Expense Management

Let’s Make Smarter Spending Your 2022 Resolution

Manual spend management tools are time-consuming and prone to error. With a near year around the corner, it’s time for a fresh start! Allow us to introduce you to a better, more efficient way to track and manage your spending with smart spend software and virtual corporate cards.

December 14, 2021

A new year is the perfect time to have a clean slate. If you’re leading a startup, it’s a great opportunity to introduce new processes and leave the inefficiencies of the past year behind you. Use this first month of the new year to make business decisions or “resolutions” that will benefit you well beyond the next 12 months. A great place to start is changing the way you manage and control corporate spending with smart spend software. Let us tell you why.

Automate and hit the ground running 🏃🏻♂️💨

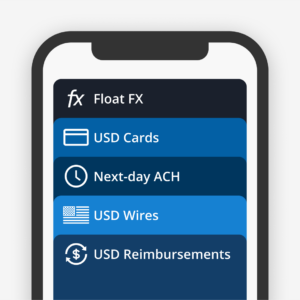

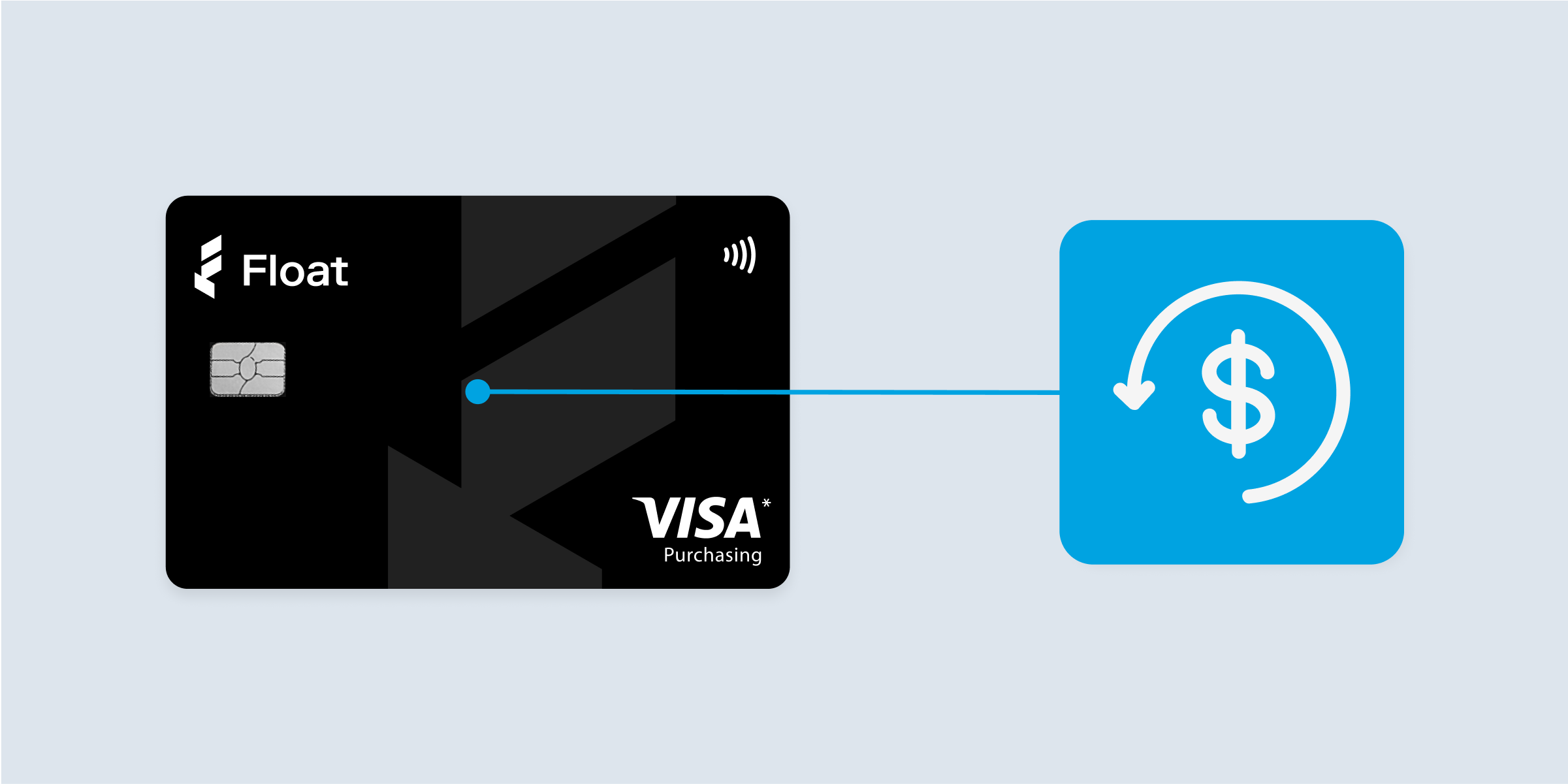

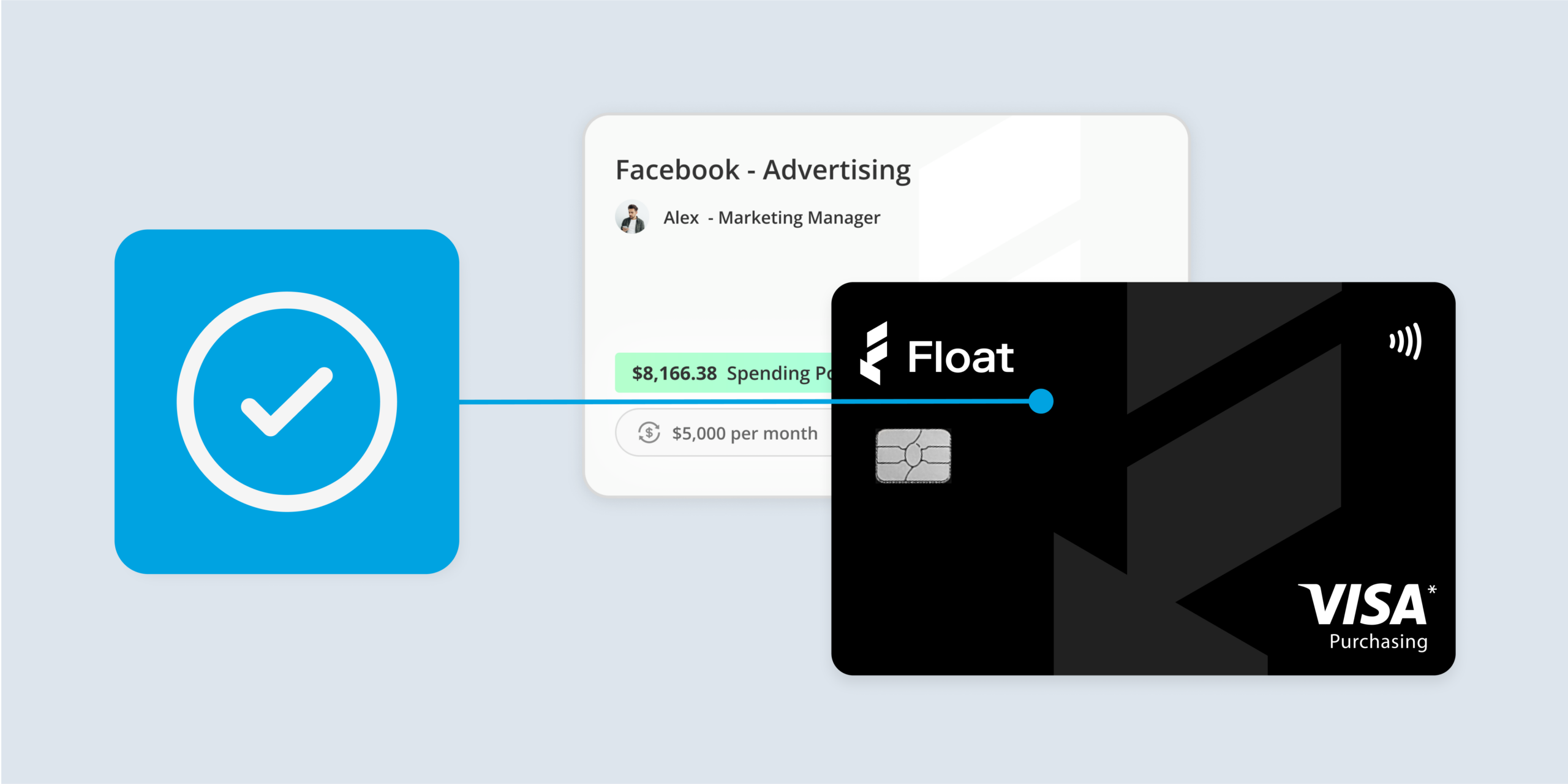

Smart spend software transforms the entire expense and spend management process by automating everything from invoice processing, spend approvals to recording transactions and issuing physical and virtual corporate cards. It quickly captures and stores all financial data online in real time and eliminates the tedious tasks that come with managing corporate expenses on a daily, monthly and annual basis. By simplifying employee access to corporate cards (no banks required), business purchases can be made easily without ever having to bring personal credit cards into the mix.👏🏼 So, in 2022, your finance team can axe those long hours inputting data and filing receipts and use their time to focus on more important work.

