Expense Management

Top 6 Reimbursement Solutions for Canadian Companies

Don’t let an out-of-date reimbursement solution slow you down. Here are six options that bring your business to the modern age.

April 29, 2025

We live in a technological age, but not every part of business has caught up—especially reimbursement solutions. This area can quietly drain your team’s time, money and resources because it’s often handled manually.

You’ll end up with error-prone spreadsheets that waste your team’s time to review, delay your month-end close and ultimately lead to inaccurate financial forecasting. Sounds like a good time, right? Nope!

But reimbursement doesn’t have to be like that. A modern reimbursement solution isn’t just for collecting and organizing receipts anymore. It’s a critical part of operational efficiency, financial control and expense management. However, not all financial management software offers the same capabilities for expense tracking.

This article will highlight key considerations for Canadian businesses looking to automate expenses and share the top six reimbursement solutions.

Understanding expense reimbursement solutions

What are reimbursement solutions?

Reimbursement solutions are a key component of expense management software. These tools help businesses track, manage and reimburse employees’ out-of-pocket expenses while reducing the time spent on manual data entry and paperwork. They improve accuracy, speed up reimbursements and help finance teams run more efficiently.

How expense tracking software simplifies accounting

Modern expense tracking software streamlines the entire expense cycle, providing complete visibility into each stage:

- Tracking: Monitor when an expense was submitted, approved and paid

- Submission: Capture and organize receipts and expense details

- Approval: Identify who approved an expense and where delays occur

- Payment: Track when reimbursements are issued

This visibility improves communication, reduces errors, and strengthens business expense controls across your organization. It also frees up your finance team to spend less time chasing receipts and more time on higher-value tasks (because no one went into finance to become a professional receipt detective).

Features and key considerations when choosing expense management solutions

When evaluating expense tracking software in Canada, prioritize more than just basic tracking. Look for solutions that offer:

1. Mobile receipt capture

Receipts are fragile and easily lost. Mobile capture allows employees to submit, track and manage expenses directly from their smartphones, while automated workflows ensure approvals move smoothly without bottlenecks. A good mobile-first experience can drive higher adoption and eliminate friction for your team, helping you stay compliant with your expense reporting policy.

Make expense management even easier

Streamline your business spending with automation tools built right into Float.

2. Accounting integrations

Great financial management software integrates with popular accounting tools like QuickBooks and Xero, automatically syncing expense data to reduce manual entry and errors. This keeps your financial records accurate and streamlines your month-end close. Fewer manual touchpoints also mean less risk of human error, which is crucial for auditability and compliance.

3. Scalability and ease of use

Your financial management software should evolve as your business grows. If it can’t scale with you, you may face costly and disruptive migrations later.

Ease of use is just as important—who wants to use a platform that feels impossible to navigate? If the platform is confusing, adoption rates will suffer and you risk wasting your investment. Look for an intuitive interface that supports quick employee onboarding and enables self-service for basic tasks.

4. Security, data privacy and customer support

Expense management software handles sensitive financial data. Prioritize solutions that offer strong encryption, comply with Canadian privacy standards and provide responsive customer support. It’s essential to be able to get help quickly if you run into any issues.

Top 6 expense management solutions

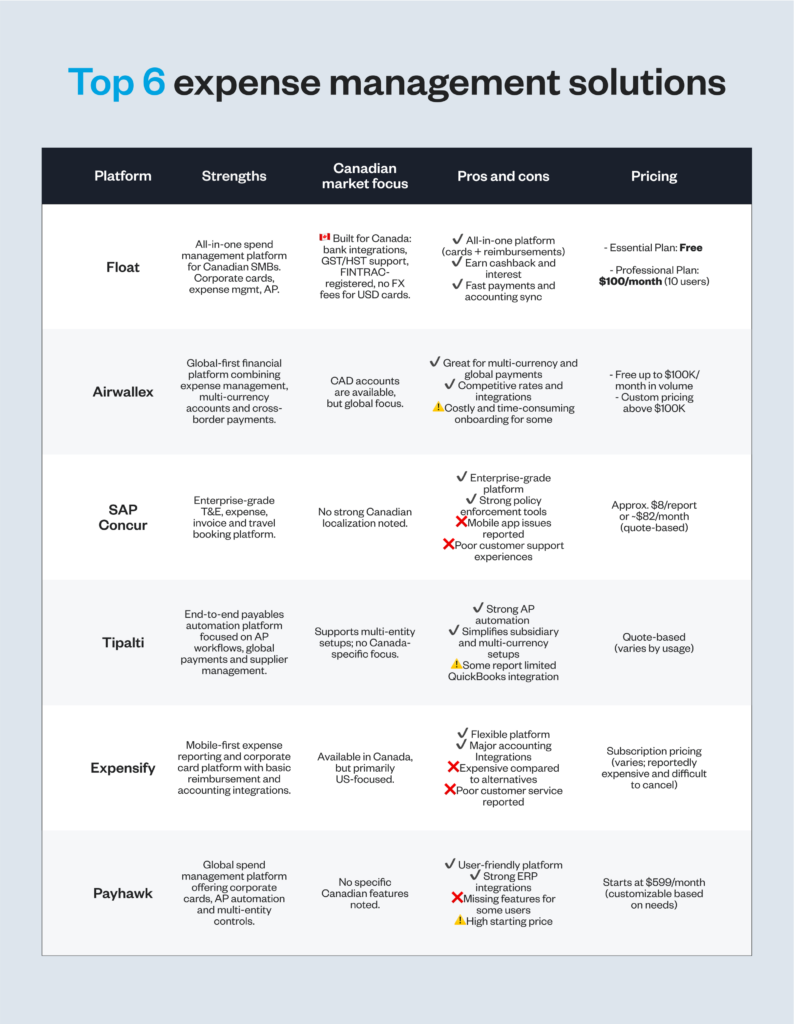

Choosing a modern reimbursement solution is a smart move. As an SMB, finding the best expense tracker for your business can also streamline your processes and boost team morale. But with so many options on the market, each with different features, pricing, and market focus, it’s crucial to find the right fit, especially for Canadian businesses.

Here’s a comparison to help you navigate the top choices:

Moving forward with the right tools

Manual expense reports are inefficient and costly. Adopting the right expense management solution can save your business valuable time, reduce human error and strengthen your overall financial controls.

While reimbursements are an important part of employee expense management, they should ideally be the exception—not the norm. For ultimate visibility and better control, the majority of spending should flow through corporate cards that are centrally managed by the finance team. Then, reimbursements are best reserved for occasional, unavoidable out-of-pocket expenses. Your expense management solution should seamlessly support both corporate card transactions and reimbursements within a unified workflow.

Canadian companies looking to modernize should choose software that supports scalability, easy integration, intuitive use, and strong security—now and for future growth. Float is a smart choice for those ready to move beyond manual processes. Designed for Canadian businesses, it unifies employee reimbursements, corporate cards, and real-time accounting in one powerful platform. Book a demo today!

Written by

All the resources

Cash Flow Optimization

ACH vs EFT Payments: Key Differences for Canadian Companies

Learn the key differences between EFT and ACH payments, how they work, which options might be available to your business

Read More

Corporate Cards

Xero Integration for Corporate Cards: Modern Accounting Software Guide

Using Xero becomes more powerful the second you integrate it with your corporate cards. Here's what you need to know.

Read More

Float News

Float 2025: Year in Review

How Float is building the financial system Canadian businesses run on

Read More