Expense Management

Smart Receipt Management: Tips for Timely Receipt Submission on Corporate Cards

Managing corporate card receipts might not sound thrilling, but getting it right is crucial for keeping your business running smoothly.

May 2, 2025

Managing corporate card receipts might not sound thrilling, but getting it right is crucial for keeping your business running smoothly. And as your business grows, those minor issues can snowball. Month-end delays can turn into quarterly reporting issues, missed insights and poor forecasting.

Timely receipt submissions are a massive part of keeping an accurate eye on your current cash flow. This is especially true when 60% of businesses report ongoing challenges in managing cash flow, and 18% express challenges in tracking expenses and revenue, according to Canadian Western Bank. Our own SMB report found that 30% do not have good cash flow visibility and can’t accurately predict potential issues. Late submissions are a big part of this problem, slowing down month-end close while creating potential compliance risks and financial discrepancies.

On the other hand, timely expense submission helps you stay audit-ready, prevents financial surprises, and ensures you can trust the numbers guiding your business decisions.

The takeaway? Building smart habits and choosing the right tools now will save you a lot of headaches later. Let’s break down how to get it right.

Tools and tactics to streamline receipt submission

It’s time to move on from how you may have learned to handle corporate card expense reports, and technology is your best ally. Old-school methods like keeping paper receipts or manually entering data no longer cut it, especially for growing businesses.

Investing in the right tools means employees can submit receipts quickly and accurately, and finance teams can chase less paperwork. The goal is to make submission so seamless that it becomes a natural part of the spending process, rather than a dreaded afterthought.

And the best way to make the submission a natural part of the process? Make it ridiculously easy for employees.

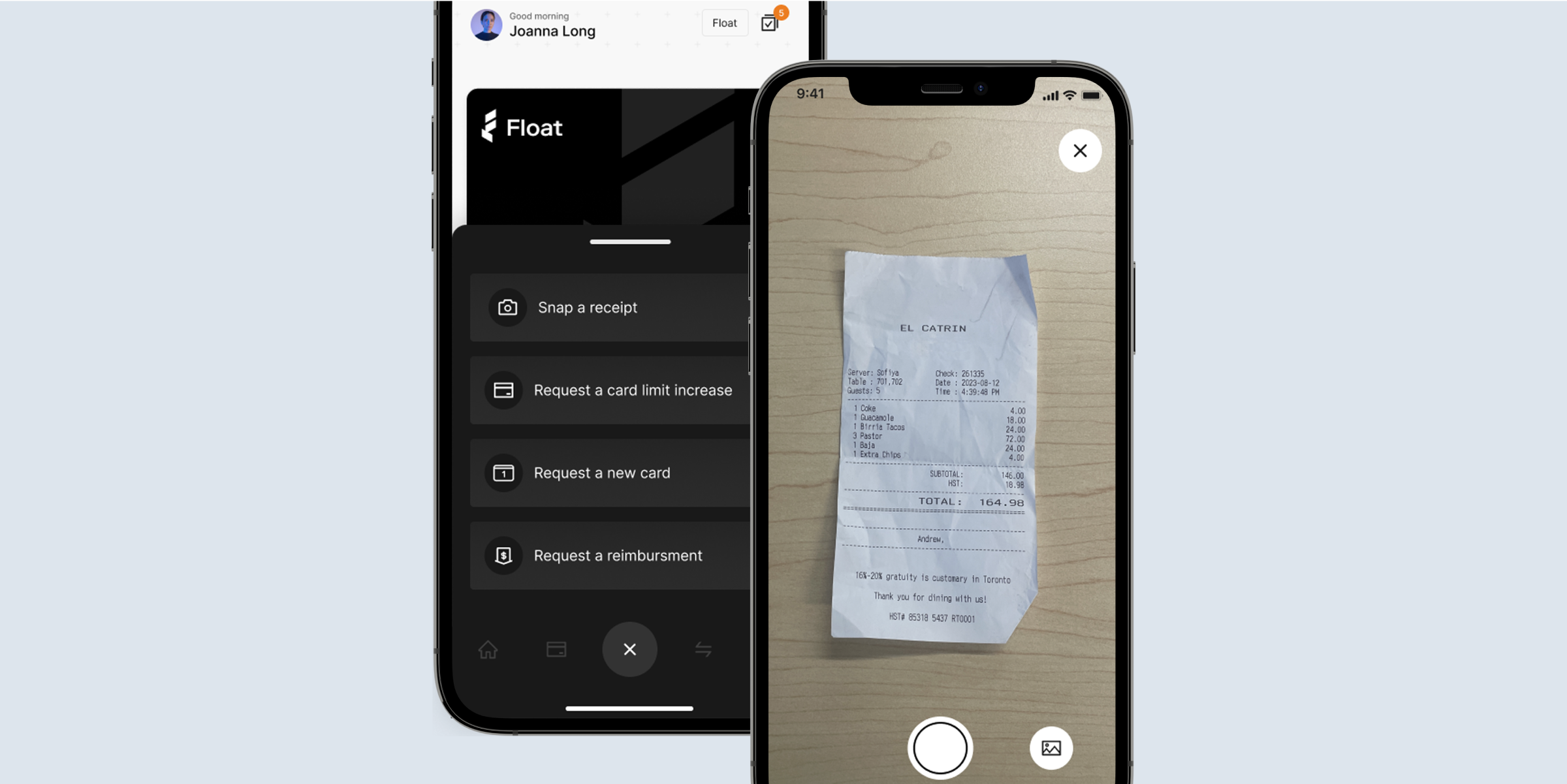

Use mobile-friendly receipt capture apps with OCR

Optical Character Recognition (OCR) technology turns a quick photo into usable data. No more manual entry. Mobile apps that instantly capture and categorize receipts mean employees can snap and submit a receipt seconds after paying, from anywhere.

