Corporate Cards

What Your CFO Wishes You Knew About Pre-Spend Controls

CFO Vinnie Recile shares what every business leader should know about pre-spend controls—a proactive approach to spotting and stopping risky expenses before they spiral into costly, morale-draining problems.

June 9, 2025

We’ve all heard the saying “better safe than sorry.” That’s the idea behind pre-spend controls. Instead of scrambling to fix budget issues after expenses occur, these tools help businesses spot and manage spending risks before the money goes out the door. It’s a proactive approach that can save you a lot of financial headaches.

With 25+ years in finance, Vinnie Recile, CFO at The CFO Centre, has seen it all—from fuel card misuse and gift card scams to surprise software purchases no one approved. “The biggest financial disasters aren’t caused by spending,” says Vinnie. “They’re caused by uncontrolled spending.”

In this article, Vinnie shares all the things your CFO wishes you knew about proactively managing spend before it becomes a business and morale problem. We’ll walk through what’s at stake, plus real-world consequences and steps for effectively managing expenses using modern solutions.

Why it’s important to control spend before it happens: the consequences

Clear pre-spend policies help your business maintain profitability, stability and employee trust, explains Vinnie. The control they provide actually gives you freedom in the form of smoother operations, happier teams and a CFO who doesn’t need a stress ball.

On the flip side, the absence of pre-spend controls often leads to loose budget management, higher risks and lower profits.

Here’s what’s at stake:

Reputational risk

When spending looks off, people notice—both inside and outside of the company. Misaligned or excessive purchases, such as sign-offs on expensive software or vendor commitments made on a whim, can quickly damage your business’s credibility This can send signals to your stakeholders that you may not be keeping a close enough eye on your budget. In turn, stakeholders might start raising eyebrows, and your team may question your leadership.

Employee morale issues

A lack of structure around spending can lead to confusion and frustration, especially if some teams or executives appear to operate under different rules than others.

Once a purchase is made, approved or not, the damage is done. As Vinnie likes to say, “you can’t unburn the toast.” Most finance teams will process the reimbursement to keep the peace, tossing in a gentle “don’t do it again.” But problems can snowball when employees bend the rules and get their way, and others start to question the policies.

According to Vinnie, this “can lead to resentment, loss of employee trust and low morale—especially among finance, human resources or accounts payable teams bearing the burden of the fallout.”

Operational chaos

Without pre-spend controls, operations can also become a mess. Think disjointed processes and hours wasted justifying purchases after the money’s gone.

Expense report mayhem

Vinnie explains that if you’ve got six months of expense claims submitted all at once, especially around the holidays, you’ve got a problem. Not only can this crush your finance team’s holiday spirit, it also throws a major wrench in your forecasting.

But wait—it gets worse. If expense management isn’t correctly forecasted and controlled, it can significantly reduce your profit margins, Vinnie adds. This can jeopardize any loan agreements, forecasts, cash management or covenants with a lender you may have.

“Missing company expense targets signals to the bank, investors and/or stakeholders that you have weak internal controls,” she says. This can quickly shift your focus from running the business to managing your banking relationship.

Fraud potential

“I’ve encountered fraud, with fuel card misuse and buying gift cards being the most widespread problems,” says Vinnie.

When fraud is discovered, the story often shifts to “the one who got scammed” or “the employee who misused funds”—intentionally or not. Employees feel embarrassed, judged and even ashamed, especially if they didn’t fully understand the spending boundaries. The emotional toll is real, often spilling into HR with tears, guilt and financial stress. This can leave finance and HR asking, “Who are we really reimbursing—and should we be?”

Even though the purchase has already happened, the damage continues: company funds are lost, time is spent managing the fallout, and morale takes a hit. That’s why pre-spend controls matter.

Runaway subscription and maintenance costs

“Forgotten subscription cancellations and unexpected expenses are other common issues,” Vinnie shares. “For instance, SaaS subscription costs can climb quickly.

One month you’re testing out a tool with a free trial, and the next thing you know, it’s been quietly auto-renewing for six months on the premium plan.”

Often, maintenance teams pay out-of-pocket on personal credit cards for urgent expenses like tools, supplies or materials. Later, they submit for reimbursement, only for finance to discover after the fact that thousands of dollars were spent.

Culture damage

“A lack of upfront clarity around which expenses are allowed sets the stage for HR challenges,” Vinnie says. Those responsible for approvals are left in awkward situations, too. This creates tension, confusion and a sense of misalignment within teams. What starts as a financial issue, like someone buying software or supplies without approval, can quickly become an HR issue.

“Employees often feel unheard and disillusioned,” says Vinnie. “They think their spending was reasonable, so why the extra questions?”

In other instances, when layoffs are followed by big executive reimbursements, this also sends a poor message. That’s why a lack of pre-spend controls isn’t just a compliance issue—it’s a cultural one. Clear, consistent expense policies are about more than protecting cash flow—they’re about protecting people.

How to establish proactive spending controls

“The good news is that with established policy guidelines, transparency and training, all of the horror stories are avoidable,” Vinnie says. Modern expense management solutions like Float can be a game changer for your business when it comes to managing expenses, introducing corporate credit cards, and even handling bill payments and reimbursements, she adds.

