Financial Controls & Compliance

Financial Controller Guide: Roles, Responsibilities & Success Strategies

Behind every confident CFO is a financial controller who knows the numbers inside out—and how to use them to guide the business forward.

November 3, 2025

Behind every confident CFO is a financial controller who knows the numbers inside out—and how to use them to guide the business forward. For decades, the role revolved around reporting and compliance. Now, controllers are expected to do that and more: manage growing tech stacks, automate processes and act as a strategic partner to the CFO. It’s a role that has quietly transformed into one of the most critical in Canadian business.

Controllers today balance technical accounting with business strategy. They synthesize data, tell the story behind the numbers and guide decisions that impact every department. And with larger finance stacks and rising expectations for real-time insights, their jobs have only grown more complex.

This guide breaks down the financial controller role from every angle: what it is, why it matters, the responsibilities and skills it requires and how controllers can position themselves for long-term success. Whether you’re a seasoned CPA or exploring the next step in your finance career, you’ll walk away with a clear picture of what it takes to excel as a financial controller in Canada today.

The role and evolution of the financial controller

Financial controllers ensure the financial integrity of the organization. They’re responsible for accurate reporting, compliance with accounting standards and the systems that keep day-to-day financial operations running smoothly. Traditionally, that meant closing the books, producing statements and keeping auditors satisfied.

But the role has expanded far beyond compliance. Today’s controllers are expected to partner with leadership, analyze data and provide insights that influence strategy across the business. As finance stacks become more complex and organizations rely on real-time financial visibility, controllers are no longer just gatekeepers of the past, but active participants in shaping the business’s future.

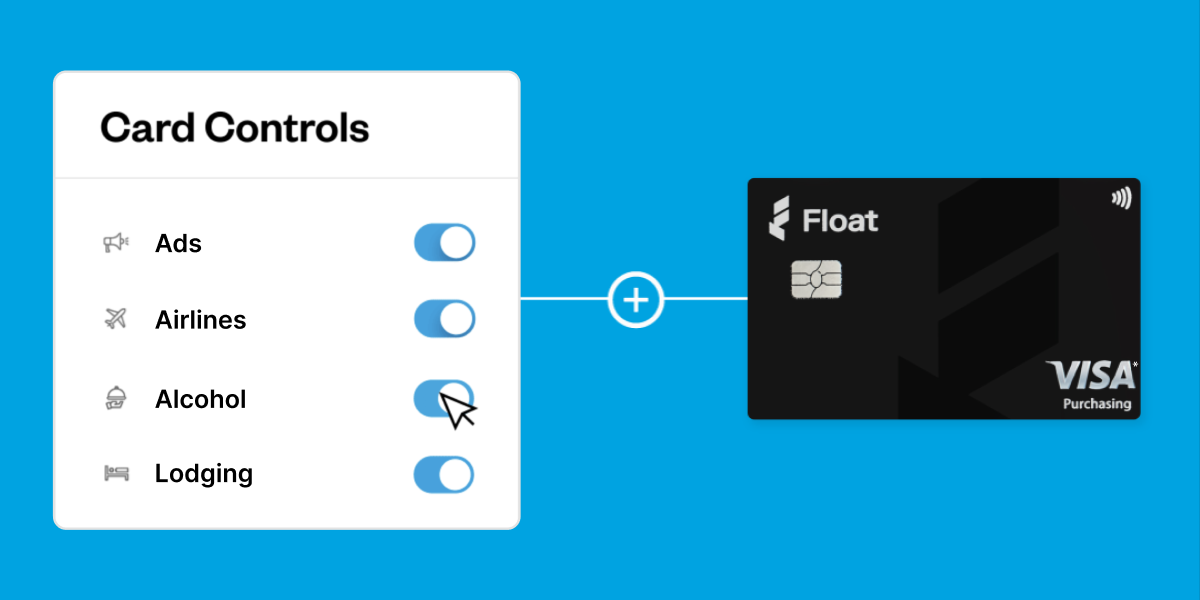

Another way the role has evolved is through the use of technology. From enterprise resource planning (ERP) systems to modern spend management platforms like Float, controllers are leveraging automation to cut out repetitive tasks and free up time for higher-value work. Month-end close, accounts payable and controls that once took days of manual effort can now be streamlined through integrated systems.

The result? Controllers can focus on process improvement, cross-functional collaboration, and helping CFOs make informed decisions with confidence.

Think of it this way. The CFO sets direction, but the controller makes sure the ship actually moves.

Key responsibilities of a financial controller

While the scope of financial controller responsibilities has grown, the foundation remains rooted in accountability and precision. Here are the core areas that every controller oversees, along with how modern tools are reshaping them.

1. Financial reporting and compliance

Controllers are the stewards of accurate financial reporting. They ensure statements are prepared in line with GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards), coordinate audits and meet tax obligations. Accuracy here isn’t optional, because it upholds trust with leadership, regulators and stakeholders.

2. Accounting operations

Day-to-day financial operations, such as accounts payable (AP), accounts receivable (AR), payroll and month-end close, fall within the controller’s scope. Traditionally, these processes required endless manual effort—entering invoices, toggling between systems and reconciling accounts. With platforms like Float that are designed for controllers, much of that work is automated. This cuts down errors and gives controllers more bandwidth to focus on analysis rather than administration.

3. Budgeting and cash flow management

Controllers also build budgets, forecast performance and manage liquidity. This involves striking a balance between short-term needs and long-term planning, ensuring the business can meet its obligations while investing in growth. Tools that provide real-time visibility into spend—like corporate cards and automated payment workflows—give controllers sharper insights into how cash is moving through the business.

