Product Education

New! Bill Pay and Reimbursements

Float is the first business finance platform in Canada to offer an end-to-end solution that simplifies all non-payroll spending.

January 30, 2025

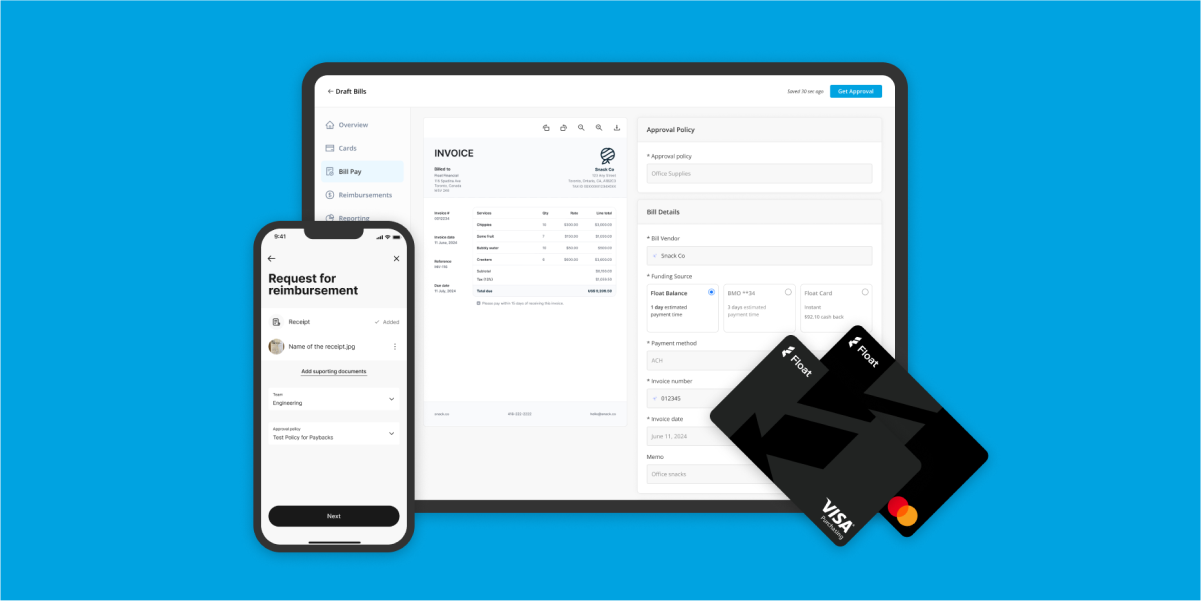

Float is proud to announce two new solutions: Float Bill Pay and Float Reimbursements.

These additions make Float the first business finance platform in Canada designed to offer an end-to-end solution that simplifies all non-payroll spending, driving up to 7% savings on corporate spend for Canadian companies and teams by offering 1% cashback, 4% yield on deposits, eliminating FX fees, and helping employees save up to 20 hrs per month on manual expense submissions.

“Four years ago, we embarked on a mission to revolutionize corporate spending in Canada,” said Rob Khazzam, CEO and Co-Founder of Float. “We noticed a significant gap in the market – Canadian businesses were either forced to rely on international solutions that weren’t localized for Canada or settle for outdated local options. Today, we are proud to introduce Float Bill Pay and Float Reimbursements, designed specifically for Canadian finance teams.”

Float’s business finance platform is the only solution in Canada to integrate reimbursements, corporate cards, a credit facility and bill payments — including bank, EFT, wire, and ACH payments — into a single, streamlined platform. This consolidation allows businesses to manage all their spending in one place, eliminating the inefficiencies and frustrations associated with fragmented systems.

“It’s amazing to see how Float has grown from offering smart corporate cards to becoming an entire payment processing platform with its new addition, Bill Pay. They’ve listened to the needs of their target market and delivered an all-encompassing tool, which allows for greater visibility into cash expenditures. In a world where software is becoming more specific and less of a one-stop shop, having a centralized platform for all our accounts payable needs means one less software to manage and more time for meaningful work.”

Eleni Kasimos, Director of Finance at CPA education platform LumiQ

New Angus Reid Group survey data reveals the productivity challenges Canadians are facing when it comes to managing their corporate expenses and payroll. In a survey of 200 Canadian finance leaders:

- 71% said that expense reporting needs to be more efficient

- 69% feel that processing and paying vendor invoices needs to be more efficient

- 56% spend 1-7 days per week processing invoices, with 18% 4-7 days per week

Key features of Bill Pay and Reimbursements include:

- Robust and Fast Bill Intake Process: Utilizing advanced OCR and AI technologies, Bill Pay extracts relevant information from bills, significantly reducing manual data entry and streamlining the process.

- Automated Approval Policies and Workflows: These features ensure bills are managed efficiently, freeing finance teams from manual oversight.

- Embedded EFT, ACH, and Wire Payments: Bill Pay supports payments in both CAD and USD directly from the platform, eliminating the need for outdated bank account management.

- Seamless Reconciliation: Bill Pay integrates smoothly with QuickBooks Online (QBO), Xero, and Float, ensuring accurate and effortless reconciliation.

- Reimbursements: Eliminate manual expense reports, keep all company spending in one platform, and speed up approvals and payouts

These innovations highlight Float’s commitment to addressing the specific needs of Canadian SMBs and enhancing the efficiency of their financial operations. As Canadian businesses adopt these new tools, they can look forward to more efficient operations, reduced administrative burdens, and a unified approach to managing non-payroll expenses. Companies can sign up for early access at www.floatfinancial.com/bill-pay

Written by

All the resources

Cash Flow Optimization

ACH vs EFT Payments: Key Differences for Canadian Companies

Learn the key differences between EFT and ACH payments, how they work, which options might be available to your business

Read More

Corporate Cards

Xero Integration for Corporate Cards: Modern Accounting Software Guide

Using Xero becomes more powerful the second you integrate it with your corporate cards. Here's what you need to know.

Read More

Float News

Float 2025: Year in Review

How Float is building the financial system Canadian businesses run on

Read More