Cash Flow Optimization

How to Read Your Business Cash Flow Statement

Master cash flow statements with our how-to guide. Learn to analyze this important business finance document to make informed decisions and drive success.

March 17, 2025

Your cash flow statement can provide precious insights about the health of your business and give you the information you need to make strategic financial decisions. But for small business owners who don’t have an accounting background, reading financial statements can feel like decoding ancient Egyptian hieroglyphs. Creating them can be just as confusing. To get value out of your cash flow statements, you need to know when to use them and how to analyze them.

In this guide we go beyond the basics of what is business cash flow. We’ll cover how to prepare a cash flow statement, illuminate the nuances of direct vs indirect cash flow statement methods and take a look at a cash flow statement example so you can read your own like a pro.

What is a cash flow statement?

A cash flow statement (CFS) summarizes the inflow and outflow of cash in your business over a specific period of time, usually a month. It tells you how much operating cash you have on hand to spend. This cash contributes to your business’ liquidity—your ability to pay bills and debts, also known as liabilities, with cash or the current assets you own. Along with the income statement and balance sheet, it’s one of the three core financial statements that businesses are required to generate.

Who prepares cash flow statements?

We hate to break it to you, but every small business owner should know how to either prepare or read a cash flow statement. It can give you a serious edge when you’re making business decisions. If you have a bookkeeper, they can prepare your CFS and give you insights about how your cash flow is doing. In larger companies, the accounting team is usually responsible for creating cash flow statements as part of quarterly or annual financial reporting.

Why creating a cash flow statement is important for your business

Managing cash flow is the cornerstone of strong operations. If you don’t have enough cash, you can’t cover your regular bills, or pay yourself or your employees. About 54% of new small- and medium-sized businesses (SMBs) in Canada experience cash flow issues and two-thirds of SMB owners agree it’s important to improve cash flow management efficiency.

Creating and analyzing your cash flow statements on a regular basis gives you insight into how well you’re managing cash and whether you’re striking a healthy balance between your investments and your cash on hand.

Understanding your cash flow statement can help you assess whether you’re generating enough cash to cover your regular operating expenses. If you’re struggling with cash flow, it may be time to seek out a loan or find ways to cut costs.

Looking at your cash flow over time can help you determine whether your financial strategy will work for your business in the long run. It can also help you figure out whether you’re ready to invest in the next stage of growth and provide a starting point for your financial strategy for expansion efforts, like hiring more team members or buying materials for a new product line.

How to prepare a cash flow statement

There are two main approaches you can take to generating your CFS: the direct method and the indirect method. Understanding the direct vs indirect cash flow statement methods can help you determine which one is the right fit for you and your business—one of them is definitely the better option for growing businesses (and busy owners), but we’ll let you decide.

Cash flow statement direct method

The cash flow statement direct method requires you to keep a record of every single time cash leaves or hits your bank accounts during the reporting period. When you’re ready to prepare the CFS, you subtract the total cash spent from the total cash earned.

If you’re using the direct method, it’s important to accurately identify cash inflows and outflows. For example, outstanding invoices in your accounts payable (AP) or accounts receivable (AR) don’t count towards your cash flow because you haven’t actually sent or received that money yet.

You also don’t need to list individual purchases made with your credit cards or revolving line of credit as part of your cash outflows. You only need to include the payments you make from your bank account when you pay down the balance.

Frankly, the direct method can be pretty tedious and lead to headache-inducing data entry errors. It works well if you don’t have frequent cash inflows and outflows, so it’s a better option for freelancers or sole proprietors. Bear in mind that even if you calculate your cash flow using the direct method, you need to use the indirect method to reconcile the CFS with your income statement.

Cash flow statement indirect method

The cash flow statement indirect method requires you to pull up your income statement, where you’ll find your net income—your business’ bottom line. That number is your starting point. Then, you’ll need to make adjustments to the transactions listed on your income statement balance sheet that don’t truly reflect the movement of cash into and out of your bank accounts.

Using the cash flow statement indirect method is more technical than the direct method. If you have a bookkeeper or accountant, this is likely the method they’ll use. If you want to get hands on with your finances as a small business owner, learning the indirect method can save you some time and effort when you’re generating a monthly, quarterly, or annual CFS yourself.

How to read a cash flow statement

Maybe your bookkeeper just emailed you your first official cash flow statement. Perhaps you’re feeling ambitious enough to try out the indirect method of calculating last month’s cash flow for yourself. Either way, congratulations are in order: prioritizing expense management and getting familiar with your financial statements is a rite of passage for any small business owner. But how the heck do you read this thing?

Let’s walk through a simple cash flow statement template to give you a better idea of what you’re looking at.

