Corporate Cards

Unlocking Benefits: How to Get a Virtual Credit Card for Your Canadian Business

Discover how your Canadian business can benefit from a virtual credit card. Unlock convenience, security, and smarter spending today with our expert guide!

January 30, 2025

As a Canadian business owner, you understand the importance of streamlining your financial processes and ensuring the security of your transactions. One powerful tool that can help you achieve these goals is a virtual credit card.

By obtaining a virtual credit card for your business, you can enjoy enhanced security, simplified expense tracking, and greater control over your company’s finances. In this article, we’ll guide you through the process of getting a virtual credit card for your Canadian business, highlighting the key steps and considerations along the way.

Instantly Issue Virtual Cards with Float

Canada’s only modern USD and CAD Visa and Mastercard virtual cards solution for businesses — plus cashback and average savings of 7%.

What is a Virtual Credit Card?

Virtual credit cards are digital versions of traditional credit cards designed for secure online transactions. They provide unique card numbers for each transaction, reducing the risk of fraud and simplifying expense management for businesses. For a more detailed overview, checkout our deep dive into — What are Business Virtual Cards?

Why Your Canadian Business Needs a Virtual Credit Card

Virtual credit cards offer enhanced security, streamlined expense tracking, and greater control over business finances. They are an ideal type of corporate credit card used for managing online subscriptions, vendor payments, and employee expenses, making them a valuable tool for Canadian businesses.

How to Get a Virtual Credit Card for Your Canadian Business

Getting a virtual credit card for your Canadian business involves several steps, from researching providers to integrating the card with your existing systems. It’s essential to consider factors such as eligibility requirements, fees, and features when choosing a provider that best suits your business needs.

Step 1: Research Virtual Credit Card Providers

Start by identifying reputable virtual credit card providers in Canada that specialize in business solutions. Compare the features, fees, and benefits offered by different providers to find the one that aligns with your company’s requirements.

Step 2: Understand Eligibility Requirements

Before applying for a virtual credit card, review the eligibility criteria set by the providers you’re considering. Ensure that your business meets the necessary financial and operational standards to qualify for a virtual credit card.

Step 3: Prepare Necessary Documentation

To apply for a virtual credit card, you’ll need to gather required documents such as business registration, financial statements, and identification. Having accurate and up-to-date documentation ready will streamline the application process.

Step 4: Submit Your Application

Once you have chosen a provider and prepared the necessary documentation, complete the online application process through the provider’s website. Pay attention to the information you provide to ensure a smooth application process.

Step 5: Set Up Your Virtual Credit Card

After your application is approved, follow the provider’s instructions to set up your virtual credit card. Configure settings such as spending limits and authorized users to ensure the card aligns with your business’s financial policies.

