Expense Management

New Survey Reveals Pain Points in Spend Management

Angus Reid survey of Canadian Finance leaders reveals operational bottlenecks

June 23, 2022

Today we released new data that shows companies are struggling with managing corporate spend, particularly with the shift to a remote or hybrid workforce. The survey, conducted among business decision makers on the Angus Reid Forum, reveals the negative impacts of inefficient spend management on company security, workforce productivity and employee happiness — which are of increasing concern as businesses navigate the uncertain economic climate.

Key survey highlights include:

- 61 per cent of businesses who have most or all employees working remotely express that expense reporting is one of the most tedious jobs in their organization

- More than half (51%) at these companies agree that time spent reporting expenses negatively impacts their ability to accomplish work

- 49 per cent of businesses where most or all employees work remotely share company credit card across multiple employees, and among this group, 63 per cent share card details over Slack or email, more than three times the proportion of businesses with only some employees working remotely (18%)

- Seven-in-ten (71%) businesses report that their employees incur company expenses on personal credit cards, increasing to 80 per cent for businesses with remote employees

Shift to remote work has created new pain points for employees and HR leaders

The pandemic was an unexpected push to remote work that created operational challenges as businesses moved quickly to adapt. Even in a post-COVID world, the strain on employees and HR leaders lingers as companies settle permanently into hybrid and flexible working arrangements. Four-in-five (80%) businesses with remote employees have staff who incur company expenses on their personal credit cards, and 45 per cent report that employees are incurring more company expenses personally for reimbursement since shifting to remote work. With inflation and the cost of living rising, this is a significant financial burden for many Canadians.

For HR leaders, maintaining existing benefits such as team building activities and socials, as well as managing new employee benefits brought on by remote work arrangements, has resulted in difficulties with expense tracking. Over half (54%) of businesses working primarily remotely report an increase in funds or stipends distributed to employees, and half (51%) of businesses who had most or all of their employees shift to remote work said that it has made receipt tracking more complicated. On both ends, more than half (53%) at these companies agree that expense reporting is a major pain point for employees, and 51 per cent agree that time spent reporting expenses negatively impacts their ability to accomplish work. As remote or hybrid work becomes the norm, these challenges will only become more prevalent unless businesses adapt new processes and technology to streamline spend management.

Concerns for corporate spend management in a tough economic climate

As recession fears grow in Canada, business leaders are increasingly focused on maximizing productivity and finding cost-saving opportunities. The survey found an operational bottleneck amongst many Canadian businesses to be their manual expense tracking, which directly impacts productivity. 82 per cent of businesses spend at least a day to close their books at month-end, and among businesses whose workforce shifted to remote work during the pandemic, two-in-five spend at least four days on the task. This is significant as almost three-in-four (74%) businesses agree that they could spend less time closing their books at month’s end.

The ripple effect of heavy manual expense tracking is that it leaves businesses unable to scale up without increasing overhead. Currently, the most time-consuming expense reporting tasks for companies that have shifted to remote work are: ensuring expenses are accurate (64%), fixing human errors (56%), tracking down employees for receipts (56%) and manually reconciling and entering data (55%). These are pain points that will become larger as a company grows, limiting Canadian businesses’ ability to shift as needed during a volatile economic period.

Additional findings include:

- Almost half (48%) of businesses with most or all employees shifting to remote work are seeing increased paperwork from expense reporting

- 30 per cent of businesses who have most or all of their employees working remotely use 6 or more different finance software and tools for accounting-related work

- More than two-in-five (44%) businesses with primarily remote employees plan to purchase new software for finance and accounting-related work in the coming year

Methodology: These are the findings of a survey conducted by Float from May 26-30, 2022 among a nationally representative sample of 427 Canadian finance decision makers at companies with 15-300 employees. All respondents were members of the online Angus Reid Forum. For comparison purposes only, a probability sample of this size would yield a margin or error of +/- 4.7 percentage points, 19 times out of 20. The survey was offered in both English and French.

Written by

All the resources

Corporate Cards

7 Best Business Credit Cards Canada 2025

Pinpoint the right credit card choice for your company in a sea of options with our roundup of the seven

Read More

Corporate Cards

Instant Corporate Card Issuance: How to Get Cards in Minutes, Not Days

Ready to equip your team to spend quickly while minimizing risk? Cue instant corporate card issuance.

