Financial Controls & Compliance

Bookkeeping Best Practices: How Often to Audit Your Books

Discover essential bookkeeping best practices and learn how often you should audit your books to ensure financial accuracy with Float.

October 27, 2024

As a business owner, you understand the importance of maintaining accurate financial records. Regular bookkeeping audits are essential for ensuring the integrity of your financial data and making informed business decisions. By establishing a consistent audit schedule and following best practices, you can stay on top of your finances and avoid potential pitfalls.

In this article, we’ll explore the concept of bookkeeping audit frequency and provide guidance on determining the right audit schedule for your business. We’ll also delve into the specific steps involved in conducting monthly reviews, quarterly audits, and annual comprehensive audits. By the end, you’ll have a clear understanding of how often you should audit your books and the benefits of doing so.

What is Bookkeeping Audit Frequency?

Bookkeeping audit frequency refers to the regular intervals at which a business reviews its financial records to ensure accuracy and compliance. This process is crucial for identifying discrepancies, maintaining financial health, and preparing for potential external audits or tax obligations.

How to Determine the Right Audit Schedule

Establishing a consistent audit schedule is vital for maintaining financial accuracy and compliance. Consider factors such as business size, transaction volume, and regulatory requirements when setting your audit frequency.

Use the bookkeepers guide to understand industry standards and best practices.

1. Monthly Bookkeeping Review

Conduct a monthly review to catch any irregularities early. This practice helps in understanding trends and making informed decisions.

A monthly review is also essential for verifying that all transactions are recorded accurately, aiding in fraud prevention.

2. Quarterly Financial Audits

Perform a more comprehensive audit quarterly to assess the overall financial health of your business.

Quarterly audits provide a more detailed analysis, allowing for adjustments in financial strategy and ensuring compliance with audit compliance guidelines.

3. Annual Comprehensive Audit

An annual audit involves a thorough review of all financial records and systems.

This audit is crucial for preparing financial statements, identifying long-term trends, and confirming compliance with all regulatory requirements.

Use resources like the float bookkeeper guide to streamline the audit process and ensure thoroughness.

Frequently Asked Questions

How often should you audit your books in a year?

Ideally, conduct monthly reviews, quarterly audits, and a comprehensive annual audit for optimal financial management.

What are the benefits of regular bookkeeping audits?

Regular audits help in early detection of discrepancies, informed decision-making, and preparation for tax obligations.

What steps are involved in conducting an internal audit?

Establish a schedule, gather necessary documents, review for accuracy, and rectify discrepancies.

How can auditing your books improve financial accuracy?

Auditing ensures that all transactions are recorded correctly, identifies errors, and enhances overall financial transparency.

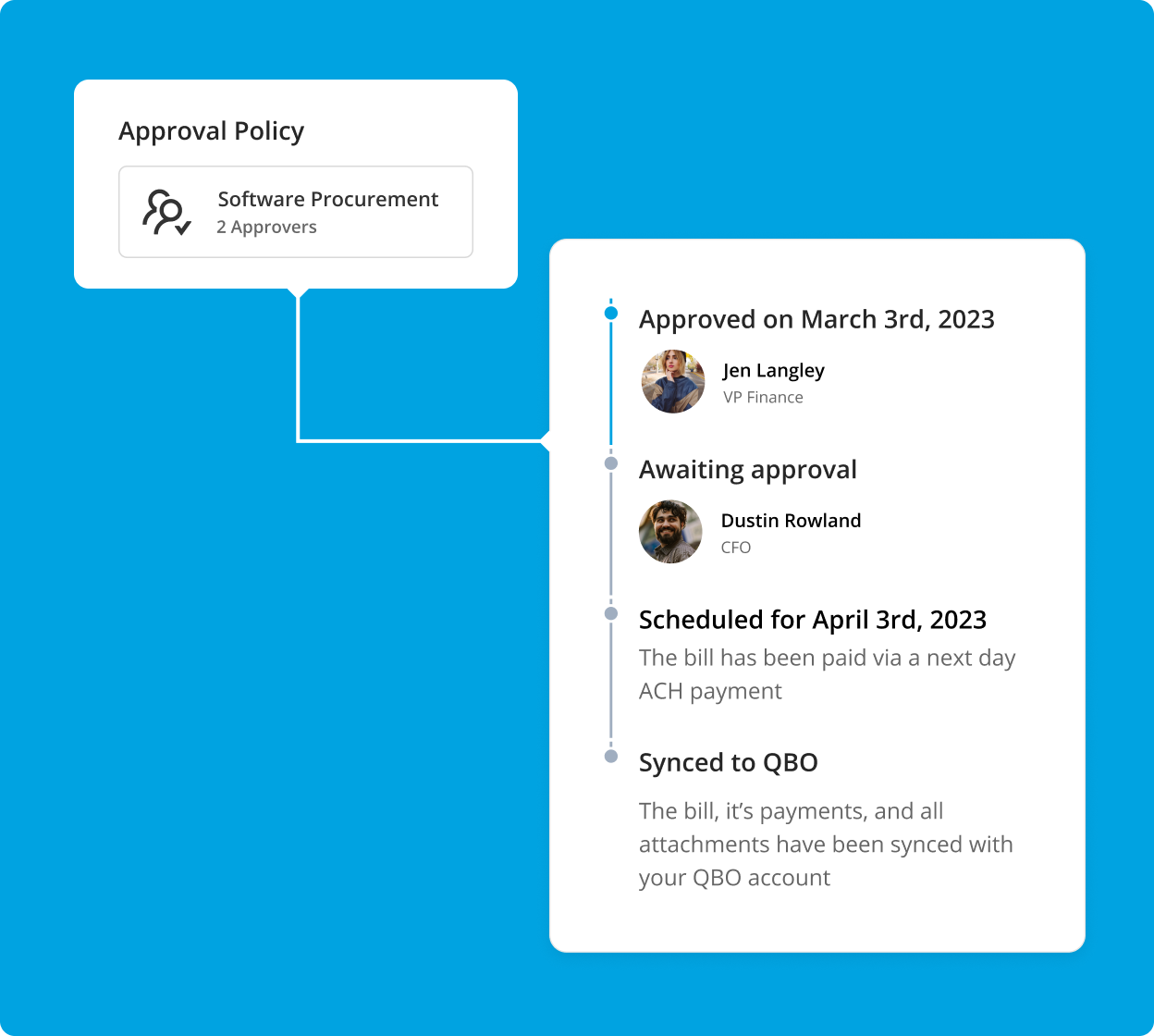

Best way to audit your books is with Float

Using modern tools can significantly ease the auditing process. Automated platforms enable seamless tracking and analysis of financial data, ensuring compliance and accuracy. Explore solutions that offer real-time insights and streamline the entire bookkeeping audit process.

Streamline Compliance With Float

High limit corporate cards in both CAD and USD, perfectly paired with intelligent software that saves businesses 7% on their spend.

Sync all of transactions and receipts to your accounting system

Require employees to submit receipts and set GL codes per transaction

Maintain a centralized audit log of expenses, receipts, transactions, and expense approvals

Written by

All the resources

Industry Insights

Canada’s Crossroads: Why Now is the Moment to Move from Defensive to Intentional Growth

Float's 2025 report on Canadian business shows modest growth, rising costs and shrinking reserves. Find out exactly what the data

Read More

Expense Management

Controller Month-End Close Automation: Streamline Financial Reporting

Controllers, this one's for you. Let's talk about how how automating month-end close helps you move faster without sacrificing accuracy.

Read More

Corporate Cards

Corporate Card Program Implementation: Complete Management Guide

Ready to implement a corporate card program? This is where to start.

Read More