Finance Team Efficiency

4 Signs Your Company is Outgrowing its Accounting Software

Is your accounting software holding you back? Discover four telltale signs it’s time to upgrade. Learn how to spot inefficiencies, scale your finances, and boost your business growth with the right tools.

September 28, 2022

Is your accounting software struggling to keep up with your business growth? Discover the telltale signs it’s time to upgrade and how Enterprise Resource Planning (ERP) can revolutionize your financial management.

The Growing Pains of Business Success

With growth comes great responsibility. As your company expands, you may find yourself:

- Hiring new talent

- Introducing more efficient internal processes

- Seeking innovative solutions to everyday tasks

For finance teams, it’s all of the above and more. While growth is exciting, change isn’t always easy. When it comes to your accounting software, acting fast is crucial to avoid potential pitfalls.

Why It’s Time to Move On from Your Accounting Software

Breaking up with long-time software isn’t easy. You’ve been through thick and thin together. But now, something better has come along – enter Enterprise Resource Planning (ERP).

What is ERP?

ERP is a cloud-based platform providing visibility into every aspect of your business. Unlike accounting software designed to manage one area, ERP integrates across multiple departments, including:

- Sales

- Financial reporting

- Inventory management

4 Tell-Tale Signs It’s Time to Upgrade to ERP

1. You’re Wasting Precious Time

Time is money! Traditional accounting software often requires:

- Manual data entry

- Time-consuming processes

- Higher risk of errors

As your business grows and transactions increase, ERP can:

- Remove administrative burdens

- Drive efficiency

- Free up time for strategic tasks

2. Your System is No Longer Compatible with Modern Times

In our tech-driven economy, employees need:

- User-friendly tools

- Convenient systems

- Reliable and efficient ways to complete daily tasks

ERP empowers employees by:

- Saving time, money, and stress

- Allowing remote work on various devices

- Freeing up time from redundant tasks

3. Lack of Visibility Across the Company

Growth means more:

- Customers

- Products

- Brands

- Revenue streams

Traditional accounting software stores information in spreadsheets, which:

- Requires manual updates

- Increases margin of error

ERP, on the other hand:

- Maintains real-time cost and adjustment tallies

- Provides access to historical reports for long-term analysis

- Offers snapshots of current budgets and cash flow

4. Your Current Software Can’t Scale with Your Business

As your company expands, you need a system that can:

- Handle increased data volume

- Provide advanced reporting capabilities

- Integrate with other business systems

ERP is designed to scale with your business, ensuring you’re never held back by your software.

The Bottom Line: Investing in Your Financial Future

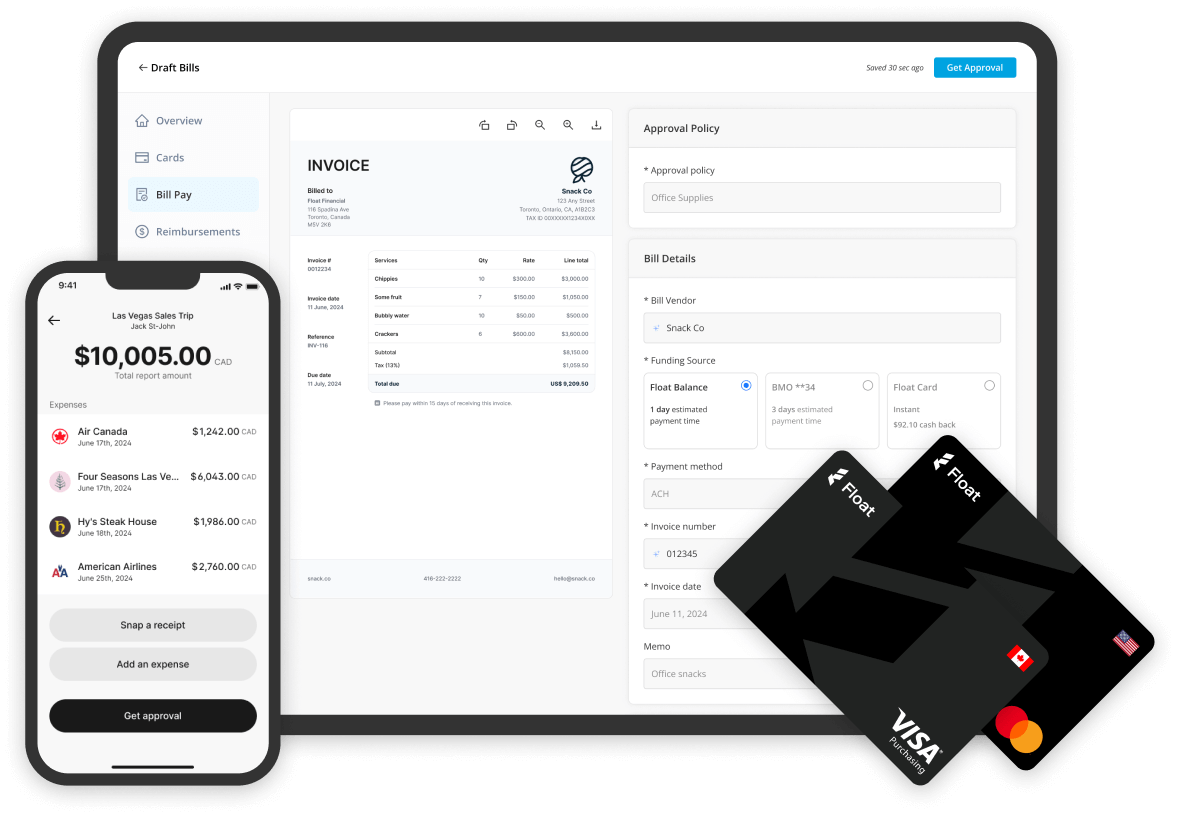

While ERPs may have a higher initial cost, they’re proven to optimize several areas of business. Good news: Float now integrates with NetSuite to support companies transitioning from old accounting software to ERP.

Float also offers:

- Native two-way sync with QuickBooks Online and Xero

- Easy implementation of past spreadsheets and financials into your new ERP

Here at Float, our team is committed to helping you step into a brighter and smarter future with innovative features that support your ongoing growth. Book a demo with us today.

Float is Canada’s only all-in-one corporate cards, reimbursements, and bill pay platform that helps customers:

- Earn cashback on all categories and save on FX

- Generate 4% interest on funds held with Float

- Eliminate expense reports and receipt chasing

- Close the books 5x faster at the month-end

Want to learn how companies like Clutch, Neo, Knix, and 1,000s of other Canadian businesses on average save 7% of their monthly spend with Float? Get started with Float today by clicking the button below!

Want to learn more before singing up? Book a demo today to learn more about the product from our team!

Written by

All the resources

Industry Insights

Canada’s Crossroads: Why Now is the Moment to Move from Defensive to Intentional Growth

Float's 2025 report on Canadian business shows modest growth, rising costs and shrinking reserves. Find out exactly what the data

Read More

Expense Management

Controller Month-End Close Automation: Streamline Financial Reporting

Controllers, this one's for you. Let's talk about how how automating month-end close helps you move faster without sacrificing accuracy.

Read More

Corporate Cards

Corporate Card Program Implementation: Complete Management Guide

Ready to implement a corporate card program? This is where to start.

Read More