CASE STUDY

How Andgo Systems Saved $2.5K and 20+ Hours Per Month with Float

$2,500+

saved monthly by eliminating two full point solutions

100%

team adoption with virtually no training required

20+

hours saved/month on AP, reimbursements and reconciliation

THE CHALLENGE

Before switching to Float, Andgo’s finance stack relied on a patchwork of disconnected tools—separate solutions for payment processing, receipt collection, US contractor reimbursements and even transaction coding into Xero. This patchwork created friction, delays and duplication of work. Accountant Leigh Spinney spent hours each week chasing receipts, manually entering transactions and following up on approvals.

“I was chasing people for receipts every day,” Leigh says. “Sometimes I didn’t even know who made the purchase.”

Shared corporate credit cards added to the chaos, occasionally leading to the headache of replacing payment information for multiple recurring expenses across the business. With limited visibility, high tool costs and too much time spent on basic administrative functions, it was clear that Andgo needed a centralized and scalable solution.

THE SOLUTION

Andgo implemented Float to centralize their spend—from corporate cards to reimbursements—on one easy-to-use platform. This makes it simple for Leigh to code all transactions directly in Float and use custom fields to categorize spend by department or event.

THE RESULTS

- Eliminated the need for separate point solutions, including Dext and a bookkeeping firm

- Enabled the finance team to scale operations without increasing headcount

- Gained real-time visibility into expenses with custom fields and reporting

- Saved 20+ hours per month on AP, coding and reconciliation

- Delivered fast, easy employee adoption with minimal training required

About Andgo Systems

Andgo Systems is a Canadian software company that helps large organizations automate and optimize their workforce scheduling. With teams across Canada and a growing US presence, Andgo supports thousands of employees in sectors like healthcare and manufacturing, which demand robust solutions to complex staffing challenges. As a tech-forward company, Andgo values operational efficiency—both in how it enables customers to manage staff and how its team manages company spend. For Andgo accountant Leigh Spinney, that meant finding tools that could scale with a lean team and reduce the manual burden of accounts payable, employee expenses and reconciliation.

THE DETAILS

Leigh Spinney was managing all of accounts payable at Andgo when their new VP Finance, Zach Hill, introduced Float, having used it at a previous company.

“Zach had used Float before and said, ‘We’ve got to get on board with this.’ I had no choice—and I’m so glad,” Leigh says.

The timing was ideal. Leigh, who was deeply involved in day-to-day finance operations, was overwhelmed with manual processes, and Float offered a way to consolidate their finance tools while automating the most painful parts of the job.

Float now powers everything from bill payments and reimbursements to virtual cards and subscriptions. Leigh speedily codes all transactions directly in Float and uses custom fields to categorize spend by department or event, making it easy to report back to stakeholders across the company.

“We made a tag for each event. When department heads ask, ‘What did we spend on this trip?’ I can send them a report in minutes,” she says. “We stopped using three, maybe four platforms when we moved everything to Float. It’s just a dream, really.”