Real-time prompts help ensure nothing gets forgotten in a car console or laundry cycle. Plus, OCR reduces human errors and ensures the information logged is accurate, minimizing reconciliation issues later.

Implement digital receipt management tools

Tools that automate and organize receipts are game-changers. Good platforms don’t just store photos; they categorize expenses, match them to transactions and allow finance teams to review instead of manually processing every entry.

Digital receipt management tools also maintain a digital audit trail, which speeds up and simplifies compliance checks. Advanced platforms offer customization so businesses can collect project codes, client names, and departmental data at the point of spending, not after the fact.

Set up automated reminders and notifications

Even with great tools, people sometimes need a nudge. Automated notifications (like push notifications or email reminders) help employees stay on top of receipt submissions, so you don’t need to chase them down manually.

These timely prompts and notifications reduce excuses and employees ducking when they see you coming down the hall. Even better, they help everyone build healthier submission habits.

Bonus: it’s a lot more effective than Post-it notes, email chains or your colleague’s famous “Oh yeah, I’ll send that later” promise.

Float’s real-time receipt capture solution, smart reminders and customizable policy enforcement (including the ability to pause cards for missing receipts) remove the friction of managing spend compliance. Smart automation supports your team with no awkward follow-up conversations or convoluted email threads.

Make expense management even easier

Streamline your business spending with automation tools built right into Float.

Create a strong policy framework

Even the best tech won’t fix a broken process. A clear corporate card policy ensures everyone knows what’s expected and removes any ambiguity that could cause friction later.

An expense policy isn’t just a boring document your team signs once and never reads again. Done right, it’s like a user manual for spending—clear, consistent and blessedly drama-free.

To create a strong framework, you need to ensure that you:

1. Establish clear guidelines with submission deadlines and consequences

Set firm expectations about how quickly employees must submit receipts, whether immediately after the purchase, within 24 hours or by the end of the week. Make it crystal clear what happens if their submissions for corporate card expense reports are late or missing.

(Hint: Those messages about paused cards get people’s attention fast). Without consequences, policies become optional and compliance crumbles.

2. Communicate policies company-wide and ensure accessibility

It’s not enough to create an expense policy and bury it in a forgotten folder. During onboarding, make sure every employee receives corporate card training. Host refresher sessions annually or whenever policies change. Keep the policy easy to find and understand. Plain language beats legalese every time.

3. Encourage accountability with feedback loops and recognition programs

Acknowledge the teams or individuals who stay consistently compliant. A little positive reinforcement can drive strong habits. For those who slip up, use insights from your expense management platform to flag missing receipts automatically with no judgment and no nagging—just clear visibility. In time, compliance becomes second nature.

Why receipt submission policies matter more as you scale

Scaling a business without scaling your finance processes is like duct-taping your bumper to your car and hoping for the best. Sure, it’ll hold for a while, but not forever.

Small businesses often manage a few cardholders informally. But as you add employees, vendors and spending categories, those informal processes crack under pressure.

Scaling a business without scaling your financial controls leads to:

- Delayed financial closes that impact strategic decisions

- Increased risk during audits because of incomplete or missing documentation

- Disconnected systems that require manual, time-consuming reconciliations

- Frustrated finance teams bogged down in detective work instead of analysis

Getting a strong corporate card receipt management system in place early protects your business’s financial health, allowing you to grow and stay competitive. You’ll be able to pivot faster, manage budgets more effectively, and operate without financial hesitation.

Float: Smart automation for smooth receipt submissions

Timely expense submission might seem like a small matter, but it has a massive impact on your financial health, compliance and growth readiness. Finance teams shouldn’t have to moonlight as private investigators. When submission is easy, compliance isn’t a battle. It’s just how things work.

Choosing the right tools, creating a strong policy and removing friction for employees make it easier for everyone to stay on track. You and your finance teams can move out of reactive mode and into strategic leadership.

Float can take the pain out of corporate card receipt management with receipt capture solutions that work for you and your teams. With real-time prompts, automated enforcement and smart spend tracking, you’ll spend less time chasing receipts and more time moving your business forward.

Written by

All the resources

Corporate Cards

Corporate Card Security Best Practices for Canadian Businesses: 2026 Complete Guide

Corporate cards should streamline spending, not invite fraud. Seb Prost, CPA, shares how businesses can stay ahead with proactive security.

Read More

Corporate Cards

Discover: Virtual Credit Cards for Canadian Businesses

Explore the benefits of virtual credit cards with Float. Discover how this modern payment solution enhances security and simplifies your

Read More

Cash Flow Optimization

ACH vs EFT Payments: Key Differences for Canadian Companies

Learn the key differences between EFT and ACH payments, how they work, which options might be available to your business

Read More