Corporate Cards

Who on Your Team Should Have a Corporate Credit Card?

Get help cutting through card confusion with us breaking down how to decide who gets a card and how to protect your business.

May 23, 2025

Figuring out who should have a corporate credit card isn’t always straightforward. Should everyone get one? Just your exec team? What if your intern picks up a gift for a client?

This is where many small business owners may get stuck. And with 50% of small businesses already spending 10 to 40 hours per month on payments and reconciliation processes, adding more cards might seem like more work. However, thanks to modern tools that let you issue $0 limit cards with spending restrictions, it’s possible to empower employee spending while actually easing admin levels.

In this guide, we’ll help you cut through the confusion by breaking down how to decide who gets a corporate card and how to protect your business. We’ll also share what to look for in a business credit card management program that gives you full visibility, without creating headaches for finance teams.

Criteria for issuing corporate cards

The first step in corporate card issuance is to stop thinking about business credit cards the old-school way. You’re not handing out blank cheques or giving everyone several thousand dollars to burn through. With the right platform, every card can be customized for its purpose, right down to the dollar amount and merchant category.

So, who should get one?

Employees who frequently incur business expenses

Think client lunches, coffee runs and office supply pickups. You know, all those helpful purchases that keep clients happy, teams caffeinated and operations running smoothly. If someone regularly spends on behalf of the business, a corporate card streamlines the process and eliminates out-of-pocket costs.

Roles that require travel or client entertainment

These expenses tend to be ad hoc and time-sensitive. Instead of juggling reimbursements, give travelling employees a $0 limit card that gets funded per trip, with merchant restrictions that keep spending tight.

Positions with purchasing responsibilities

Think IT managing software subscriptions or operations staff buying supplies. In these cases, the person managing the service and completing the transaction may not be the budget owner. Assign the card accordingly.

Trusted, policy-aware employees

Even if someone’s role doesn’t scream cardholder, having the ability to request spend quickly (and within guardrails) can be a time-saver. A modern expense management solution (like Float) allows you to issue a card to every employee with significantly less risk. Limits and category restrictions ensure the tool fits the task, keeping everyone’s routine running smoothly without hiccups or frustrating delays.

The key isn’t to try to limit who gets a card, because with a better solution, anyone can have one. With the company credit card policy and frameworks in place, paired with a modern solution, all of your employees can have access to the spending they need within your guidelines.

Benefits of providing corporate cards

Trusting your team with corporate cards can feel daunting, but there are substantial payoffs ahead with minimal risk when implemented correctly. The most common corporate card benefits will positively impact your entire team.

1. Smoother expense management

Employees stop dipping into their own money, and finance stops chasing receipts like they’ve taken up detective work as a side hustle. Corporate cards and employee expense accountability combined with streamlined expense management software create a win-win.

2. Instant spend visibility

Know where your money is going while it’s going, not a month later during reconciliation. This improves forecasting, budget tracking, and overall agility and minimizes risks.

3. Happier employees

Spare your team the awkward Slack conversations about covering a flight or hotel bill on their own card or waiting a month to get reimbursed. Corporate cards remove friction and create trust.