Step 6: Integrate with Your Business Systems

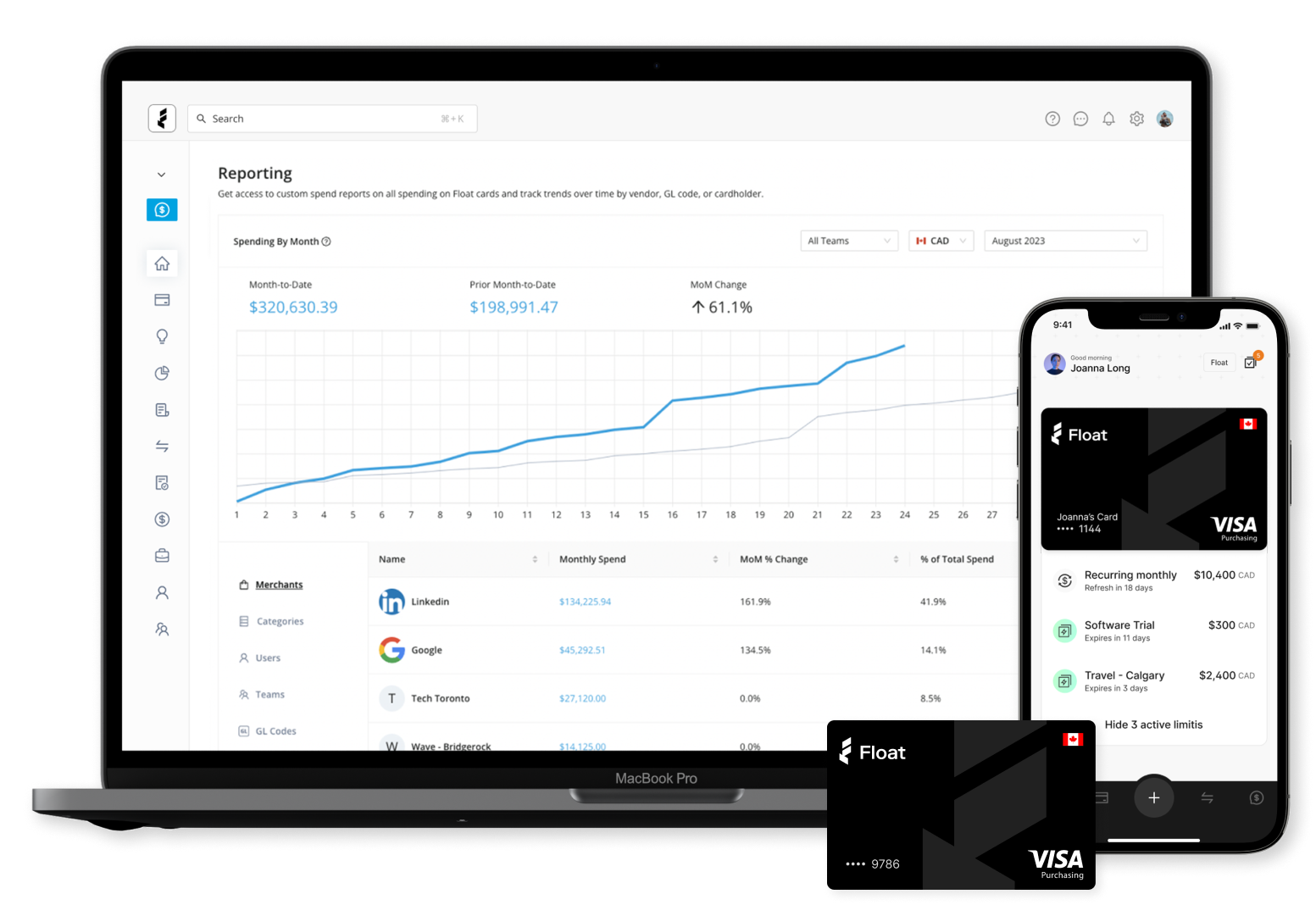

To maximize the benefits of your virtual credit card, connect it with your accounting and expense management software. Seamless integration will simplify tracking and reporting, saving you time and effort in managing your business finances.

Step 7: Train Employees on Usage

Finally, educate your team on how to use virtual credit cards for business expenses. Ensure that they understand and follow company policies and procedures when making purchases with the virtual credit card.

Issue Unlimited Virtual Cards With Float for Free

Canada’s only modern USD and CAD Visa and Mastercard virtual cards solution for businesses — plus cashback and average savings of 7%.

Tips on Maximizing the Benefits of Virtual Credit Cards

As you embark on your journey with a virtual credit card for your Canadian business, it’s crucial to make the most of its features and benefits. By implementing best practices and staying proactive, you can optimize your business’s financial management and ensure a seamless experience for your team.

1. Monitor Spending Regularly

Regularly reviewing transactions is essential to maintain compliance and identify any discrepancies early on. Set aside dedicated time to analyze your virtual credit card statements and address any issues promptly.

2. Leverage Automated Expense Reporting

Take advantage of automated tools offered by your virtual credit card provider to streamline expense tracking and reporting. These tools can save you valuable time and reduce the risk of manual errors.

3. Set Clear Policies and Guidelines

To ensure the smooth adoption of virtual credit cards within your organization, establish clear guidelines for employees on their use. Communicate expectations, spending limits, and approved categories to minimize misuse and maintain control over expenses.

4. Evaluate Provider Features Periodically

As your business grows and evolves, it’s important to periodically review and assess the features and benefits offered by your virtual credit card provider. Stay informed about new offerings and consider switching providers if better options become available.

Frequently Asked Questions

To get a business virtual credit card in Canada, research providers, understand eligibility requirements, prepare necessary documentation, submit your application, set up the card, integrate with business systems, and train employees on usage.

Fees can vary by provider, so it’s important to compare features and costs. Float is a completely free virtual card solution for Canadian businesses that you should consider.

