CASE STUDY

How a 3-Person Team Saved 3+ Hours a Month by Switching to Float

3+ hours

saved per month by cutting reconciliation from half a day to under an hour

20 cards

issued instantly, customized to vendors + spend categories

Unlocked

efficiency with automated payments, receipt capture, seamless integrations

THE CHALLENGE

Chad had already lived the pain of traditional expense management at past companies: shared credit cards, messy spreadsheets and hours spent reconciling receipts. So when he co-founded BES+D, he wasn’t about to repeat the experience. With just three people on the team, they needed a financial tool that worked as efficiently as they did, with no extra admin or manual overhead.

For a founder wearing multiple hats, this approach wasn’t just inefficient. It also exposed the company to more risk, leaving it prone to errors and lost time. In addition, manual reconciliation created delays and left gaps in visibility. It also tied Chad up in tasks that didn’t drive growth.

Adding to the challenge, most corporate cards required a personal guarantee. That wasn’t ideal for a founder looking to separate business from personal liability. BES+D needed a solution that offered more control, less risk and a smoother path to operational maturity, without adding complexity or headcount.

THE SOLUTION

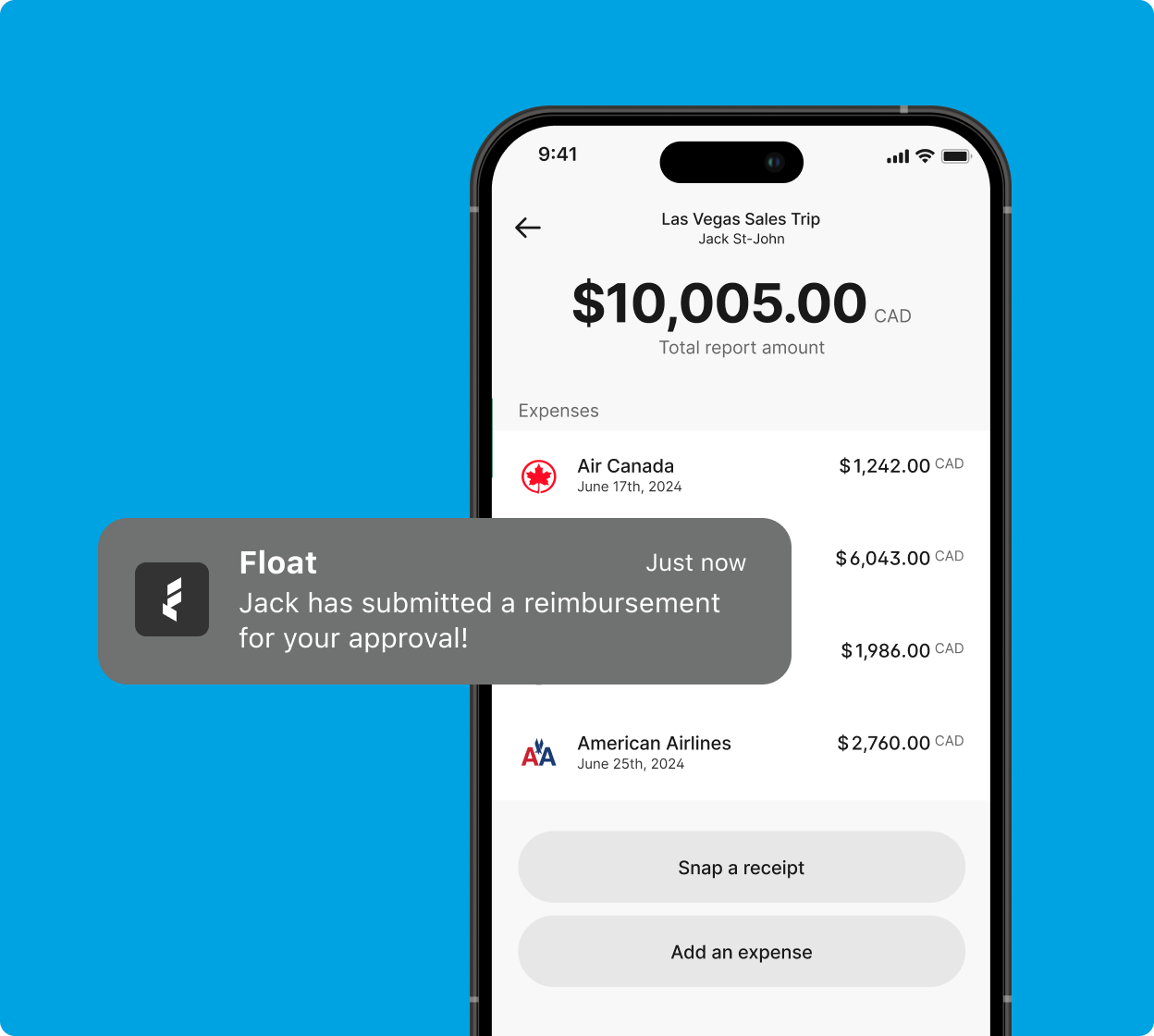

When launching BES+D, Chad looked for a modern finance solution and discovered Float. A prepaid platform purpose-built for Canadian businesses, Float offered everything his team needed: instant access to corporate cards, automated expense categorization and no need for a personal guarantee.