The scope of a controller’s responsibilities can vary widely depending on the company’s size. In a smaller business with 50 employees, a controller might be hands-on with everything from payroll to vendor payments, wearing multiple hats across finance. In a 5,000-employee enterprise, the role becomes more specialized and strategic, focused on overseeing teams, implementing financial systems and advising executives.

Regardless of scale, the common thread is accountability for accuracy, compliance and the insights that keep the business financially sound. And across each of these areas, modern technology is helping to automate repetitive tasks, giving controllers the time and clarity they need to deliver real strategic value.

Financial controller skills and qualifications

If you were to scan a financial controller job description today, you’d see a blend of technical expertise, leadership ability and business acumen. Controllers need to be both detail-oriented and strategic, balancing practicality with big-picture thinking.

Education and credentials of financial controllers

Most financial controllers hold a bachelor’s degree in accounting, finance or a related field. In Canada, a CPA designation is often expected, with some professionals also pursuing a Master of Accounting (MAcc) or MBA to strengthen their leadership profile.

Technical skills of financial controllers

Financial controllers are responsible for ensuring compliance with accounting standards (GAAP or IFRS), managing internal controls and interpreting financial data. Strong analytical skills and proficiency with ERP systems and financial software are essential. Today, controllers also need to be comfortable with automation tools and spend management platforms, such as Float, that streamline processes and improve accuracy.

Leadership and soft skills of financial controllers

Beyond the numbers, financial controllers manage teams, collaborate with department heads and communicate insights to executives. Skills like clear communication, strategic thinking, ethical judgment and people management are just as critical as technical know-how.

The strategic value of a financial controller

Controllers sit at the intersection of financial integrity and business strategy. They’re the ones who can spot inefficiencies, identify risks before they escalate and provide leadership with the insights needed to make informed decisions.

A strong grasp of financial principles and technical accounting is foundational, but controllers also need to think analytically and with business acumen. It’s about synthesizing data, telling the story behind the numbers, and guiding decisions that are both financially sound and operationally relevant.

In practice, this means:

- Shaping financial strategy by providing the analysis that underpins budgets, forecasts and long-term planning.

- Strengthening processes by streamlining workflows and leveraging automation tools like Float to reduce friction and errors.

- Managing risk by maintaining strong internal controls, ensuring compliance and protecting the business from fraud or oversight gaps.

This mix of strategy, process and risk management is what elevates the controller from “number cruncher” to trusted advisor. As companies face mounting pressure for real-time reporting and smarter capital allocation, the controller’s ability to bridge accounting details with big-picture direction makes them indispensable.

Career path and outlook of financial controllers

For most financial controllers, the career journey begins with a foundation in accounting. Many start their careers as staff accountants or auditors, building technical expertise in financial reporting and compliance. From there, the path often moves into management roles, with increasing responsibility for teams, processes and systems.

The financial controller role is a natural next step, blending technical depth with leadership. Controllers are trusted to oversee the organization’s financial operations while providing the insights that guide executives in decision-making. From this vantage point, many go on to senior leadership roles such as CFO or VP of Finance.

The career outlook is strong. In Canada, financial controllers typically earn between $120,000 and $180,000 per year, often with performance-based bonuses. Demand is high across industries, and controllers with a mix of technical accounting skills, business acumen and comfort with modern financial technology stand out the most.

Continuous professional development also plays a big role in career growth. In Canada, CPAs are required to complete 120 hours of learning every three years, which could include formal courses, industry conferences or even podcasts approved by CPA Canada. This ongoing education keeps controllers sharp and ensures they stay ahead of evolving standards and best practices.

For those willing to embrace new tools and technologies, the opportunities are even greater. Platforms like Float free up hours once spent on manual AP and month-end tasks, giving controllers more time to focus on process improvements, audit readiness and strategic leadership—all areas that drive career progression.

Best practices for success as a financial controller

The most effective financial controllers combine leadership, communication and a willingness to embrace modern tools. Here are a few best practices that set top performers apart:

- Build and lead high-performing teams. Strong teams free up controllers to focus on strategy rather than being buried in daily tasks.

- Leverage technology and automation. Tools like Float reduce manual work in AP, month-end and spend tracking, giving controllers time to focus on higher-value activities.

- Communicate clearly with stakeholders. Translating numbers into insights is just as important as producing reports.

- Adopt a continuous improvement mindset. Controllers who consistently look for ways to streamline processes and strengthen controls create long-term value for the business.

These habits not only help controllers succeed in their current role but also position them as trusted advisors and future finance leaders.

Excel in your financial controller career with the right toolkit

The financial controller’s role has come a long way from being purely about compliance. Today, controllers balance the precision of technical accounting with the influence of strategic leadership. They ensure financial integrity, guide cross-functional decisions and help organizations navigate an increasingly complex financial landscape.

The takeaway? Controllers who embrace technology and automation are the ones getting ahead. By using platforms like Float to reduce manual workloads and gain real-time visibility into spend, controllers can focus on the areas that matter most: strategy, process improvement and business impact.

Discover why Canadian controllers choose Float >

Written by

All the resources

Cash Flow Optimization

Working Capital Management for Controllers: Optimize Cash Flow with Corporate Cards

Let's explore how controllers can use corporate cards to strengthen cash flow, improve operational control and support smarter financial decision-making

Read More

Corporate Cards

Sole Proprietor Corporate Cards: Business Credit Solutions for Single-Owner Companies

Let's explore the best sole proprietor corporate cards to give you the business finance access you need at any size.

Read More

Corporate Cards

Corporate Card Misuse Prevention: 2026 Control Strategies for Canadian Businesses

Corporate cards can be a powerful tool—if you set the right guardrails from the start. Here's what you need to

Read More