Here’s what to leverage to make a solution like this work for you:

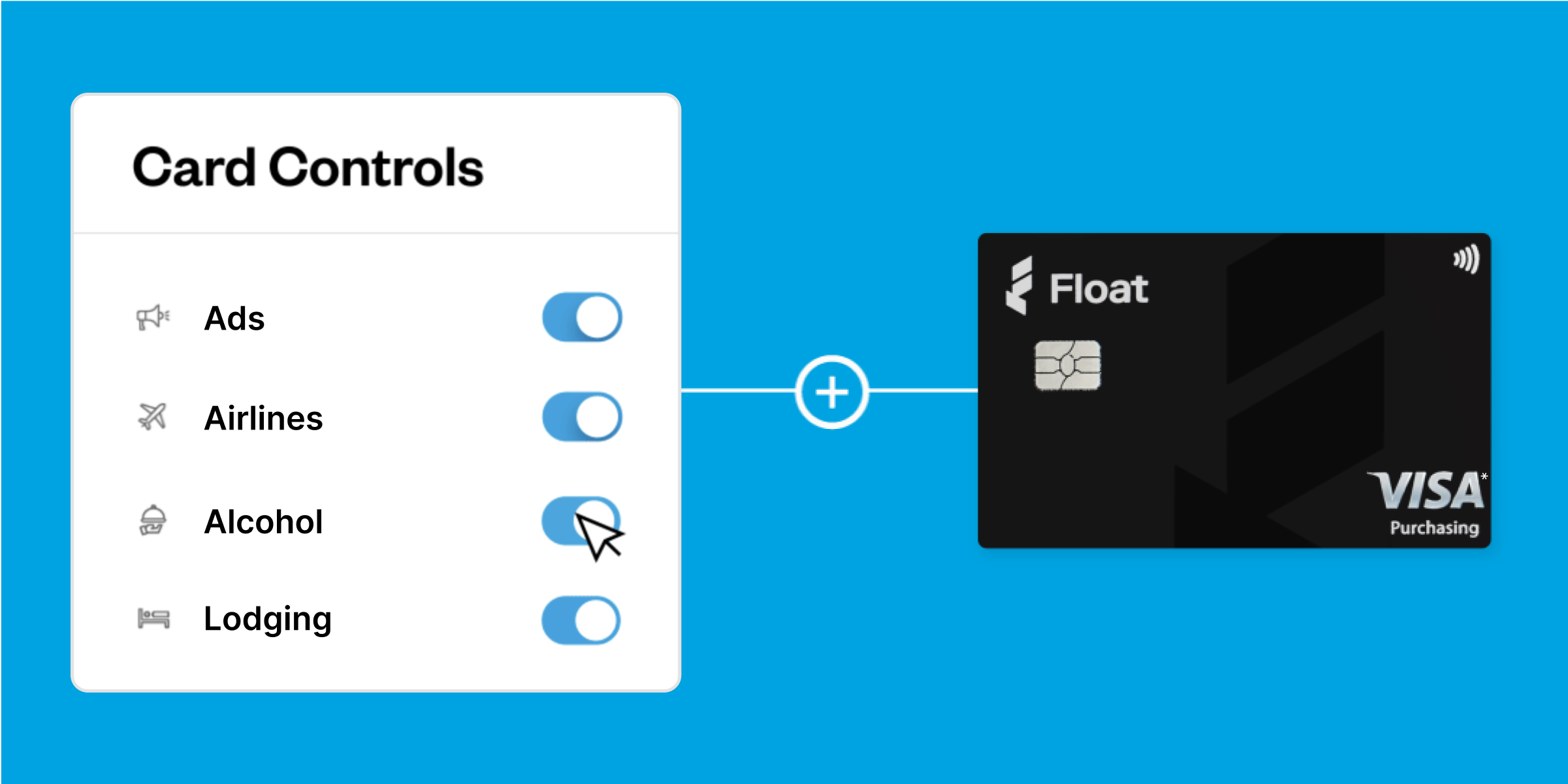

Corporate cards with pre-set limits and purpose

Set and enforce card limits. When receipts are late, cards are paused automatically without any shaming. Accountability without chaos? Sounds good to us.

Customizable rules and workflows

Automate receipt submission and reduce manual errors by customizing rules. This way, your team won’t have to panic when it’s time for month-end close. “With a solution like Float, you can manage limits per employee or department,” says Vinnie.

Real-time visibility

Intuitive reporting offers real-time updates to prevent out-of-policy spending before it occurs. This helps you avoid surprises and late expense reports.

Fraud prevention by design

A system built with transparency in mind cuts down on manual errors, miscommunication and fraud risk. Less time spent on clean-up means more time spent growing your business.

Improved morale and culture

Fairness and clarity lead to happier employees, less resentment and a healthier company culture. Pre-spent controls reduce judgment calls and awkward approvals. “When employees know the rules, they feel trusted, not policed,” Vinnie says.

Lead with intention and spend smarter

Spend control is a cross-functional effort, which means it’s not just a financial concern—it’s a leadership issue.

As Vinnie puts it, “The shift from reactive enforcement to proactive policy doesn’t restrict growth but protects it.” When teams have the tools, clarity and guardrails they need, they operate with greater accountability and confidence, creating a culture of trust.

Ready to implement pre-spend controls at your organization?

Float is an all-in-one platform for managing team and corporate expenses. Get up and spending with Float in as little as one business day.

Try Float for free

Business finance tools and software made

by Canadians, for Canadian Businesses.

Written by

All the resources

Industry Insights

Canada’s Crossroads: Why Now is the Moment to Move from Defensive to Intentional Growth

Float's 2025 report on Canadian business shows modest growth, rising costs and shrinking reserves. Find out exactly what the data

Read More

Expense Management

Controller Month-End Close Automation: Streamline Financial Reporting

Controllers, this one's for you. Let's talk about how how automating month-end close helps you move faster without sacrificing accuracy.

Read More

Corporate Cards

Corporate Card Program Implementation: Complete Management Guide

Ready to implement a corporate card program? This is where to start.

Read More