Even better, BES+D could get started without waiting on a bank or customer support. The company quickly issued virtual cards tied to specific vendors or purchase types, which made reconciliation faster and reduced the chance of human error. The team no longer had to pass around a single card or worry about mismatched receipts.

Float’s integration with QuickBooks Online was another game-changer. Assigning categories and GL codes directly in Float means BES+D could sync data to QBO without duplicating effort. The streamlined setu

THE RESULTS

- Expenses that once took hours now take less than an hour to reconcile

- Multiple virtual cards customized to vendors and spending categories

- Stronger internal controls without adding headcount

- No more manual expense reports or card hand-offs

About Built-Environment Signage & Décor

Built-Environment Signage & Décor (BES+D) is a small, three-person Canadian company serving clients nationwide, specializing in interior signage and visual décor for multi-unit residential buildings. Co-founded by Chad Croissant, BES+D works with design teams, project managers and building operations professionals to reduce friction in how interior signage projects are specified, coordinated and delivered.

As a distributed team with over 30 years of combined experience in building design, manufacturing and signage, BES+D brings technical expertise to a workflow-focused framework—one designed to engage project teams early, simplify coordination, align with construction schedules and target zero rework. The goal: creative signage solutions that go beyond basic compliance—contributing to environments that support people where they live.

Despite their size, this lean team runs a highly efficient operation, handling all financial operations in-house without a dedicated finance team.

THE DETAILS

When Built-Environment Signage & Décor launched, the founders knew they needed to avoid replicating the same clunky financial processes they’d seen in previous companies.

“At our previous company, which we’ve since exited, we had close to $1.5 million in sales in our best year, but we only had one corporate card that we’d end up passing around to avoid the pain of getting more,” says Chad Croissant, Co-founder of Built-Environment Signage & Décor.

BES+D wouldn’t have the manpower for an outdated approach. The company needed to sidestep the delays and inaccuracies built into manual processes and explore a more streamlined solution from the start.

Having used manual expense processes at previous companies, Chad knew how much time the company could lose chasing receipts and reconciling expenses at month-end. With a small team and big client demands, every hour counted.

“With BES+D, we’ve been deliberate about exploring next-generation best practices,” says Chad. “Fortunately for us, Float also believes there’s a better way. I’m grateful we’ve never had to deal with how difficult it could be.”

In contrast, Float’s solution is designed for speed and simplicity, ideal for a small business owner managing finance on top of everything else. The self-serve setup meant BES+D didn’t need IT support or a finance hire to get started. The platform’s intuitive interface and built-in help documentation made it easy to issue cards, set up rules and start automating from day one.

“We didn’t need to wait to talk to anyone,” says Chad. “The self-onboarding process is very well thought-out.”

BES+D was up and running within minutes using Float. The company leveraged Float’s virtual business credit cards, automated categorization and receipt capture process, seamlessly fitting into daily operations. The virtual cards give BES+D clarity into how and where funds are spent, but the real value is in flexibility and control.

“If a card gets compromised, we only need to replace one instead of rerouting an entire network of payments, which is painful,” says Chad.

Integration with QuickBooks Online sealed the deal. “We can assign codes and push it all through to QuickBooks without touching it again,” says Chad.

With virtual cards tied to vendors, recurring tools or even specific projects, BES+D could categorize spend instantly with no more guesswork or end-of-month detective work. Float’s automation meant fewer errors and faster, cleaner reporting.

“What used to take half the day now takes less than an hour. It’s done in minutes.”

Chad Croissant, Co-founder, Built-Environment Signage & Décor

Float also brought clarity to expense management. With separate cards for different vendors and services, the company has better visibility into where money is going. And because Float is prepaid, there’s no risk of overspending or unauthorized charges.

BES+D can avoid the risks of shared cards or high-limit corporate credit lines. Each card has a clear purpose and spending cap, helping the team maintain control without slowing anyone down.

Now, most of BES+D’s operational spend runs through Float. As the team starts using features like Bill Pay to leverage more consistency and tighter workflows, Chad is confident Float will continue to grow with the business.

“One of the partners at our previous firm spent hours making sure numbers matched, records made sense, and the accountant had everything they needed,” says Chad. “Without in-house bookkeeping support at BES+D, this only reinforces our appreciation for having Float in place early.”

Finance shouldn’t be a bottleneck for a lean, ambitious company like BES+D. With Float handling the back end, Chad and his team can focus on delivering standout design and signage solutions, not sorting spreadsheets.

“As a non-financial business leader, Float takes care of many things we don’t have the experience to do. It leads us through a process so we can concentrate on building the other aspects of our business.”

Chad Croissant, Co-founder, Built-Environment Signage & Décor

Explore more customer stories

Learn more about Float

Get a 10-minute guided tour through our platform.

Makeship

Float provides seamless management in both CAD and USD currencies, while decreasing time spent on month-end by 60%.

Coastal Reign

Float cards are issued to a quarter of their team, providing immediate access to spend capital in order to do their jobs more efficiently.

Practice Better

“Where it took 12 days before, I can now close expenses in one or two days. It just reconciles so easily.”