Expense Management

The Best Expensify Alternatives for Canadian Finance Teams

Explore the top Expensify alternatives for Canadian finance teams. Compare features, pricing, and what’s the leading choice in 2025.

April 23, 2025

You’re not alone if you’re a finance leader fed up with Expensify. Maybe you’ve already started scanning online threads, Slack groups or finance forums looking for better options—anything that doesn’t leave you chasing down support tickets, battling sync issues or dodging aggressive purchasing card pitches.

We hear you.

Too often, expense management tools promise automation and simplicity, but deliver friction, confusion and bloated workflows. You want something that just works—intuitive, reliable and built with Canadian finance teams in mind. Instead, you’re spending hours untangling what should be a five-minute task.

This guide is for you.

We’ve pulled together insights from real finance leaders, sourced from community conversations and hands-on experience. It’s a practical overview of what’s out there, what to watch out for and which Expensify alternatives are truly delivering value—especially for Canadian businesses. If you want, you can jump right to the comparison here.

(Spoiler alert: Float is leading the pack.)

Why finance leaders are replacing Expensify with alternatives

Expensify made a name for itself as an early leader in expense management, promising automation, simplicity and a sleek mobile experience. And it worked. For a while.

But more and more finance teams—especially in Canada—are searching for the best Expensify alternatives. A tool that once felt like the future now feels stuck in the past, leaving users frustrated. And there are some major common frustrations among users.

1. Opaque (and increasingly frustrating) pricing

“[The] subscription is hard to cancel and then they add on extra fees at [the] end.”

Surprise charges, shifting contract terms and aggressive upselling have left many finance leaders looking for a more transparent Expensify competitor. Billing changes mid-contract, limited visibility into costs and forced bundling of products like corporate cards are common complaints.

2. Outdated user experience

“[Expensify has] an automated ‘concierge’ system that tries to auto-submit everything and makes it harder to manage expense report[s] than it should be.”

Finance teams often describe Expensify’s platform as clunky, confusing and overloaded with unnecessary automation. Instead of speeding things up, workflows become tangled. App navigation feels dated, and features don’t evolve to meet modern team needs.

3. Inconsistent customer support

“…we have started having endless sync issues and their support team has basically given up on us after hours and hours of back and forth.”

Long response times, support loops and limited resolution pathways leave Canadian teams feeling like second-class users. With support teams based in other time zones and a heavy reliance on bots, the ability to get timely help is often lacking.

4. Challenging onboarding for new users

“The setup process was virtually non-existent for someone inexperienced with previous expense reporting software.”

For small teams, especially those without prior experience in expense management tools, the onboarding experience can feel overwhelming. The lack of intuitive guidance can lead to confusion, rework and unnecessary back-and-forth, all of which represent wasted time and effort that teams can’t afford to lose.

4 things to look for in an Expensify altnerative

If you’re shopping for an Expensify replacement or even just starting your research on expense management software, great news: better options exist. But not all platforms are created equal. Here are four must-have features every modern finance team should demand in the best Expensify alternative.

1. Ease of use (for everyone)

Your team won’t use what they can’t understand. And this isn’t just frustrating—it can lead to real loss for the company and for employees who face long cash flow issues. A great software and a clear, modern expense policy can resolve these issues.

The right tool is intuitive, user-friendly and eliminates manual headaches. A clean user interface, easy onboarding and low learning curve help increase adoption. This is especially important for teams with distributed or hybrid work models.

2. Corporate card integration

You should be able to easily issue and manage company cards—in CAD and USD—and sync seamlessly with accounting tools like QuickBooks, Xero and NetSuite.

Look for tools that let you control spending in real time, assign cards to users instantly, and offer built-in safeguards for compliance and accountability.

Best business credit cards

Compare top options, fees and benefits for

Canadian companies.

3. Automation and visibility

Modern tools automate expense categorization, flag policy violations and simplify approval flows.

Finance leaders need real-time dashboards that break down spend by team, department and project. This gives you the power to identify trends and make data-backed decisions.

4. Support that actually supports

You deserve fast, responsive help from real humans who understand your business. This is especially critical when you’re dealing with tax rules, banks, and tools unique to Canada.

Prioritize platforms that offer dedicated customer success and live chat with real experts during Canadian business hours. The best tools won’t just help you track expenses—they’ll help you grow confidently.

So, which Expensify alternatives are actually doing it better?

