The Float Difference

Intelligent corporate cards, reimbursements, and bill payments. Built for Canadian businesses, tailored for finance teams.

Easily manage employee expenses with 100% free plans (and get high interest yield on cash balances)

Create, approve and pay bills quickly via EFT, ACH, or Global Wires

Get fast support in under 2 minutes with Float’s all-Canadian support team

Trusted by thousands of leading Canadian companies.†

Compare Float vs Rippling

| Purpose-built for Canadian companies by Canadians | ||

| Smart corporate cards with temporary limits | ||

| Virtual and physical cards in CAD and USD | ||

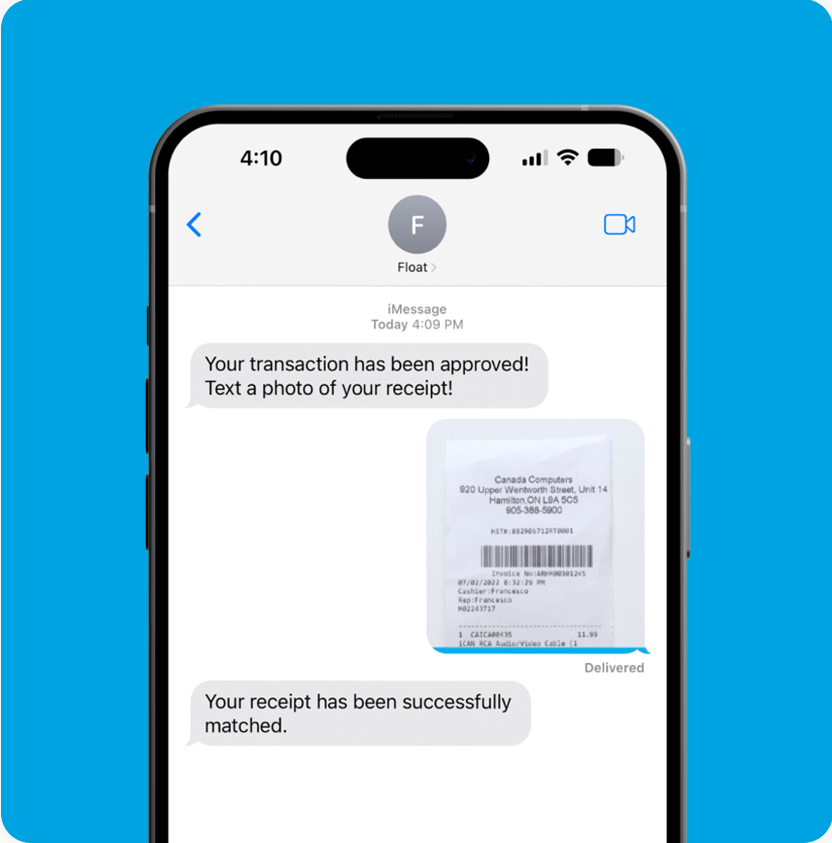

| Automated receipt capture and matching | ||

| High-interest yield on cash balances | ||

| Bill payments via EFT, ECH, or Wire | ||

| Transparent, simple pricing and free plans | ||

| HRIS connection to popular platforms |

Looking for a Canadian payroll solution?

Manage payroll and team expenses with Humi x Float –

an all-Canadian duo at a fraction of the cost.

Why choose Float?