4. Built-in rewards

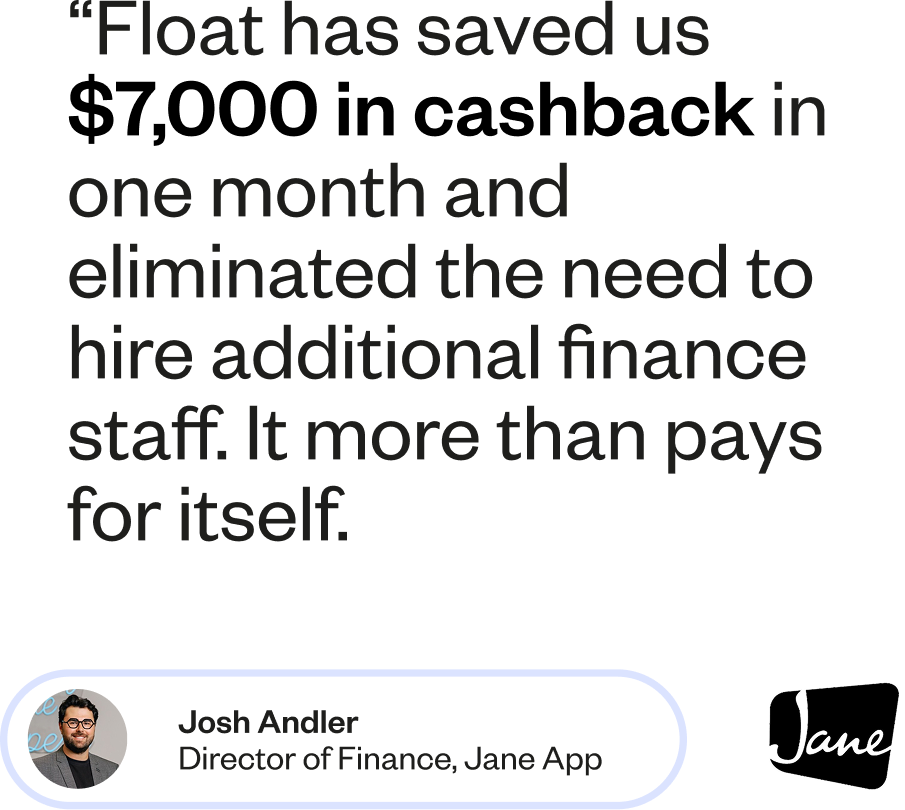

Every dollar you spend can earn cash back with Float, returning money to your business, not to someone’s Aeroplan account. Financial rewards can be a welcome cushion to buffer against ever-growing expenses.

5. Less manual work

Pre-approved spend, automated categorization, and real-time tracking are measurable corporate card benefits. These benefits lighten the load for your finance team and speed up your month-end close.

Risks and considerations

Worried someone’s going to quit and take their card on a farewell shopping spree? Totally fair, but also totally fixable. You’re not alone in these worries, but most concerns are rooted in outdated systems.

Modern platforms like Float flip that script with features that help to minimize risks of giving members of your team their own corporate cards, including:

- $0 balance cards ensure no one can spend unless you fund it first.

- Category restrictions prevent misuse (for example, a lunch card can’t be used at a spa).

- Temporary limits expire after a transaction or event, closing the window for misuse.

- Post-transaction reviews allow managers to audit spending easily, without micromanaging.

You also have more control than with reimbursements. With cards, you approve spending before it happens, not just hoping your team follows your company credit card policy and submitting corrections after the fact.

Still unsure? Float offers virtual corporate cards, onboarding support, and an implementation team to ensure you can confidently use the platform from day one.

Make expense management even easier

Streamline your business spending with automation tools built right into Float.

How to select the right program to empower employee spending and employee corporate credit cards

The best corporate card program gives you flexibility and control, so you can enable spending where it’s needed and trim time from your month-end close.

Here’s what to look for:

Finely-tuned controls

Choose a provider that lets you issue physical or virtual corporate cards with precise spending rules per person, category and transaction.

Real-time expense tracking

The faster you see spend, the faster you can act to pivot strategy, catch fraud or spot trends.

Accounting integrations

Solutions that integrate directly with Xero, QuickBooks and NetSuite (plus custom CSV exports) streamline your month-end close and reduce the need for manual entry and spreadsheet wrestling matches.

Unified platform

The fewer disconnected tools you use (cards here, reimbursements there and bill pay elsewhere), the less room there is for error, and the less time your team spends pulling reports and shuffling data around like a game of telephone.

Ultimately, you want a system that supports scale. Even if you’re starting small, issuing cards now with the right restrictions sets your team up for easier growth later.

Float: A smart solution for spending with control

Traditional views on corporate credit cards can leave businesses stuck in the past, and poorly prepared for what company spend actually looks like today.

Float offers you more freedom in business credit card management, so you can focus on how you’d like cards to be used to support your business. With the right platform, you can equip employees with the tools they need to do their jobs while keeping your budget airtight and your processes clean.

Ready to give your team spending power, without the stress? Float gives you the power to hand out cards without breaking a sweat or your budget.

Learn more about Float

Get a 10-minute guided tour through our platform.

Written by

All the resources

Corporate Cards

Corporate Card Security Best Practices for Canadian Businesses: 2026 Complete Guide

Corporate cards should streamline spending, not invite fraud. Seb Prost, CPA, shares how businesses can stay ahead with proactive security.

Read More

Corporate Cards

Discover: Virtual Credit Cards for Canadian Businesses

Explore the benefits of virtual credit cards with Float. Discover how this modern payment solution enhances security and simplifies your

Read More

Cash Flow Optimization

ACH vs EFT Payments: Key Differences for Canadian Companies

Learn the key differences between EFT and ACH payments, how they work, which options might be available to your business

Read More