CANADIAN BUSINESS SPENDING TRENDS | Q1 2024

Canadian SMBs accelerate travel spending as the economy shows signs of recovery

By Andrew Dale and Mako Cheung

Q1 2024 Canadian business spending trends reveal investments in growth and productivity

Float’s Canadian Business Spending Trends reporting provides a comprehensive analysis of business spending trends across various sectors of the Canadian economy, highlighting key areas of growth and contraction over the specified period. It utilizes data from a cross section of 1,000 Canadian SMBs to offer insights into overall economic health and investment patterns. The following charts highlight the Q1 2024 findings from Float’s Canadian SMB Insights team.

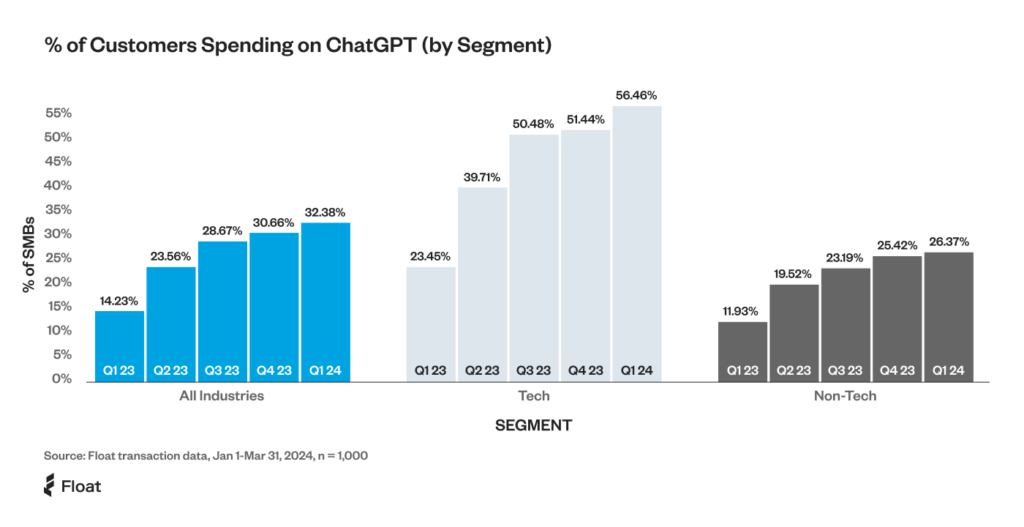

AI adoption skyrockets, doubling in 2024

The percentage of Canadian SMBs investing in ChatGPT has doubled within a single year, with subscriptions soaring from 14% of Canadian SMBs in Q1 2023 to 32% in Q1 2024.

Tech companies continue to lead other industry sectors with over 50% now subscribing to ChatGPT, a significant increase from the previous year’s adoption rate of just 25%.

Meanwhile, non-tech sectors at Float are closing the adoption gap, jumping from 12% to 26% year over year, almost reaching parity with tech companies’ adoption levels observed one year ago.

“With Canadian labour productivity at crisis levels, its encouraging to see Canadian SMBs dramatically increase their investment in AI. It’s a promising leading indicator of Canadian businesses generating more value through investments in innovation and tools that reduce manual employee tasks in favour of more high impact work.”

Rob Khazzam

CEO and CoFounder, Float

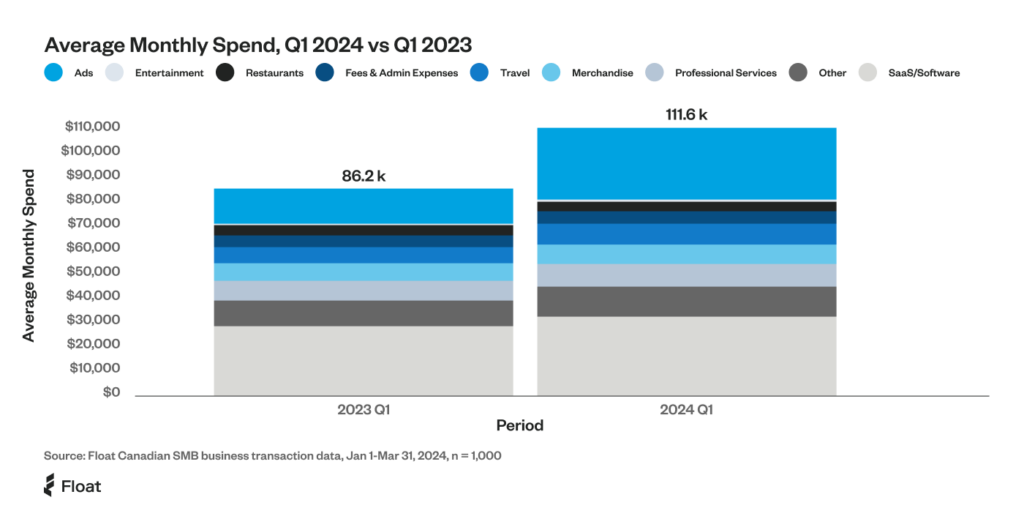

Investing in visibility: SMBs hold the line on costs while doubling advertising spend

Canadian businesses have largely retained stable spending patterns year over year, with the exception of a doubling in advertising expenditures.

