Financial Controls & Compliance

How to Find My Corporation or Business Incorporation Number?

Learn how to find your business incorporation number quickly and easily. Discover why it’s important, where to look, and avoid common pitfalls. Essential guide for Canadian entrepreneurs.

September 10, 2024

Struggling to locate your business incorporation number? You’re not alone. Many entrepreneurs find themselves scratching their heads when it comes to this crucial piece of information. Let’s dive into what a business incorporation number is and how you can track it down.

What Is a Business Incorporation Number?

A business incorporation number, also known as a corporation number or CRA number, is a unique identifier assigned to your company when it’s officially registered. Think of it as your business’s ID card.

Why It Matters

- Legal requirement for various business activities

- Needed for tax purposes

- Essential for opening business bank accounts

- Required when applying for loans or grants

What Is the Difference Between a Corporation Number and Business Incorporation Number?

In Canada, a corporation number is a unique identifier assigned to a corporation when it is registered with the federal or provincial government. This number stays with the company throughout its existence. A business incorporation number, on the other hand, refers specifically to the number assigned when a business is incorporated under the federal or provincial laws. While both numbers are linked to legal registration, the business incorporation number specifically relates to the incorporation process, whereas the corporation number identifies the entity for tracking purposes in government systems.

Confident SMBs are 2x as likely to expect >10% profit growth

See how they’re doing it.

How to Find Your Business Incorporation Number?

Your business number is assigned by the CRA shortly after incorporation. You can find your business number through a free Government of Canada search or by consulting Canada’s Business Registries.

Your corporation number is assigned by Corporations Canada or a Provincial Business Registry upon incorporation. You can find your corporation number through a free Government of Canada search or by consulting Canada’s Business Registries. This number may also be referred to as your Registry ID. If you have both a business number and a corporation number, please provide your corporation number.

What Does Corporation Number Look Like?

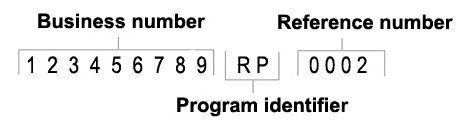

A CRA program account number has three parts:

- the nine-digit BN to identify the business

- a two-letter program identifier code to identify the program account

- a four-digit reference number to identify an individual program account (since businesses can have more than one of the same kind)

Example

You start a sole proprietorship. You need a GST/HST program account if you need to charge GST/HST. If you have one or more employees, you will also need a payroll deductions program account.

Once registered, your business will receive a:

BN:

- 123456789

GST/HST program account number:

- 123456789 RT 0001

Payroll deductions program account number:

- 123456789 RP 0001

If your business does not receive the information, you will need to check that the program accounts were registered properly. If your business needs to confirm their account number(s), you will need to contact the CRA.

Note

If the business later incorporates, you will need to register for a new BN. This will generate an RC program account for corporation income tax and you will need to add other CRA program accounts that you require (RP, RT). You will then close the sole proprietor BN accounts if you do not need them for any other businesses that you operate. For more information, go to Corporation income tax program account.

Things to Remember:

- Don’t confuse it with your tax ID number (they’re different!)

- Beware of scam websites claiming to provide this info for a fee

- Double-check the number’s format – it varies by country

FAQ

Is my business incorporation number the same as my tax ID?

Not always. In some countries, they’re separate numbers. Best to confirm with your local tax authority.

How long does it take to get a business incorporation number?

It varies, but typically you’ll receive it within a few days to a few weeks after registering your business.

Can I change my business incorporation number?

Generally, no. This number stays with your business for its entire life.

What if I can’t find my business incorporation number anywhere?

Don’t panic! Contact your local business registry or corporate affairs office. They can help you retrieve it.

Remember, your business incorporation number is a key part of your company’s identity. Knowing where to find it and how to use it will make your business operations smoother. Keep it handy – you’ll need it more often than you might think!

Written by

All the resources

Corporate Cards

How to Control Employee Spending: 5 Tips for Finance Teams

Employee spending out of control? These five tips for finance teams will help you control employee spending with ease, without

Read More

Corporate Cards

Corporate Card Alternatives: Comparing Your Options in 2025

Are your outdated cards slowing you down financially? Corporate card alternatives might be what will free you up — time-wise

Read More

Corporate Cards

No Annual Fee Business Credit Cards: A Smarter Way to Manage Spend

You don't need to be saddled by hefty annual fees to get the most benefits from your business cards. Here's

Read More