CAD to USD Live Exchange Rates & Fee Estimates

Track live USD to CAD and CAD to USD conversion rates. Use Float’s free benchmark data to compare pricing and fees between various banks in Canada.

Canadian Dollar

US Dollar

Compare rates

Compare the fees charged by major Canadian banks relative to Float FX

Compare FX Services and Fees

Compare most common FX services available to the Canadian businesses and their fees below.

Provider

Markup %

Compared to Google Rate

Conversion Fees

Converting 1,000 CAD

0.49%

4.90 CAD

0.72%

7.20 CAD

0.92%

9.20 CAD

2.30%

23.00 CAD

2.38%

23.80 CAD

2.53%

25.30 CAD

2.56%

25.60 CAD

3.07%

30.70 CAD

3.36%

33.60 CAD

4.19%

41.90 CAD

How to Save on CAD to USD Conversion Fees

Navigating the world of international transactions can be a daunting task, especially when you’re faced with the added burden of currency conversion fees. These charges, often hidden in the fine print, can quickly accumulate and take a significant toll on your finances.

As a savvy business owner, it’s crucial to understand the impact of these fees and explore strategies to minimize their effect on your bottom line. By taking proactive steps and leveraging the right financial tools, you can effectively reduce or even eliminate the cost of currency conversions.

Choose the Right Financial Products

Take the time to research and compare credit cards and bank accounts that offer low or no conversion fees. Choosing the right financial products can have a significant impact on your overall expenses.

Avoid Online Bank Conversion Services

Banks are notorious for charging fees when you convert funds directly in their web portal. However, you can often get a better rate by visiting a branch in-person or getting a hold of your specific account manager to negotiate better rates.

Take Advantage of Large Value Conversion Discounts

You can also get a better rate if you convert a larger amount at the same time. Ask your bank or FX provider if they offer discounts for large value conversions.

Use Third-Party Conversion Services like Float FX

Unlock fast, cost-effective USD ⇄ CAD conversions with market leading rates and zero hidden fees. Seamlessly move money between your accounts and make cross-border payments with ease. Get started with Float FX today!

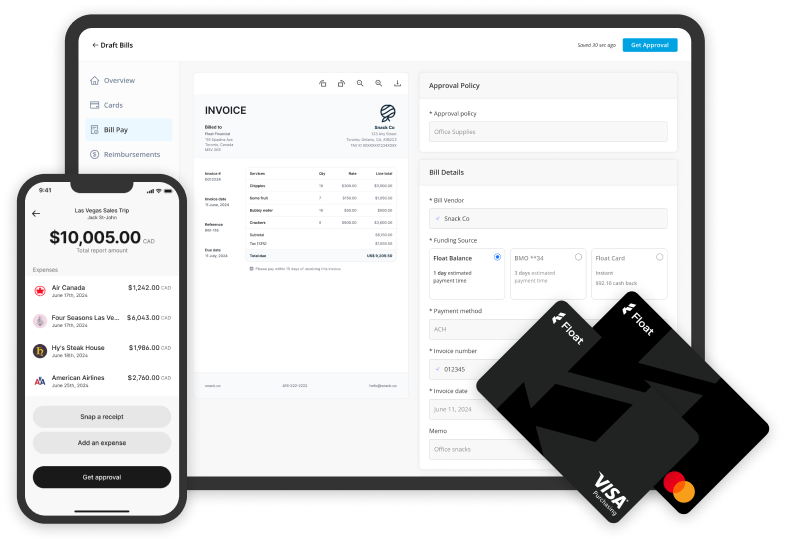

The Easiest Way to Make CAD & USD Payments

With Float you can send money internationally in CAD or USD to pay your suppliers or employees. Open a Free Float account to experience the future of global business payments.

Open a Float account

Create your Free account with Float, get approved in <24hrs and begin making payments.

Manage payees in Float

Create any number of payees in Float track their invoices and payments.

Send money in Canada, US or Internationally

Send money directly from your Float account in CAD or USD via EFT, wire, or ACH payments.

Why Are the Canadian Dollar Rates Changing in 2025?

The recent fluctuations in the Canadian Dollar to United States Dollar exchange rate can be attributed to a few key factors:

1. Trade Policy Uncertainty

The U.S. government’s announcement of a 25% tariff on Canadian imports has introduced significant uncertainty, affecting investor confidence and impacting the Canadian dollar. (Reuters)

2. Interest Rate Differentials

A widening gap between U.S. and Canadian interest rates has influenced investor behavior, with higher U.S. rates attracting capital flows into U.S. assets, thereby strengthening the U.S. dollar relative to the Canadian dollar. (Bank of Canada)

3. Commodity Price Volatility

As a major exporter of commodities, particularly oil, fluctuations in global commodity prices have a direct impact on Canada’s trade balance and, consequently, the value of its currency. (OANDA)