Expense Management

How Do You Reconcile Corporate Card Statements Efficiently?

Improve your credit card reconciliation process to manage spend, catch errors and stay audit-ready with these tips.

April 25, 2025

Credit card reconciliation feels deceptively simple—until it isn’t. Most business owners and finance leaders know expenses should match what’s in the books, but that’s not always true.

Corporate credit card reconciliation can be particularly tough for small-to-medium-sized businesses and startups, where processes aren’t always clearly defined. But it doesn’t have to be that way.

Wondering how to do credit card reconciliation without giving you or your finance team a headache? In this article, we’ll answer all your most pressing questions around this topic, with industry expertise from Erika Dowell, CEO of Signal Operations, a Canadian bookkeeping and accounting company.

What is credit card reconciliation?

Simply put, credit card reconciliation is “a matter of taking the bank statement and matching it to your accounting files or bookkeeping files,” says Dowell. “The point of reconciling is to make sure that what the credit card company says you’ve spent is the same as what you’ve recorded in your books.”

Why does credit card reconciliation matter?

Reconciling your corporate cards is essential if you want to maintain:

Control over your cash flow

Credit card reconciliation lets you monitor your corporate spending and identify alarming trends before they escalate.

Oversight of corporate expenses

It’s easier to prevent employees from exceeding travel limits or submitting personal restaurant receipts when you’re on top of what’s being spent. This oversight also means you’ll catch credit issues before you sink hundreds into something—think charges for outdated software and subscriptions that should have been cancelled after a trial.

Audit readiness

Staying on top of reconciliation also keeps you ready for any surprise audits. “The biggest mistake I see in credit card reconciliation is that people think the source document is the bank statement,” says Dowell. “But the CRA could look at a meal expense and deem it a personal expense if you don’t have the itemized receipt to support it.”

How to prevent operational blind spots with credit card reconciliation

According to Dowell, problems tend to surface when businesses begin handing out corporate cards in a more widespread way, “especially in larger organizations where multiple people are using credit cards, but maybe don’t understand the importance of keeping source documents.”

To prevent operational blind spots, ensure that:

- Employees know (and remember) to keep receipts and invoices

- You have a strong expense policy guide that clarifies everyone’s role in the process

- There’s a high level of oversight in your credit card reconciliation process

What’s at stake?

Most business owners are so busy running the company that it’s hard to find time to manually match transactions and receipts. Finding an employee who knows how to reconcile credit cards can take time, too. But when corporate card reconciliation slips, you risk:

Tax errors and misstatements

Without receipts, tax auditors may void entire categories of expenses, creating significant tax burdens, especially for small businesses. Dowell has seen it happen: “They went from $30,000 of net income to $100,000 of net income—taxable income—which is a significant increase in taxes owing.”

Overspending and fraud

If you aren’t actively reconciling credit card spend, you’ll likely see spending increase over time, and not on things that are necessarily business critical—especially if multiple employees have access to credit cards.

“You’re going to start to see a direct impact on cash flow,” says Dowell. “That will impact every other part of your business.”

Cash flow surprises

Dowell once worked with a business client who was a few years behind on their taxes. As they went through the client’s expenses, the client discovered that they’d spent $45,000 on software in a single year, including trials they’d intended to cancel.

“That particular entrepreneur just didn’t know where their money was going,” she says. “Now they can make different business decisions.”

How to reconcile your corporate card spend

If you’ve been wondering how to do credit card reconciliation, here’s what Dowell recommends.

- Collect your credit card statements

- Gather all your receipts and other source documents

- Match your source document to the corresponding line item on your credit card statements

- Identify any leftover line items without source documents

- Contact the employee who made the purchase and ask them for the source document

Note: For online purchases, Dowell highlights the importance of tracking who’s receiving email receipts. “It’s sometimes hard to know who to email, but ultimately it’s the cardholder’s responsibility to keep the source document,” she says. “And depending on the company’s policies, if the cardholder isn’t able to produce it, then they’re potentially liable for that expense.”

When to automate with credit card reconciliation software

If you’re considering automating your credit card reconciliation, there are four main signs:

- The number of employees with credit cards has increased to a level where the reconciliation process has become too difficult or time-consuming

- It’s taking longer to manage your month-end

- Employees are regularly missing or losing their receipts and other source documents

- Administrators are spending too much time chasing employees for receipts and other source documents

Credit card reconciliation software can ease administrative work, enforce spending limits, send receipt reminders, flag unusual spending patterns and more.

“Software could very quickly highlight a parking transaction without a receipt attached to it, and you’d need to review that,” says Dowell. “It can detect a transaction with a matching receipt and ensure that it’s not just a garbage receipt for a thousand dollars. Credit card reconciliation software can even highlight a thousand-dollar transaction that’s higher than it typically is.”

Make expense management even easier

Streamline your business spending with automation tools built right into Float.

