In the news

US Tariffs Are Coming…Maybe: What Canadian SMBs Need to Know

As US-Canada trade tensions rise, small and medium-sized businesses (SMBs) in Canada face uncertainty about potential tariffs.

February 10, 2025

The U.S. has just announced new tariffs on steel and aluminum imports from Canada. While the more widespread proposed tariffs still remain on hold until March 4, these latest developments mean rising costs and supply chain disruptions are on the horizon. If tariffs go into effect, small businesses will feel the squeeze first. Higher costs, disrupted supply chains, and tighter margins mean that businesses need financial tools that move as fast as they do.

So many questions remain. Will tariffs actually happen? Which industries will be hit hardest? And how can your business stay resilient, no matter what?

In this article, we’ll break down what tariffs are, how they might impact Canadian SMBs and, most importantly, the proactive steps your business can take to navigate this period of economic uncertainty. You’ll learn practical strategies to mitigate risks, manage costs and keep your business agile in the face of potential trade disruptions.

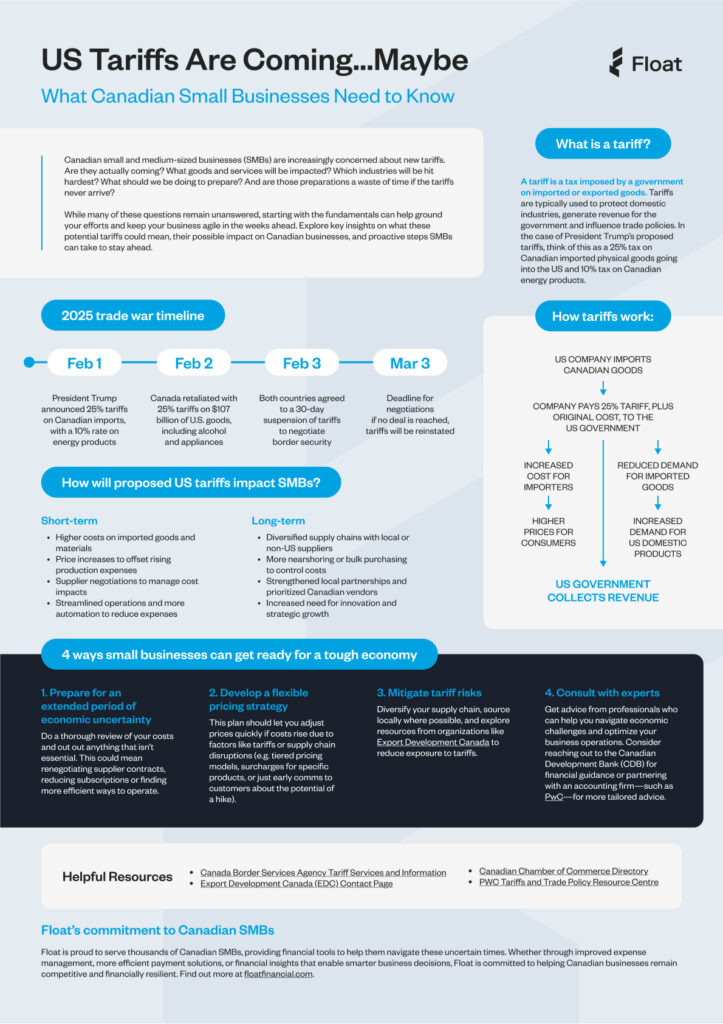

What is a tariff?

A tariff is a tax imposed by a government on imported or exported goods. These taxes are used to:

- Protect domestic industries

- Generate government revenue

- Influence international trade policies

In this case, President Trump’s proposed tariffs include a 25% tax on Canadian imported goods heading to the US and a 10% tax on Canadian energy products.

How will proposed US tariffs on Canada impact SMBs?

If these tariffs go into effect, they’ll likely result in:

- Higher costs on imported goods and materials

- Price increases as businesses offset rising production expenses

- Supply chain disruptions, forcing companies to renegotiate with suppliers

- Reduced demand for Canadian exports, as US buyers seek domestic alternatives

In the long run, this could lead to more nearshoring, diversified supply chains and a greater focus on local partnerships.

4 ways small businesses can get ready for US tariffs on Canada

Even if tariffs don’t happen, preparation is key. Here’s how Canadian SMBs can stay ahead:

1. Prepare for extended economic uncertainty

Review your expenses and cut non-essential costs. This might include:

- Renegotiating supplier contracts

- Reducing subscriptions

- Finding more efficient operational methods

2. Develop a flexible pricing strategy

Ensure your pricing can adapt to changes in costs. Consider:

- Tiered pricing models

- Surcharges for specific products

- Early communication with customers about potential price increases

3. Mitigate tariff risks

Diversify your supply chain to reduce exposure. Strategies include:

- Sourcing locally where possible

- Exploring resources from Export Development Canada (EDC)

- Partnering with multiple suppliers to avoid disruptions

4. Consult with experts

Economic uncertainty requires expert advice. Consider:

- Consulting the Canadian Development Bank (CDB) for financial guidance

- Partnering with firms like PwC for tailored advice on tariffs and trade policies

2025 trade war timeline

Stay informed with key dates in the evolving trade situation:

- Feb 1: President Trump announces 25% tariffs on Canadian imports, with a 10% rate on energy products.