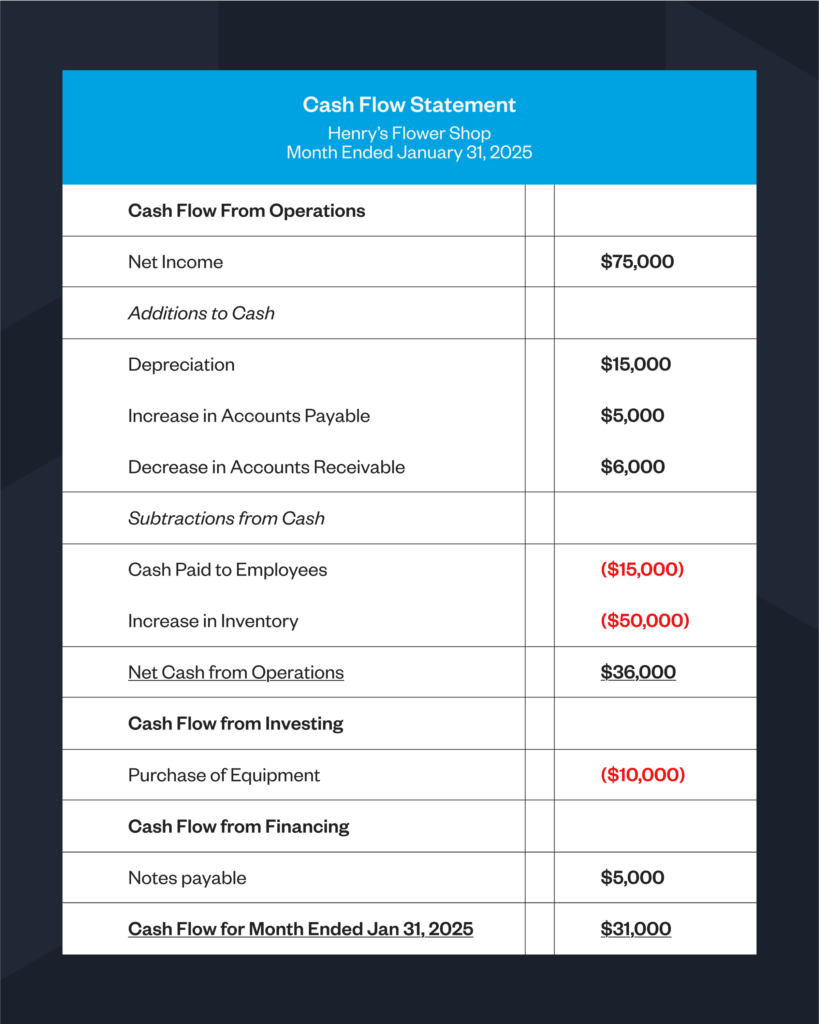

At the top of the cash flow statement you’ll find the net income number that should match net income on your income statement. In this cash flow statement example, red numbers are subtracted from net income while black numbers are added to net income.

It’s easier to read a cash flow statement if you know what’s going into it. The cash flow statement format includes three main sections: cash flow from operations, cash flow from investing, and cash flow from financing. If you were to prepare this cash flow statement using the indirect method, here’s how you’d fill out the three sections:

1. Cash flow from operations

First, you’ll calculate cash flow that comes from your everyday business operations. From your net income, you’ll need to add back transactions that reduce net income on the income statement but do not affect cash, including depreciation, amortization, decreases in AR, and increases in AP.

You also need to subtract expenses that increase net income on the income statement but do not provide more cash, like the increase in AR and inventory purchases.

In this cash flow statement example, we’ve listed depreciation, increase in AP and decrease in AR as additions in black and cash payments made to suppliers and employees and an increase in inventory as subtractions in red.

2. Cash flow from investing

Next, you’ll calculate cash coming in from investments, such as selling an asset or receiving returns from an investment into your bank account. You also need to subtract the purchase of investments or assets—like machinery, vehicles, appliances or property—if you paid by cash.

Here, we’ve listed the purchase of equipment as a subtraction. However, if the business owner put this purchase on a credit card, they should include this amount in the total notes payable line in the month that they paid down the credit card balance.

3. Cash flow from financing

Finally, you’ll add in cash received through financing, such as a loan balance or—for public companies—issuing stock, and subtract loan repayments, interest paid or dividends paid. Transactions related to business loans are listed as notes payable.

In our cash flow statement example, the number is black because the business received a loan that counts towards increased cash on hand. When a repayment is made, that number would be listed in red and subtracted from the total.

As you can see from this cash flow statement template, while the business had a net income of $75,000, the cash available in the business that month was $31,000. With this information, the business owner knows that they’ve only got $31,000 to cover payroll, pay their taxes and invest in the business at this point in time.

Business owners should return to their cash flow statement monthly or quarterly to better understand and optimize their cash management. It’s important to note that positive cash flow isn’t always good and negative cash flow isn’t always bad. For example, this business spent money on equipment purchases. While this represents negative cash flow from investing, using extra cash on hand for new equipment is a good investment in business growth.

On the other hand, having an excess of positive cash flow several months in a row could mean that you’re not allocating the cash available in your business effectively. Cash is best used for reinvesting in your business or earning interest. To make sure your cash is working hard for you at all times, it’s smart to keep it in a high-yield account like the one Float offers that gives you 4% interest on your balance.

Use Float to take control of your cash flow

It never hurts to have some extra cash on hand. Using business credit cards can give you more flexibility around your cash flow and empower you to seize opportunities even if your invoices haven’t been paid.

Float combines corporate cards with intuitive expense management software. Providing Float cards for your team allows employees to pay with the company card, rather than paying expenses out of their own pocket. This means you can get real-time visibility into spend, rather than waiting on them to submit their receipts. You can also earn interest on the cash you keep in Float.

With Float, you can track all of the expenses you put on your corporate cards in one place and seamlessly pay your vendors, subscriptions and employee reimbursements through a single platform. Float integrates directly with your accounting software, so incorporating expenses paid through Float in your cash flow statement is frictionless.

Get the cash you need, when you need it. Try Float for free and boost your cash flow with high-limit corporate credit cards and 4% interest on funds held in your Float Balance.

Written by

All the resources

Expense Management

Canadian Month-End Close Process: 2026 Best Practices Guide

Discover what month-close is, steps of the process, the most significant challenges and the best strategies to overcome them.

Read More

Expense Management

Effective Working Capital Management: 2026 Strategic Guide for Canadian Businesses

Let's explore how credit can help you manage your working capital needs more effectively.

Read More

Expense Management

Managing Travel Expenses for Growing Companies

Learn how to streamline manual work and empower your teams with a solid travel expense management process.

Read More