Read More

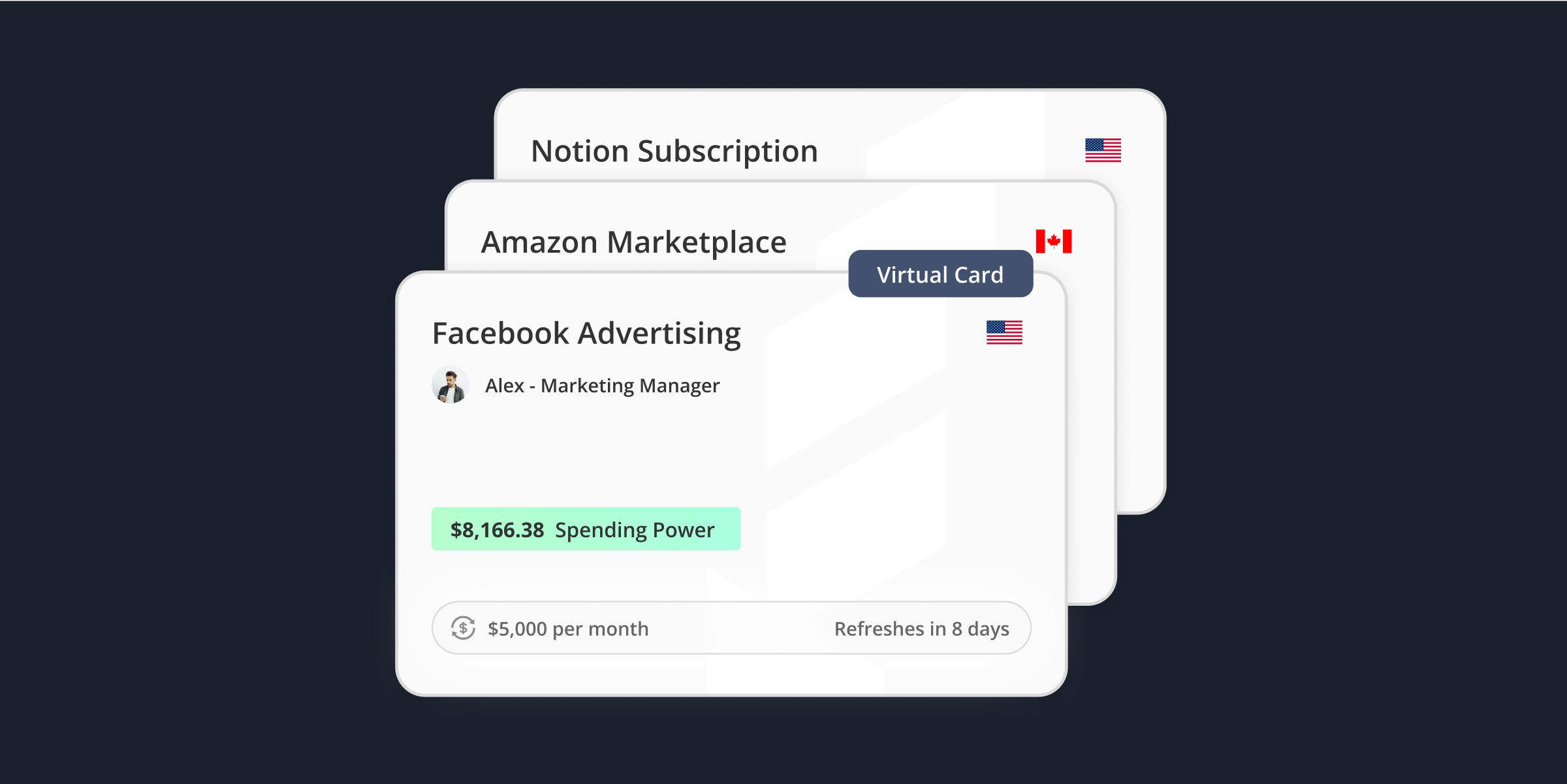

Corporate Cards

On-Demand Virtual Cards: Revolutionizing Business Payments

On-demand virtual cards are a game changer for businesses wanting to move quickly—learn how to get set up today.

Read More