Float + Xero

Close your books 8X faster with Float + Xero

Float customers can try Xero 90% off for 6 months.

Trusted by thousands of leading Canadian companies.†

Benefits

Why finance teams love Float x Xero

Purpose-built for Canadian companies that want to move fast and reconcile even faster. Sync every Float corporate-card swipe, reimbursement and bill payment into Xero automatically—fully coded, receipted and tax-ready.

Automated Bookkeeping

Auto-code transactions as they happen and close your books continuously.

Automatic Canadian tax compliance

The only platform that truly understands Canadian tax complexity. Float handles multi-part GST/HST/PST codes automatically.

Intuitive Receipt Capture

Capture every expense detail with helpful prompts, ready to be exported to your Xero account.

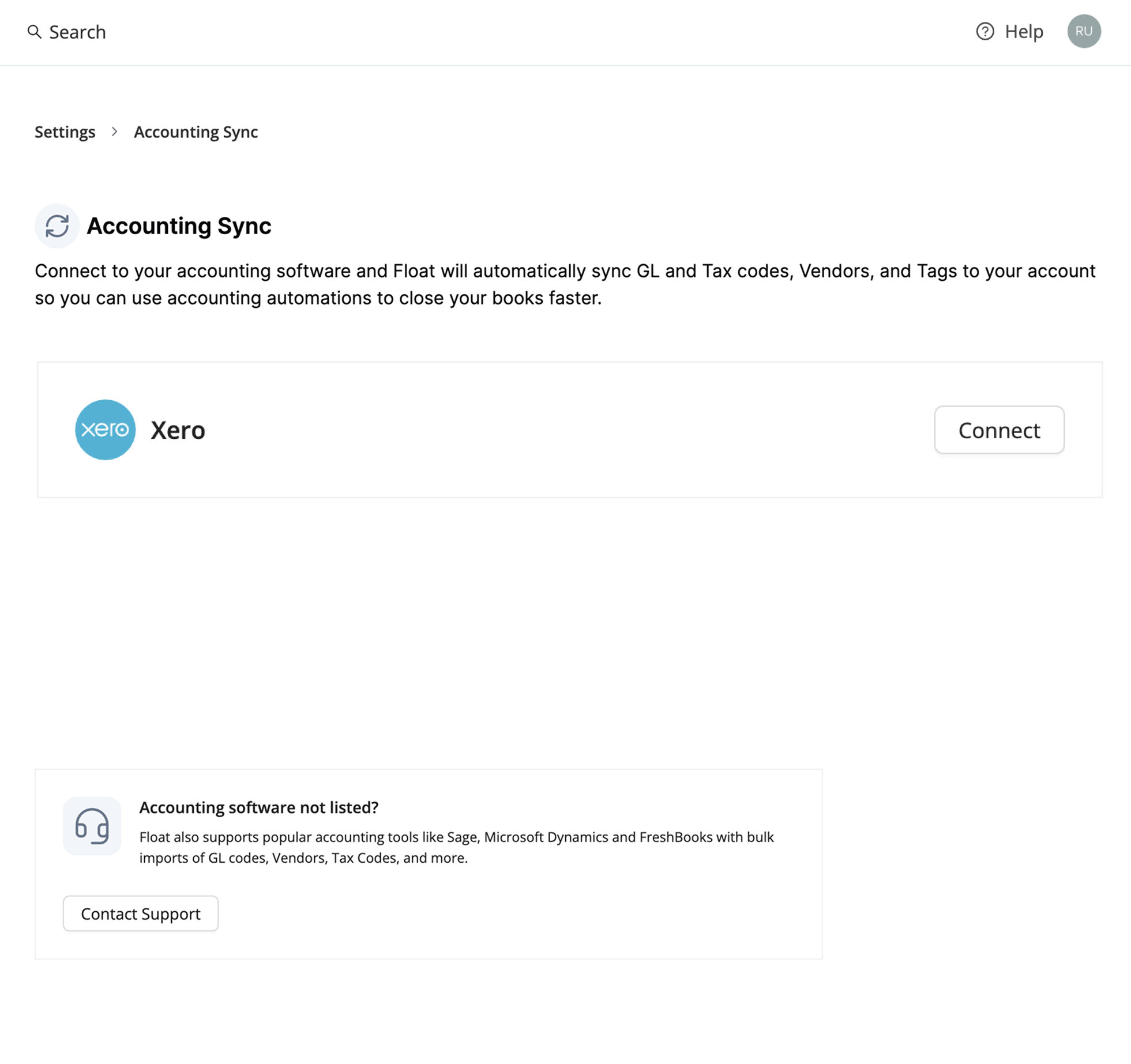

How it Works

Connect Float to Xero in five minutes

1

Connect your accounts

Create a Float Clearing account in Xero and authorize Xero inside Float to import your Chart of Accounts.

