Corporate Cards

A Better Way to Manage your Company Subscriptions with Float

Learn how to audit and manage your company software subscriptions with Float

January 30, 2024

As teams adopt more and more software tools, you can imagine how often auto-renewal payments get mixed in with other charges on your corporate cards and go unnoticed.

A recent study found that most companies spend approximately $10,000 per employee per year on software subscriptions. 😯 With this amount of money being paid out to vendors on an annual basis, there’s a huge risk of missing questionable charges, hidden fees, or price increases.

Pro tip: Looking at a list of your subscriptions is one of the best places to find cost savings! 💲

As a best practice, we recommend reviewing big ticket vendors and purchases regularly. Start by doing the following:

👍🏼 Ensure tools and platforms are being used

👀 Look for ways to control costs

💵 Set a budget and stick with it

Let’s go over how to review your current subscriptions to help you achieve greater accountability, transparency, and autonomy over company spending.

Step 1: Make a list of your subscriptions ✏️

- Create a spreadsheet listing all of your subscriptions, and be sure to include the team owner, cost, plan type and payment frequency and update it throughout the year

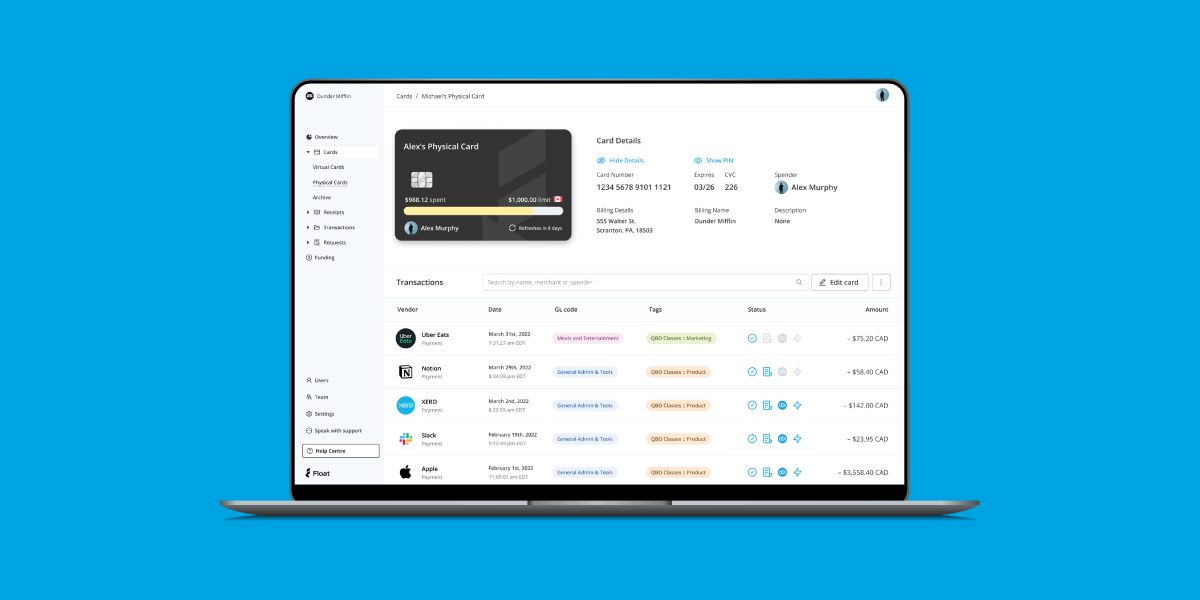

Step 2: Set up a virtual Float Card by vendor 💳

- To make subscription payments easier, Float allows you to set up an unlimited number of virtual corporate cards for your vendors, which allows you to:

- Assign daily, weekly, monthly, and yearly card limits

- Instantly pause or cancel cards

- Request and approve card top-ups

- Automatically capture receipts and match to transactions

- Track spending in real time

Step 3: Automate your subscription spend monitoring 🤑

- Using Float’s Savings Insights to get monthly suggestions on how to save money on your company’s software spending and notifications of any unexpected billing increases, or double charges.

- Monitor spending using our Reporting feature, to track spend trends over time and spot anomalies as they happen

Subscribe to Float’s management method 👀

There’s no doubt that we all love subscriptions – shoutout to Netflix! 🍿 When it comes to your business, they serve as a convenient way to pay for some pretty cool tools that support your day-to-day operations. But we also recognize that it can become overwhelming to manage these expenses at times. Luckily, Float’s virtual corporate cards can help. By assigning a virtual card per vendor, you’ll be able to stay on top of your monthly purchases and save money along the way. 🤩

To learn more about our smart spend software and how we can help you improve the way you manage your company’s subscriptions, book a demo with us today! Our team is happy to walk you through all of our incredible features.

Written by

All the resources

Corporate Cards

Corporate Card Security Best Practices for Canadian Businesses: 2026 Complete Guide

Corporate cards should streamline spending, not invite fraud. Seb Prost, CPA, shares how businesses can stay ahead with proactive security.

Read More

Corporate Cards

Discover: Virtual Credit Cards for Canadian Businesses

Explore the benefits of virtual credit cards with Float. Discover how this modern payment solution enhances security and simplifies your

Read More

Cash Flow Optimization

ACH vs EFT Payments: Key Differences for Canadian Companies

Learn the key differences between EFT and ACH payments, how they work, which options might be available to your business

Read More