

-

Credit limits up to $3M

-

1% cashback on spend

-

Up to 4% interest on CAD and USD funds

-

0.25% FX Rates

-

Mobile app, automated receipt collection, and matching

-

Canadian tax tracking

-

Employee reimbursements with mileage and CAD direct payouts

-

Bill payments via Wire, and no-fee EFT & ACH

-

Interac e-Transfer and 1-business-day funding

-

Accounting sync with QBO, Xero or custom exports

-

Customer support in English and French

Professional

$10CADuser/mo2

Advanced controls & workflows for growing teams.

Everything in Essential, plus:

-

Unlimited physical and virtual cards with advanced controls

-

Team management with multi-level requests and approvals

-

Customizable submission and approval policies

-

International reports and USD direct payouts for employee reimbursements

-

Post-sale manager transaction reviews

-

Delegate access

-

Advanced accounting integration with NetSuite

-

Free for up to 50 users for qualified non-profits

Enterprise

Contact Us

Dedicated support and custom solutions at scale.

Everything in Professional, plus:

-

Custom implementation and data migration

-

Team training and advanced workshops

-

Premium support and access to new features

-

Dedicated Customer Success Manager

-

Custom Charge Credit terms with dedicated underwriting team

-

Custom pricing and rewards

Essential

Professional

Enterprise

No more manual reconciliation and platform-hopping

From store teams to fulfillment teams to marketing big spenders, sync spend across departments and close the books faster with direct integrations to QuickBooks, Xero and NetSuite. Plus, a custom API.

“I’m super happy with Float. I think what helps us the most is that we can have everything in one spot. It makes our lives so much easier to keep track of things, from the bill pay process to reimbursements.”

Gregory Kalinin

Co-Founder, Holistic Roasters Inc.

See how Holistic Roasters streamlined spending and bookkeeping with Float

E-commerce and retail FAQ

Float’s corporate card offers real-time visibility into spending, plus expense management tools that streamline expense tracking and categorization. Your business can avoid expense bottlenecks and instead focus on maximizing return on ad spend.

Holidays and sales campaigns can cause rapid spikes, while scaling can be unpredictable. Float offers the flexibility and control you need to adjust spending limits, issue new corporate cards instantly, and track spending all from one place. To support your cash flow needs, Float Charge offers unsecured, fast credit, while our business account offers 4% interest with no lock-ups.

Yes! Float’s corporate cards include granular controls, so you can determine spend limits for physical and virtual cards—which you can set instantly with a few clicks. This way, you can approve funding in real time and ensure your team remains competitive and agile.

No. Float corporate cards operate on a charge (credit-based) or prepaid funding model, offering direct 1% cashback on card spend above $25K. You can access up to $3 million in unsecured, interest-free credit terms, where the balance is repaid fully at the end of the term. Both models offer up to 4% interest on all deposits with no cash lockups with account opening in under 24 hours.

Float’s real-time visibility dashboard provides your team with direct insight into your team’s spending. Issue and control corporate cards, categorize expenses, set up custom approval workflows, temporarily increase or decrease spending limits and more.

Float integrates with leading accounting tools like Xero and QuickBooks, helping you close books faster. It also offers intuitive receipt capture to streamline month-end reconciliation, as well as auto-coding transactions for automated bookkeeping. Eliminate manual data entry and the errors that come with it.

Most retail and e-commerce businesses can get up and running with Float in under a day, with cards issued instantly and key integrations live within hours. Traditional banks require 1-3 weeks just to get started.