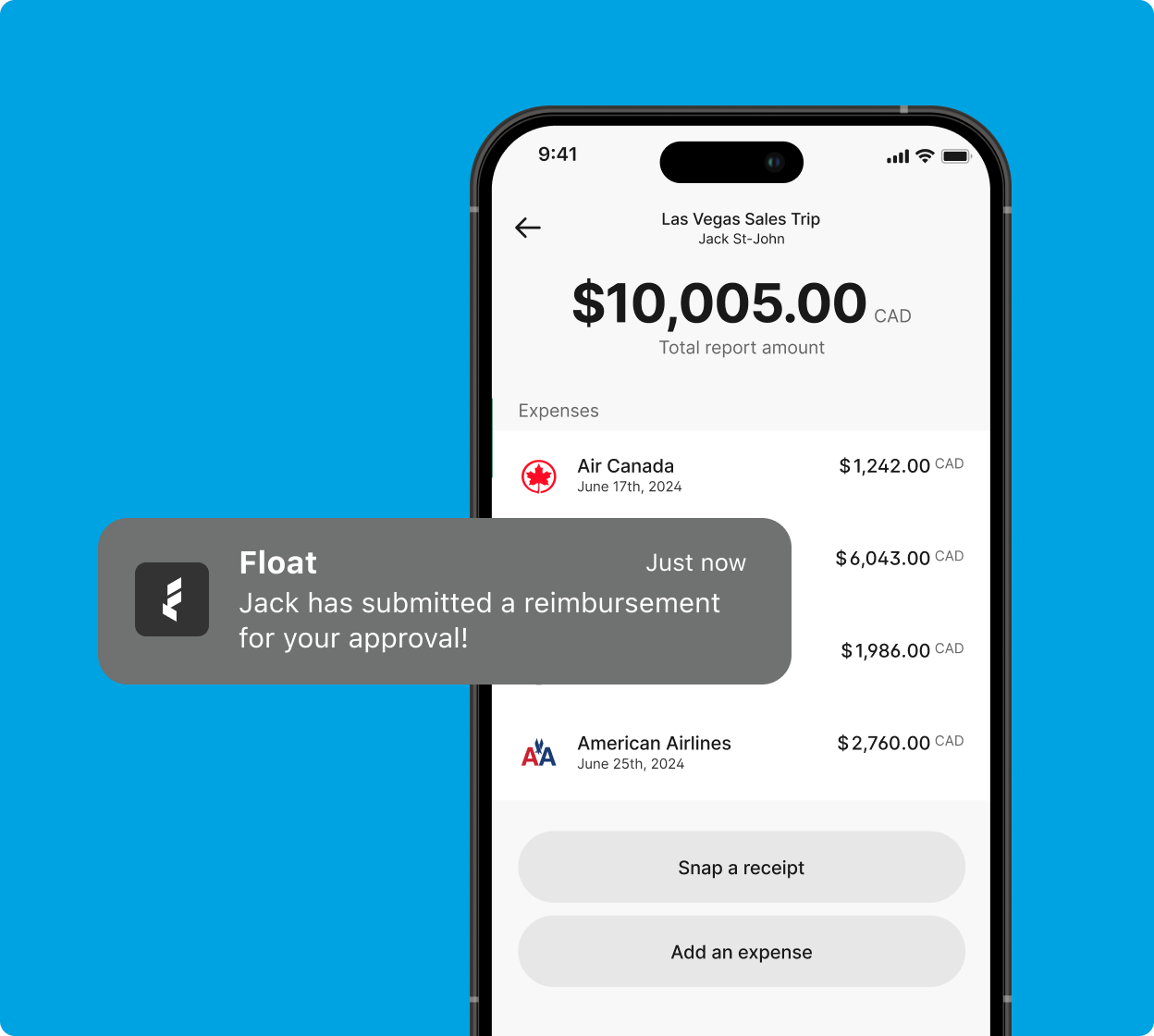

While most spending at Andgo happens on Float cards, there are still situations where reimbursements are necessary—like when a new hire makes a purchase before getting their first card or when employees use their personal vehicles. Float provided Leigh’s team with a simple way to handle these exceptions without adding friction.

“My work feels more valuable, and I can see how my contributions are helping Andgo hit our goals.”

Leigh Spinney, Accountant, Andgo

Before Float, processing reimbursements for their US staff involved navigating a complex, multi-step approval process, often requiring coordination between internal stakeholders and external contacts. It was slow, confusing, and frequently frustrating for the team.

“Reimbursements used to be a nightmare,” Leigh says. “We had too many people involved in approvals and the whole process felt like a black box. Now with Float, reimbursements are a breeze.”

Float lets employees submit expenses directly through the platform and, once approved by the appropriate manager, payments can be made in just a few clicks.

Getting staff to adopt and use Float across Andgo was also smooth. Leigh was delighted to find that her team found the platform to be so straightforward and easy to use, she didn’t need to commit much time to training. A short onboarding session for new team members was all it took—they were up and running right away with Float Cards, Reimbursements and Bill Pay.

But the best part?

Moving to Float freed up so much time that Leigh was able to expand her role, taking on AR and broader operations responsibilities. “All I used to do was AP,” Leigh says. “Now I barely even think about it.” Her scope now includes month-end close, financial statement prep, invoicing, and collections—with a noticeable drop in Days Sales Outstanding (DSO).

“My work feels more valuable, and I can see how my contributions are helping Andgo hit our goals.”

Beyond the platform itself, Leigh says the support from Float has been just as impactful. “I often tell our team that Float support is the GOAT—Greatest Of All Time,” she says. “The team is incredibly responsive, and I’ve even seen a few of my product suggestions implemented, which has been extremely helpful.”

Explore more customer stories

Learn more about Float

Get a 10-minute guided tour through our platform.

Makeship

Float provides seamless management in both CAD and USD currencies, while decreasing time spent on month-end by 60%.

Coastal Reign

Float cards are issued to a quarter of their team, providing immediate access to spend capital in order to do their jobs more efficiently.

Practice Better

“Where it took 12 days before, I can now close expenses in one or two days. It just reconciles so easily.”