Corporate Cards

Corporate Cards for Small Canadian Businesses: Benefits and Implementation Guide

Managing business spending shouldn’t be a constant source of stress—especially when the right tools can make it easier.

May 28, 2025

From unpredictably high costs to time-consuming expense reports, effectively managing business spend often leads to frustration and headaches. However, travel expenses, client dinners and office supplies are hard to avoid.

Whether you’re getting ready to launch a startup or leading finance for a small business in Canada, you know that corporate cards play an important role in growing and managing your company. So, how can you—and your team—spend company money without it resulting in a migraine?

With the right corporate cards for your small business, you can improve cash flow, avoid unwanted purchases and make your money go further, all while streamlining expense management.

In this implementation guide, you’ll get step-by-step instructions on the best way to set up corporate cards for a small business in Canada.

Step 1: Identify benefits of corporate cards for your small business

It may seem easy to put your business expenses on your personal credit card, but this can leave you missing out on some major benefits. Leveraging corporate credit cards for small Canadian businesses offers a number of advantages:

- Personal finance protections: Separating business and personal spending helps protect personal finances if your business ever runs into trouble.

- Improved cash flow: Corporate cards provide a way to increase your access to capital and use your enhanced purchasing power to pay bills and buy supplies without waiting for accounts payable.

- Financial rewards: Corporate cards offer financial perks that make your money go further, such as cashback, travel points, shipping discounts and waived foreign transaction fees.

- Better business credit rating: Want better business loan terms or insurance rates? Improve your company’s credit rating with a corporate card that you pay off every month.

- Enhanced financial control: With a corporate card program, you can set limits, track spending in real time, and avoid budget overruns. This control is especially important considering that 30% of SMBs don’t have good cash flow visibility.

Step 2: Evaluate corporate card features that suit your small business needs

Your corporate card program should make managing your business expenses easier. After all, you’re trying to reduce the number of headaches on any given day.

Opt for corporate card programs that integrate with your accounting software, like QuickBooks and Xero, so you can have seamless expense management processes. Float’s expense management software offers the ability to automatically submit receipts via mobile app or text, completely eliminating the need for those pesky expense reports.