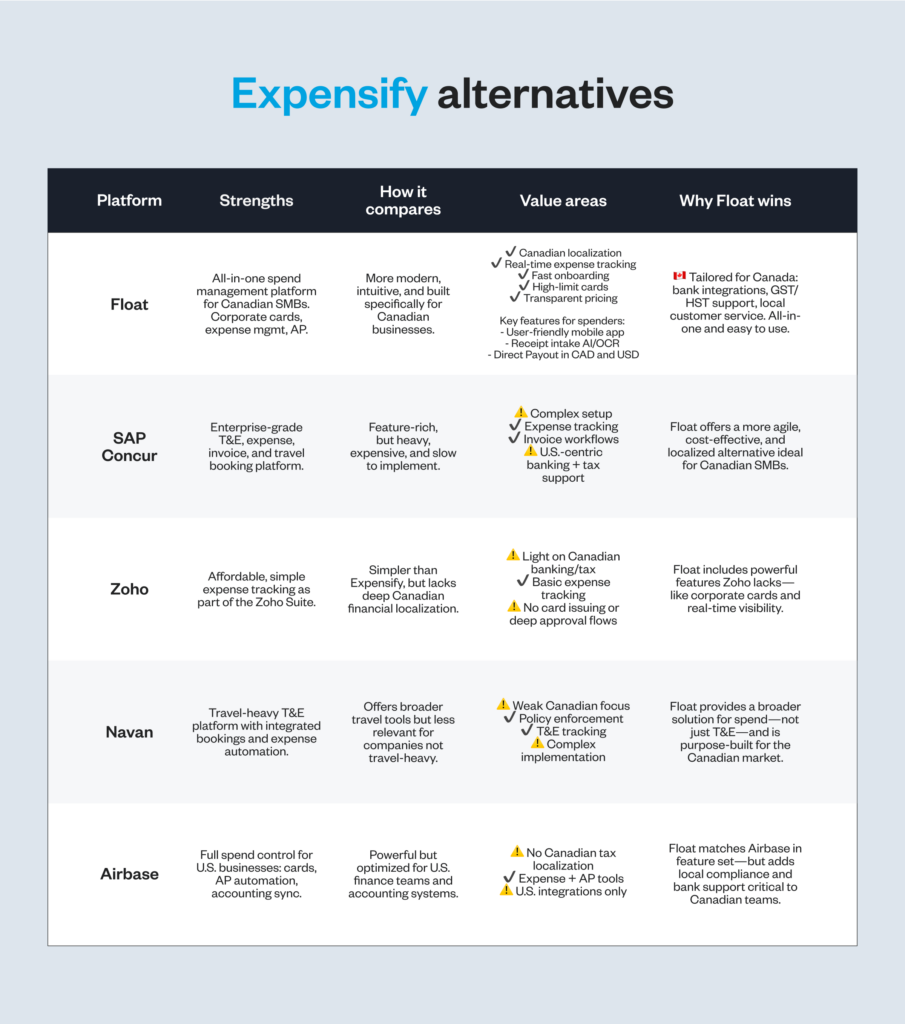

There’s no shortage of Expensify competitors on the market. Each one brings something different to the table—whether it’s automation, card integration, or accounting software compatibility. Ultimately, it’s up to you as the finance leader to choose the right fit for your team.

Canadian SMBs face unique challenges that many US-centric platforms overlook. For example, you need to issue and manage corporate cards in CAD, handle FX conversions smoothly, and track GST/HST accurately—taxes that vary by province and require CRA-compliant reporting. Float is built to handle all of that, right out of the box. With most other tools, these become an endless loop of support calls and emails that never go anywhere.

Curious how Float stacks up against the competition?

Our side-by-side breakdown highlights the key differences in Float vs. Expensify, along with other leading tools.

Compare Expensify Alternatives

Canadian-based? Start with Float

If you’re a Canadian business searching for the best Expensify alternative, start with Float. Purpose-built for Canadian companies, it’s designed to simplify your expense management—without the complexity, hidden fees or inflexible workflows.

Not sure yet? Take the tools for a spin. Book demos, take advantage of free trials and get hands-on with the platforms that catch your eye. We’re confident that once you try Float, you’ll see the difference—especially when it comes to Float vs. Expensify.. Say hello to faster onboarding, local support and features that actually scale with your team.

Learn more about Float

Get a 10-minute guided tour through our platform.

And don’t forget to tap into the wisdom of other businesses in the same spot as you. Reddit threads, finance forums and Slack groups are gold mines for honest, unfiltered insights. Ask around. Learn what others love (and hate) about the tools they’ve tried. It’s one of the fastest ways to get a real-world sense of what will work best for your business.

Bottom line: expense management should work for you, not the other way around. Let’s make it easier, smarter and Canadian.

Written by

All the resources

Cash Flow Optimization

ACH vs EFT Payments: Key Differences for Canadian Companies

Learn the key differences between EFT and ACH payments, how they work, which options might be available to your business

Read More

Corporate Cards

Xero Integration for Corporate Cards: Modern Accounting Software Guide

Using Xero becomes more powerful the second you integrate it with your corporate cards. Here's what you need to know.

Read More

Float News

Float 2025: Year in Review

How Float is building the financial system Canadian businesses run on

Read More