This indicates a propensity to invest in areas of the business that drive growth, while maintaining spending on operational expenses such as software, utilities and travel and entertainment.

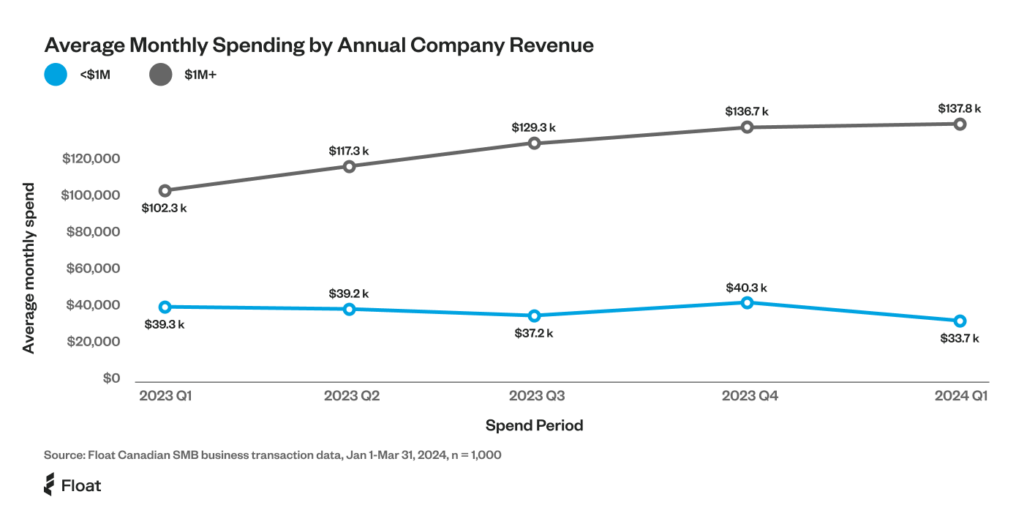

Midmarket sector shows signs of recovery while microSMBs hold spending flat

Companies with greater than $1 million in annual revenue increased spending year over year by 37%, while their smaller counterparts have kept spending levels flat over the past 4 quarters.

“SMBs are the lifeblood of Canada’s economy, and an essential part of the country’s economic recovery. We are seeing signs of midmarket and larger SMBs leading the way in investing for growth, and hope to see the microSMB sector follow suit, accelerating economic growth and ensuring a more sustainable and equitable future for all Canadians.”

Andrew Dale

SVP, Operations and Financial Products, Float

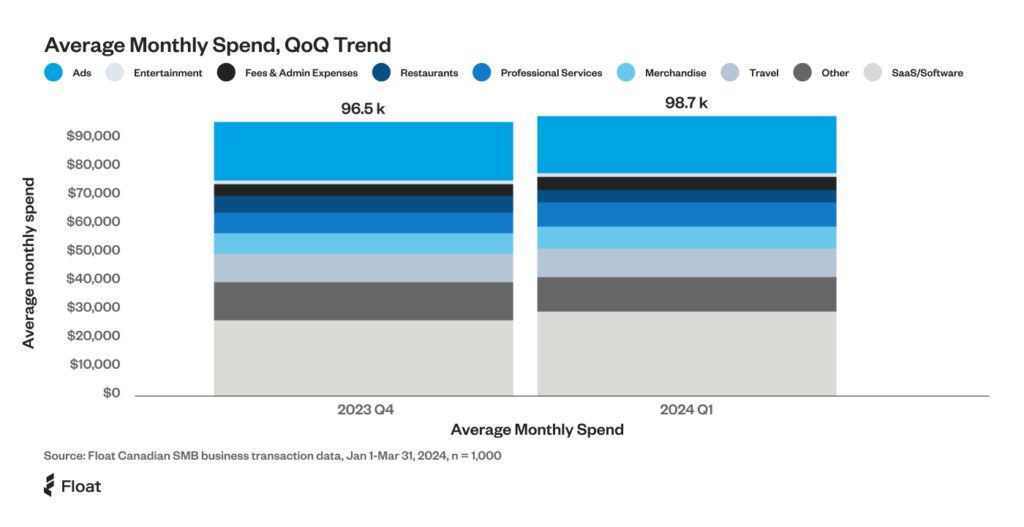

Q1 2024 sees flat spending vs. Q4 2023, amid economic caution

While overall business spending grew year over year, there has been a flattening of spend in the last 6 months, with total spending in Q1 2024 at similar levels to that in Q3 2024.

This demonstrates a continued caution in the Canadian SMB sector amidst a challenging macroeconomic climate.

About Float

Float is a business finance platform built to simplify business spending and drive savings for Canadian SMBs. For media inquiries or further information on Float, please contact Amrita Gurney at press@floatfinancial.com

For media inquiries contact press@floatfinancial.com.