New year, better expense management

‘Tis the season for year-end accounting. If you’re currently in the middle of getting your ducks in a row and aren’t using smart spend software, listen up! 📣 When companies wait until the end of the year to gather receipts and review what they’ve spent, they often find themselves buried in expense reports and dumbfounded by the money they’ve spent. 🤯 With smart spend software, all of this can be put to bed. Expense reports are eliminated altogether, you can track spending in real time, prompt employees to submit receipts and easily review expense requests and approvals without ever having to chase anyone down.

Tracking expenses on a daily basis gives you greater visibility into how your company is spending all year round, allowing you to establish clear financial policies, develop more strategic budgets and make year-end a happier time for everyone.👍🏼

Create a healthy company spend culture 😊 💵

A healthy spending culture is when an organization has the proper processes in place to manage and track spending. It empowers companies, especially startups, to get everyone on board in the quest to spend smarter – that includes employees too. Smart spend software enables finance teams to set these foundational financial policies and spend controls that employees can understand and follow on a daily basis. It holds employees accountable to strategic budgets and workflows to keep everything organized for finance teams. Smart spend software also makes it easier for companies to issue physical and virtual corporate cards to employees, empowering them to make spending decisions and act on innovative ideas without a complex chain of command. All this together will evoke a healthy spend culture with improved operational efficiency and happy employees who are given greater autonomy and are more engaged to do their best work. 🤩

The countdown to smarter spending starts with Float 💸

Float gives businesses the power to set smarter spending goals and improve the way they manage their money. Our smart automation spend software and virtual cards bring greater efficiency, accuracy and oversight to your financial operations – all the things you want in your organization for 2022. 🙋🏼♂️

To learn more about how Float can help you start 2022 with a bang, connect with us today! 🍾

Written by

All the resources

Corporate Cards

How Corporate Card Programs Deliver ROI for Canadian Companies: Measuring Financial Impact

When every dollar matters, the right payment solution can help you grow—and a smart corporate card program is your first

Read More

Financial Controls & Compliance

GST/HST Tracking in Canada: Why It Matters and How Float Simplifies the Process

Learn how GST/HST tracking works in Canada, why it’s essential for your business, and how Float automates the process to

Read More

Corporate Cards

How to Get Approved for a Virtual Corporate Card as a New Business (Without Hurting Your Credit Score)

Looking to add a virtual corporate card to your wallet without messing with your credit score? This guide is for

Read More