CASE STUDY

How Impact Kitchen saved 100+ hours a year with Float

100+ hours

Saved per year on reconciliation and admin

500+

Transactions processed every period across 150+ vendors

7 restaurants

And counting, unified under a single spend platform

THE CHALLENGE

As a multi-location business, Impact Kitchen’s small but mighty three-person finance team faced the difficult task of managing seven separate bank credit card programs. This led to constant receipt chasing and time-consuming manual NetSuite entries. Month-end close became a lengthy, error-prone process that frequently exceeded deadlines and took time away from more strategic projects. The fragmented card setup also introduced significant operational friction. With cards tied to each location’s general manager, every time a GM moved locations, it triggered a disruptive reset—forcing the team to update vendor payment details from scratch.

THE SOLUTION

Impact Kitchen needed a way to unify and simplify its fragmented spend management setup across all seven restaurant locations. Senior Financial Analyst Xavi Ysarn and Director of Finance Katherine Lei led the rollout of Float to bring everything under one platform. Each restaurant was issued a dedicated digital vendor card, along with physical cards for on-site managers, enabling consistent controls while maintaining local flexibility. Float’s automated receipt reminders, GL-code mapping and one-click NetSuite exports replaced manual processes and scattered communication, giving the head office the visibility and control it needed to manage spend seamlessly across the business.

THE RESULTS

- Cut 10+ hours of manual reconciliation every period—that’s over 100 hours saved per year

- Consolidated spend from 7 locations onto a single platform

- Retired 100% of legacy bank cards

- Streamlined exports directly into NetSuite in seconds

About Impact Kitchen

Founded in 2015 by personal trainer/entrepreneur Josh Broun and co-founder of M·A·C Cosmetics Frank Toskan, Impact Kitchen is a nutrition-focused restaurant with seven locations across Toronto and one in New York City. Through its catering arm, the company also fuels Toronto’s top athletes—from the Maple Leafs and Blue Jays to Toronto FC.

THE DETAILS

Impact Kitchen’s three-person finance team manages a wide range of responsibilities—from reporting, budgeting and forecasting to daily financial operations for the business. This includes overseeing the entire accounts payable process, spanning more than 500 transactions per period from over 150 business partners and vendors across food, beverages, packaging, operations, and software. And before Float, they were doing all of it manually.

“It was a big administrative burden,” says Katherine Lei, Director of Finance at Impact Kitchen.

In addition to vendor payments, there were also ad hoc purchases made by general managers, chefs and other leaders that required manual entry of every transaction detail—first by the employee, then again by the finance team in the accounting system. Others would just text photos of their receipts once a month to the bookkeeper, with no descriptions. “Not a smooth process for anyone—not the employee and not the finance team.”

When Senior Financial Analyst Xavi Ysarn joined Impact Kitchen in June 2024, he recalls that month-end felt like a second job. “We had to post every single transaction manually in NetSuite,” he says. “It took forever.”

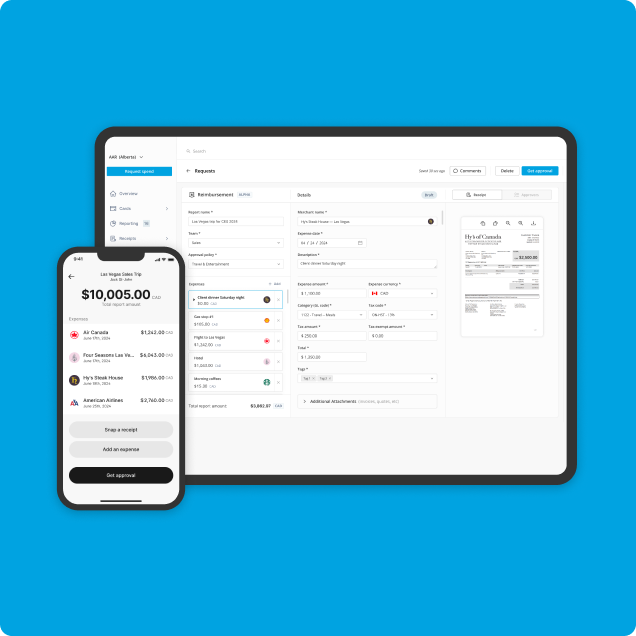

In search of a fix, Xavi found Float: a Canadian company offering a user-friendly platform for both employees and admins. Best of all, it integrates with NetSuite—automating transaction coding, reducing manual entry, and minimizing errors

Xavi teamed up with Katherine to roll Float out across all seven locations. Each location received a digital vendor card to ensure uninterrupted billing, while individual physical cards empowered managers to make purchases without using personal funds. “We removed every single other credit card and moved everyone to Float,” says Xavi.

The impact was immediate. Receipt reminders now go out automatically, sparing finance from chasing colleagues. Export rules pre-map GL codes and departments, so transactions flow smoothly into NetSuite—Xavi simply reviews and clicks “Export.”

“No matter how large Impact Kitchen scales, Float will remain an evergreen solution for us.”

Katherine Lei, Director of Finance

“We save upwards of 10 hours every period, which is so significant,” says Katherine. “It’s more than a hundred hours saved per year.”

Float reduces the operational complexity of managing a multi-location restaurant—especially when the finance team is remote. With Float, they maintain visibility and control whether working from home or any restaurant location.

The team loves that Float makes it easy to:

- Request a new card

- Request a temporary spending limit increase

- Ensure expense compliance through automated reminders

- Review GL codes before exporting to NetSuite

As Impact Kitchen continues to expand with additional locations in New York City, Xavi can also spin up USD accounts in minutes. No bank visits. No back-and-forth. No monthly fees. Just seamless cross-border spend management from a single dashboard.

For a fast-growing company like Impact Kitchen, Float delivers the structure and automation finance needs to stay agile without compromising control. It transforms a traditionally manual, messy process into a streamlined system that just works. The team is now free to focus less on reconciliations and more on driving the company’s mission to offer people nutrition-dense food that not only tastes great, but makes them feel great too.

“No matter how large Impact Kitchen scales, Float will remain an evergreen solution for us,” says Katherine.

Explore more customer stories

Learn more about Float

Get a 10-minute guided tour through our platform.

Makeship

Float provides seamless management in both CAD and USD currencies, while decreasing time spent on month-end by 60%.

Coastal Reign

Float cards are issued to a quarter of their team, providing immediate access to spend capital in order to do their jobs more efficiently.

Practice Better

“Where it took 12 days before, I can now close expenses in one or two days. It just reconciles so easily.”