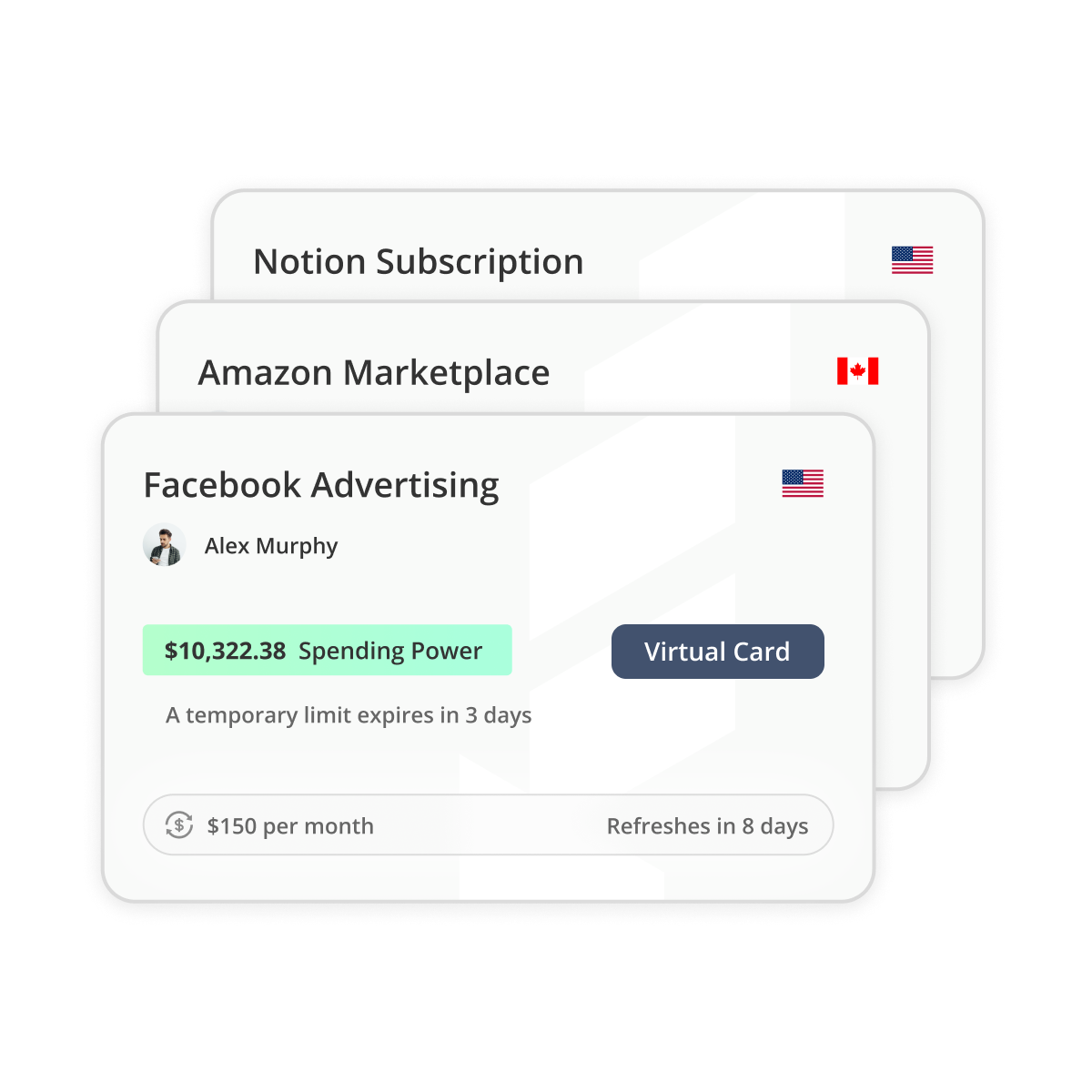

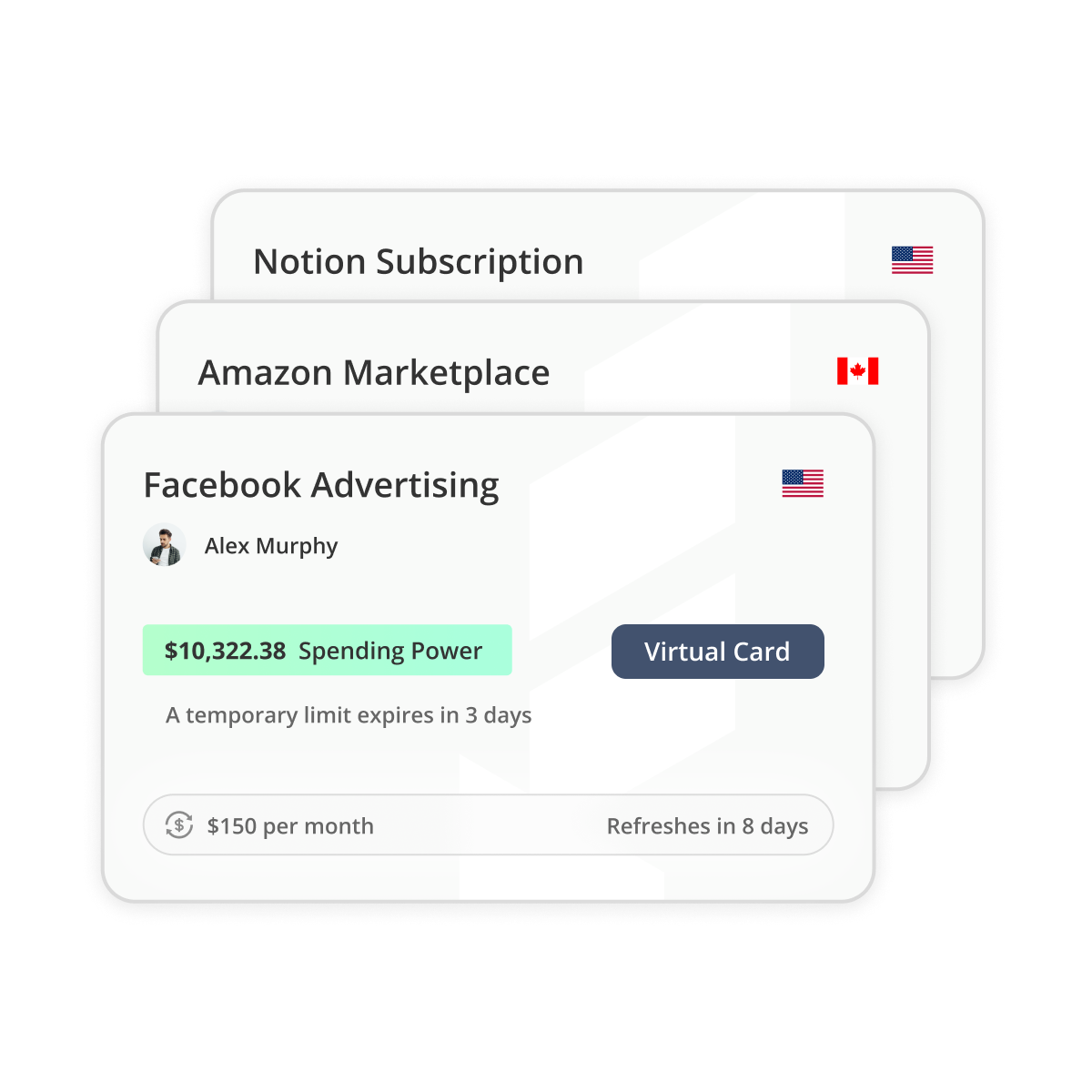

Virtual cards are the same as a traditional physical card with the exception that the card number for these cards is presented digitally. You can create and cancel virtual cards for any purchase and set custom limits on a per-card level to avoid overcharges from the vendors. Float’s virtual cards are excellent for recurring subscription expenses, digital ads spend, and one-off small employee purchases as they can be added into Apple or Android Wallet and deleted once the purchase is complete. Float’s Essentials plan offers unlimited virtual cards and <10 minutes account application time.

Signing up for Float takes less than 10 minutes and can be done fully online. Float does not require any personal guarantees and does not perform credit checks to open your account. Ready to get started on our Free Essentials plan? Sing-up today.

Float is Free to use on our Essentials plan, where you will be able to issue unlimited virtual CAD/USD cards, earn 4% interest on deposits, reimburse employees and pay vendor bills. If you need more sophisticated functionality, like over 20 physical cards, Netsuite integration, or an API solution, you will have to consider our paid Professional and Enterprise plans.

Float offers Charge Card and Prepaid funding models. You can apply (*Conditions apply. Book a demo to learn more) for unsecured, 30-day credit terms with high limits up to $1M, no credit checks and personal guarantees. Prepaid model offers 4% interest on all deposits with no cash lockups with account opening in < 24 hours.

Unlike traditional cards that get you to spend more, Float is the only corporate card in the world that helps businesses spend less. Through a combination of financial rewards like our 1% cashback, 4% interest on deposits, no FX fees with our USD cards and time savings of at least 8 hours per employee Float’s customers on average save 7% on their spend.