The bottom line

If you’re a business owner, credit card reconciliation might feel like a trivial task. Early-stage entrepreneurs might wonder, “what is credit card reconciliation, anyway?,” but be too embarrassed to ask. Either way, neglecting it can have big operational consequences like blown budgets, tax risks and lost productivity.

But when it’s done well?

It can help control spending, strengthen forecasting and build healthier finance habits across your entire organization.

How Float can help

At Float, we love helping businesses save time, money and frustration with automation and real-time spend controls. Whether your business uses one corporate card or twenty, our automated expense management platform offers headache-free reconciliation and expense policy enforcement.

Want to learn more? Get in touch to find out where Float fits into your operational workflow.

Written by

All the resources

Cash Flow Optimization

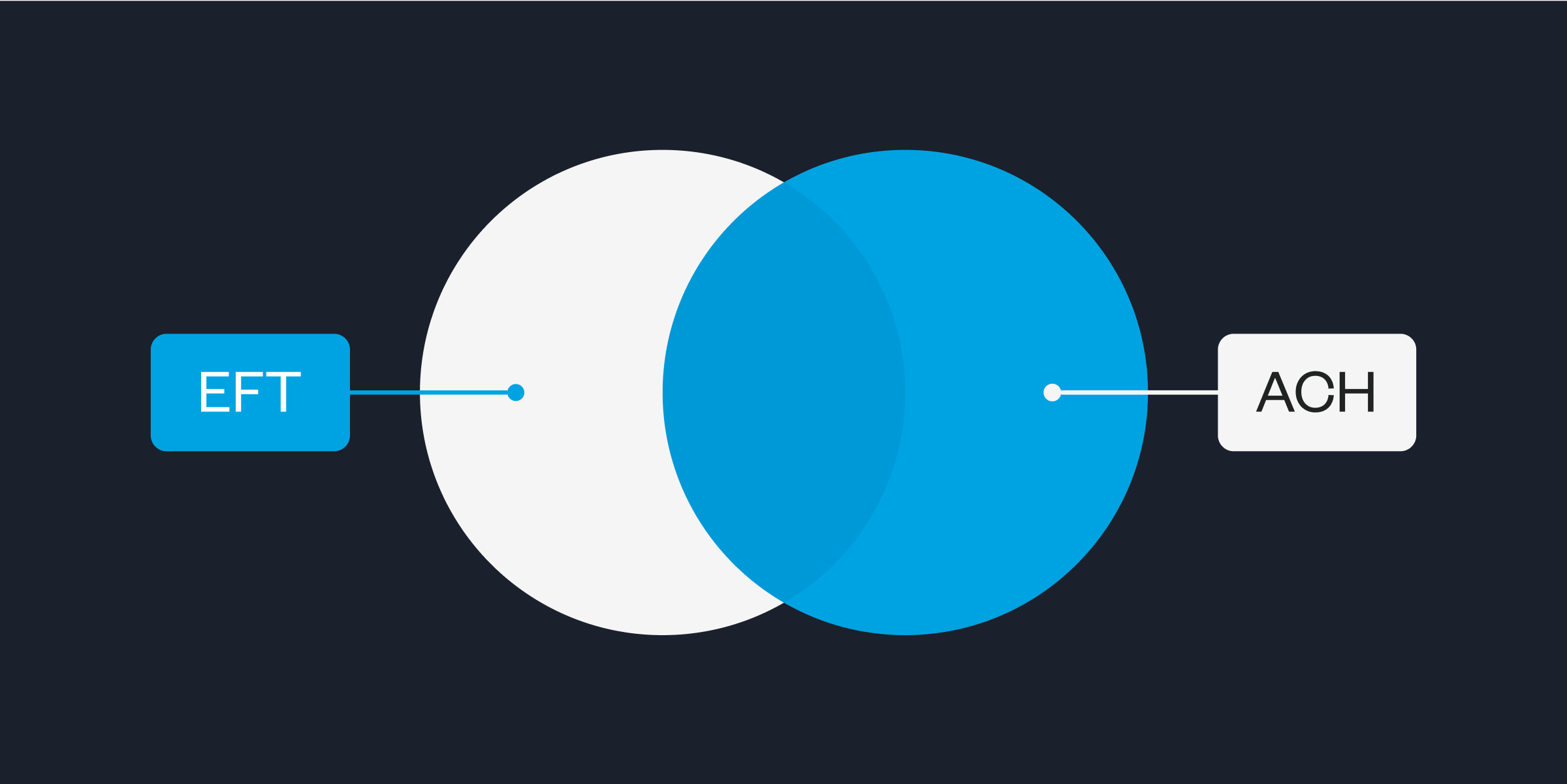

ACH vs EFT Payments: Key Differences for Canadian Companies

Learn the key differences between EFT and ACH payments, how they work, which options might be available to your business

Read More

Corporate Cards

Xero Integration for Corporate Cards: Modern Accounting Software Guide

Using Xero becomes more powerful the second you integrate it with your corporate cards. Here's what you need to know.

Read More

Float News

Float 2025: Year in Review

How Float is building the financial system Canadian businesses run on

Read More