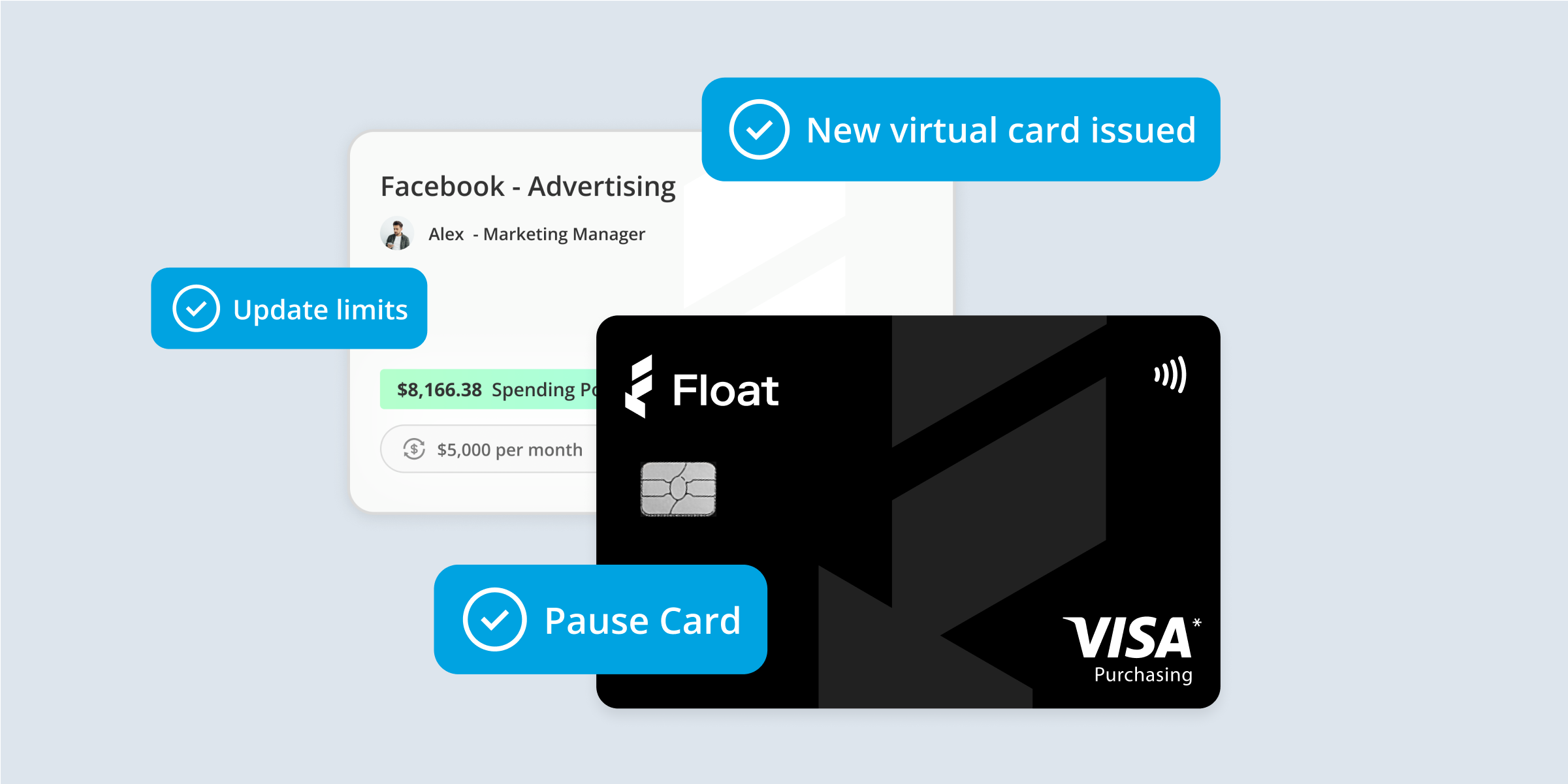

Another major feature to consider when you’re choosing a small business credit card in Canada is employee management. Does the card offer custom spending controls for each cardholder, for example, or can you set limits for one-off purchases? These types of controls remove the burden of manual expense monitoring so you can focus on running the business.

Step 3: Implement corporate card policy rules

Having a corporate card with employee controls is one thing, but you still need corporate card policy rules to ensure compliance and accountability. Effective policies minimize the risk of financial fraud and corporate card misuse and clarify confusion around business expenditures.

Your corporate card policy rules should cover:

- Corporate card eligibility: Define which individuals are eligible for a corporate card based on their title or duties.

- Rules for usage: Determine what the corporate card can be used for to avoid surprise reimbursement requests. Outline what it should not be used for, such as personal expenses.

- Spending limits: Set spending limits for each cardholder or specify limits for specific purchases, such as client dinners and airline tickets.

- Documentation requirements: Specify whether you want electronic or hard-copy receipts and how you want the documentation submitted. Clarifying this up front significantly streamlines business expense management (especially at tax time!).

- Expense approvals: Clarify the organizational hierarchy for spending approvals and outline the timeline for approvals to avoid expense management delays.

Step 4: Select the right small business corporate card

To get the most business credit card benefits, you’ve got to choose a card that offers perks that matter to you. Here are the key considerations when choosing the best business credit card for your needs:

- Annual fee: If you’re paying an annual fee, it should deliver real value. There are also great options with no annual fee that still offer plenty of benefits, so make sure whatever you choose is worth it.

- Rewards: Does the card offer cash back on purchases, and if so, how much? Some cards give you a flat percentage back after a certain spending threshold, while others only reward specific categories. Also consider whether the card includes points, discounts, travel perks or other benefits that matter to you.

- Interest rates: Many business credit cards have high interest rates, while some, like Float, offer interest-free credit terms.

- Application times: Most banks take two to three weeks to process applications, while Float cards are issued almost instantly (if you don’t mind waiting five minutes).

Best business credit cards

Compare top options, fees and benefits for

Canadian companies.

Step 5: Train employees on corporate card use

A recent study on corporate-issued credit cards showed that 30% of company cardholders have not received any training on how to use them appropriately. That’s a recipe for misuse, and one that can be easily avoided with the right training.

To fully take advantage of business credit card benefits, it’s important to educate staff about company credit card policies (see step 3!). Set up training sessions covering misuse, spending boundaries and documentation requirements when submitting expenses. Make sure to tailor your training to your specific business needs. You can even train people based on their roles and what permissions they would have.

Corporate credit cards for small Canadian businesses: A strategic tool for growth

Business credit cards have considerable advantages for Canadian businesses when implemented properly. Following these steps when getting corporate cards for your business will help you avoid banging your head on your desk at the end of each month while spending confidently.

Ready to get your own corporate credit card program started?

Check out Float corporate cards and see how we can help you scale your financial operations with a balance of control and flexibility. Book a demo with our team today.

Learn more about Float

Get a 10-minute guided tour through our platform.

Written by

All the resources

Industry Insights

Canada’s Crossroads: Why Now is the Moment to Move from Defensive to Intentional Growth

Float's 2025 report on Canadian business shows modest growth, rising costs and shrinking reserves. Find out exactly what the data

Read More

Expense Management

Controller Month-End Close Automation: Streamline Financial Reporting

Controllers, this one's for you. Let's talk about how how automating month-end close helps you move faster without sacrificing accuracy.

Read More

Corporate Cards

Corporate Card Program Implementation: Complete Management Guide

Ready to implement a corporate card program? This is where to start.

Read More