- Feb 2: Canada retaliates with 25% tariffs on $107 billion of US goods, including alcohol and appliances.

- Feb 3: Both countries agree to a 30-day suspension of tariffs to negotiate border security.

- Feb 9: Trump warns of 25% tariffs on steel and aluminum imports, including from Canada

- Mar 3: Deadline for negotiations. If no deal is reached, tariffs will be reinstated.

Helpful resources

- Canada Border Services Agency Tariff Services

- Export Development Canada (EDC) Trade Support

- Canadian Chamber of Commerce Directory

- PwC Tariffs and Trade Policy Resource Centre

Float’s commitment to Canadian SMBs

At Float, we’re proud to support thousands of Canadian SMBs with financial tools that help them navigate uncertain times. Whether through improved expense management, efficient payment solutions, or financial insights for smarter decision-making, we’re here to ensure your business stays competitive and resilient.

Written by

All the resources

Cash Flow Optimization

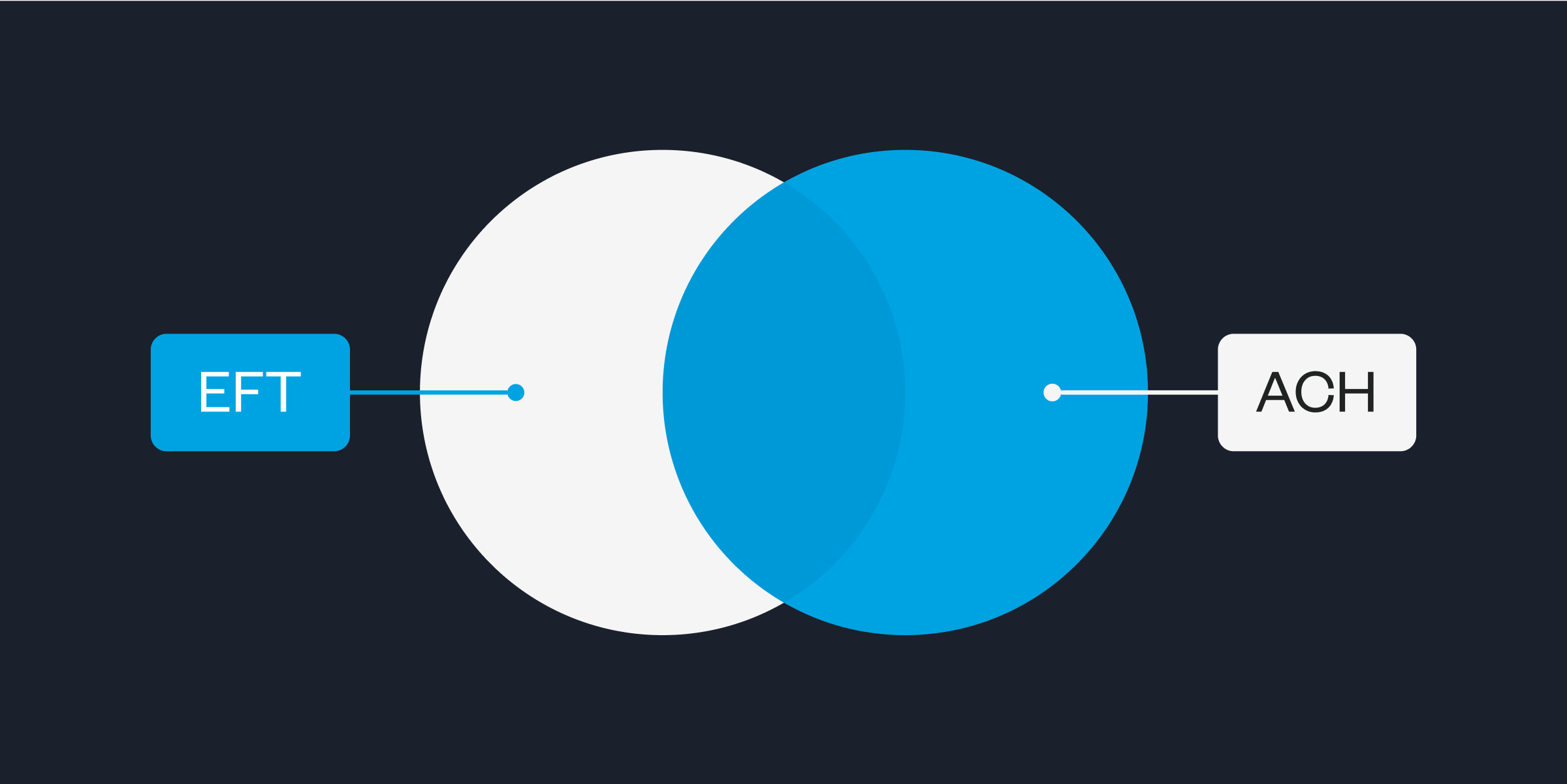

ACH vs EFT Payments: Key Differences for Canadian Companies

Learn the key differences between EFT and ACH payments, how they work, which options might be available to your business

Read More

Corporate Cards

Xero Integration for Corporate Cards: Modern Accounting Software Guide

Using Xero becomes more powerful the second you integrate it with your corporate cards. Here's what you need to know.

Read More

Float News

Float 2025: Year in Review

How Float is building the financial system Canadian businesses run on

Read More