2

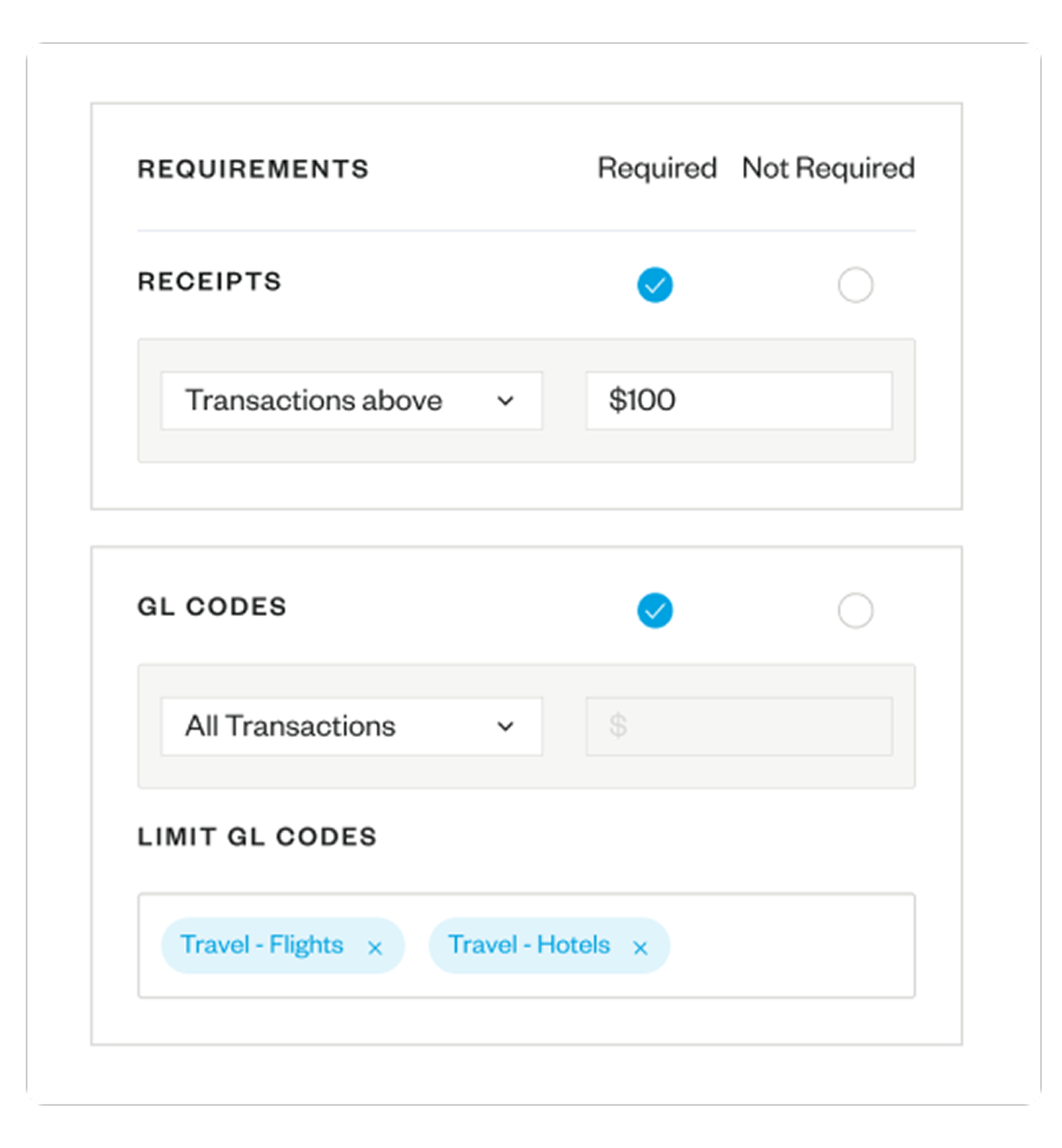

Configure automations

Code transactions as they appear in Float (GL, Tax, tracking categories) and set up rules for auto-categorization.

3

Export transactions for a faster month end

Sync your Chart of accounts to Float and export export transactions directly at month end.

Frequently Asked Questions

Float’s corporate cards are issued by Visa for CAD cards and Mastercard for USD spending. Float operates on a Charge (credit-based) funding model or a Prepaid funding model. Both funding models offer direct 1% cashback on all categories after the first $25K of monthly spend.

Float Charge: Float Charge offers customers access to unsecured, interest-free credit terms, where the balance is repaid fully at the end of the term (no balances are carried). You can apply (*Conditions apply. Book a demo to learn more) for unsecured credit terms with high limits up to $1M, no credit checks, and no personal guarantees.

Float’s Prepaid Model: Prepaid model offers up to 4% interest on all deposits with no cash lockups with account opening in < 24 hours.

This offer (90% off Xero’s then-current list price for six consecutive months) is only available to subscribers to new business edition subscriptions who redeem this offer via this pricing page. After six months, Xero’s then-current list price will apply. Xero reserves the right to change its list price, charges and billings terms at any time at its sole discretion. This offer cannot be redeemed in conjunction with third-party or other Xero offers. Prices are listed in local currency and inclusive of taxes (if any). This offer ends March 31 2026. Xero reserves the right to change or cancel this offer at any time at its sole discretion. This offer and use of the Xero services are subject to Xero’s terms of use.

Signing up for Float takes less than 10 minutes and can be done fully online. Float does not require any personal guarantees and does not perform credit checks to open your account. Ready to get started on our Free Essentials plan? Sign-up today.

Float is Free to use on our Essentials plan, where you will be able to issue unlimited virtual CAD/USD cards, earn up to 4% interest on deposits, reimburse employees and pay vendor bills. If you need more sophisticated functionality, like over 20 physical cards, Netsuite integration, or an API solution, you will have to consider our paid Professional and Enterprise plans.

Float is based in Toronto, Canada and built for Canadian businesses, expertly handling complex provincial and territorial tax and accounting nuances.

Unlike traditional cards that get you to spend more, Float is the only corporate card in the world that helps businesses spend less. Through a combination of financial rewards like our 1% cashback, up to 4% interest on deposits, no FX fees with our USD cards and time savings of at least 8 hours per employee Float’s customers on average save 7% on their spend.

*Trademark of Visa International Service Association and used under licence by Peoples Trust Company.