Close your books up to 8x faster

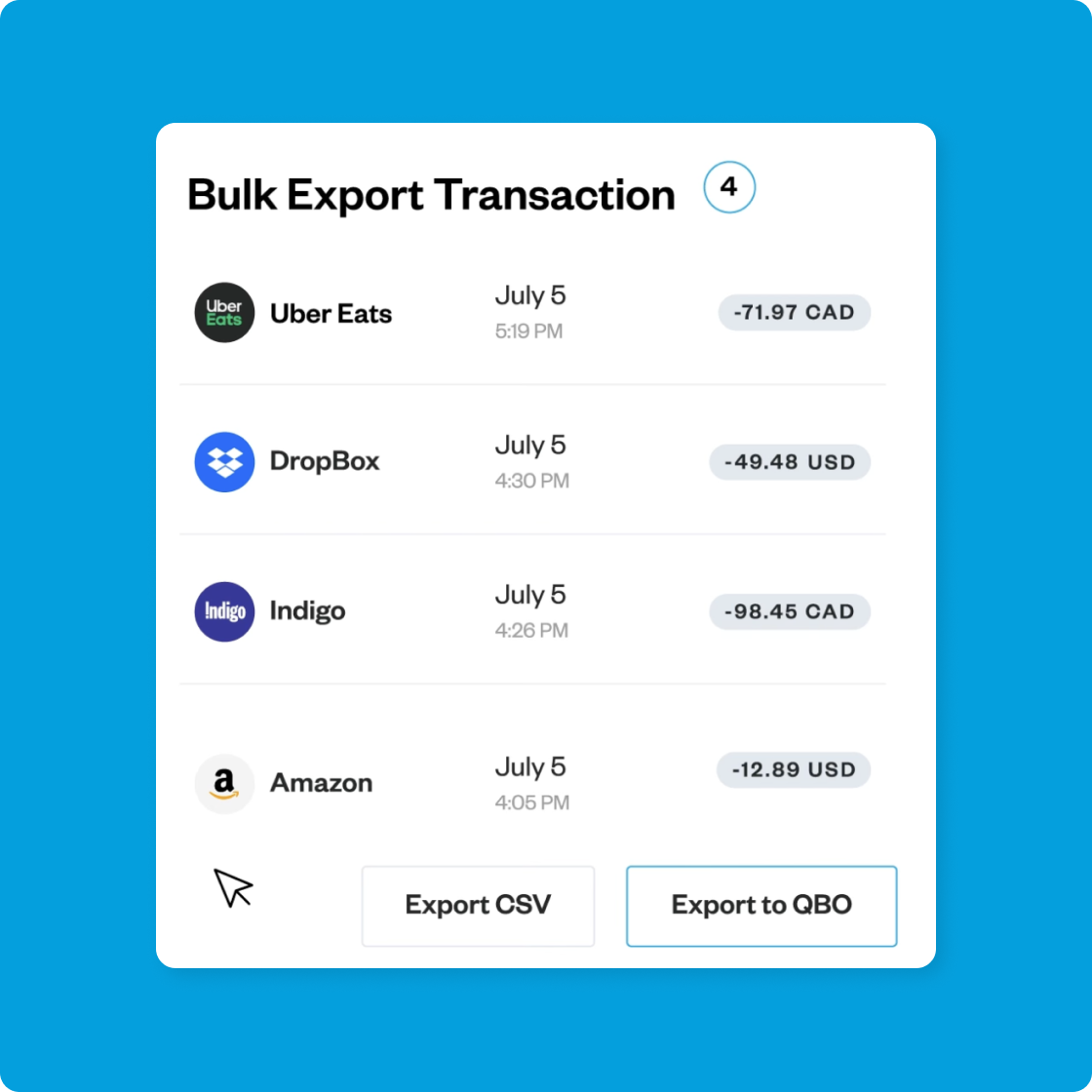

Eliminate expense reports with our automatic receipt collection and matching software. One-click export to your accounting platform makes month-end a breeze.

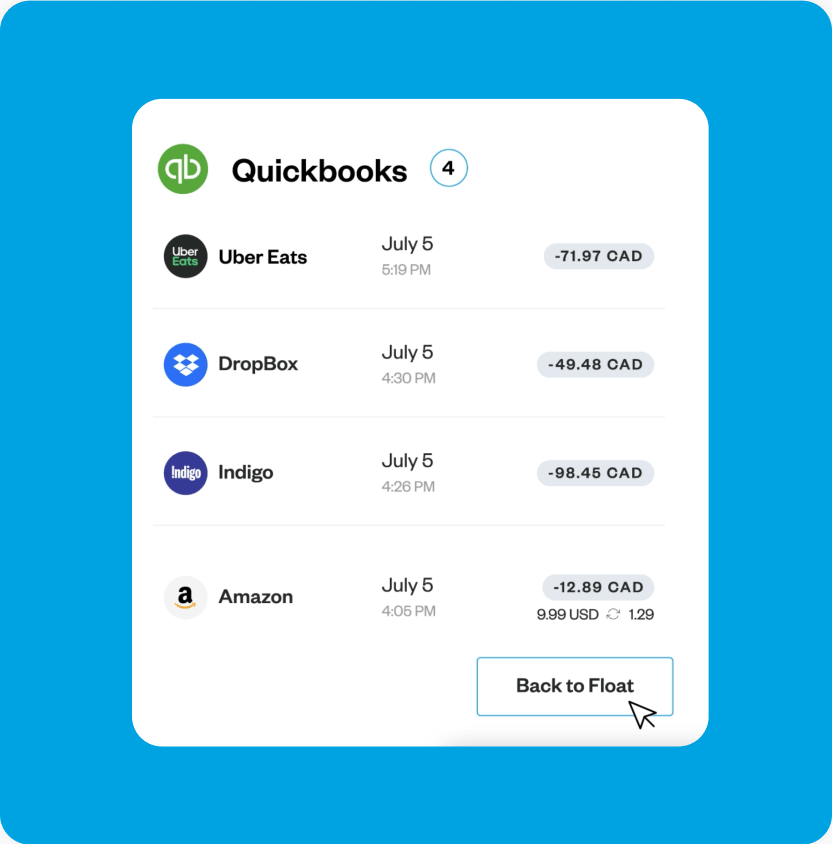

Powerful Canadian integrations

Float integrates with QBO & Xero and supports custom exports into Netsuite & Sage. Plus, Float directly integrates with Canadian banks.

Canada’s smartest corporate card

Manage spending on a per-card basis with proactive controls that enforce company expense policies. Float automatically categorizes expenses and assigns the proper GL code.

Close books 8x faster

Float’s corporate cards are tied to our smart spend management software. Transactions are automatically matched and assigned to your custom expense policies and GL codes.

Employees are prompted to easily text, email or upload receipts directly to Float in real-time.

At month-end, review your transactions and export to your accounting software with one click. It’s that easy.

Save 7% of your total spend

Float is the only platform that helps companies save 7% of their total spend, between time savings at month-end, productivity gains across the company and better-than-your-bank earnings.

Enjoy 1% cashback on card spend, up to 4% interest on cash balances, and lower FX fees.

The Smartest Expense Report Ever

Float’s AI-powered OCR automatically captures receipt details and generates the expense report – no manual data entry required from your team.

Approve, sync and initiate employee Payouts directly from Float to save time and money when processing mileage or reimbursements requests.

Why Athennian switched to Float

“The receipt capture feature has played a big role in improving receipt compliance to close to 100% and enhancing the overall accuracy of our accounting.”

Zach Hill

Director of Finance, Athennian

*Trademark of Visa International Service Association and used under licence by Peoples Trust Company.