Best Way to Get a Business Virtual Credit Card in Canada

As you explore the world of virtual credit cards for your Canadian business in 2024, consider providers that offer comprehensive solutions tailored to your needs. Look for features like automated expense management, seamless accounting integration, and enhanced security to ensure an efficient and secure way to manage your business expenses. By choosing the right provider and implementing best practices, you can unlock the full potential of virtual credit cards and take your business’s financial management to the next level.

“Float’s virtual cards continue to give our team the flexibility and autonomy they need and deserve.”

Andy O’Reilly

Senior Manager of Finance & Technology

As you embark on your journey to streamline your business expenses with a virtual credit card, remember that choosing the right provider is key. We invite you to explore our comprehensive solution designed specifically for Canadian businesses like yours. Get started for free today and experience the benefits of enhanced security, automated expense management, and seamless integration with your existing systems.

Written by

All the resources

Corporate Cards

No Annual Fee Business Credit Cards: A Smarter Way to Manage Spend

You don't need to be saddled by hefty annual fees to get the most benefits from your business cards. Here's

Read More

Corporate Cards

Best 0% Interest Business Credit Cards for 2025

Explore why choosing a 0% APR business credit card can be a strategic move for Canadian businesses.

Read More

Corporate Cards

7 Best Business Credit Cards Canada 2025

Pinpoint the right credit card choice for your company in a sea of options with our roundup of the seven

Read More